Genki Insurance: In-Depth Review for Digital Nomads

As full-time digital nomads, getting reliable, flexible insurance isn’t just a nice-to-have... It’s essential. Between unpredictable travels and unexpected accidents, we’ve learned firsthand just how important solid coverage is.

Genki is one of the few insurance providers built specifically for people like us: digital nomads and remote workers. I’ve used Genki Traveler on the road and even filed a claim abroad after that accident. Spoiler: it worked exactly when I needed it to.

In this review, I'll break down what Genki covers (and what it doesn’t), compare the Explorer and Native plans, show real pricing by age group, and share our honest experience making a claim, so you can decide if it’s the right fit for your lifestyle.

Genki Insurance Overview

Launched in 2018, Genki is an international health insurance provider built specifically for digital nomads, expats and remote workers. It offers coverage that’s both flexible and easy to manage for people from any country, traveling to any country.

Unlike traditional travel insurers, Genki is designed for people who live on the move. Its plans include both travel health coverage like emergency treatment, hospital stays, repatriation, and even mental health support for backpackers and short-term travelers, as well as specialized health insurance for long-term travelers and expats, all wrapped into a monthly subscription you can cancel anytime.

Is Genki Insurance Actually Legit?

Let's get this out of the way immediately: Genki is a legit insurance provider.

Although Genki can be considered a startup, it is backed by major providers like Allianz as their risk carrier, DR-WALTER for the insurance and claims handling and Squarelife as their actual insurer. These are big names in the insurance industry with a history of over 100 years for some of those names.

hanks to these partnerships, they are able to offer solid protection with a user-friendly digital experience, making it one of the most trusted names in nomad insurance today.

Genki has also insured so far more than 50,000 nomads in 193 countries, earning a positive score of 4,1/5 on Trustpilot with almost 700 reviews.

Plans Offered by Genki Insurance

Genki offers two worldwide coverage plans: Genki Traveler and Genki Native, and they both automatically renew every month for up to two years, striking the perfect balance between travel flexibility and affordability.

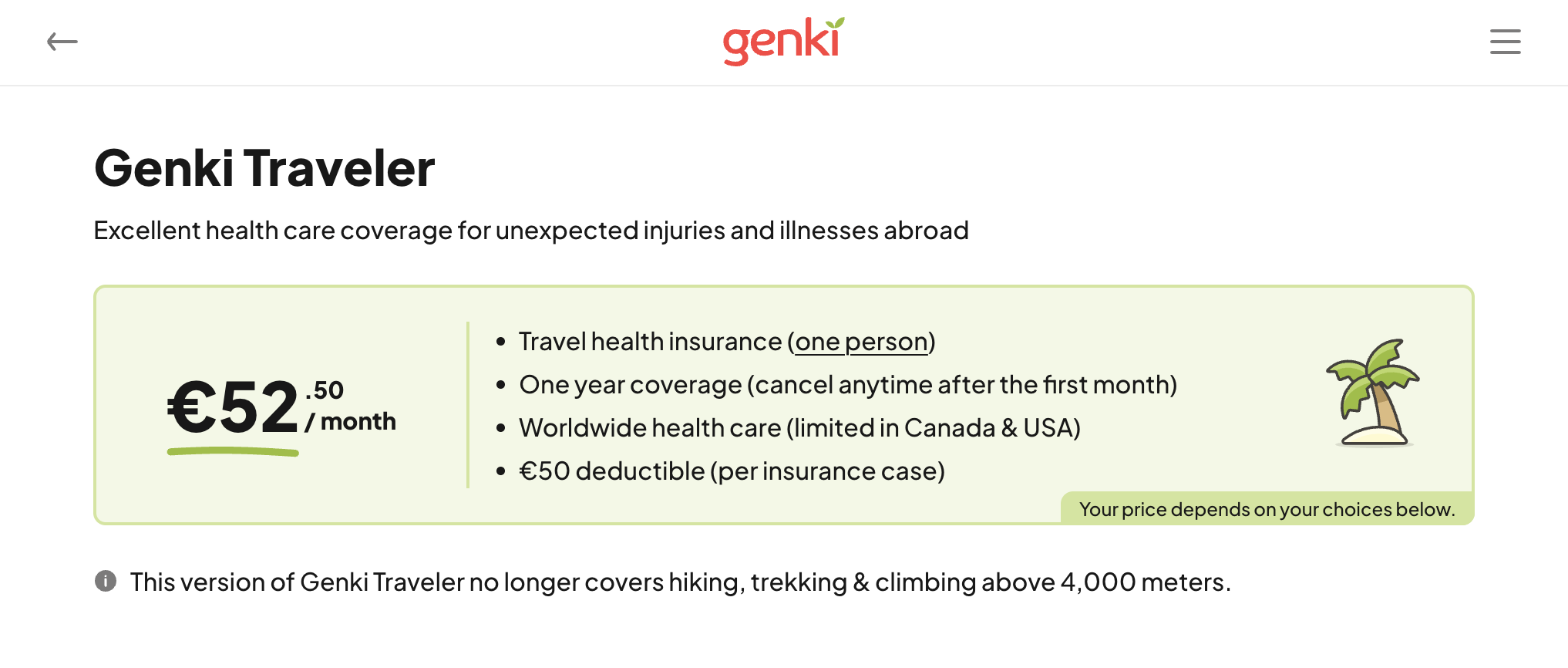

Genki Traveler

Genki Traveler is a travel health insurance plan that covers individuals from any country, aged 0 to 69, up to two years.

It’s designed more for budget-conscious backpackers and short-term travelers, offering all the essential travel coverage plus dental care, mental health, pregnancy and adventure activities such as skiing that many travel insurance just don't offer.

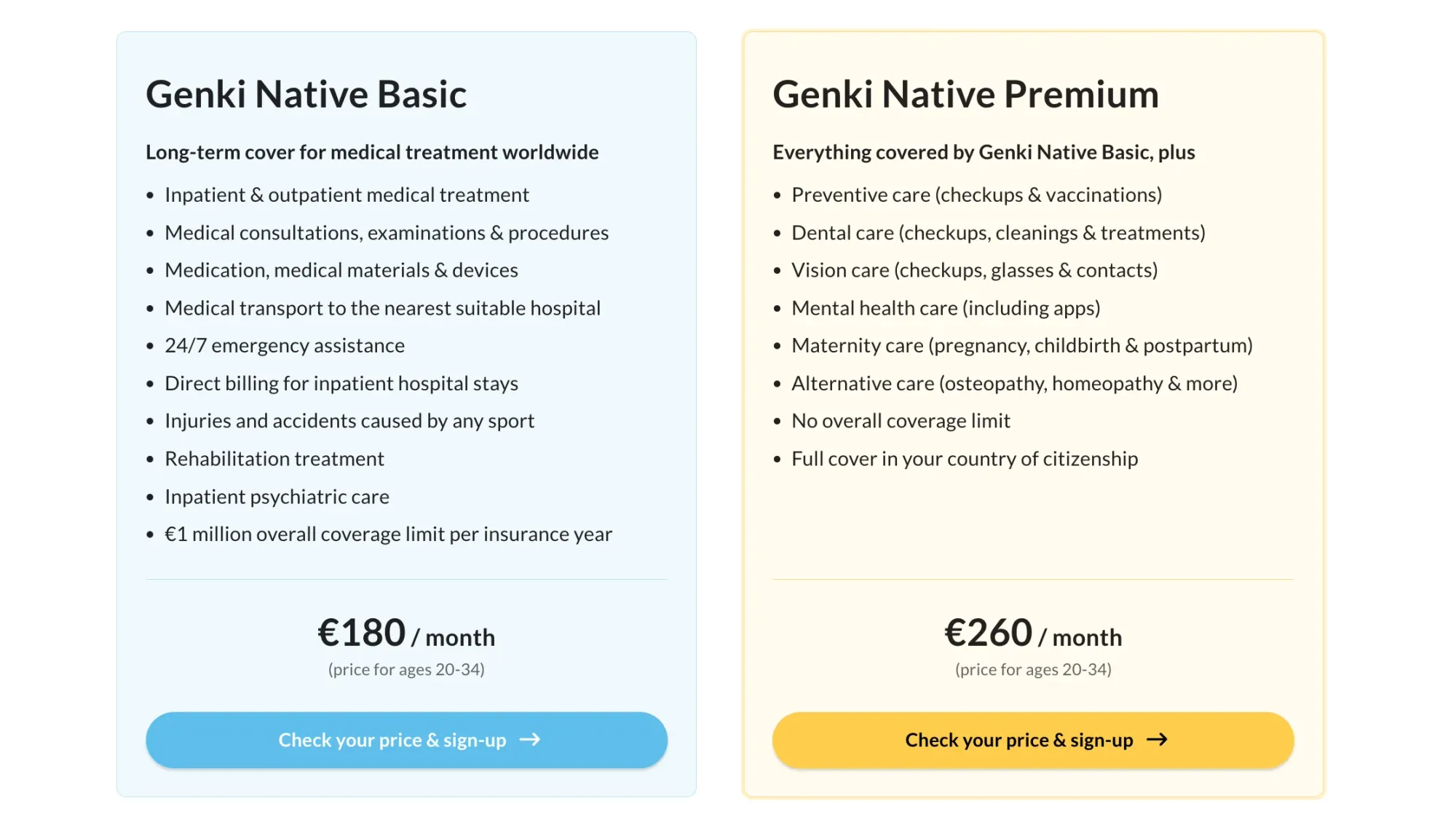

Genki Native

While for those of us who are full-time travelers and digital nomads (but also expats), the Genki Native plan offers international health insurance that goes beyond the basics.

With telemedicine and access to a global network of doctors, it’s suited for expats and long-term travelers making a home away from home. This plan applies regardless of your nationality.

Genki Native comes in two different tiers: Genki Native Basic and Genki Native Premium. The Basic plan covers emergencies and accidents and only the most common ailments. Whereas the Premium gives you everything in Basic, plus things like vision, pregnancy, and even preventive care. Here’s a breakdown of what you get in each of the Genki Native plans.

Genki Insurance Pricing

Diving into the costs, Genki practices transparency, breaking down how factors like age and destination affect your premium. The cost of their insurance plans is determined by:

- Your Age: Different age groups have different pricing tiers.

- Regions of Cover: Costs adjust depending on whether you include or exclude the U.S.

Let's look at each of the two plans they offer (Genki Traveler and Genki Native) and how much they cost.

Genki Traveler Prices

The Genki Traveler plan offers transparent prices starting at just €52.50 per month.

Here's a breakdown of Genki insurance costs:

| Age Group | Monthly Cost (Excluding U.S.) | Monthly Cost (Including U.S.) |

|---|---|---|

| 0-29 | €52.50 | €98.10 |

| 30-39 | €63.90 | €123.60 |

| 40-49 | €79.80 | €146.70 |

| 50-59 | €109.80 | €213.60 |

| 60-69 | €168.30 | €345.30 |

Tossing the U.S. into your coverage mix undoubtedly nudges your premium upwards, a common scene across the board with travel insurance, given the steep medical costs stateside.

Genki Native Prices

The Genki Native Basic plan starts at €180 per month for people 20-34 years old, while the Genki Native Premium plan starts at €260 per month for that same age group.

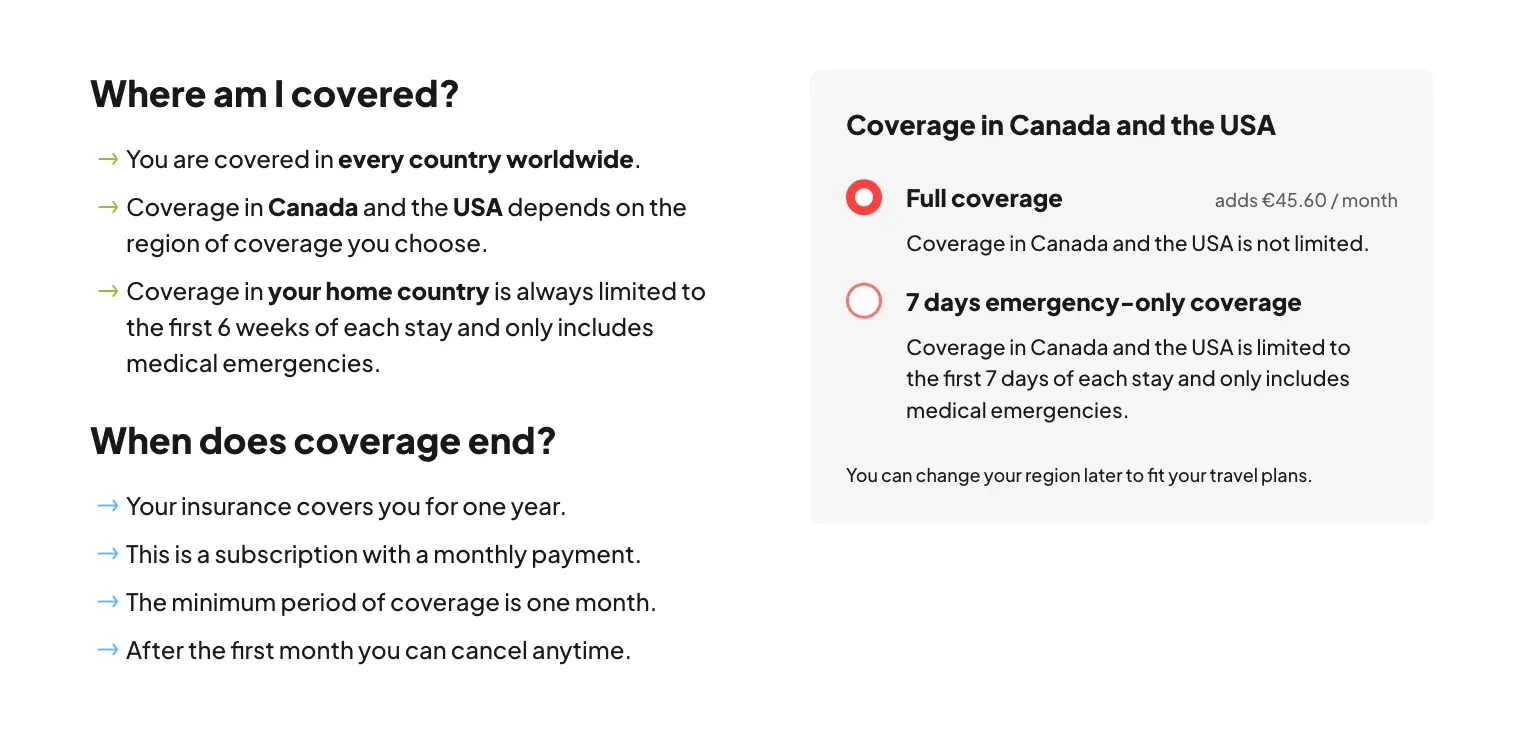

On the flip side, for the explorers not planning on charting a course towards Canada or the USA, if you exclude coverage in these two countries, there’s a sweet spot in Genki’s pricing model that lightens your financial load each month.

The great part is that this isn’t a once-and-done decision. As your journey unfolds and your destinations evolve, you’re free to tweak your coverage monthly.

You're also covered for 30 days per calendar year for all benefits during stays in your country of citizenship. This means peace of mind as you reconnect with friends and family, or take a break from your nomadic adventures.

It’s this kind of adaptability that aligns so well with the unpredictable rhythm of nomadic travels, allowing your insurance to seamlessly sync with your ever-changing itinerary.

Keep in mind, though, that this coverage applies only once you've embarked on your international journey; it doesn't kick in if you're still at home preparing for your travels! Forget to purchase your plan before setting off? Don’t worry – you can purchase a Native plan even after your adventure is well underway.

What’s Covered By Genki Health Insurance?

When it comes to both coverage plans, Genki Insurance offers two different options to choose from:

- Worldwide Coverage: This is your passport to pretty much every corner of the globe, freeing you from the usual constraints and letting your wanderlust lead the way.

- Worldwide with Limited Cover in Canada and the US: Opting for this means you’re still covered globally, but with some caps when it comes to the North American giants (USA and Canada). This is a thoughtful nod to the varying needs and budgets of travelers. You can also decide to have emergency-only coverage for those countries, limited to 7 days, if you prefer, and change your region later to fit your travel plans.

The beauty of Genki's approach is its flexibility and destination-independent approach to travel insurance. There's no need to map out every step of your journey ahead of time. Instead, you're free to let your adventures unfold naturally, secure in the knowledge that your insurance can aapt alongside you.

Medical Coverage

When it comes to health, Genki insurance's got your back with a comprehensive suite of medical coverages that’s hard to beat. They've thought of everything.

Here's a breakdown of what you get with the Genki Traveler plan:

| Medical Coverage | No Limit | Limit | Limit (Up To) |

|---|---|---|---|

| Emergency Treatments | ✓ | ||

| Medications and Supplies | ✓ | ||

| Dental Care (Immediate pain relief) | ✓ | Up to €500 | |

| Dental Care (Due to an accident) | ✓ | Up to €1k | |

| Mental Health (Outpatient initial) | ✓ | Up to €1,5k | |

| Mental Health (Inpatient emergency) | ✓ | Up to €20k | |

| Transportation to the nearest hospital | ✓ | ||

| Transportation back to home country | ✓ | ||

| Repatriation of mortal remains | ✓ |

One of the standout features of Genki's medical coverage is its inclusivity. Genki's ensures that no matter the situation—be it a sudden illness or an injury—you're covered with few if any limits.

When it comes to dental care, you're supported with up to €500 for immediate pain relief and up to €1,000 for accidental damage. After all, the life of a nomad shouldn't be restricted by something as fixable as a toothache.

Moreover, most medical-related incidents have no limit on coverage, which is a rarity among travel insurance providers. Mental health support is also robustly included, offering both initial outpatient care and emergency inpatient care with generous limits.

Transportation for medical emergencies, whether to the nearest hospital or back to your home country, is fully covered, alongside the repatriation of remains. It’s this level of inclusivity and understanding of the traveler’s needs that truly sets Genki apart.

Activities and Sports

Genki insurance offers a comprehensive range of activities covered under its travel insurance plans.

Activities and Sports Included in Genki Traveler Plan

Some of the activities that the Genki Traveler plan covers include:

- Climbing (indoor only)

- Cycling

- Hiking

- Motorcycle/-scooter

- Surfing

- Skiing (any kind)

- Snowboarding (any kind)

- Kitesurfing

- Kayaking

- Mountain biking

While Genki covers a wide range of activities, certain "Dangerous activities" are excluded from the coverage. Those include:

- Base jumping

- Bungee jumping

- Diving

- Parachuting & gliding

- Racing

- Professional sports

For those who live for the rush of adrenaline and the freedom of the open sky, the Genki Native Plan dramatically expands your horizon of possibilities. It not only matches the Explorer Plan in terms of activities and sports coverage but goes beyond by embracing those very adventures that carry an element of risk—activities previously labeled as too dangerous.

Now, the thrill of base jumping, the leap of bungee jumping, the depths of diving, the soar of parachuting, and the glide across skies are all within your reach, under the protective wing of the Native Plan. It's an invitation to push the boundaries, to explore further, and to experience more, securely.

Yet, it's worth noting, for those who professionalize their passion in sports, that this realm remains outside of what Genki covers. This applies to all Genki plans.

What’s NOT Covered by Genki Health Insurance?

In the world of wanderlust and remote work, the insurance fine print can often be a buzzkill, especially when you're trying to decipher what's covered and what's not. Genki insurance brings some clarity to this often murky world, but like any good story, there are plot twists. Let's break it down, no jargon attached.

Pre-existing Conditions

The Genki Traveler plan does not cover medical conditions you’ve received treatment or advice for within 6 months before the policy starts. This includes chronic illnesses such as diabetes, cancer, sleep apnea, and chronic obstructive pulmonary disease (COPD).

With the Genki Native plan, if you have a pre-existing condition, mentioning it before signing up for a plan is essential, as the insurer will assess this information to decide if and under what conditions your existing medical conditions will be covered.

Adventure & Extreme Sports

Now, for the adrenaline junkies: If launching off cliffs or diving into the deep blue is your idea of a typical Tuesday, the Genki Traveler plan might not be your best co-pilot, keeping certain heart-pounding activities off the list.

But, switch gears to the Genki Native plan, and it's like unlocking a level where previously "too wild" pursuits are now fair game. Just remember, turning your passion into a profession (read: professional sports) still won't make the cut.

Alcohol & Drugs

Here's a no-brainer but often overlooked chapter: accidents and illnesses caused by the use of alcohol, drugs, or similar substances are not covered by Genki's plans.

That means if your adventure takes a detour into party territory, leading to mishaps under the influence, Genki's not covering that journey.

Same goes for those seeking a helping hand with substance recovery, it's a road you'll walk without Genki's backing. This means if you need professional help overcoming substance addiction, Genki won't be able to help.

If you need such coverage, you may need to look at other insurance providers or purchase additional coverage specifically for rehabilitation treatments. It's a reminder to navigate your travels and life choices wisely, keeping safety first.

Pre-existing Pregnancy

If your journey to parenthood begins before your Genki policy does, the path gets a bit rocky for all plans. Immediate and unforeseen hiccups in health will have coverage, but it's a narrow lane.

What is Genki Good (and Not Good) For?

Genki insurance shines for a specific crowd, especially for those whose lifestyles aren't just about the 9-to-5 grind. In other words, for:

- Digital Nomads, Long-Term Travelers, and Backpackers: If your office changes time zones more than you change your toothbrush, Genki's got your back. Designed for the digital nomad, the backpacker, and anyone who's made the world their office, Genki speaks your language.

- Health Coverage Seekers: Comprehensive doesn't quite cut it when describing Genki's health coverage. From an unexpected tumble off a mountain bike in the Alps to needing a dentist after a too-hard bite of a baguette in Paris, they cover the mishaps and misadventures that health often throws our way.

- Travelers Valuing Flexibility: If the only constant in your life is change, Genki's flexibility is a breath of fresh air. Plans can shift as often as your destinations do, from a month up to two years, and if you need to bail? No problem. Their cancel-anytime policy is as nomad-friendly as it gets.

- Budget-Conscious Travelers: Who said comprehensive coverage had to empty your wallet? Genki's competitive pricing proves you can protect your health without sacrificing your travel fund.

On the flip side, Genki might not be the best fit for those who are:

- Some senior travelers: If you've celebrated more than 54 trips around the sun, pause for a moment. The age cap for new applicants is 69 for Genki Traveler and 55 for Genki Native

- Short-Term Vacationers: Here for a good time, not a long time? If your travel is more about weekend getaways than wandering indefinitely, you might find Genki's extensive coverage more than you need.

- Extreme Adventure Seekers: If you love the adrenaline but hate the idea of not being covered for the wildest of your escapades. While Genki is adventurous, it puts the brakes on for the most extreme of sports under its Explorer plan.

- Pre-existing Condition Concerns: If you have health conditions that have been part of your journey for a while, Genki's stance on pre-existing conditions, more specifically for Genki Traveler, might not align with your needs.

While Genki insurance offers a compelling package for many digital nomads and long-term travelers, weighing its offerings against your individual needs and preferences is essential.

My Experience Using Genki

I first discovered Genki a few years ago after seeing it recommended multiple times in the r/digitalnomad subreddit. It kept coming up in discussions about reliable insurance for long-term travelers, so I decided to give it a shot. I’ve been using it ever since.

For a while, I didn’t need to make any claims. But during a trip to Thailand, my boyfriend had a scooter accident. While the injuries weren’t serious, he needed several medical check-ups and spent a couple of days in the hospital for observation.

That’s when Genki really proved its value. The claims process was surprisingly smooth: we submitted the hospital documents and receipts online through their partner, DR-WALTER, and got reimbursed quickly with no back-and-forth (except the 50 euros deductible I had opted for in my plan). Even though we were in a foreign country, the support felt reliable, responsive, and stress-free. Exactly what you want in a moment like that.

Since then, I’ve had even more peace of mind while traveling. It’s one thing to read about great coverage, it’s another to use it and have it actually work.

Pros and Cons of Genki as a Nomad Insurance

PROS: The monthly subscription model is a huge plus: you’re not tied down, and the coverage adjusts as your plans change. It also covers things most travel insurance skips, like mental health, dental emergencies, and sports injuries. You can use any doctor worldwide, and reimbursements are quick when documents are clear and complete.

CONS: The 2-year limit on the Explorer plan means you’ll eventually need to upgrade to the more expensive Native plan. We also noticed that claims can take longer if documents aren’t formatted properly — it’s best to double-check everything before submitting.

Digital Nomad Health Insurance Alternatives to Genki

If Genki isn’t quite the right fit for your needs, there are a few other options that digital nomads often turn to, each with its own strengths depending on how you travel and what level of coverage you’re after.

SafetyWing

Often referred to as the “starter insurance” for digital nomads, SafetyWing offers simple, affordable monthly coverage for digital nomads. It’s especially good if you're looking for basic medical protection without overcomplicating things.

The policy covers hospital visits, doctor fees, medical evacuation, and some travel-related incidents like trip delays and lost baggage. You can sign up even after you've already left your home country, and home country coverage is included for short visits after 90 days abroad. Their pricing start at around $56.28/month, making it it’s one of the most budget-friendly options on the market.

Heymondo

Heymondo stands out for its balance of medical and travel coverage, paired with a super intuitive mobile app. It’s a great pick if you want more than just basic health insurance while on the road.

Their plans include emergency medical care, trip interruption, COVID-19 coverage, and medical transport, with optional add-ons depending on your travel style. The 24/7 in-app chat support makes it easy to handle emergencies or claims, even if you're halfway across the world.

While prices vary based on destination and trip length, Heymondo tends to cost a bit more than Genki, but you’re getting a wider range of travel protections included.

World Nomads

World Nomads has been around for years and is trusted by backpackers, long-term travelers, and adventurous nomads alike. Their plans are especially strong for people engaging in activities like hiking, diving, and skiing, since they cover a wider range of sports than many other providers.

Coverage includes emergency medical care, evacuation, trip protection, and even stolen gear, which makes it ideal if you’re traveling with expensive electronics or camera equipment. You can buy or extend a policy even if you're already abroad. Pricing usually falls between $40–$70/month, depending on where you're going and what you want included.

Check out this comparison of all three to see which might be right for you:

Genki Insurance FAQs

How do I file a claim with Genki?

Start by collecting itemized receipts and invoices for any medical services you received. Then, log into your Genki profile or use their provided email to submit your claim with the necessary documents. Be sure to report the illness or accident as soon as possible and allow Genki to access your medical records if needed. Claims are typically processed in 2–5 weeks, but can be faster depending on your plan and documentation quality. Under the Native plan, some claims are reimbursed in as little as 3 business days.

How do I cancel my Genki insurance plan?

You can cancel anytime, directly from your account. Coverage remains active until the end of your paid month. If you cancel within the first 14 days, you’re eligible for a full refund. Note: once cancelled, you can’t file new claims, but ongoing claims will still be processed.

How do I get a Genki insurance quote?

Head to Genki’s website and fill in your age, nationality, and travel dates to get a free, no-commitment quote. You can customize your coverage by choosing whether to include U.S. and Canada and selecting your start date. Payments are monthly, and you’ll be billed automatically on the same day each month.

Am I covered in my home country?

Yes, but it depends on your plan. The Explorer plan covers you for up to 6 weeks every 180 days for emergencies and accidents only, while the Native plan covers you for 30 days per year in your home country, including routine care and ongoing treatment.

Are there any deductibles with Genki?

Yes. The Explorer has a €50 deductible per claim while Native offers three options:

- €1,000 annual deductible

- €500 annual deductible

- No deductible (with a higher monthly premium)

Have You Tried Genki Yet?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

You can also follow us on Instagram and join our digital nomad community to find places, workspaces and events and connect with other members of our growing digital nomad community. We'll see you there, Freaking Nomads!

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Travel tips, hacks, and news

Travel tips, hacks, and news Exclusive travel discounts

Exclusive travel discounts Offers and promotions

Offers and promotions Digital nomad inspiration

Digital nomad inspiration Latest articles form our blog

Latest articles form our blog

Comments ()