Best Banks for Digital Nomads

Discover the top international banks for digital nomads worldwide with our comprehensive guide. Find out their features, pros, and cons.

Managing your finances can be quite challenging when you're constantly working and traveling. While you might already have a traditional bank account, not all banks are designed for the flexibility and adaptability your digital nomad lifestyle demands.

Many traditional banks come with high exchange fees and limited international services, making them less than ideal for remote workers on the move.

But don’t worry, we’ve done the research for you! This guide explores the best banks tailored for digital nomads, so you can focus on living your dream while navigating the globe. Let’s dive into the world of nomad-friendly banking!

• Best International Banks for Digital Nomads

• Best Banks for US Digital Nomads

• Best Banks for UK Digital Nomads

• Best Banks for European Digital Nomads

• Best Banks for Canadian Digital Nomads

• Best Banks for Australian Digital Nomads

Best International Banks for Digital Nomads

Let's now analyze them individually, including their features, pros and cons, and anything else you need to know for your digital nomad bank.

1. Revolut

Best Bank for Everyday Digital Nomad Expenses

Revolut is a digital nomad's best friend when it comes to everyday spending and managing finances on the go. With its feature-packed app, innovative tools, and no-fuss approach to banking, it's no wonder that remote workers and travelers alike are raving about this fintech gem.

Services and Features

- Multi-currency account with support for over 150 currencies

- Real-time exchange rates and no-fee FX transactions (subject to monthly limits)

- Instant and free peer-to-peer payments

- Debit card with contactless payments and ATM withdrawals

- User-friendly mobile app with budgeting tools, analytics, and security features

- Access to cryptocurrencies and investment options

- Free cash withdrawals up to $1,200 in the US and up to 5 ATM Withdrawals or €200/£200 per rolling month in the EU and UK

- Travel and device insurance available (with premium plans)

Bank Accounts Available

- Revolut Standard – Free

- Revolut Plus – £2.99/month (price in £ as it's not available in the US)

- Revolut Premium – $9.99/month

- Revolut Metal – $16.99/month

- Revolut Ultra (UK Only) – £540 / year

- Revolut Business (Company & Freelancers) – Free

- Revolut Business Grow (Company) – $39.99/month

- Revolut Business Scale (Company) – $149.99/month

- Revolut Professional (Freelancers) – $149.99/month

- Revolut Ultimate (Freelancers) – $39.99/month

*Prices are mentioned in USD (and GBP for Revolut Plus) but might vary based on the country.

2. Wise

Best Multi-Currency Account

Wise has become a digital nomad favorite for hassle-free currency management and international transfers. It offers a fantastic multi-currency account that makes juggling currencies extremely easy, allowing globetrotters like us to focus on their adventures without worrying about fees and exchange rates.

Services and Features

- Multi-currency account supporting over 50 currencies

- Real-time exchange rates (mid-market rates) for fair conversions

- Low, transparent fees on international transfers

- Debit card for convenient spending and ATM withdrawals

- User-friendly online platform and mobile app for easy account access

- Compatibility with popular budgeting apps

- 2 free cash withdrawals per month up to 100 USD in the US or 200 GBP/EUR in the UK/EU

Bank Accounts Available

- Wise Personal – Free

- Wise Business – Free

3. Payoneer

Best Bank for Freelancers and Entrepreneurs

While not a direct-to-consumer bank, Payoneer deserves to be mentioned in our list as it's a financial lifesaver for digital nomad freelancers and entrepreneurs who need a reliable and efficient way to manage their international transactions. With its easy-to-use platform and global reach, Payoneer takes the stress out of getting paid by international clients while exploring the world.

Services and Features

- Multi-currency account with support for over 150 currencies

- Global Payment Service for receiving payments from clients worldwide

- Mass Payout option for businesses and entrepreneurs

- Debit card for spending and ATM withdrawals abroad

- Online platform and mobile app for convenient account management

- Integration with popular e-commerce platforms and freelance marketplaces

- Currency conversion at competitive rates

Bank Accounts Available

Payoneer Account – $29.95/year

Best US Banks for Digital Nomads

Let's now look at the top banks that cater excellently to the needs of digital nomads who are residents of the United States.

4. Charles Schwab

Best US Bank for Travel Perks

Charles Schwab has long been a trusted ally for US-based digital nomads and remote workers who value a comprehensive banking experience. With its robust financial services and commitment to customer satisfaction, Charles Schwab delivers a seamless banking solution for those living and working around the globe. And if Europe is on your travel list, feel free to read more about this card and its benefits for Europe in our dedicated review.

Services and Features

- High Yield Investor Checking account with no monthly fees or minimum balance requirements

- Unlimited ATM fee rebates worldwide

- Debit card with contactless payments and global ATM access

- Full-service brokerage services and investment options

- Mobile app and online platform for easy account management

- 24/7 customer support and financial advisory services

- FDIC-insured accounts for added security

Bank Accounts Available

Schwab Bank Investor Checking™ Account – Free

5. CapitalOne 360

Best US Bank for Budgeting

CapitalOne 360 is a fantastic banking buddy for US-based digital nomads and remote workers who appreciate an all-in-one solution for their financial needs. Combining convenience, flexibility, and a suite of modern banking tools, CapitalOne 360 takes the hassle out of handling your money, no matter where your travels take you.

Services and Features

- Fee-free checking and savings accounts with competitive interest rates

- Over 70,000 fee-free ATMs worldwide

- Debit card for contactless payments and global ATM access

- Credit card options with travel rewards and cashback

- Mobile app and online platform for easy account management

- Zelle integration for quick, secure money transfers

- FDIC-insured accounts for peace of mind

Bank Accounts Available

CapitalOne Checking Account – Free

Best UK Banks for Digital Nomads

Here is our list of top banks that cater excellently to the needs of digital nomads who are instead residents of the United Kingdom.

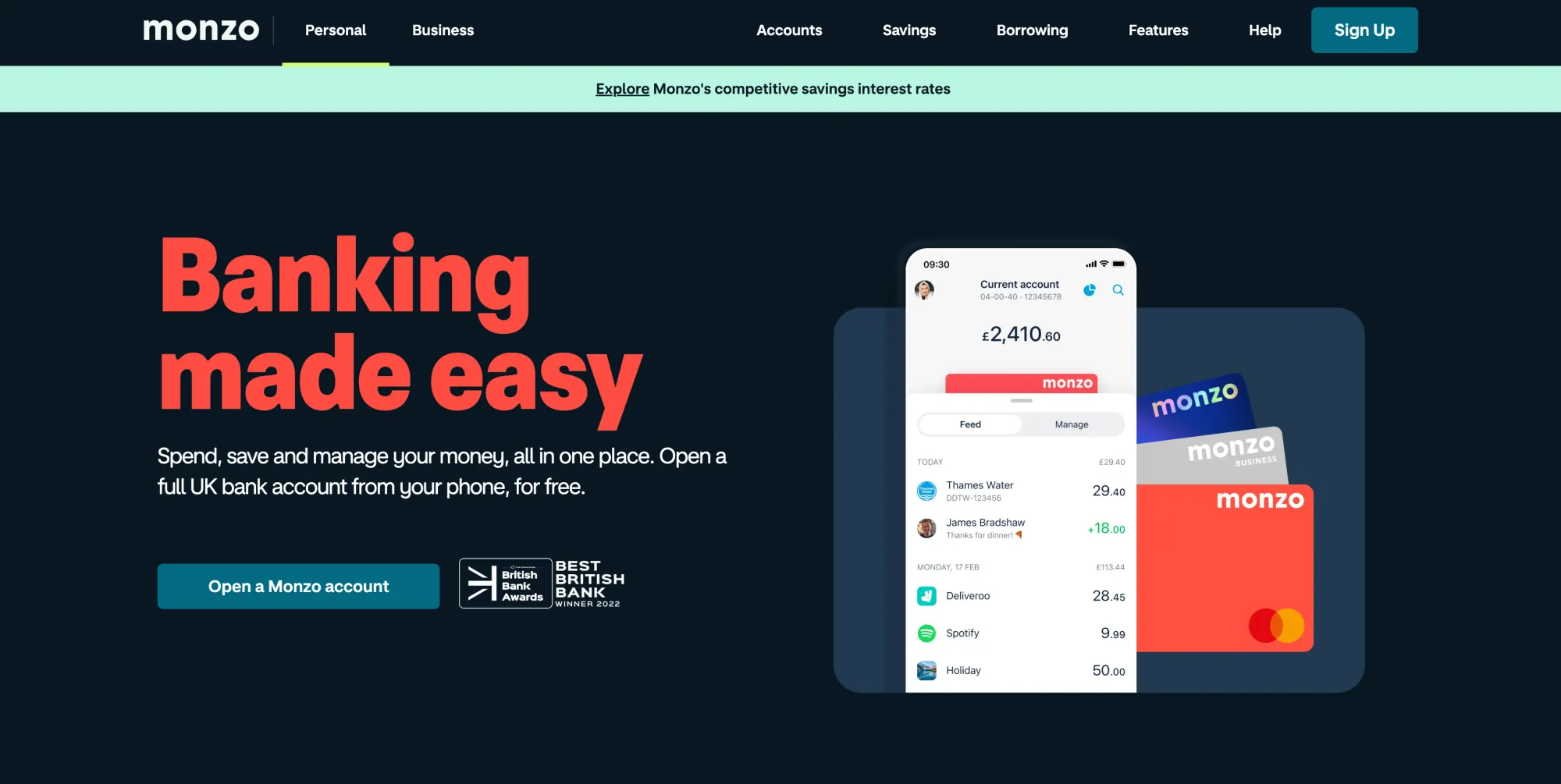

6. Monzo

Best Fully-Licensed Neobank for EU Residents

Monzo is a vibrant, digital-first bank that has quickly become a go-to choice for digital nomads and remote workers in the UK. With its striking coral-colored card and the app loaded with handy features, Monzo is all about making banking enjoyable, transparent, and stress-free for globe-trotting professionals.

Services and Features

- No-fee UK current accounts with a contactless debit card

- Instant notifications and real-time balance updates

- In-app budgeting tools and spending categories

- Fee-free international ATM withdrawals (up to £200 per month)

- 0% foreign transaction fees on card payments

- Pots feature for effortless savings and bill management

- Split bill features to split expenses with other Monzo users

- Integration with Apple Pay, Google Pay, and Samsung Pay

Bank Accounts Available

- Monzo Current Account – Free

- Monzo Plus – £5/month

- Monzo Premium – £15/month

- Monzo Business Lite – Free

- Monzo Business Pro – £5/month

- Monzo for 16-17 year olds – Free

- Monzo Join Account – Free

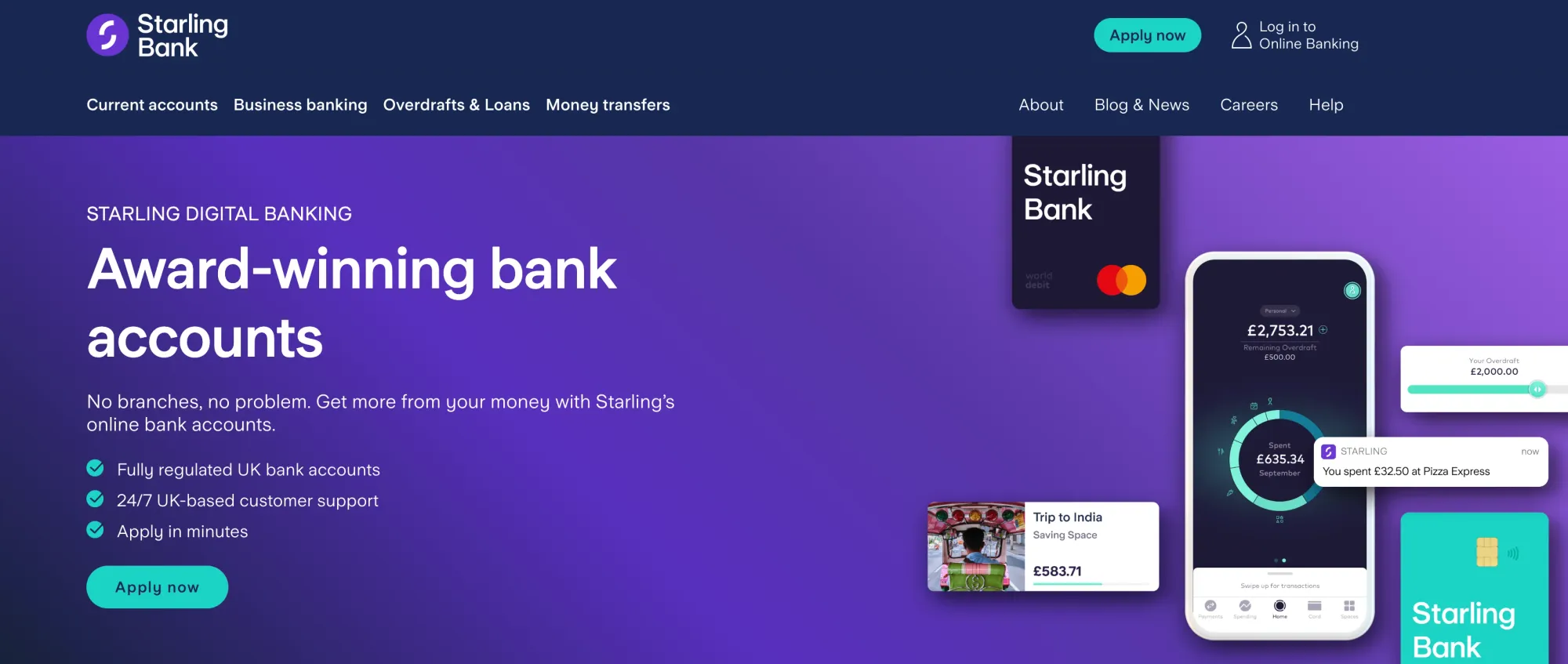

7. Starling

Best UK Bank for Seamless Integration

Starling Bank is a trailblazing, mobile-only challenger bank that has carved out a niche for itself among digital nomads and remote workers in the UK. With its focus on simplicity, transparency, and user experience, Starling offers a fresh and innovative approach to banking for those embracing the remote lifestyle.

Services and Features

- Fee-free UK current accounts with a contactless Mastercard debit card

- Instant notifications and real-time balance updates

- In-app budgeting tools and spending insights

- Unlimited fee-free international ATM withdrawals

- 0% foreign transaction fees on card payments

- 'Spaces' feature for easy savings and financial goal tracking

- Integration with Apple Pay, Google Pay, and Samsung Pay

Bank Accounts Available

- Starling Personal – Free

- Starling Business – Free

Best Banks for European Digital Nomads

Finally, this is our list of top banks that we think would fit perfectly to the needs of digital nomads that are residents of the European Union (EU).

8. Monese

Best European Bank for Instant Account Opening

Monese is a dynamic UK-based mobile banking solution that breaks down barriers for digital nomads and remote workers across Europe. With its commitment to easy account opening and borderless banking, Monese is a fantastic ally for those needing a financial companion to keep up with their fast-paced, location-independent lifestyle. They don't require a local address to be opened, which is a big advantage for digital nomads who sometimes don't have a fixed base.

Services and Features

- Fast and easy account opening without a local address

- UK and European IBANs for seamless international transactions

- Contactless Mastercard debit card

- Multi-currency accounts with competitive exchange rates

- Fee-free ATM withdrawals and card payments in selected currencies

- In-app budgeting tools and real-time notifications

- Integration with Apple Pay and Google Pay

Bank Accounts Available

- Monese Simple – Free

- Monese Classic – €5,95/month

- Monese Premium – €14.95/month

- Monese Business – £9.95

9. N26

Best Fully-Licensed Neobank for EU Residents

N26 is a sleek, digital-first bank that has won over the hearts of digital nomads and remote workers across Europe and beyond. With its minimalist design and focus on seamless, frictionless banking, N26 has become a trusted financial partner for European digital nomads seeking a modern banking experience that aligns with their borderless lifestyle.

Services and Features

- Streamlined account opening process

- Fee-free basic account with a contactless Mastercard debit card

- Multi-currency accounts with real-time exchange rates

- Fee-free ATM withdrawals in Euros

- In-app budgeting tools and spending analytics

- Integration with Apple Pay, Google Pay, and other mobile wallets

- Dedicated Spaces for easy savings and financial goal tracking

- Your money is protected up to €100,000

Bank Accounts Available

- N26 Standard – Free

- N26 Smart – €4.90/month

- N26 You – €9.90/month

- N26 Metal – €16.90/month

They charge the same prices for both personal and business accounts.

Best Banks for Canadian Digital Nomads

Here is our list of top banks that cater excellently to the needs of digital nomads who are based in Canada.

10. Scotiabank

Best Canadian Bank for No Foreign Transaction Fees

Scotiabank, one of Canada's leading financial institutions, offers a comprehensive range of banking services. The bank's Passport Visa Infinite Card is particularly appealing to digital nomads due to its no foreign transaction fees feature.

Services and Features

- Range of financial services including chequing and savings accounts, credit cards, and investment options

- Passport Visa Infinite Card offering no foreign transaction fees

- Mobile app and online platform for easy account management

- 24/7 customer support

- CDIC-insured accounts for added security

Bank Accounts Available

- Scotiabank Passport® Visa Infinite Card – 150 CAD/year

11. Tangerine

Best Online Bank in Canada for Low-Fee Structure

Tangerine is an online bank offering no-fee daily banking, making it a good option for digital nomads looking for easy online access and a low-fee structure.

Services and Features

- No-fee daily banking, savings accounts, credit cards, and investment options

- Mobile app and online platform for easy account management

- 24/7 customer support

- CDIC-insured accounts for added security

Bank Accounts Available

Best Banks for Australian Digital Nomads

Here is our list of top banks that cater excellently to the needs of digital nomads who are based in Australia.

12. Citibank

Best Australian Bank for Free International Services

Citibank Australia's Plus account is a standout for digital nomads, offering no monthly fees, free international money transfers, and free international ATM withdrawals.

Services and Features

- Plus account offering no monthly fees, free international money transfers, and free international ATM withdrawals

- Mobile app and online platform for easy account management

- 24/7 customer support

- Accounts are protected by the Australian Government guarantee

Bank Accounts Available

- Citibank Plus Account – Free

13. ING

Best Australian Bank for Rebates on International Fees

ING's Orange Everyday account stands out for digital nomads, offering to rebate all international ATM fees and foreign transaction fees if you meet certain conditions.

Services and Features

- Orange Everyday account offers potential for no international ATM fees or foreign transaction fees

- 100% rebate on any ING International Transaction fees charged on transactions made in the month

- 1% cashback on eligible gas, electricity and water bill payments made from your Orange Everyday account using BPAY or Direct Debit

- Mobile app and online platform for easy account management

- 24/7 customer support

- Accounts are protected by the Australian Government guarantee

Bank Accounts Available

- ING's Orange Everyday – Free

How to Choose the Best Bank for your Digital Nomads Needs

As a digital nomad, you're always on the go, so you need a bank that understands your unique lifestyle. Here's what you should look for when choosing a digital nomad bank account that has your back while you're exploring the world:

Low or no fees

Traveling across borders and dealing with multiple currencies and atm fees can be costly. That's why you should find a bank that keeps fees to a minimum or, better yet, doesn't charge them at all. Choosing one of the best debit cards for international travel can reduce costs and give you peace of mind while spending abroad.

Global accessibility

When you're always on the move, it's essential to have a bank that's accessible from anywhere. Look for one with a broad network of ATMs, partner institutions, and user-friendly online and mobile banking services. That way, you can manage your money no matter where your adventures take you.

Multi-currency accounts

Juggling different currencies can be a headache. To keep things simple, opt for a bank that offers multi-currency accounts and competitive exchange rates. This will save you time and money when dealing with various currencies.

International wire transfers

You may need to transfer or receive money from different countries as a digital nomad. Ensure your bank offers international wire transfers with reasonable fees and quick processing times.

Customer support

Sometimes, you just need a helping hand. Choose a bank with friendly and knowledgeable customer support that's available when you need them. They'll be your financial guardian angels while you're exploring new destinations.

Travel perks and rewards

Who doesn't love a good perk? Look for banks offering travel-related benefits, like travel insurance, airport lounge access, or discounts on accommodations and transportation. For even more perks, some of the best travel credit cards for digital nomads can complement your banking experience, offering exclusive rewards tailored to frequent travelers.

Security

Since you'll rely on online banking, finding a bank that takes security seriously is crucial. To keep your hard-earned money safe, look for banks with strong security features, such as two-factor authentication, account monitoring, and real-time transaction alerts.

So, What's the Best Digital Nomad Bank?

After exploring the ins and outs of these fantastic digital nomad banks, it's clear that there's no one-size-fits-all solution. The best digital nomad bank for you will depend on your unique needs, travel habits, and financial priorities.

If you're looking for the best overall experience, Revolut is a solid choice with its wide range of features, competitive exchange rates, and global accessibility. Wise is a game-changer for those who frequently deal with multiple currencies, offering an excellent multi-currency account with low fees.

Freelancers and entrepreneurs might find Payoneer's focus on international business and invoicing particularly appealing, while those seeking a U.S.-based solution with excellent travel perks should consider Charles Schwab. UK digital nomads have fantastic options in Monzo and Starling Bank, both of which offer user-friendly apps and fee-free spending abroad.

For European digital nomads, N26 and Monese stand out as top choices with their easy bank account opening processes and support for multiple currencies.

Ultimately, it's essential to assess your banking needs and preferences carefully before making a decision. Consider the factors that matter most to you, such as fees, currency support, ATM access, and customer service. Use this information to choose the best digital bank that best aligns with your nomad lifestyle. Happy banking!

Ready To Start Saving Money With Your New Digital Nomad Bank Account?

Join our global

digital nomad community

Join us for free

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Read Next

BNESIM eSIM Honest Review

Are Coworking Spaces Worth It?