SafetyWing vs World Nomads: Which Insurance is Better?

SafetyWing or World Nomads? Discover the best digital nomad insurance for your travels and choose between these two leading travel insurance.

In the digital nomad space, the debate between World Nomads vs SafetyWing for the best travel insurance is a hot topic. Both are leading providers with unique benefits tailored to the nomadic lifestyle. Which one is the right fit for you?

This article will compare their offerings—from cost to coverage—and share insights from fellow nomads who have used these services to help you make an informed decision for your travel needs.

What is SafetyWing?

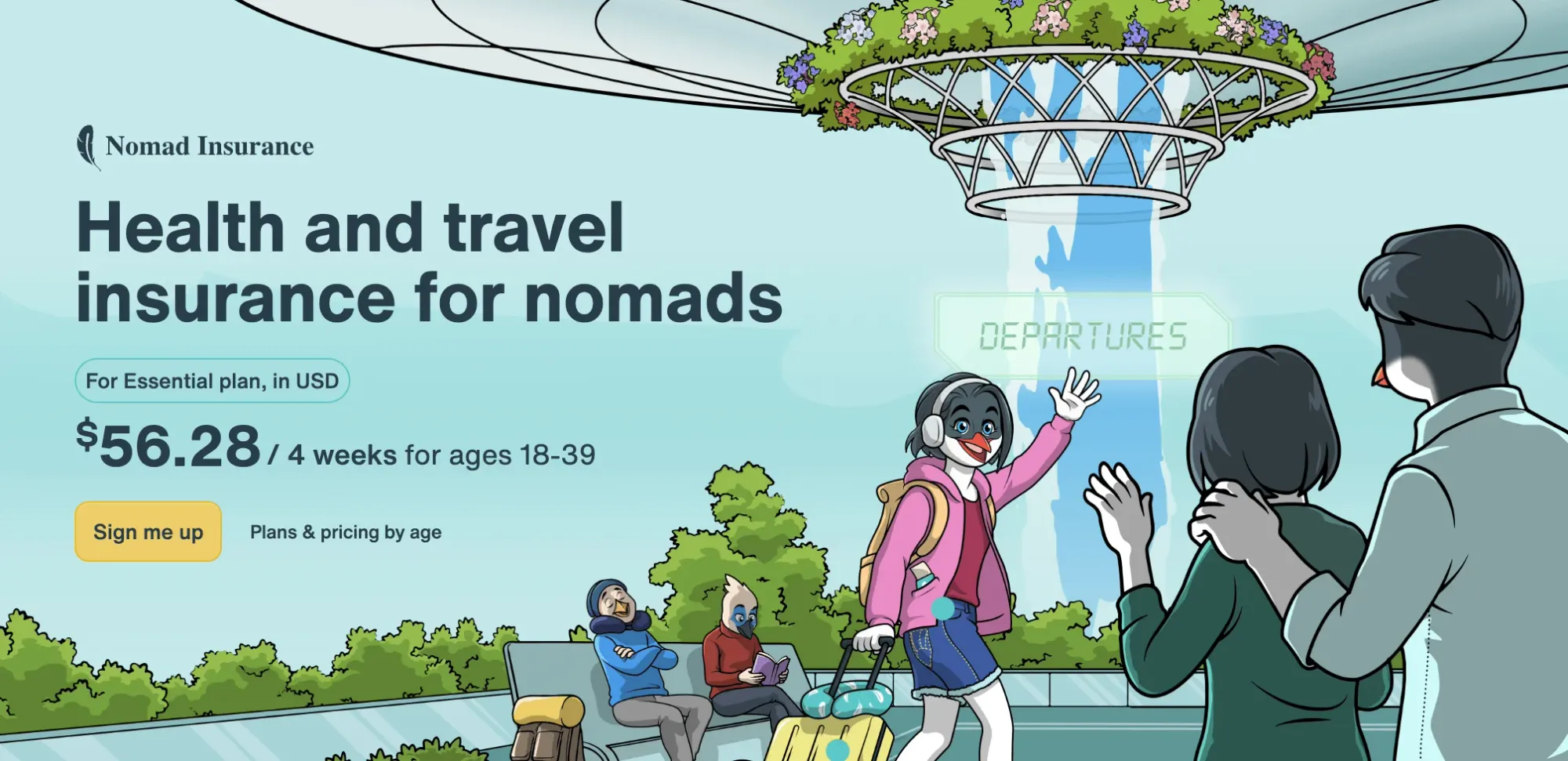

SafetyWing and its Essential Nomad Plan have quickly become a go-to choice for many digital nomads and remote workers worldwide. Established with the mission to build a global safety net for freelancers and entrepreneurs, SafetyWing offers a flexible, subscription-based model that allows you to start, pause, or cancel your insurance plan as per your travel needs.

Their insurance coverage is comprehensive, covering unexpected illnesses or injuries abroad, including hospital, doctor, and even some dental expenses. They also provide coverage for emergency evacuation and travel delays beyond your control. However, it's worth noting that SafetyWing does not cover trip cancellations or routine check-ups and preventative care.

One of the standout features of SafetyWing is its affordability. With coverage starting at $56.28 USD per 4 weeks, it's a cost-effective solution for digital nomads seeking comprehensive yet budget-friendly insurance.

What is WorldNomads?

World Nomads, on the other hand, is a well-established name in the travel insurance industry, known for its comprehensive coverage tailored towards adventurous travelers and backpackers. Their mission is to inspire, connect, and empower travelers, providing them with the freedom to explore the world with confidence.

World Nomads offers two tiers of plans - the Standard Plan and the Explorer Plan, allowing travelers to choose the level of coverage that best suits their needs. Their coverage includes unexpected illness or injury abroad, hospital, doctor, dental and prescription expenses, emergency evacuation, and even trip cancellations. They also provide coverage for lost checked luggage and stolen or damaged gear, which includes electronics, a feature that sets them apart from many other providers.

While World Nomads is a bit pricier than SafetyWing, with coverage starting at about $120 USD per 4 weeks, it's recognized for its extensive coverage, especially for high-risk sports and activities, making it a popular choice among adventure travelers.

SafetyWing vs World Nomads: A Quick Comparison

|

|

|

|---|---|---|

| Coverage | Medical (including some dental), Emergency Evacuation, Travel Delays, Lost Checked Luggage | Medical (including dental), Emergency Evacuation, Travel Delays, Trip Cancellation, Lost, Stolen or Damaged Gear |

| Cost | Starting at $45 USD per 4 weeks | Starting at $120 USD per 4 weeks |

| Payment Model | Subscription model, can start, pause, or cancel anytime | One-time payment, can extend or claim online while traveling |

| Coverage Area | Worldwide coverage excluding North Korea and Cuba, and limited coverage in the US | 140+ countries |

| Home Country Coverage | Limited coverage for 30 days every 3 months (15 days for US citizens) | No coverage in home country |

| Adventure Activities | Limited coverage, some activities excluded | Extensive coverage, including high-risk sports and activities |

| Personal Belongings | Coverage for lost checked luggage | Coverage for lost, stolen or damaged gear, including electronics |

| Deductible | $250 per claim | Varies by plan and coverage type |

| Maximum Limit | $250,000 for medical expenses | Varies by plan and coverage type, up to $1 million for medical expenses |

| COVID-19 Coverage | Coverage for COVID-19 related illnesses at no additional cost | Coverage for COVID-19 related illnesses, subject to terms and conditions |

| Customer Support | 24/7 customer support via email and phone | 24/7 customer support via email and phone |

SafetyWing vs World Nomads: A More Detailed Comparison

When comparing World Nomads and SafetyWing, several key factors come into play. We will look mainly at coverage, cost, flexibility, and additional benefits.

Coverage

Both companies offer comprehensive coverage for unexpected illnesses or injuries abroad, including hospital, doctor, and some dental expenses. World Nomads, however, also provides coverage for trip cancellations and lost, stolen, or damaged gear, including electronics, which SafetyWing does not.

Cost

SafetyWing is generally more affordable, with coverage starting at $56.28 USD per 4 weeks, making it a budget-friendly option for many digital nomads. On the other hand, World Nomads' coverage starts at about $120 USD per 4 weeks, but it offers more extensive coverage, especially for high-risk sports and activities. If you're comparing options, understanding how SafetyWing compares to Genki could also help you weigh the cost and coverage differences.

Flexibility

SafetyWing operates on a subscription model, allowing you to start, pause, or cancel your insurance plan as per your travel needs. World Nomads offers two tiers of plans - the Standard Plan and the Explorer Plan, allowing travelers to choose the level of coverage that best suits their needs.

Additional Benefits

World Nomads stands out for its coverage of high-risk sports and activities, making it a popular choice among adventure travelers. SafetyWing, on the other hand, offers a unique benefit of limited home country coverage, providing protection for short visits home.

As you can see, the choice between World Nomads and SafetyWing depends largely on your specific needs, travel style, and budget. If cost is a significant factor, SafetyWing may be the better choice. However, if you're looking for more extensive coverage, especially for adventure activities or electronics, World Nomads may be worth the higher price.

SafetyWing vs World Nomads: Our Personal Experience

As digital nomads ourselves, we've had the chance to personally test both SafetyWing and World Nomads, and our experiences have given us some unique insights.

We found SafetyWing to be a fantastic fit for the majority of our travels. Its affordability and the flexibility of its subscription model were perfect for our lifestyle. We could start, pause, or cancel our coverage at any time, which was a huge advantage given the unpredictable nature of our travels. The coverage was comprehensive for our basic medical needs and managed to cover us for over $1500 of medical expenses from a scooter accident that we experienced in Turkey this year. As digital nomads, we don't always engage in high-risk activities, so the lack of coverage in this area wasn't a significant issue for us most of the time.

However, we do love our share of adventure! When we planned to go camping in remote areas of Romania, hiking and trailing in the rough terrains of Maderia, or surfing in Sri Lanka, we turned to World Nomads. The comprehensive coverage for high-risk activities gave us the confidence to fully enjoy these experiences without worrying about potential accidents or injuries. The gear coverage was also a major plus, as we often travel with expensive equipment. The higher cost we thought was justified by the peace of mind it brings during these adventurous breaks from work.

Both insurance have served us well in different scenarios, and we believe the choice between the two should be based on your individual needs, lifestyle, and travel plans.

The Bottom Line

When it comes to health insurance coverage for digital nomads, both SafetyWing and World Nomads have their unique strengths and weaknesses.

SafetyWing offers solid health insurance coverage that includes hospital stays, intensive care, emergency room visits, urgent care, and even some outpatient care. It also covers unexpected illnesses or injuries and provides coverage for COVID-19-related illnesses at no additional cost. One of the standout features of SafetyWing is its limited home country coverage, which provides coverage for 30 days every 3 months (or 15 days for US citizens). This can be a significant advantage for digital nomads who spend a portion of their time back home. SafetyWing's affordable pricing and flexible subscription model make it an excellent choice for digital nomads on a budget or those who prefer to have the flexibility to adjust their coverage as their travel plans change.

On the other hand, World Nomads offers more comprehensive health insurance coverage. In addition to medical and dental expenses, it covers emergency evacuation, which can be crucial if you're traveling in remote areas. World Nomads also covers a wide range of adventure activities, making it a great choice for digital nomads who love to explore and take on adventurous pursuits during their travels. While World Nomads is more expensive than SafetyWing, the extensive coverage it provides can offer peace of mind, especially for those who frequently engage in high-risk activities or travel to remote locations.

Still not sure? We've compared the most popular travel insurance providers, so you can learn more about the differences and decide which one suits you best:

Ready to Pick The Most Suitable Travel Insurance To Get an Extra Piece of Mind?

Join our global

digital nomad community

Join us for free

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Read Next

Are Coworking Spaces Worth It?

espresso by Kensington Magnetic Privacy Screen Review