Heymondo Travel Insurance: A In-Depth Review for Nomads

As frequent travelers and digital nomads, we live to discover new places and make new memories. But there’s no denying that things could go wrong in a matter of minutes. So, travel insurance is a must.

But to find the right travel insurance, learning about your options is crucial. Heymondo travel insurance is touted as a good choice in customizable insurance plans for demanding travelers on a budget. We’ll just see about that! In this Heymondo travel insurance review, I'll share everything I learned from using Heymondo multiple times in the last 3 years of traveling.

Heymondo insurance: an overview

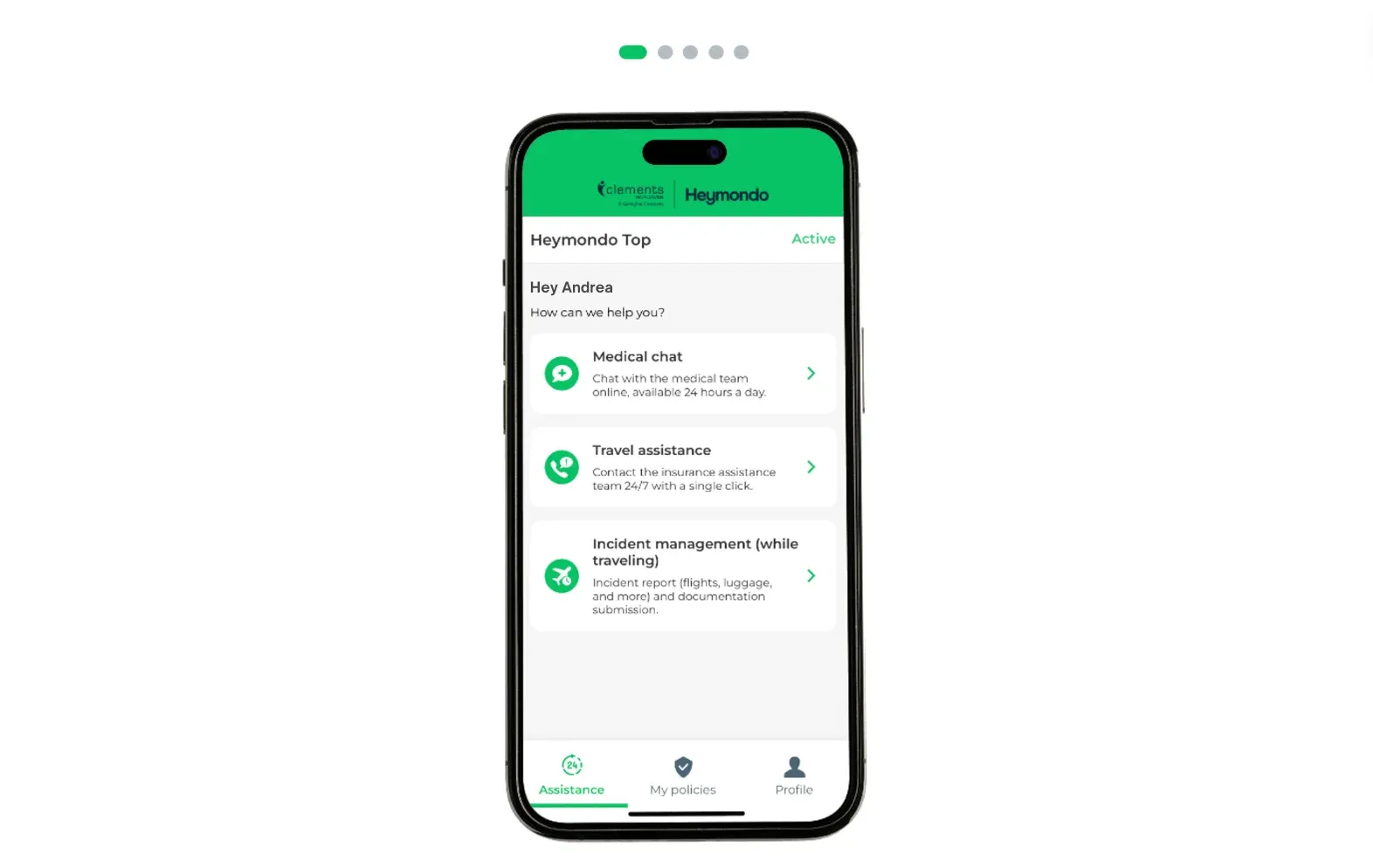

Heymondo is a travel insurance company that is made for modern travelers, not stuck in the early 2000s like a lot of its competitors. It’s fully digital, super user-friendly, and you can manage everything from your phone with their app, which already sets it apart.

But what actually makes them stand out from other travel insurance providers is how easy they’ve made the whole experience. You can chat with a doctor in-app, file claims online, and get help 24/7, without calling hotlines or digging through PDFs to find out if you’re covered.

Is Heymondo actually legit?

Yes, Heymondo is a legitimate company owned by J.C. Flowers & Co., a US-based investment fund specializing in financial services. They acquired a majority stake in Heymondo in February 2025 and, prior to this acquisition, it was backed by other investors, including Banco Sabadell, Bankinter, Howzat Partners, and Cartera de Inversiones CM.

They partner with AXA Group (yep, the big global insurer) and IRIS Global to back their policies, so you’re not dealing with some random startup with no muscle behind it.

While it might not be as “nomad-branded” as SafetyWing or Genki, it’s honestly one of the most modern, streamlined travel insurance options I’ve tried, and one that actually works for nomads too, not just vacationers.

Which insurance plans does Heymondo offer?

Heymondo offers three travel insurance types: single-trip, annual multi-trip, and long stay.

Single-Trip Insurance

Heymondo’s Single-trip insurance is best for occasional travelers who need one-and-done coverage. You get coverage mainly for emergency medical, baggage, trip delays, trip cancellations and trip interruptions. Adventure sports and cruise travel are also included with this insurance plan type.

Annual Multi-Trip Insurance

The Annual multi-trip insurance is ideal for frequent travelers like digital nomads who plan on taking multiple trips in a single year. It covers every trip you plan on taking over a period of 12 months. Each trip must last no more than 60 days each.

Long-Stay Insurance

If you are going on a trip that is expected to last more than 90 days, then the long-stay insurance is the Heymondo plan to choose. After the initial 90 days, you can renew it indefinitely. This is also great for digital nomads, but it's mainly made for expats.

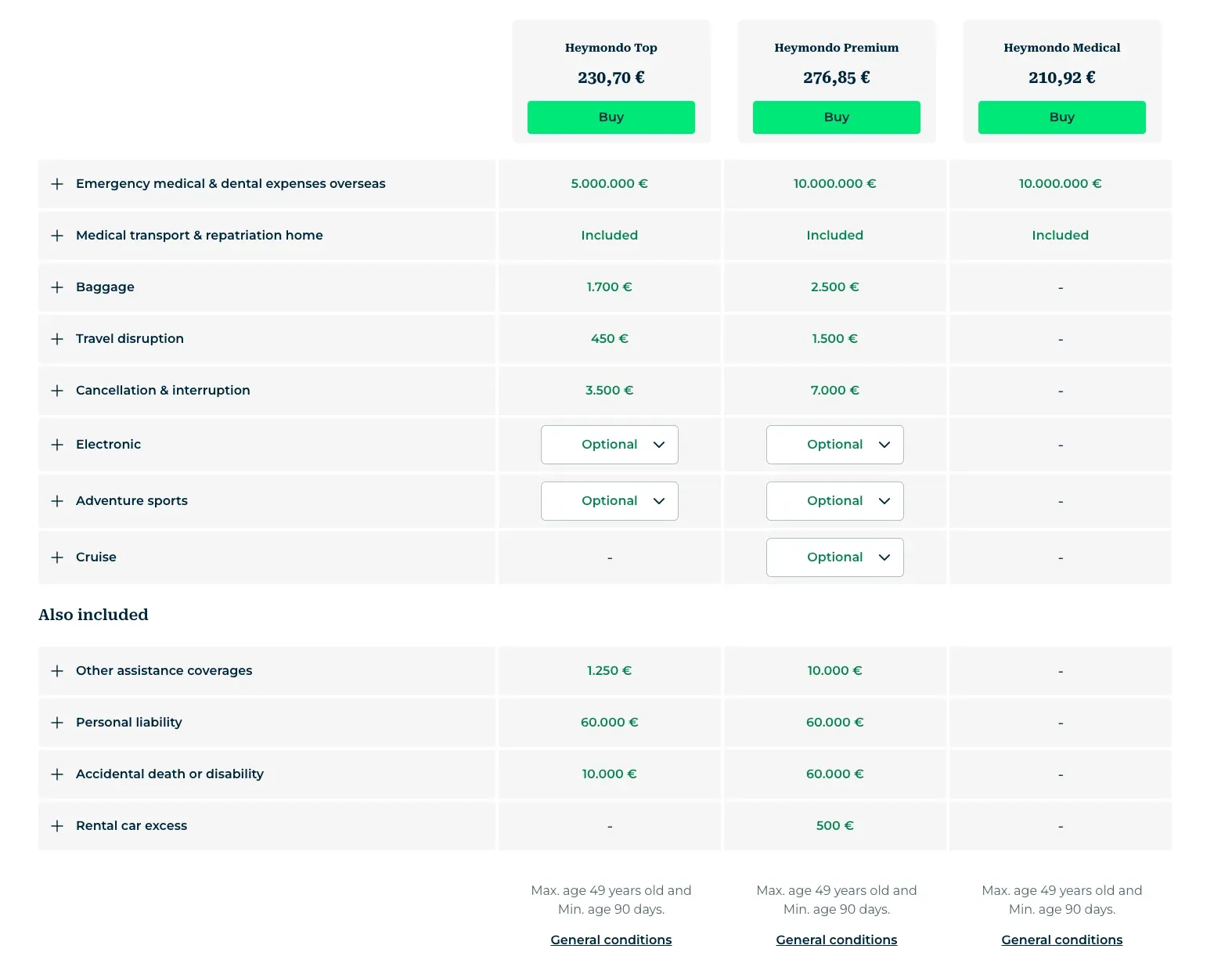

There are three tiers of coverage for each main coverage type, including:

- Heymondo Medical: includes medical coverage, trip delay coverage, search and rescue, natural disaster evacuation, and accidental death and dismemberment.

- Heymondo Top: includes everything in the Medical plan, along with trip cancellations and interruptions.

- Heymondo Premium: the best and most expensive tier. It has all the benefits of the other two plans but with much more coverage (higher plan coverage limits/higher potential payouts).

Heymondo insurance pricing

Shady insurance companies will try to get over on customers by making their policy prices vague. They’ll also use a lot of small print to avoid legal problems while misleading buyers.

You get none of that with Heymondo. Seconds after generating the quote above, the plans and prices popped up front and center. There is no room for confusion about the pricing.

Heymondo isn’t the least expensive travel insurance provider out there. However, that’s not necessarily a bad thing, considering that their plans offer a good coverage mix with extras that typically aren’t included for free, like adventure sports and specialty items (where you’re reimbursed for lost, stolen, or damaged belongings like cameras and camcorders).

Your age also doesn’t increase the price of your policy, which is rare in the insurance industry.

To give you a realistic idea of pricing ranges, these are the pricing options I had at the time of my quote as a European traveling worldwide (except the US), without any extra added:

My experience using Heymondo

I've been using Heymondo multiple times during my travels and what I really like about them is that they have always been super helpful. They don’t duck and dodge their customers like many insurance providers do (I hate that!). Their Clements Heymondo app allows you to quickly contact them for medical questions, any emergency assistance, or for managing any accident.

Having all these functions at my fingertips for me really removes the wall between the user and the insurance company, making claims management easier and more personable. It also makes it super easy for me to locate and handle my plan documents and any other pertinent contact numbers when I need them.

Overall, my experience has always been super positive, but here are some caveats to remember as you decide whether Heymondo travel insurance is for you:

Age limits

Travel insurance companies often use multiple tactics to cover themselves and reduce their financial risk. One of the ways Heymondo does this is through age limits. The Heymondo age limit for trips of 29 days or less is 69 years old. And the age limit for trips 30 days or longer is 49. If you fall outside of these age limits for longer trips, you won’t be able to buy a Heymondo plan. You’d have to explore alternative insurance options.

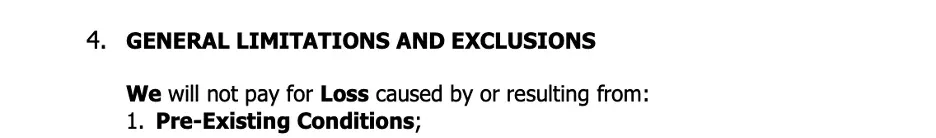

Limitations for pre-existing conditions

When it comes to travel insurance, pre-existing conditions are a hot topic. In case you aren’t aware, pre-existing conditions are health issues existing before the effective date of your travel health insurance plan. Some companies cover these conditions (at least partly), while others do not. Heymondo is on the “do not” side. Here it is stated in plain language in their sample premium policy:

So, if a pre-existing condition results in medical bills, trip delays, a trip cancellation, etc., Heymondo won’t pay up. Just know that this is relatively common with travel insurance.

Other limitations

Heymondo also won’t cover losses related to:

- Criminal conduct or intoxication

- Dental treatments unless due to accidental injury or severe pain

- Mental or emotional disorders

- Military duty

- Cosmetic surgery

- War

- Unnecessary medical treatments

- And more (there’s not enough room to list everything here)

72-hour wait for policies

If you’re ever in a situation where you forgot to buy travel insurance or decided to buy it after starting your trip, know that Heymondo has a 72-hour grace period. So, your plan benefits don’t apply until 72 hours after you purchase the policy. A lot can go wrong in those 72 hours, and customers have found that out the hard way. So, if at all possible, I suggest you to buy your policy in advance of your trip (best right after putting your first trip deposit down).

Are there any alternatives to Heymondo?

If you were already wondering about Heymondo alternatives, you’re on the right track. It’s rarely smart to make a purchase decision without considering the alternatives. There are several Heymondo alternatives you should know about - let’s explore them below:

SafetyWing

SafetyWing Nomad Insurance is one of the most popular insurance options for digital nomads and frequent travelers alike. And if you’ve done any amount of research, you’ve probably heard of them. The company offers comprehensive travel medical insurance coverage for $56.28/month, and you can cancel your plan at any time. Covered benefits include emergency medical and dental treatment, emergency transportation, lost checked luggage, trip interruption, and more.

Compared to Heymondo travel insurance, SafetyWing is more cost-effective and still covers all the basic unexpected events and scenarios (often at higher benefit limits). Though, you may be left wanting when it comes to adventure coverage and plan options overall.

Genki

Another super affordable alternative to Heymondo insurance is Genki. For as little as $50 per month, you get a plan that covers inpatient and outpatient care, medications as needed, COVID treatment, repatriation coverage, and much more. They offer two different plan tiers.

All in all, if you’re looking for a plan with both travel and medical coverage, Genki won’t be as good a choice as Heymondo. The lack of travel-related benefits leaves you open to financial losses. But if you need an affordable travel insurance plan and don’t mind the risk of travel-related losses, Genki is a solid choice!

World Nomads

You’ll find World Nomads on countless “best travel insurance” lists because of how inclusive their insurance plans are. From medical to dental to trip cancellations and interruptions and baggage issues to over 200 adventure sports and activities, you will be very much covered. But don’t expect to pay pennies for one of their plans. Like Heymondo, the prices are on the premium side. For a 30-year American traveling to Japan for 30 days, their base Standard plan is $127.64 and $225.91 for their more expensive Explorer plan.

Heymondo and World Nomads are similar in many ways, namely in their range of plan offerings and pricing. But what separates the two is World Nomad’s more inclusive coverage mix.

The Bottom Line

If you are still wondering whether Heymondo travel insurance is any good, the answer for me is “Yes.” Why?

Because of the sheer amount of coverage you get for the money. With a Heymondo policy, you can travel without any worries, knowing that you’ve got a heavy-duty plan behind you.

In addition, they are very easy to reach, whether by phone, email, or their 24/7 app. Plus, getting a 4.3 out of 5 star review on Trustpilot isn’t easy. The company is definitely legit.

Just remember the age limits for select policy lengths and read any policy language very closely. If you want to explore Heymondo further, go for it! And if you decide to go with them, snag our 15% off Heymondo discount code for a little extra savings.

Ready to get insured and travel safe?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

You can also follow us on Instagram and join our digital nomad community to find places, workspaces and events and connect with other members of our growing digital nomad community. We'll see you there, Freaking Nomads!

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Travel tips, hacks, and news

Travel tips, hacks, and news Exclusive travel discounts

Exclusive travel discounts Offers and promotions

Offers and promotions Digital nomad inspiration

Digital nomad inspiration Latest articles form our blog

Latest articles form our blog

Comments ()