NOMADS.Insure Travel Insurance Review

Read our hands-on breakdown of using NOMADS.Insure travel insurance brokers for finding comprehensive long-term travel and global health policies.

=We know a thing or two about nomad insurance…but even we get a little overwhelmed when we see our policy end date on the horizon. The world of nomad health and travel insurance is changing literally all the time, and keeping track of where to find the best deal, coverage, and add-ons is by no means an easy feat.

But NOMADS.insure is not just another nomad insurance provider; they’re an insurance broker created for digital nomads by digital nomads. They promise to help solve the problem of finding long-term, comprehensive, and global insurance options…all without taking a fee from clients.

In this NOMADS.insure review, we’re putting that promise to the test. Keep reading to get a full breakdown on NOMADS.insure, including the pros and cons, insurance coverage options, and whether they’re worth it for digital nomads.

NOMADS.Insure: Pros and Cons

What is NOMADS.Insure?

NOMADS.insure is a nomad insurance broker service created by a team of digital nomads and entrepreneurs based out of Estonia. After one too many conversations with friends about the complexities (and complaints) of finding long-term international health and travel insurance, the independent insurance brokerage called Herrmann, Huebner & Partner realized it was time to change the way nomads find insurance.

As a fully licensed* and established brokerage specializing in nomad insurance, NOMADS.insure is all about finding you the perfect nomad insurance solution. They work with 25+ global insurance providers like Genki, COVRD.EE, April International, and PassportCard to secure you both travel and health insurance policies with coverage across 195 countries.

NOMADS.insure wants digital nomads to have more power in the nomad insurance world. That's why they offer a comprehensive (and completely free) digital guide to nomad insurance so that you can get a better understanding of the process without even booking a consultation.

* NOMADS.insure is supervised by the Estonian Financial Supervision Authority with a license for the entire European Economic Area

Why Use NOMADS.Insure as a Broker?

Nomad insurance brokers act as the middleman between you and the travel insurance providers. Let’s put it this way – you know that one friend you’re always calling for insurance advice because they know way more about it than you do? NOMADS.insure wants to be this friend for you. They’re going to advise, negotiate, and advocate on your behalf to secure you the best possible insurance situation.

Best of all? Working with NOMADS.insure is completely free for customers as they make their money through commissions from the insurance companies. And, because they get the same commission rate from all providers, you don't have to worry about bias – NOMADS.insure is legally on the client's side. And here’s something most people don’t realize: they can often get you better rates than if you were buying the same plan on your own.

Our Experience with NOMADS.Insure

When we were last insurance shopping, NOMADS.insure stepped in and handled...basically everything. From doing all the research, to accessing special deals, and explaining what the medical underwriting actually means, let's just say they saved us countless hours of pulling our hair out.

This came in particularly handy when dealing with the dreaded medical questionnaires. Thanks to NOMADS.insure, we learned that there are ways to optimize your answers to avoid automatic denial and even unlock better rates. NOMADS.insure is even equipped to navigate complicated insurance situations like pre-existing conditions, nomad family insurance, or pregnancy.

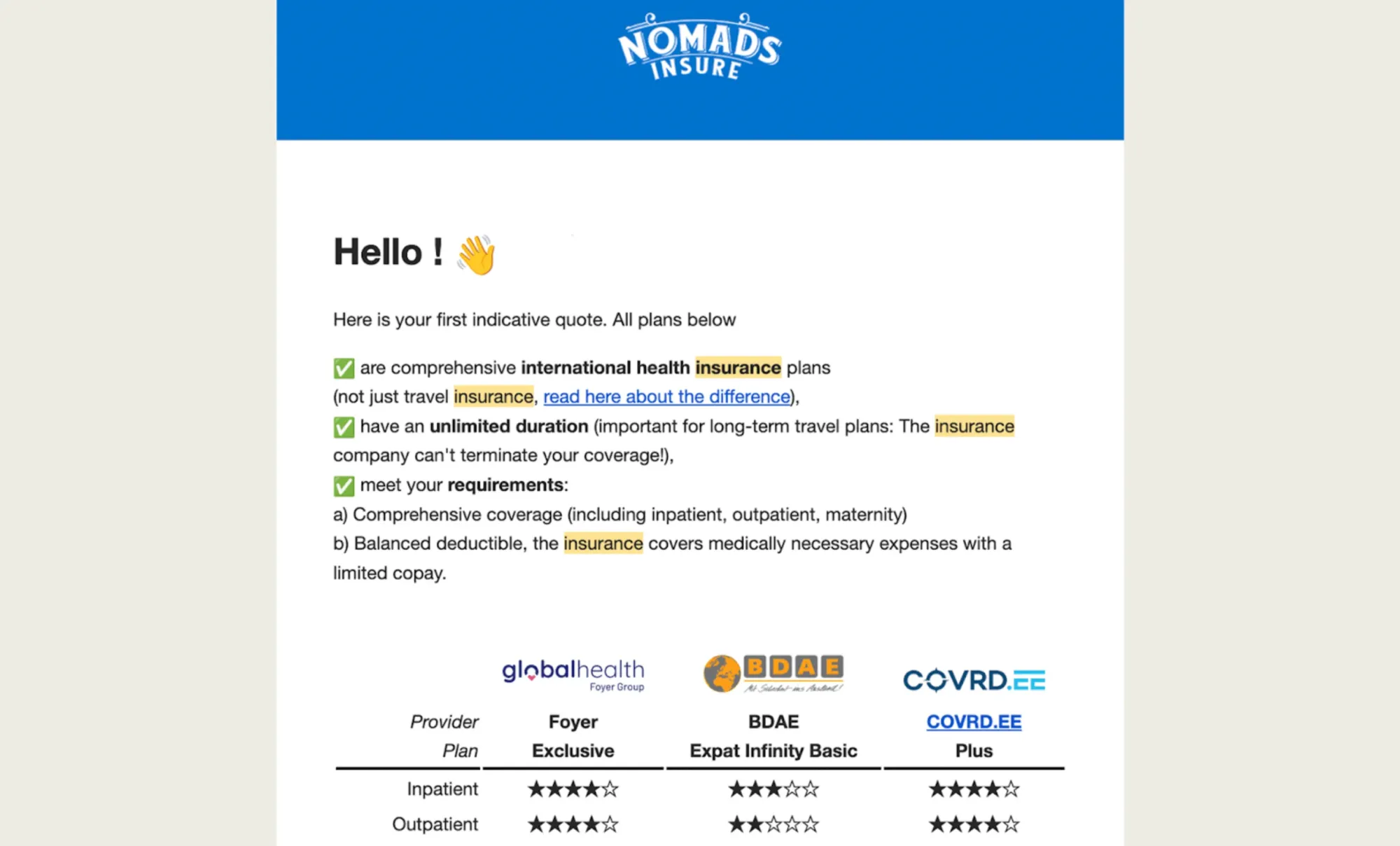

After chatting with our agent, Aaron, during the free consultation, we handed off the entire insurance shopping process to NOMADS.insure. They reached out to providers and conducted pre-checks on our behalf, and within a few days, we received three great quote options.

Aaron went through each one with us in detail to answer questions and help us make an informed decision, and then he also handled the negotiations. All we had to do was sit back and leave it to the experts.

What Does NOMADS.Insure Cover?

NOMADS.insure offers a selection of policy types to keep you covered on the road as a digital nomad. Here are the main policies you need to know about:

Nomad Health Insurance

NOMADS.insure offers comprehensive and long-term health insurance policies from 25+ providers with total global coverage. Their portfolio includes specialized options for digital nomads, expats, and even people considering relocating back home.

Nomad Travel Insurance

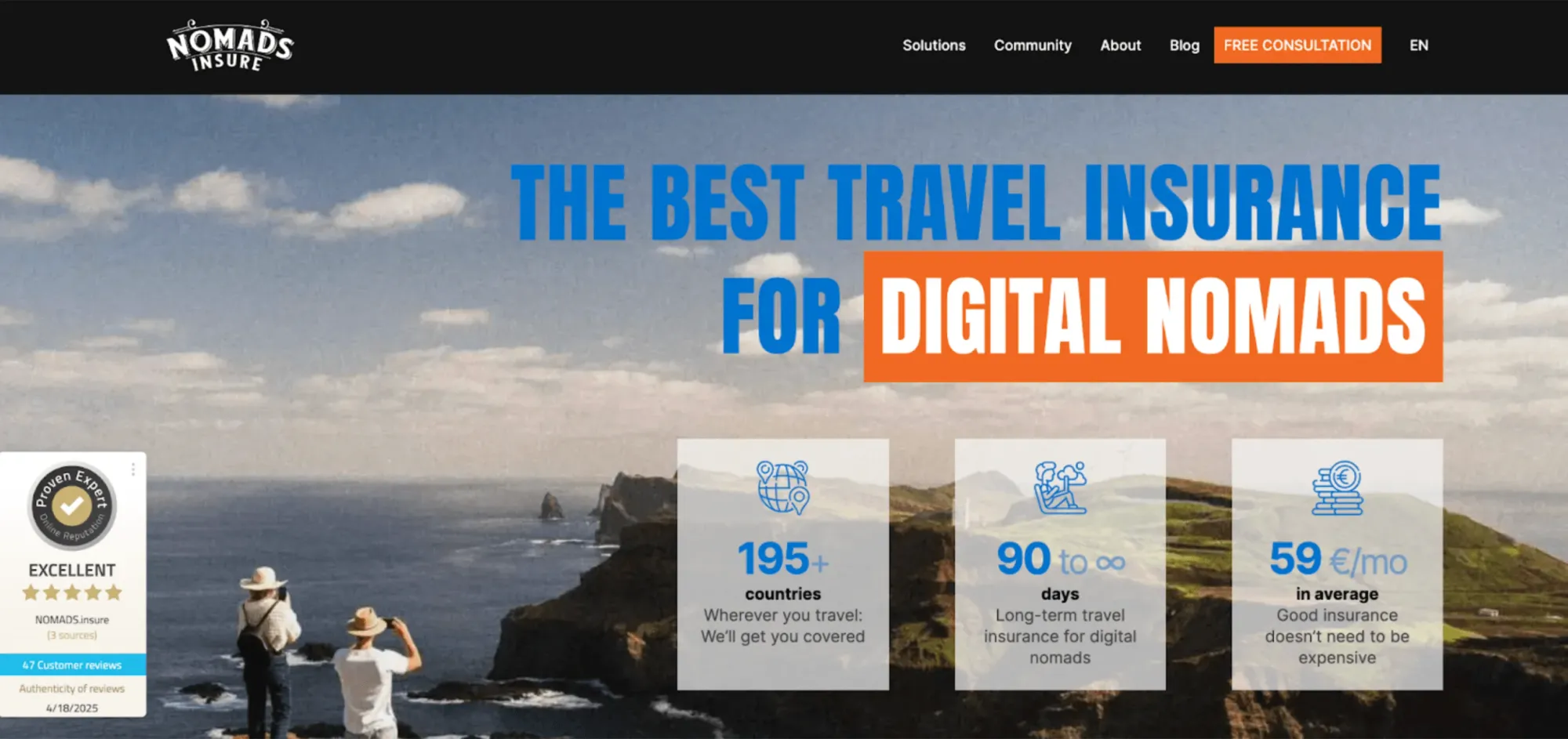

Nomad travel insurance policies with NOMADS.insure are designed for trips from three months to two+ years. Their portfolio plans average at $59/month for nomad insurance across 195 countries for 90+ days, with advanced plan options if you need coverage for your nomad belongings and trip interruptions.

Disability Insurance

For many of us location-independent workers, we rely on our health to work, travel, and earn an income. That’s why NOMADS.insure provides disability insurance that covers treatment and income compensation should the unthinkable happen and you’re left temporarily unable to work.

People With Existing Policies

Want to know something cool? NOMADS.insure isn't just for people looking for new insurance policies. You can transfer your existing plan to NOMADS.insure at zero extra cost to start receiving their support with claims and future changes immediately.

What’s NOT Covered by NOMADS.Insure?

Of course, NOMADS.insure can't cover you for everything. These are a few of the things that they don't offer:

Tech and Gear

Although they’re working on it, NOMADS.insure doesn’t currently offer standalone policies specifically for your nomad tech and gear. That’s because, based on their research, there isn’t a global gear insurance option on the market right now that offers good enough value to recommend. That said, some of their travel insurance plans do include limited electronics coverage, so it’s still worth asking about.

Short-Term Travel Insurance

Just like the name suggests, NOMADS.insure is made for digital nomads. They secure you long-term travel and health insurance policies that start from a minimum of 90 days but don’t cover short-term trips or standard vacations.

What Makes NOMADS.Insure Stand Out?

While there are a lot of insurance brokers in the world, very few of them are made for digital nomads, by digital nomads. We know that our lifestyle is a unique one, and sometimes we just don’t feel like explaining it to someone who’s worked at an office 9-5 their whole life.

But, NOMADS.insure is a part of our community. They can personally empathize with their combined 40+ years of life as remote entrepreneurs, and more than that, actively take part in nomad events. Christoph, one of the co-founders, is even a co-organizer of Nomad Summit. You’ll often find both Christoph and Aaron at Bansko Nomad Fest in June or Athens Nomad Fest in September, so don’t be surprised if you bump into them there.

We can personally tell you that NOMADS.insure just 'gets it' when it comes to our nomadic way of life. They're the first (and only) insurance brokers we’ve come across who challenge the usual system of forced annual renewals. Why? Because those renewals often come with worse terms, like new exclusions or increased pricing based on your previous claims, leaving you with little choice but to walk away or pay more. That’s why NOMADS.insure advocates for unlimited-duration policies whenever possible. We don’t have an end date on our travels, so our insurance shouldn’t either.

We also appreciate NOMADS.insure for sorting disability insurance for digital nomads. This can be hard to come by, but something we think could help reassure a lot of nomads who would struggle financially if unexpected illness or injury meant they couldn’t work.

How to Get a Quote and Sign Up for NOMADS.Insure?

The easiest way to get a quote from NOMADS.insure is to book a free 30-minute consultation with one of their insurance agents. Here’s how to sign up and get tailored quotes with NOMADS.insure:

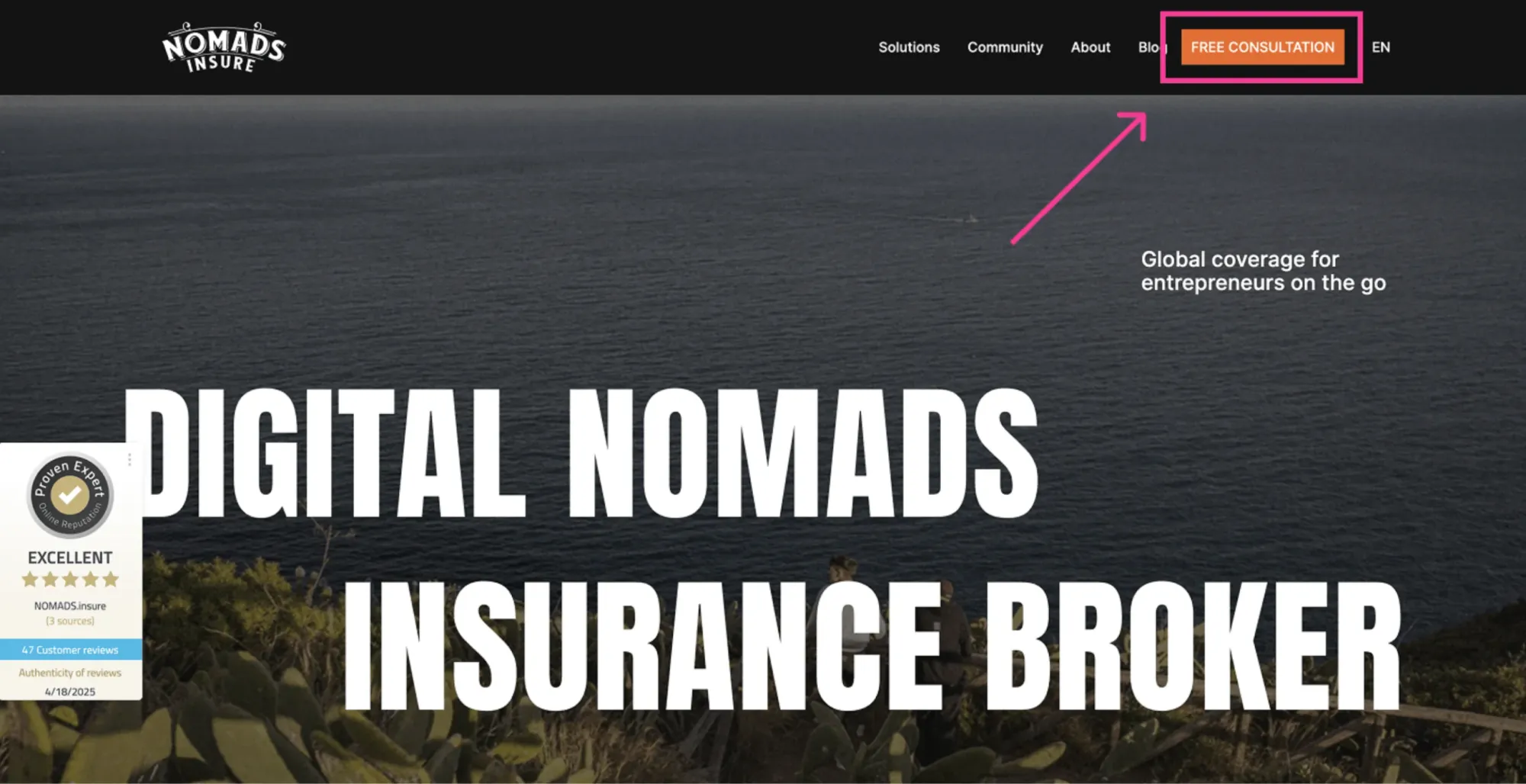

Step 1: Book a Free Consultation

Start by making your way to NOMADS.insure website. In the top right corner is a bright orange ‘FREE CONSULTATION’ button (you can’t miss it). Answer a few quick questions, select a date for your consultation, and press ‘Submit’.

Step 2: Meet with Your Insurance Broker

During your free consultation, you'll meet your broker and talk through your specific nomad insurance needs. This is the time to bring up any complications like pre-existing conditions or future family planning – the more information you give, the more personalized your quote will be.

NOMADS.insure will help you to complete your medical questionnaire, then use it to conduct anonymous pre-approvals. They anonymize your medical details and get them pre-checked with providers to avoid wasting time later on.

Step 3: Get Your Personalized Quotes

Your insurance broker will come back to you with 2-3 tailor-made insurance quotes. They'll clearly break down the pros, cons, and differences, as well as get into the details of what the medical underwriting says.

Want to look at quotes before your consultation? Check out NOMADS.insure's new instant quote calculator and fill in your details to get travel and health insurance quotes straight to your inbox.

Who is NOMADS.Insure Travel Insurance Best For?

Okay, so while NOMADS.insure can be used by any nomad looking for long-term travel and international health insurance, there are some people who might find them more useful than others.

While NOMADS.insure can support any nomad looking for long-term travel or international health coverage, they’re especially valuable if you want expert advice and peace of mind that you’re truly protected.

Even if your needs seem straightforward, like solo travel without pre-existing conditions, NOMADS.insure can often secure better pricing and higher claim success rates than going it alone. And if your situation is more complex, including managing a pre-existing condition, coordinating with public health insurance, or preparing for future family plans, their team becomes even more essential. Either way, you’ll save time, money, and likely avoid a major headache.

For nomads with more complex situations, however, NOMADS.insure is a great option. If you have any pre-existing conditions, want to find private coverage that works with your public health insurance, or need help shopping for international insurance while also family planning – we think NOMADS.insure is going to save you one major headache.

Final Verdict on NOMADS.Insure

As a free-for-consumers service that connects us nomads with insurance experts, we really recommend NOMADS.insure. They’re especially useful for anyone with additional nomad insurance considerations…or digital nomads who just don’t have the mental bandwidth to take on travel and health insurance shopping alone.

Not only do they help you compare your options, but they also offer better deals, better-matched coverage for your travel plans, and hands-on support with claims and reimbursements. All things you’d rarely get by booking directly.

We love that you can start the process with a free consultation before committing to anything, and you can also use this time to hit the NOMADS.insure team with all your insurance broker questions. Of course, whether you use an insurance broker or not, it’s always important to do your own research to make sure you’re choosing the right nomad insurance policy for you.

Ready to Get Insured and Start Traveling?

Join our global

digital nomad community

Join us for free

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Read Next

Argentina for Digital Nomads and Remote Workers: The Ultimate Guide

Virgin Connect Roam eSIM: Honest Take for International Travelers