As a digital nomad, managing your finances can be daunting due to the ever-changing nature of your income and expenses.

However, with the right budgeting tools, you can take control of your finances and achieve your financial goals.

Budgeting apps, expense trackers, and financial management software can significantly help you track your expenses and budget. This can lead to better financial health and help you maintain your nomadic lifestyle by ensuring that you have the financial resources to continue traveling and working remotely.

To make your life easier, we have tested several budgeting apps and compiled a list of our top picks, based on factors such as:

- User-friendliness

- Cost-effectiveness

- Functionality

- Security

- Customer support

So, are you ready to take control of your finances and budget like a pro? Let's dive right in and explore the best budgeting tools for digital nomads!

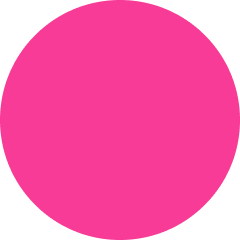

1. Wise (ex Transferwise)

Wise (formerly known as TransferWise) is a popular money transfer service that offers a convenient and cost-effective way for digital nomads to manage their finances across borders.

Wise offers a hassle-free way to transfer money between different currencies at the real exchange rate and with minimal fees, making it an attractive option for those who frequently travel and work in different countries. Its multi-currency account feature allows you to hold and manage money in different currencies in a single account, which can help you avoid unnecessary currency conversion fees.

In addition to these key features, Wise offers a debit card that can be used for purchases and cash withdrawals in different countries and integrates with various other financial management tools and services. This means that you can easily keep track of your finances and manage your money, no matter where you are in the world.

Wise is a powerful tool that can help you manage your finances as a digital nomad, by providing cost-effective money transfer services and a range of other features designed to make managing your finances abroad easier.

- Cost: Free

- iOS Compatibility: Yes

- Android Compatibility: Yes

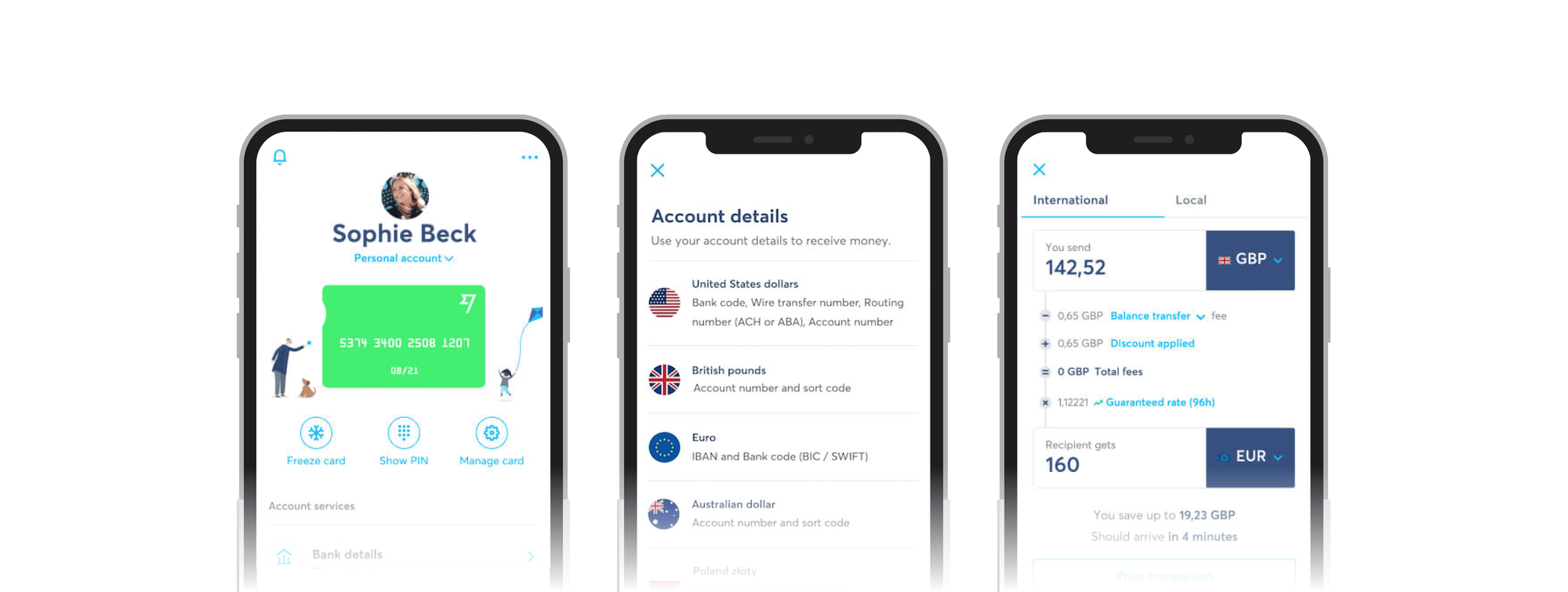

2. CLEO

CLEO is a budget and finance app that stands out for its unique and sassy approach to managing finances. The app attempts to make budgeting more fun and personalized by using text messages and comments to provide insights into your saving and spending situation. We just love it so we had to put it on our list.

With CLEO, users can connect their bank accounts, track their spending across different categories, and see how much they are saving each month.

One of the key features of CLEO is its chatbot interface, which allows users to communicate with the app in a conversational way and get instant answers to their questions. For example, users can ask CLEO how much they spent on food last month or their current balance.

CLEO also provides personalized savings tips based on a user's spending habits and helps users set and track their savings goals. Additionally, the app includes tools to help users manage their bills and stay on top of their finances, even when they are traveling abroad.

The app is completely free, and they have both an iOS and Android version.

- Cost: Free

- iOS Compatibility: Yes

- Android Compatibility: Yes

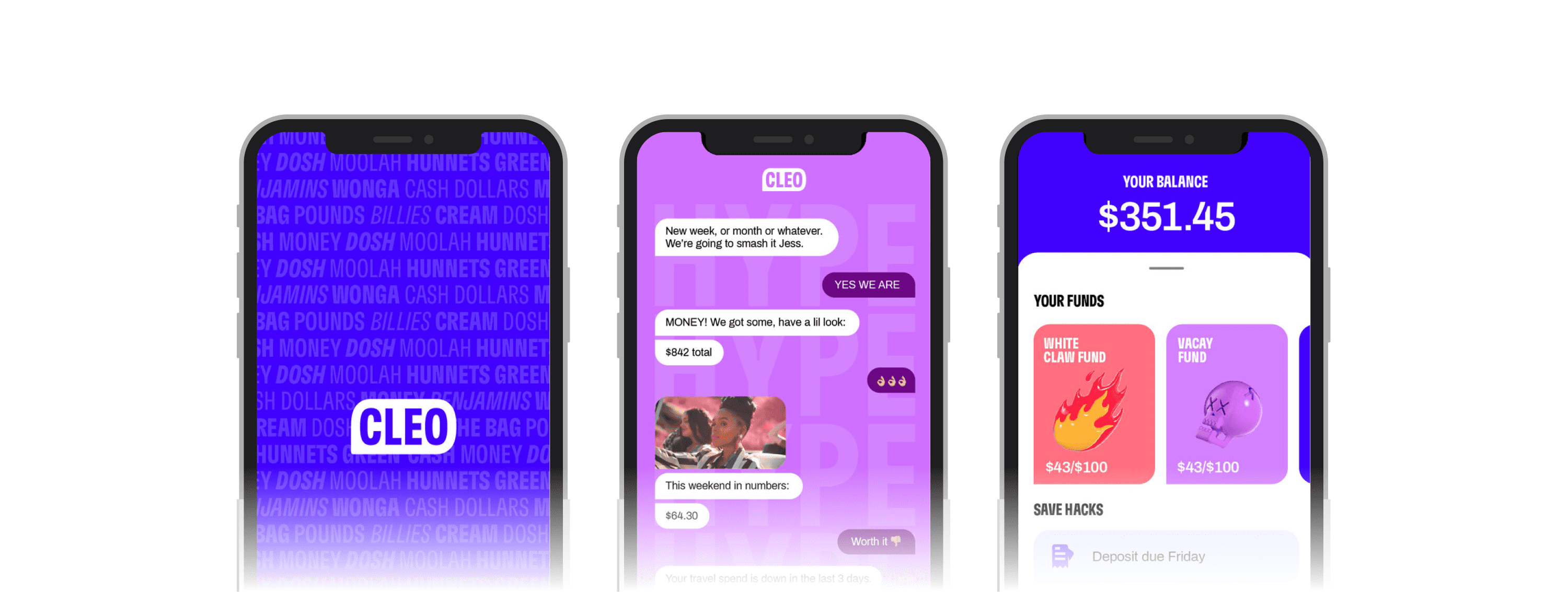

XE Currency

XE Currency is a mobile app that is especially helpful for digital nomads who need to manage their finances across different countries and currencies. The app provides live exchange rates for every world currency, allowing users to quickly and easily convert amounts between different currencies using its currency calculator.

XE Currency also offers other useful features, such as historical rate charts, which enable users to see how exchange rates have changed over time. On top of that, the app provides alerts for specific exchange rates, so users can be notified when a currency reaches a certain level. This can be helpful for digital nomads and remote workers who need to make purchases or money transfers at the right time to get the best exchange rate.

The app also allows users to monitor up to 10 currencies simultaneously, making it easy to track multiple currencies simultaneously. This feature can be particularly useful for digital nomads who are traveling to multiple countries or working with clients or customers from different parts of the world.

XE Currency is available for both iOS and Android devices and is free to download. The app's user-friendly interface, accurate exchange rate data, and convenient features make it an essential tool for any digital nomad who needs to manage their finances across different currencies and countries.

- Cost: Free

- iOS Compatibility: Yes

- Android Compatibility: Yes

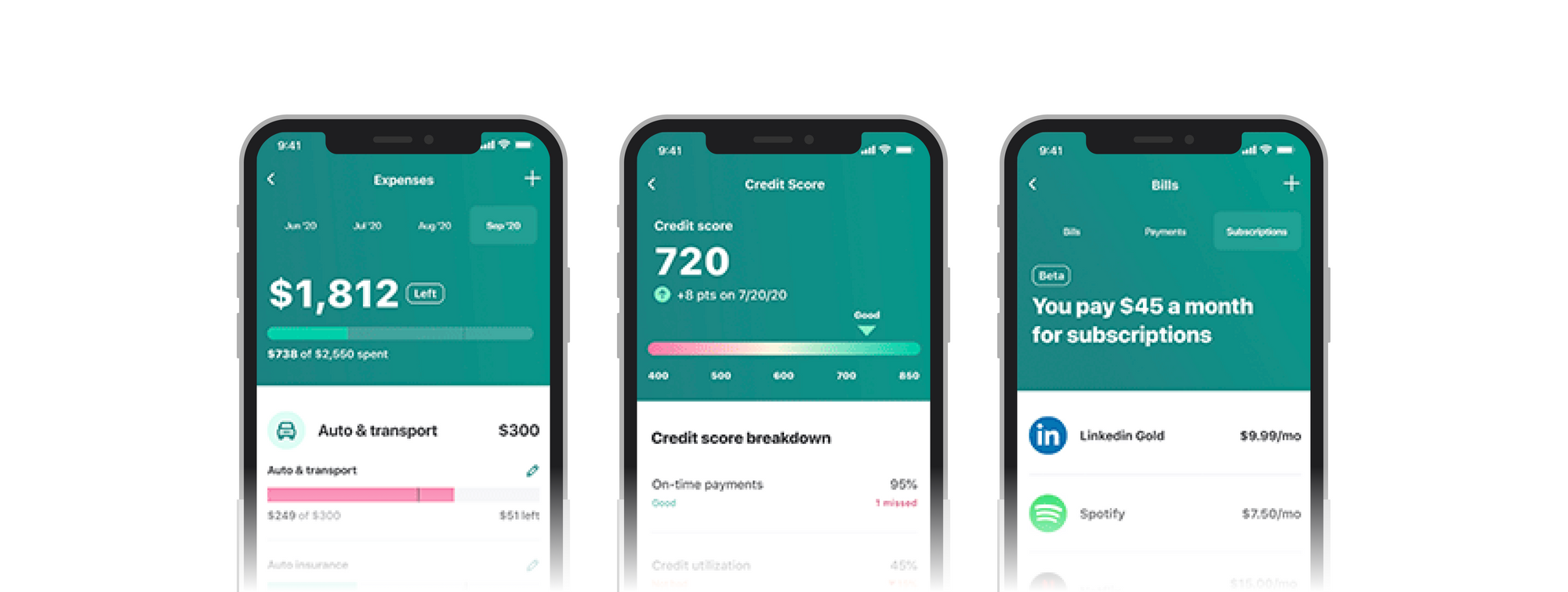

3. Mint

Mint is another popular personal finance app that helps people track spending, create budgets, and manage money.

One of the key features of Mint that digital nomads can benefit from is the ability to connect bank accounts, credit cards, and other financial accounts to the app. This allows users to automatically track their spending and income and see all their financial information in one place. The app categorizes transactions, so users can see where their money is going and make adjustments to their budget accordingly.

Mint also offers personalized financial advice and alerts for bill payments, so digital nomads can stay on top of their finances and avoid late fees. Lastly, the app provides credit score monitoring, which is helpful for remote workers who may need to access credit in different countries.

Mint is available for free, and it offers mobile apps for iOS and Android devices so that users can manage their finances on the go. The app is easy to use and provides a comprehensive view of a user's financial situation, making it a great tool for digital nomads.

- Cost: Free

- iOS Compatibility: Yes

- Android Compatibility: Yes

You may also be interested in:

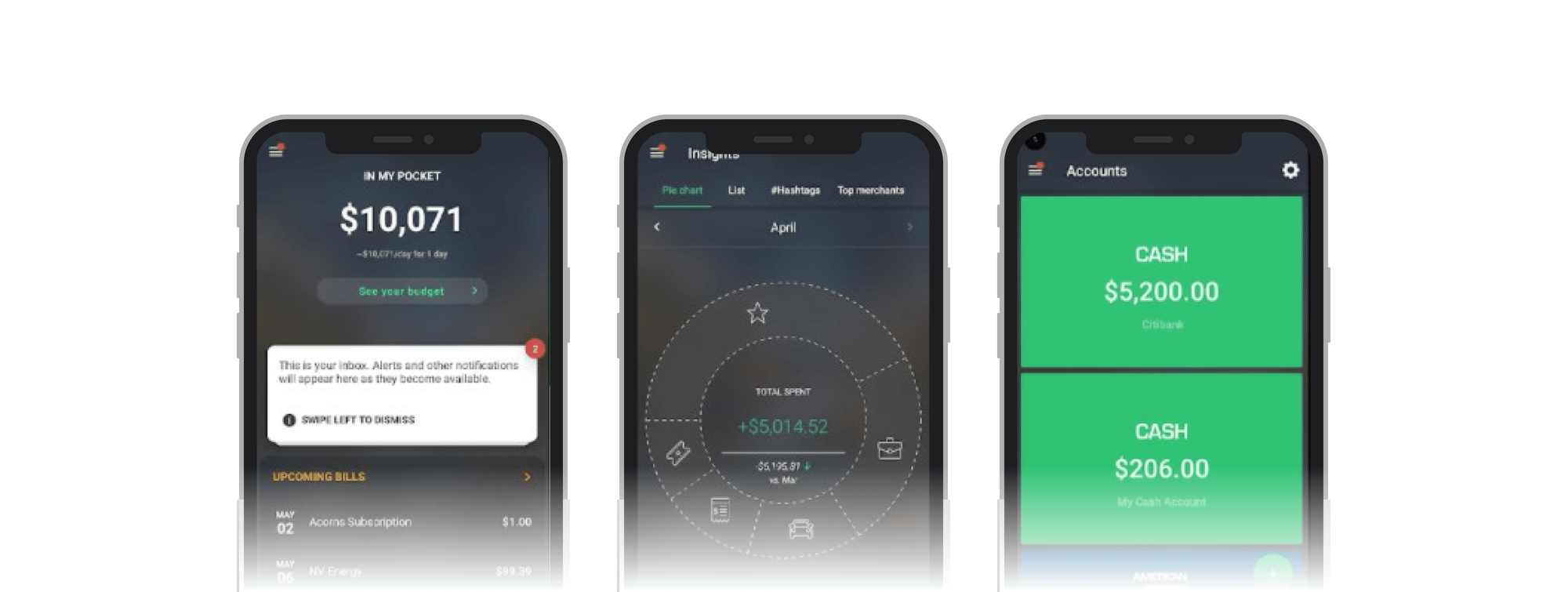

4. PocketGuard

PocketGuard is an outstanding personal finance management app that comprehensively views your financial situation, categorizes your spending, and alerts you when bills are due.

Its sleek and intuitive interface makes it easy to track your expenses, set budgets, and monitor your financial goals, no matter where you are in the world. With PocketGuard, you can easily manage your finances on the go and avoid overspending while on the road.

While it may not be specifically designed for digital nomads, its robust features and capabilities make it a fantastic tool for managing your finances, whether you're living abroad or traveling frequently.

The app is free, and it's available both for iOS and Android devices.

- Cost: Free

- iOS Compatibility: Yes

- Android Compatibility: Yes

You may also be interested in:

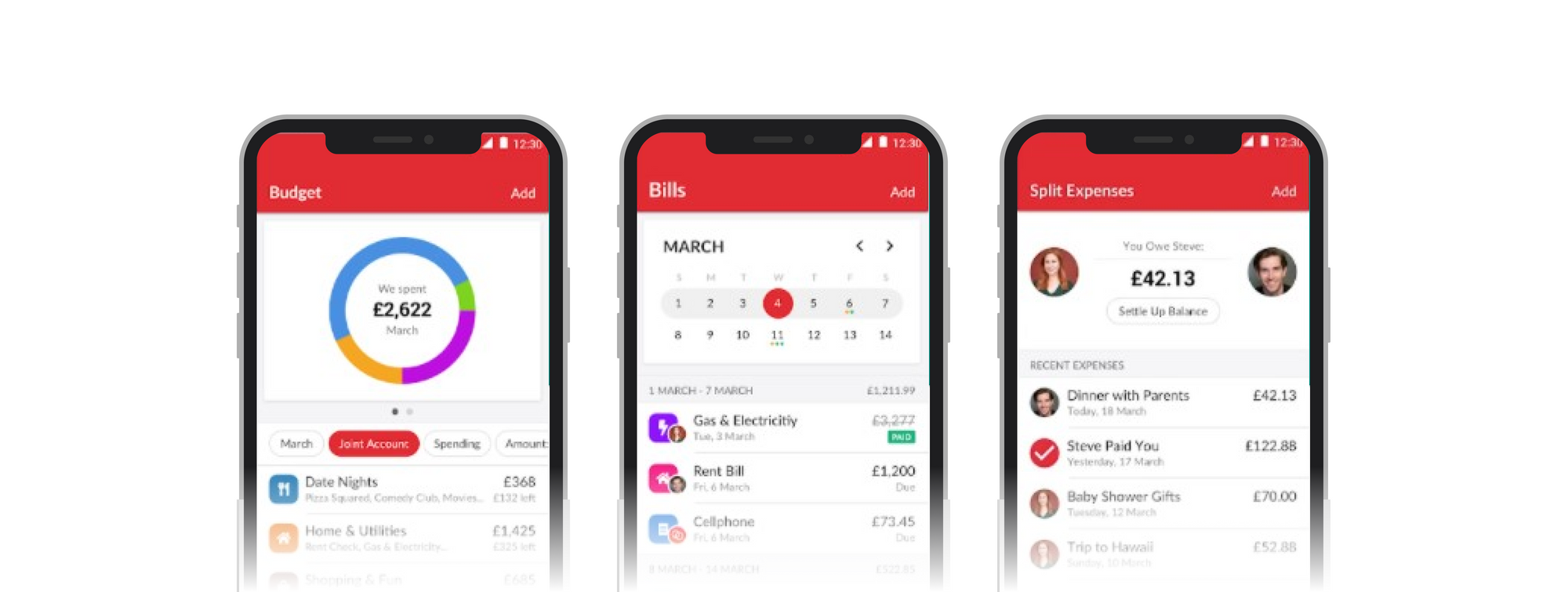

5. HoneyDue

HoneyDue is a fantastic personal finance app that can be very helpful for digital nomad couples.

This app allows you to share your finances with your partner, track your expenses, set budgets, and monitor your financial goals in real-time. With HoneyDue, you can easily split bills with your partner, manage joint accounts, and keep track of your monthly recurring expenses, all in one place.

For digital nomads, who may be managing their finances from different parts of the world, HoneyDue is an excellent tool to stay connected with their partners and manage their finances on the go. The app's interface is simple and user-friendly, making it easy to use even if you are new to personal finance management.

HoneyDue it's available both for iOS and Android devices, and, above all, it's free!

Cost: Free

iOS Compatibility: Yes

Android Compatibility: Yes

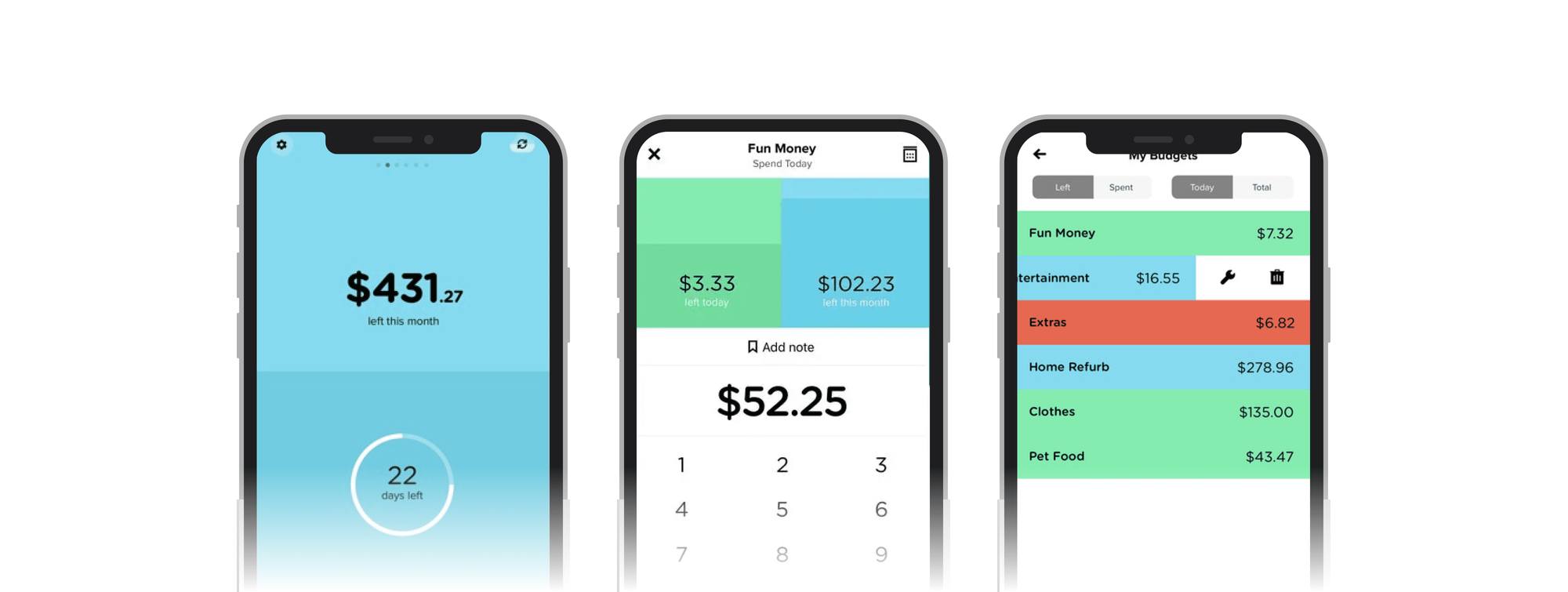

6. Pennies

Pennies is another great budgeting and expense-tracking app that allows you to easily track your expenses, set budgets, and monitor your spending across different currencies.

As a digital nomad, you likely have expenses in multiple currencies. So Pennies makes tracking and converting these expenses easy by automatically detecting the currency and applying the exchange rate. This means that you can easily stay on top of your spending and budgeting, no matter where you are in the world.

With Pennies, you can set budgets for different categories such as food, transportation, or accommodation, and monitor your spending in real-time to stay on track and avoid overspending. Plus, the app is available for iOS and Mac devices (not Android, unfortunately) and offers a free trial period, after which a one-time fee is charged for full access to the app.

- Cost: $4.99

- Free Trial: Yes

- iOS Compatibility: Yes

- Android Compatibility: No

Ready To Save Money On Your Next Trip?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

You can also follow us on Instagram and join our Facebook Group if you want to get in touch with other members of our growing digital nomad community!

We'll see you there, Freaking Nomads!

Disclosure: Hey, just a heads up that some of the links in this article are affiliate links. This means that, if you buy through our links, we may earn a small commission that helps us create helpful content for the community. We only recommend products if we think they will add value, so thanks for supporting us!