The Best Health Insurance Options for Digital Nomads

Digital nomads cherish flexible and adventurous living, but global travel comes with risks. Even the best-planned trip can unravel due to medical emergencies, like food poisoning from street food, a broken arm while skiing, or injuries from a car accident. We've all been there, which is why health insurance is so crucial.

If you're unsure which health insurance plan to choose, read on to see which are the best health insurance options for digital nomads.

1. SafetyWing

Best Health Insurance for Digital Nomads Overall

Nomad Insurance Complete by SafetyWing is the best overall option for those seeking jam-packed policies at a reasonable monthly rate. This global health insurance plan is specifically designed for digital nomads and long-term travelers.

Their worldwide plan provides comprehensive coverage for unexpected and ongoing health issues, along with extended travel protection. Whether you’re chilling out in your home country or mid-trek halfway around the world, you’re covered in over 170 countries.

Not only do your benefits apply everywhere, but you also get to see any licensed provider you want. Sounds too good to be true, right? Trust me, it isn’t. Plus, you get easy 24/7 support with a measly 1-minute wait time.

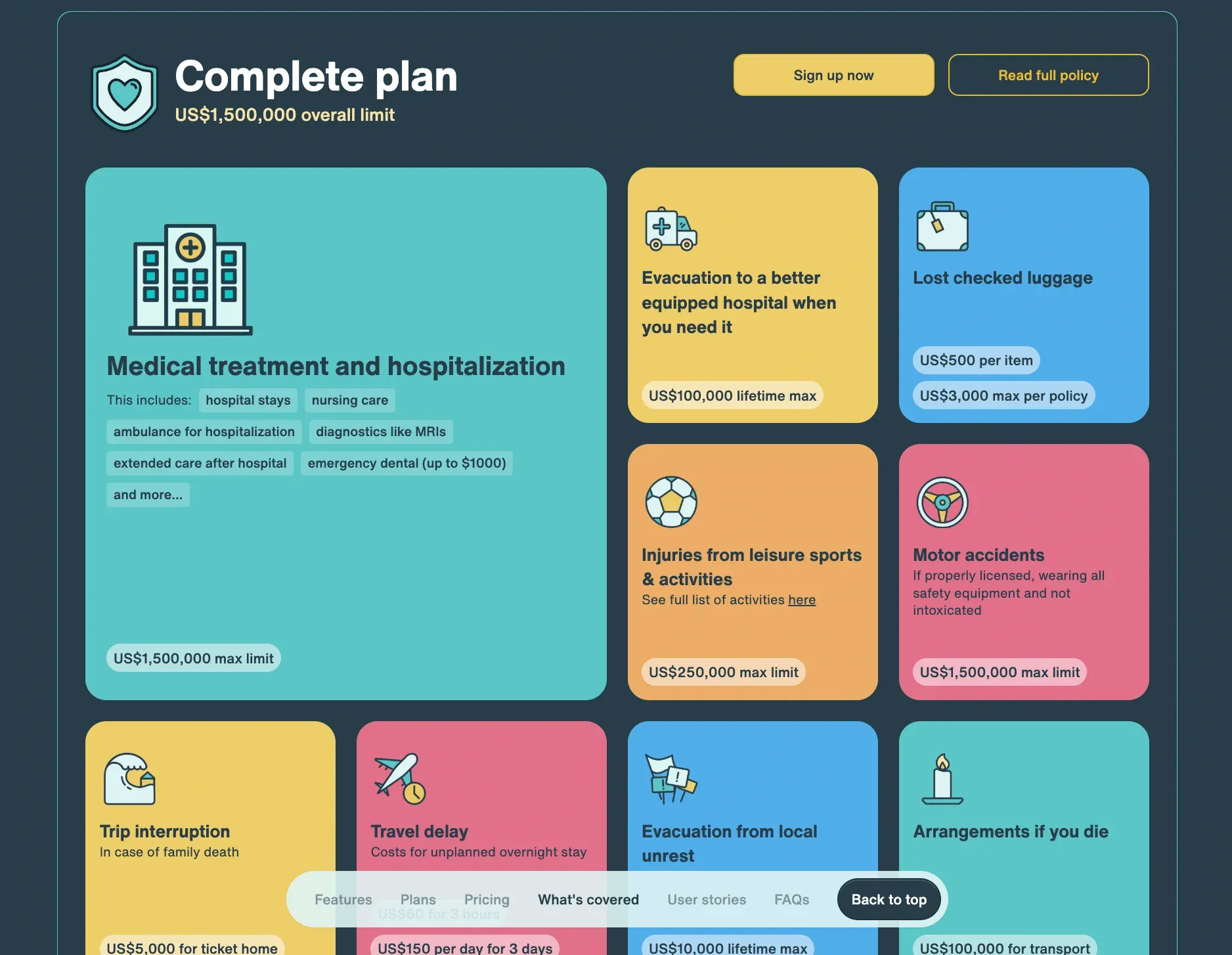

What’s Covered in Safetywing's Nomad Insurance Complete?

Nomad Insurance Complete offers extensive coverage, including:

- Emergency medical coverage up to $1.5 million annually

- Ongoing coverage for new conditions

- No coverage restrictions at home

- Hospital treatment and accommodation

- Evacuation and repatriation

- Routine visits and preventive care, including dental, vision, and vaccines

- Injuries from leisure sports and activities

- Mental health care and wellness therapies

- Motor accidents

- Maternity care up to $2,500 USD

- Travel coverage, including lost checked luggage, trip interruptions, and travel delay

- And much more!

SafetyWing Nomad Insurance Complete Pricing

For digital nomads aged 18-39 you can expect to pay $150.50/month with a required 12-month commitment. For those who prefer to pay annually, the cost is $1,625.40 USD, offering a 10% savings of $180.60 compared to monthly payments. Notice that you get over $1.5 million worldwide coverage on both plans. This is enormous.

2. Genki Native

Runner-Up for Best Digital Nomad Health Insurance

Snagging the number two spot on the list is Genki Native. Their plans boast a full laundry list of worldwide benefits with generous or unlimited payout limits and no maximum age after you’re signed up. And you get it all at a fair price.

Genki delivers undeniable value to its customers in various areas. Here’s a condensed list to help you visualize what you’d get when you go with Genki:

- Generous (or unlimited) limit on benefit payouts depending on the plan

- Worldwide coverage

- No maximum age after you have coverage

- Affordable pricing on virtually any budget

- You get to choose your own doctor and hospital

- If you are admitted to the hospital, Genki health insurance will handle the payments so you can focus on getting better. They do this on a 24/7 basis

- Telemedicine is covered for your convenience, which is rare

- You can make your plan more affordable by reducing your U.S. and Canada benefits

- Get up to 30 days of coverage in your home country of citizenship per year.

- Reasonable pricing that won’t break the bank

- Very inclusive adventure and sports activity coverage

What’s Covered in Genki Health Insurance Plans?

All of this sounds good, but if your chosen plan doesn’t have the benefits that matter, you could be on the hook for some steep bills. You get two international health insurance options through Genki health insurance - Genki Native Basic and Genki Native Premium. Below, you’ll find the benefit breakdown for each of the plans:

Genki Native Basic plan offers substantial coverage, from medical treatments to therapy to psychiatric care and more.

Just know that it does not cover:

- Preventive care, i.e. regular check-ups, immunizations, lab tests, medical exams

- Certain hospital and home care benefits, including single-room accommodations, treatment by a chief physician, and hospital daily allowance

- Most dental care

- Vision care (except prescribed examinations)

- Mental health care (except inpatient psychiatric care)

- Alternative care (massages, acupuncture, homeopathy, etc.)

The Genki Native Premium plan offers everything you get in Genki Native Basic plus more complete preventive care, inpatient hospital and home care, dental, eye, vision, mental health, and pregnancy care benefits.

As for the pricing,

Genki Native Pricing

You can expect to pay around €180 per month if you are 20-34 years old for Genki Native while Genki Native Premium costs €260 per month for people in that same age range.

But how much will it cost for you specifically? You can check yourself through the price calculator on the Genki site.

Be aware though that although many international health insurance companies allow you to purchase your policy right then and there to get you an exact quote, Genki wants to speak with (or chat with) you first to make sure you’re getting the best plan for your needs.

You will be able to choose between chatting with them on WhatsApp or scheduling a call. Genki’s staff will take things from there ensuring you get an exactly

3. Cigna Global Health Insurance

Best for Plan Flexibility

Cigna is one of the most well-known insurance companies in the U.S., offering plans for virtually everyone in every scenario. But did you know they offer one of the best international health insurance policies? Cigna Global is the name, and its bread and butter lies in its flexibility. Think of a modular computer where you can add or remove components to build the perfect machine; Cigna Global is similar. You start with a base plan and build it according to your needs and budget.

On top of its flexibility, you get coverage that follows you wherever you go - both local and global. In addition, the plan’s core benefit mix is super comprehensive (more on that later), and you also get extras like telehealth and a convenient app to manage your health anywhere. And I’d be remiss not to mention the plan’s focus on health and wellbeing benefits.

What’s Covered in Cigna Global Health Insurance Plans?

As for Cigna, there are two different plans you can choose from: Cigna Global Health and Cigna Close Care. Both have some great benefits but are tailored to different traveler types. Learn more below:

Cigna Global Health

Cigna Global Health covers everything from inpatient and mental health care to pandemic and cancer-related care. Daypatient and emergency cover are also included.

This plan is very flexible, with three levels of coverage (Silver, Gold, and Platinum) and potential add-ons like international outpatient and international health and wellbeing. Choose from worldwide or worldwide without the U.S. To learn more about coverage options, read this brochure.

Cigna Close Care

Cigna Close Care is for those who are living in a foreign country and will be visiting their home country here and there. You get coverage for both your home country and the foreign country where you have residence. If you decide to take a trip outside those areas, you get emergency medical coverage - this coverage is worldwide.

The plan includes the following benefits and more:

- $500,000 benefit max

- Inpatient, daypatient, and outpatient care

- Physical, occupational, and speech therapy

- Mental health care

- Unlimited global telehealth

- Wellness care

- And much more!

To learn more about the benefits and stipulations of this plan, read this brochure.

Cigna Global Health Insurance Pricing

To learn how much your plan costs, you’ll need to get a quote.

The Global Health coverage Silver Plan (base option) costs around $150/month for someone who’s 31 years old, will be spending the bulk of their time in India, and is of U.S. nationality. The Gold and Platinum plans, which have better benefits/higher benefit maximums, cost $209/month and $276/month, respectively. Note that you can choose to pay a percentage of your care or choose a certain max out-of-pocket amount to bring the plan cost down. Any extra benefits you add will add to your monthly payment as well.

The other plan, Close Care, is the most affordable, given that it only covers two areas - $117/month.

4. GeoBlue

Best For Coverage Variety

Don’t want to personalize your own plan but still looking for one that’ll give you peace of mind? You might want to give a try to GeoBlue, a suite of international insurance plans by Blue Cross Blue Shield. They are another great choice for digital nomads and frequent travelers who have their own specific needs.

What makes this coverage stand out from the competition is the fact that they have a huge network of English-speaking doctors in more than 190 countries! On top of that, if you don't feel like physically visiting a doctor abroad, they offer super handy 24/7 telemedicine services with English-speaking doctors.

What’s Covered in GeoBlue Health Insurance Plans?

Your coverage benefits depend on the plan you choose. GeoBlue has 8 plans in total, and each is targeted towards a specific traveler or scenario. US digital nomads/frequent travelers may be most interested in one of the General Plans above:

- Voyager - This plan gives you medical and travel health coverage for a single trip (up to 182 days).

- Trekker - Trekker is a plan you’ll purchase once that covers all the trips you plan on taking over the course of a year.

- XPlorer - This plan is the longer-term option that covers you for longer work trips or even situations where you live abroad.

The Voyager and Trekker plans include an up to $1,000,000 benefit maximum, surgery and anesthesia, hospital services, prescription drugs, physical and occupational therapy, and more. The XPlorer plan has unlimited maximums, freedom to choose your own provider (when not in the U.S.), and benefits like preventive care, office visits, and hospital visits.

GeoBlue Health Insurance Pricing

The plan costs from $46.19 to $79.36, depending on the plan coverage choices you make.

5. World Nomads

Best for Comprehensive Benefits

When it comes to international health insurance, it’s all about the benefits. What’s covered and what’s not? With World Nomads, just about everything is covered, and that’s why they’ve made it onto our list of the best.

What’s Included in World Nomads Health Insurance Plans?

With World Nomads, you get to choose from two plans - the Standard plan and the Explorer plan. Here’s how the coverage mix breaks down:

- Standard - This base plan covers necessities like emergency sickness and accident coverage and emergency evacuation, travel-related benefits like trip cancellation and interruption, and extras like certain adventure sports, among others.

- Explorer - This premium plan covers everything in the standard plan with much higher payout limits for trip cancellation, baggage and personal effects, trip delays, evacuation, and more. You also get rental car damage coverage (not included in the standard plan). You also get more adventure sports coverage on this plan.

World Nomads Health Insurance Pricing

World Nomads insurance quotes depend heavily on your traveling situation. If we consider a scenario where a 31-year-old wants to visit Japan for a month (their home country is the U.S.), you can expect, for instance, to pay $158.97 for their Standard Plan and $293.70 for their Explorer Plan.

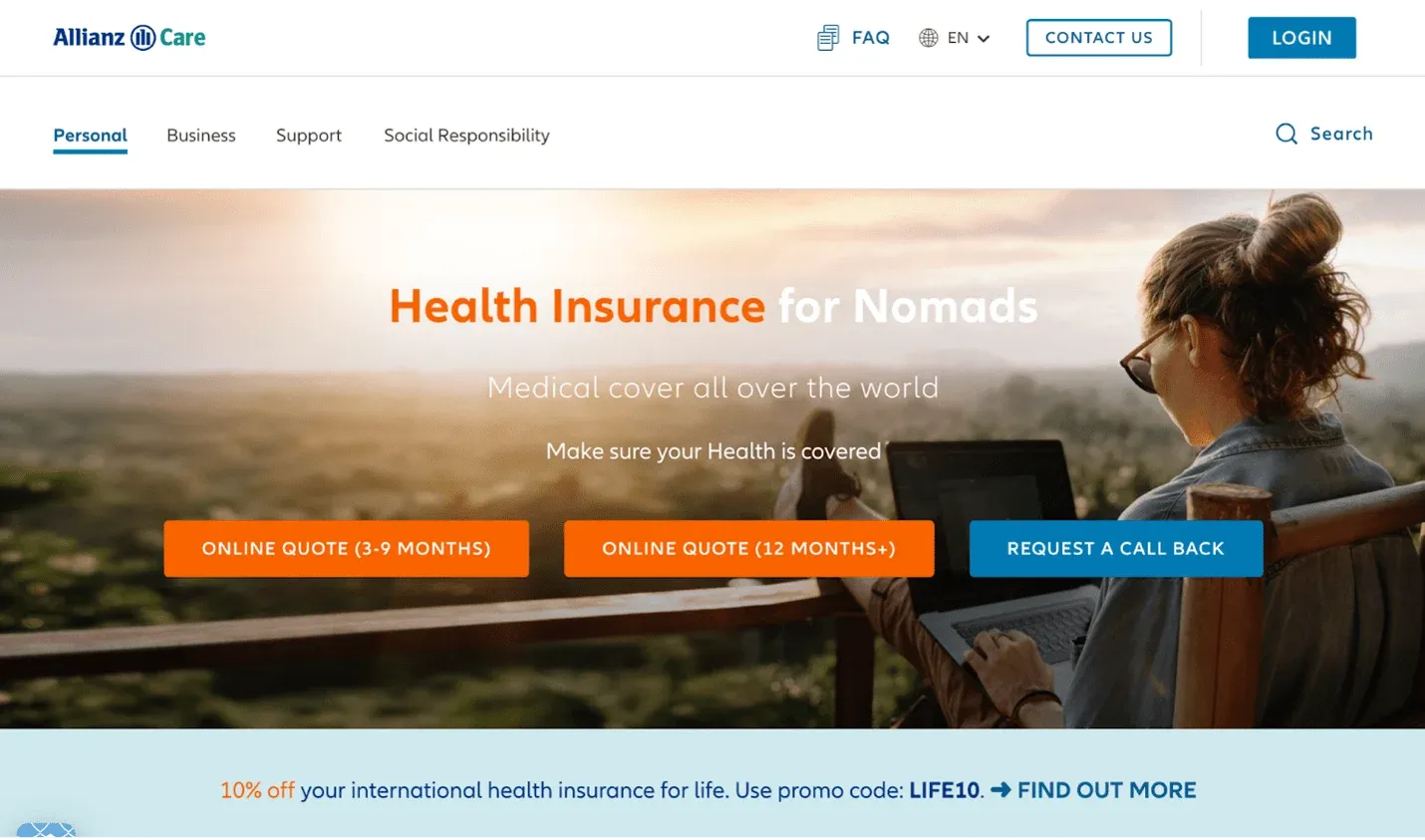

6. Allianz Care

Best for Multiple Plan Coverage Choices (Runner Up)

You never want to purchase more health coverage than you need. Allianz Care makes that possible. This company has an easy-to-navigate website, srious plan coverage, and multiple coverage term choices.

What’s Covered in Allianz Care Health Insurance Plans?

Allianz Care’s Flexicare plan gives you worldwide coverage on a 3-month, 6-month, 9-month or 12+ month basis, including the following benefits:

- Doctor visits

- Hospital visits

- Surgeries

- Vaccinations

- Prescription drugs

- And more

Allianz Care Health Insurance Pricing

As for the cost, things are very transparent with Allianz. For a 31-year-old American who will be spending some time in Japan, for example, you can expect to pay $187/month for the Care Plus Plan, and $261 per month for the Care Pro plan.

Global Health Insurance vs. Travel Insurance

Understanding the difference between global health insurance and travel insurance is crucial before making any decisions. Global health insurance provides comprehensive medical coverage worldwide, including routine check-ups, chronic conditions, and long-term treatments—ideal for digital nomads living abroad for extended periods. In contrast, travel insurance is designed for short-term trips, focusing on emergencies like sudden illnesses or accidents during travel. Knowing the distinction can help you choose the plan that best fits your nomadic lifestyle.

What to Consider When Purchasing Digital Nomad Health Insurance

You've decided to go with a global health insurance instead of a travel insurance plan. Great, but now which coverage should you choose? The only way to know is to get educated on what you should be considering. Here are a few lifelines.

Destinations and Length of Stay

Where are you going, and how long will you be staying there? If you’re going on a one-off trip, you don’t need a 12-month plan - you need something more short-term. Conversely, if you plan on spending a lot of time abroad, you need a long-term plan that caters to that.

Pre-Existing Conditions

Some plans cover pre-existing conditions, which are medical conditions you knew about before your plan became active. But in most cases, you’ll need to declare the condition to the insurer beforehand to get it approved. Others don’t cover them at all, whether you declare them or not. If you’re someone who has one or more pre-existing conditions, it may be worth it to seek out a plan that has inclusive pre-existing condition coverage.

Benefit Maximums and Coverage Details

How much will your plan pay out over a term? Is it capped at $50,000, $100,000, or $1,000,000+? This makes a big difference. Should you get ill or injured, the bills can really add up.

And then there are coverage details. At a minimum, you can expect hospital/emergency costs to be covered on short-term plans. You may also get some travel-related benefits. But when you get into the longer-term options, it’s crucial to look for preventative benefits and other coverage that protects you from day to day - not just in emergencies.

Digital Nomad Health Insurance: Our Final Thoughts

The importance of investing in quality digital nomad health insurance cannot be overstated. As dramatic as it sounds, danger and risk are all around you, and you need a way to compensate for that.

Insurance protects your wallet and can even grant you access to care you wouldn’t have otherwise been able to afford. Adequate coverage ensures peace of mind when exploring the world, knowing reliable medical care is accessible in case of unforeseen events. With this guide, you should have the full spectrum of choices to pick from. Make sure you pick the best for your own needs.

Ready To Get Health Insurance Coverage Globally?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

Make sure to sign up for our digital nomad forum to get in touch with other members of our growing digital nomad community!

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Travel tips, hacks, and news

Travel tips, hacks, and news Exclusive travel discounts

Exclusive travel discounts Offers and promotions

Offers and promotions Digital nomad inspiration

Digital nomad inspiration Latest articles form our blog

Latest articles form our blog

Comments ()