PayDo Review: Is It a Good Banking Solution for Digital Nomads and Remote Workers?

Learn the fees, features, and value for remote workers and business owners using PayDo for multi-currency accounts and international transactions.

We’ll be the first to tell you all of the amazing things about a digital nomad lifestyle, but one thing that’s not so great? Dealing with multiple currencies and banking across a lot of different countries. If we’re honest, it can easily become just one big headache.

That’s where PayDo promises to solve this issue. They’re a banking solution for remote workers that provides multi-currency accounts, virtual and physical debit cards, and a ton of merchant tools for digital nomad entrepreneurs.

Using our combined years of location-independence experience, we’re sharing our experience with PayDo, reviewing and breaking down the features, fees, and whether this finance tool is actually useful for digital nomads.

Is PayDo Worth it for Digital Nomads? Our Quick Verdict

❌ Not ideal for: Short-term travelers, casual users, and US residents

📌 Better than other popular banking solutions? → It depends on your needs.

What is PayDo?

PayDo is a UK-based electronic money institution (EMI) that lets individuals, businesses, and merchants open multi-currency accounts to make and receive payments across many different countries. In other words, PayDo is a way to manage your personal or business finances as a digital nomad.

Unlike a traditional bank, EMIs only manage e-money aka they don’t lend or invest. Instead, they make a profit through transaction fees without ever touching your funds. You can use PayDo to hold multiple currencies, receive and send international payments, and access foreign account bank details.

Comparing the PayDo Account Types

PayDo offers three different account types: Personal, Business, and Merchant. We’ve created this quick comparison table to show you the difference between them.

| Account Type | Use | Best For | Key Features | Currencies | Safety |

|---|---|---|---|---|---|

| Personal | Personal accounting across multiple currencies | Digital nomads and freelancers | Multi-currency account, international bank details, physical and virtual cards | Hold funds in 12 currencies | Fund safeguarding and 3D Secure |

| Business | Corporate financial services like payroll and payments | Remote businesses and entrepreneurs | Mass payouts, high-value payouts, 9 international payment schemes | Send and receive bank transfers in 35+ currencies | PCI DSS Level 1 compliance |

| Merchant | Process global customer payments | E-commerce and online businesses | PayDo checkout, one-click payments, fraud protection | Accept payments EUR, USD, GBP, and local currencies | Chargeback protection and built-in anti-fraud |

Key Features for Digital Nomads and Remote Workers

PayDo is all about simplifying the banking experience for people dealing with international transactions and multiple currencies. Here are the features that we think are the most important for digital nomads and remote workers:

Multi-Currency Accounts

One of the best things about PayDo is its multi-currency accounts that let you hold EUR, USD, GBP, CAD, and other eight currencies at the same time and in the same account. Not only is this suitable for freelancers receiving payments globally, but it’s also ideal for digital nomads who want to access multiple currencies from just one banking dashboard. Personal accounts can hold up funds in 12 currencies, with business accounts having 35+ different currency options.

Multi-Currency Transfers

Not only can you hold multiple currencies, but you can also send, receive, and convert them using PayDo. PayDo supports transfers in 140+ countries with exchange rates being updated several times a day to get you real-time, competitive rates. Internal transfers (sending or receiving money to another PayDo account) are also completely free.

Virtual and Physical PayDo Cards

Getting a virtual and physical debit card for your PayDo account is totally free. You can use your card in-store, online, or even to withdraw cash at ATMs not to mention use the Apple Pay or Google Pay integrations for contactless payments. You can check your account balance through your account and even top-up on the go for easy, uninterrupted shopping.

Foreign Account Details

Along with your multi-currency account will come account details for receiving payments from almost anyone in the world. International multi-currency transactions are made easy as you’re provided with BIC, IBAN, and account numbers for SWIFT, SEPA, or FPS transfers.

PayDo Checkout

For remote business owners or digital nomads running online storefronts, PayDo’s merchant solutions are huge. They facilitate transactions from over 170 countries with 350+ payment methods to ensure you receive your payments. There are loads of API integrations, customer language and payment localization, and protected high-value transfers of up to €3 million per transaction.

How Much Does PayDo Cost?

Opening and managing your PayDo account is completely free. There are no monthly fees or maintenance costs, however, you will be charged fees for sending or receiving payments from outside of PayDo.

These fees vary by your country of residence, but to give you an example, here is how the fees for someone based in Spain might look:

- ATM withdrawal EEA: €2

- ATM withdrawal non-EEA: €2 + 3%

- Markup rate for card purchases made not in EUR: 3%

- Incoming Target2 payment: Free

- Incoming SEPA payment: 0.5% (minus €5)

- Incoming SWIFT or Fedwire payment: €7

- Top-up by Visa, MasterCard in EUR: €0.2 + 3.4%

- Outgoing Target2 payments: 0.5% (minus €5)

- Outgoing SEPA payment: 0.8% (min €5)

- Outgoing SWIFT payments: 0.5% (minus €17)

- Outgoing Fedwire payments: 0.5% (minus €17)

- FX exchange: 2%

Not sure how those fees actually shape up? Check out the fee comparison table below with some of the other top payment solution platforms for digital nomads:

| Fee Type | PayDo | Wise | Revolut |

|---|---|---|---|

| Account Opening | Free | Free | Free |

| Monthly Fee | Free | Free | Free |

| Local ATM Withdrawal | €2 | Free (up to €200) | Free up to €200/month |

| Incoming SEPA | 0.5% (minus €5) | Free | Free |

| Outgoing SEPA | 0.8% (min €5) | From 0.47% | Free |

| FX Exchange Fee | 2% | From 0.47% | 0% up to $1,000/month |

Who Should Use PayDo (and Who Shouldn’t)?

PayDo is a great option when it comes to managing your money across a lot of different countries and currencies…but that doesn’t mean it’s made for everyone. After getting to know the product pretty well, we think we know who’s going to get the most out of a free PayDo account.

✅ PayDo is great for:

- Digital Nomads: With PayDo, you can open and manage multi-currency accounts remotely and from anywhere in the world.

- Freelancers: PayDo offers great solutions for remote freelancers, including invoicing tools, debit cards for business expenses, and low fees for receiving payments.

- Entrepreneurs: Use PayDo for mass payments for vendors or payroll with storefront tools to streamline incoming customer transactions.

❌ PayDo is not ideal for:

- Short-term solo travelers who don’t need multi-currency or business-level banking.

- Those needing crypto, investments, or interest-earning accounts.

- PayDo is currently not available for US residents.

Pros and Cons

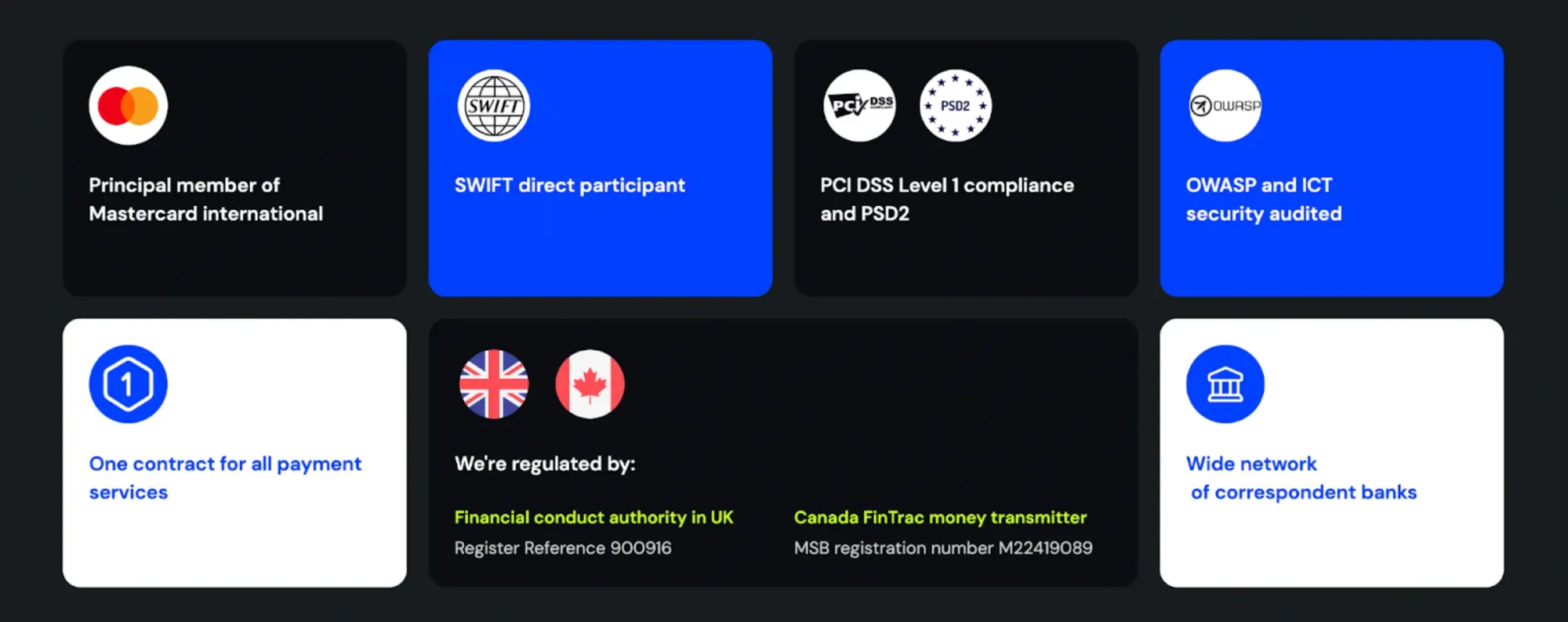

Is PayDo Safe?

It’s clear that PayDo wasn’t created for traditional banking, however, one thing that’s worth noting is that because it’s an EMI, PayDo doesn’t fall under the UK’s Financial Conduct Authority (FCA). In other words, your funds aren’t protected by FTCS.

But don’t worry, PayDo has a lot of systems in place to keep your money safe.

In fact, as an EMI, PayDo is legally required to safeguard your funds. When you hold e-money with PayDo, it is kept secure in a separate account within various European credit institutions that PayDo cannot touch. That means that even if PayDo were to dissolve tomorrow - your money would still be safe.

PayDo also uses additional safety measures when managing transactions like 3D Secure payments, built-in anti-fraud, and chargeback protection for business owners. For managing customer and merchant transactions, they meet the PCI DSS Level 1 compliance standards, which is the highest level of merchant money-handling regulations.

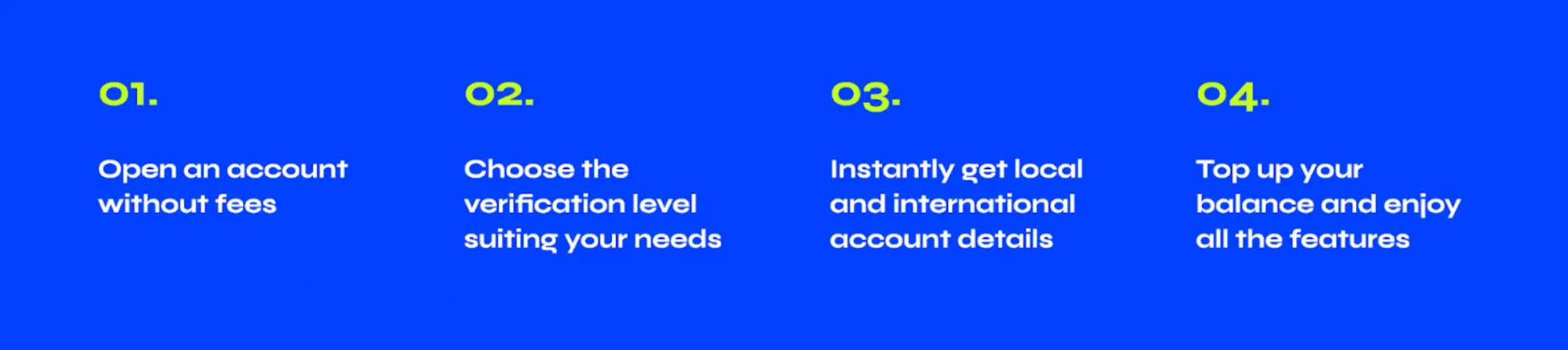

How to Open a PayDo Account?

Opening an account with PayDo is quite simple, although there are a few things to know ahead of time. Here’s how to do it:

Step 1: Create an Account

Head to the PayDo website and navigate to either the personal or business pages at the top, then click the ‘Open an Account’ button. Next, you’ll need to enter details like your email, address, and full legal name.

Step 2: Verification

You’ll be asked to choose between ‘Basic’ and ‘Pro’ levels of verification. Both tiers are free and require you to upload an ID document, however, to unlock features like cards, account details for receiving funds, and holding more than €5000, you’ll need to upload proof of residence for the ‘Pro’ level.

Step 3: Company Details (For Businesses)

If you’re opening a business account, you’ll also need to upload some additional information. You’ll be asked to provide your company registration, shareholder details, and director info.

Step 4: Approval

All that’s left to do is wait. The PayDo approvals process is typically quick but they might reach out to you for additional documents/information if needed.

Step 5: Set Up Your PayDo Cards

You can order your PayDo card straight from your account’s dash. Although the cards are free, delivery for physical cards costs €10 or €50 for express delivery. There’s no limit on EUR cards and they’re ready to use as soon as they are delivered/issued.

Final Verdict

PayDo is a brilliant option for digital nomad business owners and, in particular, remote entrepreneurs who want streamlined money management across different currencies. The storefront integrations and customer localization make PayDo incredibly useful for remote businesses and the ability to also use the platform for payroll and high-value transactions is amazing.

That being said, for personal digital nomad banking or one-off transactions, PayDo’s fees are definitely higher than alternatives like Wise or Revolut, especially If you’re looking for the lowest FX conversion fees. It’s also frustrating that PayDo isn’t available for US residents as unless you’re an American with proof of address outside of the US, you won’t be able to onboard onto the platform.

Ready to start getting paid remotely with PayDo?

Join our global

digital nomad community

Join us for free

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Read Next

espresso by Kensington Magnetic Privacy Screen Review

VirtualPostMail Review: My Honest, Hands-On Experience