SafetyWing Insurance Review for Digital Nomads

Let’s be honest, buying travel insurance is the last thing you want to think about when you’re planning your next trip. But if you’re a digital nomad like me, skipping it is just not worth the risk.

The tricky part, though, is actually choosing the right digital nomad insurance provider.

I’ve been personally using SafetyWing on and off for the past couple of years, from motorbike crashes in Turkey to missed flights in Asia, and I’ve got a lot to say. The good, the not-so-good, and whether it’s actually worth your money.

TL;DR: If you want something affordable, flexible, and easy to buy even after you’ve already left home, it’s honestly one of the best options out there. But let’s break it down properly.

What is SafetyWing?

SafetyWing is a travel medical insurance company that was built by digital nomads, for digital nomads. It launched in 2018 with the aim of making travel insurance way less painful (and way more affordable) for people who work remotely and bounce between countries.

What makes it stand out to me is that it doesn’t feel like the traditional old-school insurance. There’s no clunky paperwork, no long-term contracts, and you can even buy it after you’ve already left your home country. It’s totally remote-friendly.

But here's the part that confuses a lot of people: even though they market it as "insurance for digital nomads," you don't have to be one to use it. You could be on a long backpacking trip, taking a sabbatical, or even working from a beach in Bali for a couple of months. It still works.

Is SafetyWing Legit?

Absolutely. SafetyWing was founded by digital nomads who saw a real need for flexible, affordable insurance. Since then, it’s become one of the most trusted names in the remote work world.

They currently have over 1,800 reviews on Trustpilot with a TrustScore of 4.0 out of 5, which is actually pretty solid for an insurance company. Most of the feedback is positive, especially around their pricing and ease of use. Some complaints mention slower claims in the past, but they’ve worked on improving that and, from my own experience, the process is way smoother now.

So yes, SafetyWing is legit. I’ve used it myself, and I know plenty of other nomads who rely on it too.

Which insurance plans does SafetyWing offer?

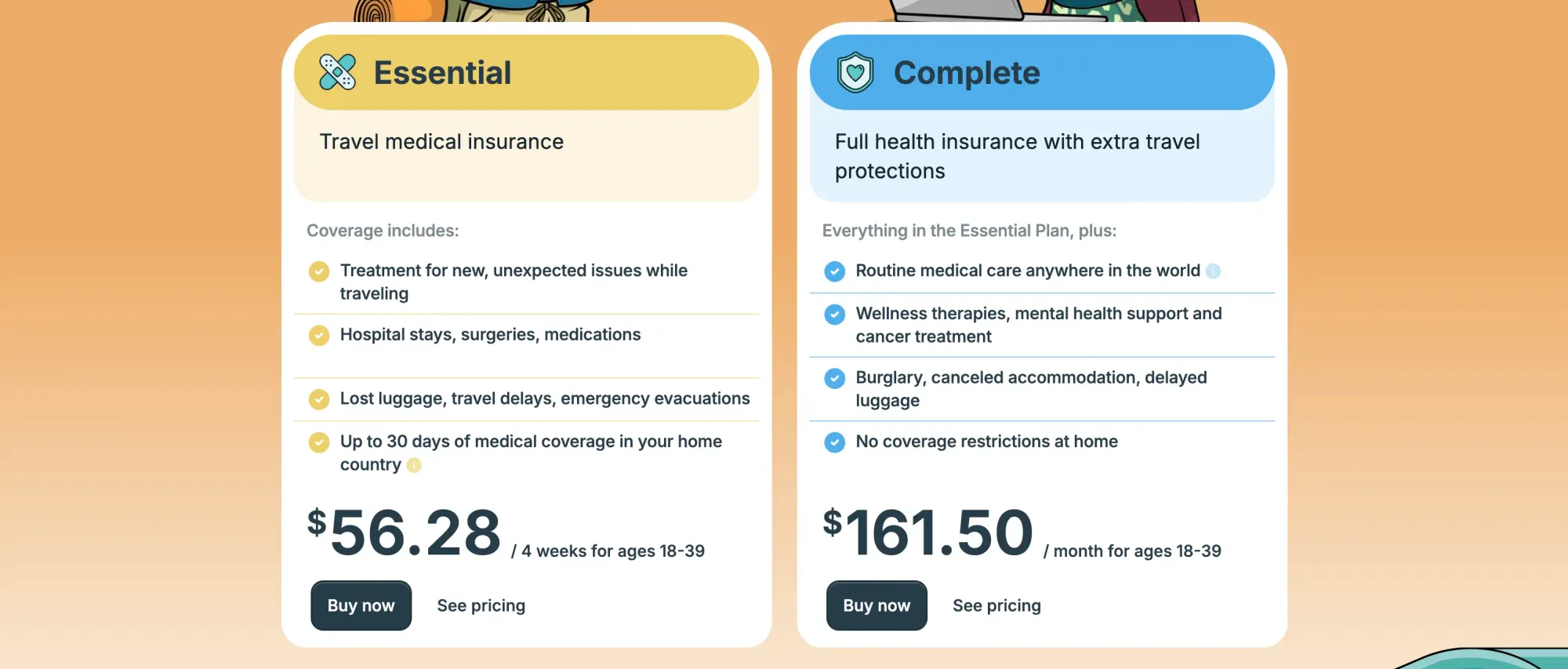

You can pick from two main insurance plans: Nomad Insurance Essential and Nomad Insurance Complete.

Plan 1: Nomad Insurance

Nomad Insurance Essential is their OG plan and the one most people go for as it's one of the cheapest in the market. It’s your usual travel medical insurance that covers things like unexpected illnesses, emergency hospital visits, lost luggage, and travel delays. It’s made for people who are outside their home country, hopping from place to place.

That's the one I personally used on multiple trips, including after a motorbike accident I had in Turkey and it saved me over $1,500 in hospital bills. It’s super affordable, runs on a 28-day subscription model, and you can buy it even if you’re already abroad. No return ticket needed.

What's covered

What isn't covered

- Pre-existing conditions

- Routine check-ups and preventive care

- Pregnancy or maternity care

- Cancer treatment

- Professional sports

- High-risk adventure sports not on the approved list (unless you buy the add-on)

- Theft of electronics (unless you buy the electronics add-on)

- Extended coverage in the USA or Canada without the add-on

Limitations

- No deductible (you’re covered from the first dollar)

- Maximum medical coverage per person is $250,000

- Emergency medical evacuation is capped at $100,000 lifetime

- Home country coverage is limited to 30 days per 90-day period abroad (15 days for US residents) and only applies to emergencies

Plan 2: Nomad Insurance Complete (formerly Nomad Health)

This one’s a more serious, all-in-one global health insurance plan. It covers way more than just emergencies, including doctor visits, dental checkups, mental health support, prescriptions, and even maternity care. It’s a good fit if you want year-round health insurance that works in your home country too.

It’s more expensive and requires a 12-month commitment, but for nomads who need full health coverage (especially Americans), this might be the better choice.

What's covered

What isn't covered

- Pre-existing conditions

- Dangerous activities (see the full list on their site)

- Professional sports

- Medical tourism

- Drugs and excessive alcohol

- Non-medical travel-related costs e.g. flight delays, lost luggage etc

Limitations

- EUR 50 deductible

- Cover in your home country is restricted to 6 weeks per 180 days and only includes accidents and life-threatening emergencies

- Cover in Canada and the USA is restricted to 6 weeks per 180 days

SafetyWing pricing

Let’s talk money. One of the main reasons I went with SafetyWing was the price (and I suspect many other nomads do that too). It’s affordable, especially for what you get.

Right now, their Essential plan (which I use) costs $56.28 for 4 weeks if you’re between 18 and 39. As mentioned, it runs on a flexible monthly subscription, so you can start or stop whenever you want.

If you need something more complete, there’s their Complete plan at $161.50 per month. It includes everything in Essential, plus routine checkups, mental health care, maternity, cancer treatment, and no restrictions back home. As I said before, it's more like a traditional health insurance plan, but for nomads and it requires a 12-month commitment.

You can also customize your plan with add-ons for USA/Canada coverage, electronics theft, or adventure sports.

You can estimate the cost of your nomad insurance coverage yourself on the Nomad Insurance page or using their handy tool below:

My experience using SafetyWing

I was in Turkey when it happened and a pretty harmless-looking motorbike ride turned into a full-blown emergency. Long story short: I lost control, hit the ground hard, and ended up in a hospital in Kuşadası. Not exactly how I planned my day.

The hospital didn’t waste any time. X-rays, bloodwork, more tests than I could count (some of them probably unnecessary if I’m being honest). The bill? Over $1,500.

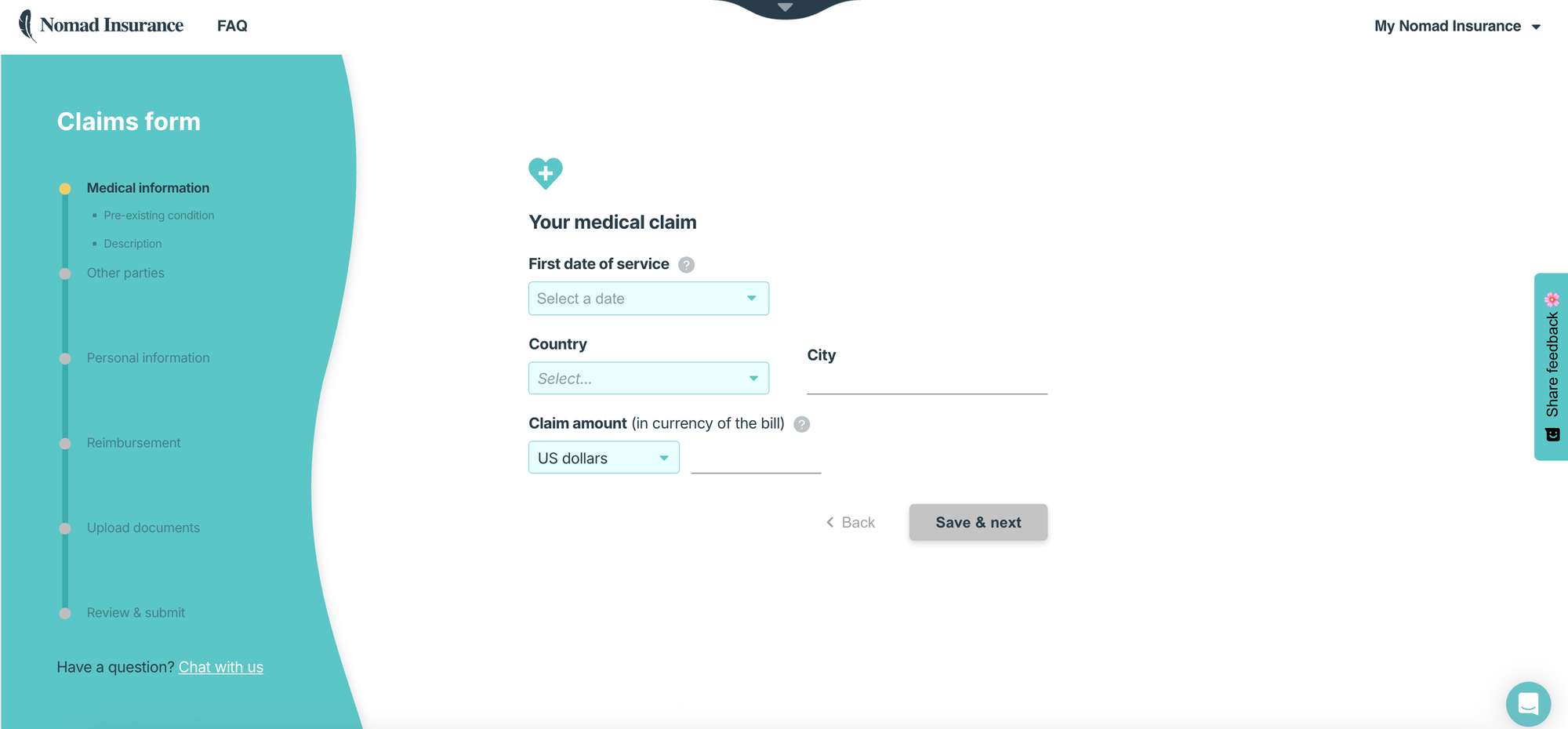

Luckily, I had signed up for SafetyWing’s Nomad Insurance just a couple of weeks earlier. From my hospital bed, my girlfriend got in touch with their live chat support to ask if everything would be covered. The response was fast and clear. They confirmed it was all good, and I just had to gather the paperwork.

I even personally shared my experience after that road accident in Kuşadası in our newsletter a few months ago, partly to remind fellow nomads not to skip insurance, but also because it was one of those moments where it genuinely saved me from a financial nightmare.

The claim process wasn’t instant (it actually took a few weeks) but I got the money back. They’ve since improved the process, and from what I’ve seen, it’s now faster and easier to submit everything online.

The biggest win for me? I was already in Turkey when I bought the policy. Most other insurance companies won’t cover you if you’ve already left your home country. SafetyWing did. And that alone made it worth every cent.

Pros and cons

Drawing from my experience, here's a list of pros and cons I could observe:

How it stacks up to other nomad insurance options

There are a ton of travel insurance providers out there claiming to be “built for digital nomads”. I’ve tried a few over the years, and honestly, most of them either cost a fortune, feel super outdated, or don’t let you buy a plan once you’re already abroad. That’s why many nomads keep coming back to SafetyWing.

It’s not perfect (no insurance is), but when you compare it to other big names like World Nomads, Genki, Heymondo, or Insured Nomads, SafetyWing usually wins on price and flexibility.

Here’s a quick comparison based on what actually matters when you’re on the road:

| Insurance Provider | Coverage | Subscription Model | Deductible | Pre-existing Conditions | Adventure Sports |

|---|---|---|---|---|---|

| SafetyWing | Medical emergencies, evacuation, trip interruption, lost luggage | Yes | $0 (Essential) / €50 (Complete) | No | Limited (add-on available) |

| Genki | Medical treatment, sports injuries, general health | Yes | No | Yes | Yes |

| Heymondo | Medical expenses, personal liability, repatriation | No | No | No | Yes |

| World Nomads | Medical treatment, gear theft, trip cancellation | No | Varies | No | Yes |

If you’re looking for full-on global health insurance with no gaps, Genki is also great, but it comes at a slightly higher cost. World Nomads is solid for short trips and one-time adventures, but it’s also pricey and doesn’t offer the same flexibility once you’re already on the move.

SafetyWing stands out because it’s simple, affordable, and actually designed around the nomadic lifestyle. No fixed return dates, no problem if you’ve already left home, and monthly billing that fits a real travel schedule.

Like with anything important, it's smart to browse around and weigh your options when it comes to travel insurance. Go ahead and compare different travel insurance plans to find the one that meshes just right with what you need – just like we did comparing SafetyWing versus Genki and SafetyWing versus World Nomads.

Ready to get insurance for your next trip?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

You can also follow us on Instagram and join our digital nomad community to find places, workspaces and events and connect with other members of our growing digital nomad community. We'll see you there, Freaking Nomads!

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Travel tips, hacks, and news

Travel tips, hacks, and news Exclusive travel discounts

Exclusive travel discounts Offers and promotions

Offers and promotions Digital nomad inspiration

Digital nomad inspiration Latest articles form our blog

Latest articles form our blog

Comments ()