SafetyWing vs Genki: Which Insurance is Better?

Compare Genki and SafetyWing travel insurance. Discover which offers better coverage, benefits, and value for your next adventure. Read our review.

Have trouble deciding whether Genki or SafetyWing is best? We don’t blame you. As it turns out, choosing between two of the most badass travel and health insurance plans is no easy task.

In this Genki vs. SafetyWing insurance review and comparison, we’ll explore the differences between these two insurance companies and the plans they offer.

And since we have firsthand experience using both Genki and Safetywing during our own travels, we know the ins and outs. Read all the way to the end for our personal thoughts on these plans - no filter.

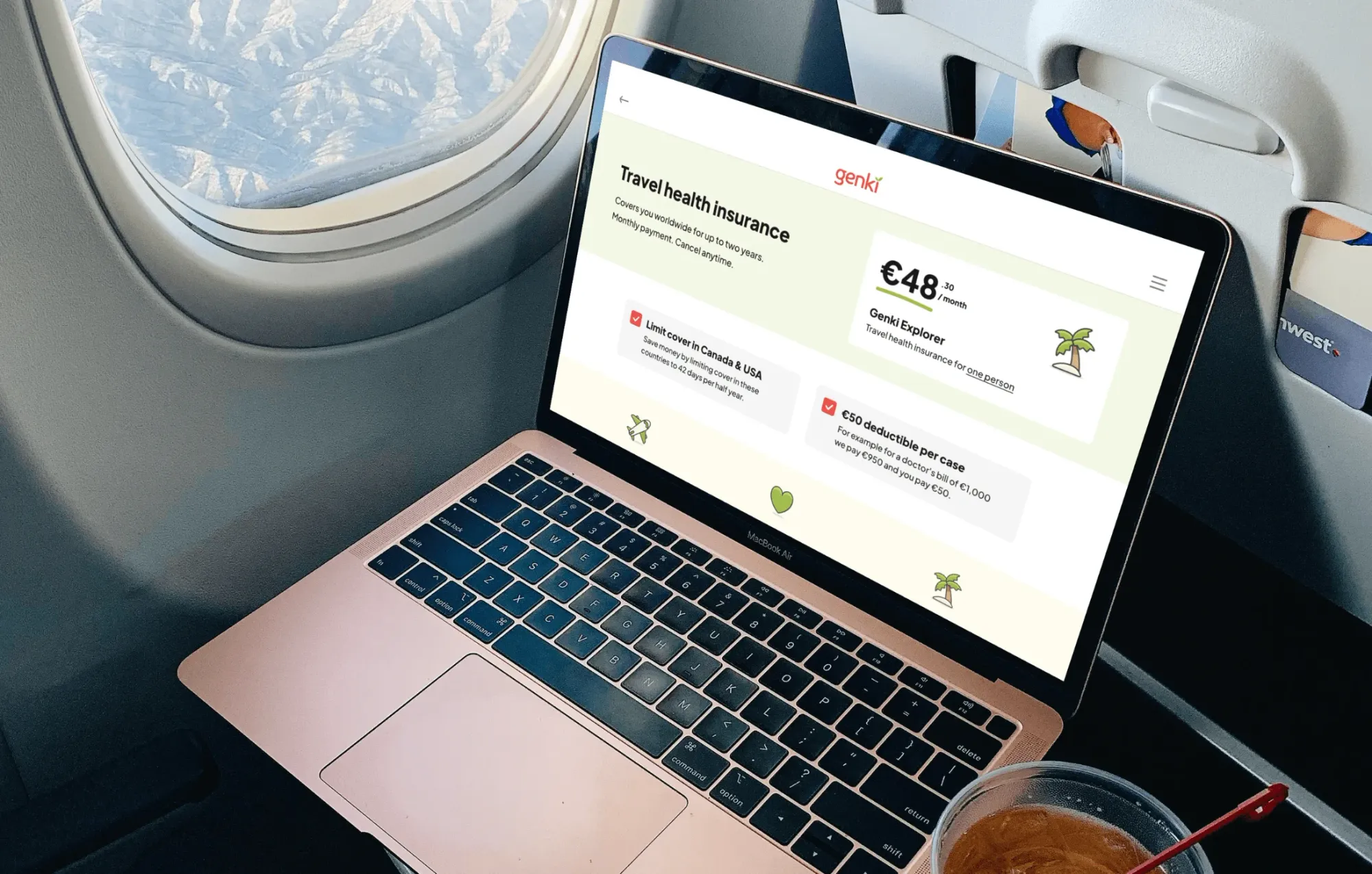

What is Genki?

Chances are you’ve heard of Genki before – most digital nomads and frequent travelers have. Genki is usually somewhere at the top of all the travel medical insurance comparison lists. But we’ll introduce them here anyway.

Genki is a well-known, highly-rated travel insurance option crafted specifically for digital nomads.

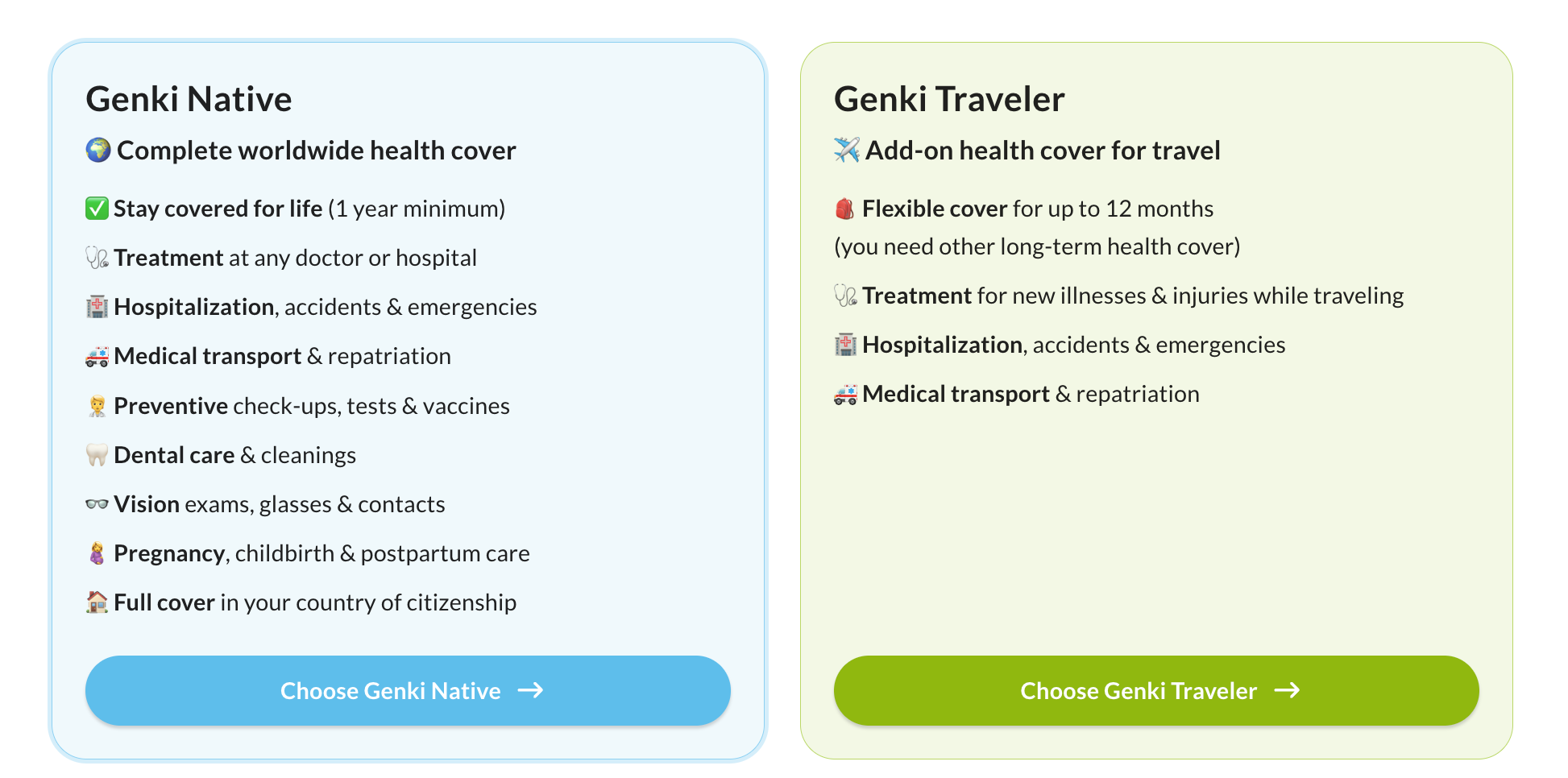

The company offers two main insurance plans:

- Genki Traveler – Short-term coverage for treatments deemed medically necessary. Gives you up to 2 years of coverage at a time.

- Genki Native – Long-term plan with worldwide health benefits for digital nomads and frequent travelers.

Coverage applies all over the world, and you get to enjoy benefits like:

- Choosing your own doctor or hospital

- Adventure sports coverage (optional add-on)

- No annual medical coverage limits

What is SafetyWing?

You might think that it’s hard to measure up to Genki, but that’s not exactly the case. SafetyWing is another top contender among digital nomad and frequent traveler insurance providers. They offer two main insurance plans painstakingly designed for us; they include:

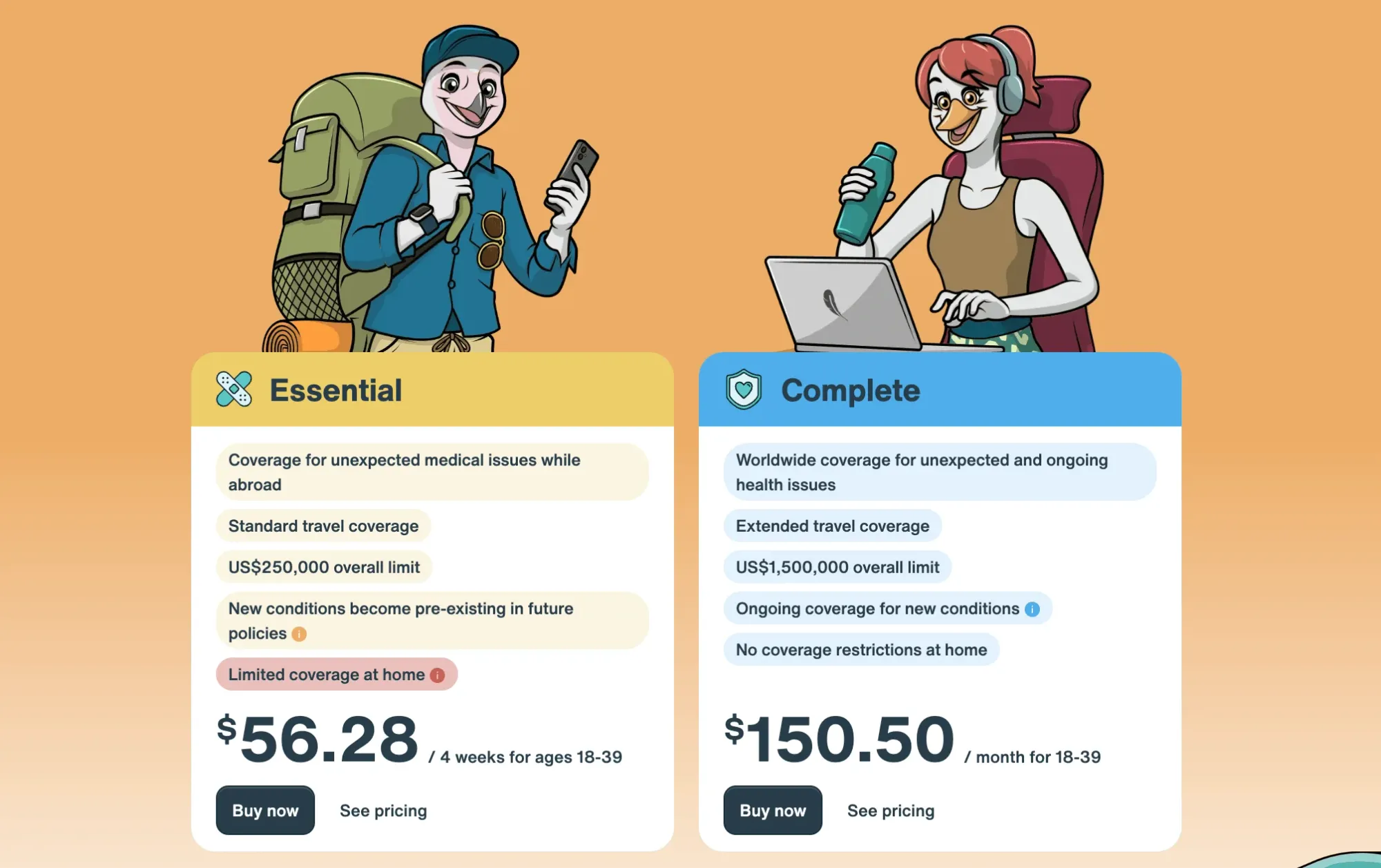

- Nomad Insurance Essential – This is a lifeline you can use if you get sick or injured outside your home country and need care. It also covers travel-related benefits like lost luggage. It’s a prime travel medical insurance option that applies in 180+ countries and caters to nomads.

- Nomad Insurance Complete – This heavy-duty nomad insurance gets you 12 months of access to both medical and travel coverage in your home country and abroad. It’s applicable in 170+ countries.

SafetyWing plans are sought after because of the perks you get to take advantage of, including:

- Truly global coverage

- Long-term coverage options

- Affordable monthly subscription model, you can cancel at any time

- Handy add-ons like adventure sports and electronics theft

Genki vs. SafetyWing: Quick Comparison Table

Want to see how Genki and SafetyWing measure up to each other? Check out this quick comparison table for a side-by-side comparison:

| Feature | Genki | SafetyWing |

|---|---|---|

| Coverage Area | Worldwide | Worldwide |

| Monthly Cost | $52.09 (Genki Traveler) $194.13 (Genki Native) *0 to 29 years old |

$56.28+ (Nomad Insurance) $150.50+ (Nomad Insurance Complete) *18-39 years old |

| Yearly Coverage Limit | Up to $5M | Up to 1.5M |

| Age Limit | 69 (Genki Traveler) No age limit (Genki Native) |

74 |

| 24/7 Support | ✅ | ✅ |

| Choose any doctor | ✅ | ✅ |

| Telehealth | ✅ | ✅ |

| Total Sports Coverage | ✅ | ✅ (Nomad Insurance Complete only)) |

| Pre-existing Conditions | ✅ | ✅ (Nomad Insurance Complete only) |

| Emergency Evacuation | ✅ | ✅ |

| Preventive Care | ✅ (Genki Native only) |

❌ |

| Buy while abroad | ✅ | ✅ |

*Yearly coverage limit depends on the plan you choose.

Medical Coverage

Genki is known for its extensive coverage for inpatient and outpatient care, and even for pre-existing conditions (if you’ve been stable for six months). They also offer high coverage limits – up to $5 million. SafetyWing also provides comprehensive coverage for medical emergencies and hospital stays, but due to the plan limitations, you could have a harder time getting coverage for pre-existing conditions. The coverage limits are also lower – up to $1.5 million annually.

Evacuation and Repatriation

It’s always good to have evacuation and repatriation benefits to help transport you to a medical facility or back home for treatment as needed. Genki offers full evacuation and repatriation benefits as part of their base packages. If you go with SafetyWing, you’ll get medical evacuation, but repatriation is only available as an optional add-on.

Travel Disruption

Travel disruptions are always a risk when you’re doing your thing as a nomad. Thankfully, Genki will cover you in the case of trip cancellation, interruptions, delays, and missed connections. SafetyWing puts some of those benefits behind a paywall; you get travel delay coverage, but if you want trip cancellation and interruption, you’ll have to buy it as an add-on.

Adventure Activities and Sports

Do you live for thrills? If you do, you’ll be glad to know that both Genki and SafetyWing cover adventure activities and sports. However, there are some stipulations that may not initially be apparent. Genki offers an Adventure Sports Rider that covers various activities, like surfing and hiking. SafetyWing offers coverage for certain adventure sports like parasailing, martial arts, and skydiving, but high-risk ones will be excluded.

Personal Belongings and Electronics

Few things are as frustrating as losing your personal belongings, especially in a foreign country. Luckily, Genki has your back and will cover your lost, stolen, or damaged baggage and belongings. SafetyWing plans cover the loss of personal belongings and cash (per policy limits), but they don’t have as much coverage for lost checked luggage.

Pricing

As for the pricing, it’s clear which option is more affordable. Overall, Genki will hit your wallet the hardest, especially when you factor add-ons into the equation. Just remember that your monthly premiums will vary based on your destination, age, and coverage level. SafetyWing costs less than Genki, and there’s a flat monthly fee regardless of your travel plans. There are optional add-ons available for additional coverage.

Flexibility

When it comes to flexibility, SafetyWing is the clear winner. You’ll subscribe to a monthly plan that you can cancel anytime. You can also start or pause your coverage as needed. With Genki, there are fixed-term plans ranging from 1 to 12 months. You can extend your plan as desired.

Additional Benefits

Unlike many other competitors, Genki offers benefits like pre-existing conditions (subject to limitations), mental health coverage, and 24/7 virtual doctor consultations. SafetyWing benefits include coverage for home-country visits and remote doctor consultations.

Our Personal Experience with Genki and SafetyWing

At Freaking Nomads, we don’t just write about nomad life – we live it. As nomads do, we’ve been busy exploring country after country, from China to Chile and many destinations in between. Throughout our travels, we’ve used several different insurance plans as a safety net. SafetyWing and Genki are two of them.

This past October, we took a weekend trip to beautiful Chile. Our itinerary was full - Valparaiso, Maipo Valley, and Santiago were a few of our planned stops. Well, on the way back to the hotel after our wine tasting in Maipo Valley, our vehicle was t-boned by a local. Fast-forward a few hours, and we’re sitting in a Chilean hospital with fees totaling over $6,000.

We contacted Genki right away to access our benefits, and we were pleasantly surprised. The claims process was everything we hoped for. Filing a claim with Genki was super straightforward each time – we just used their portal. They got back to us with a claim decision within days - not weeks or months. Our $5,525 in claims payments arrived within 30 days.

Plus, they really do provide helpful 24/7 support, and we got a lot of use out of it. You really can’t ask for more.

Since then, we used our Genki benefits five more times, and we haven’t had any issues.

Our experience with SafetyWing, on the other hand, could have been better. Though we didn’t submit claims for all of our trips, we did so during a one-week visit to Kyoto, Japan in January 2023 and a long-term Vietnam trip that summer.

We won’t waste your time - we were mostly frustrated with SafetyWing. Though submitting claims was easy, it took a while to hear back from them and receive the reimbursements we were due.

Note: It’s rare to come across insurance companies that actually listen to their customers, but SafetyWing does. We have heard through the grapevine that SafetyWing has recently improved its claims process with the launch of Nomad Insurance 2.0. Since these changes were implemented, we’ve been seeing a ton of overwhelmingly positive reviews on Trustpilot for the insurance company. It looks like they are doing much better now with the claims process.

Based on our experience with both companies, we prefer Genki. We didn’t have any issues; the plans were affordable for the coverage we got, and we could take advantage of our benefits without the documentation runaround or waiting games.

Which is Best for You: Genki or SafetyWing?

By this point, you might have a feel for which insurance plan may work. But in case you don’t, we’ll help with some recommendations in this section:

- Budget-conscious travelers: If you’re on a budget, SafetyWing may be the best option between the two, as their prices are on the lower side, and they offer month-to-month plans you can cancel anytime.

- Adventure seekers: Adventure seekers may prefer Genki, as their plans cover more adventure sports with fewer exclusions. SafetyWing’s exclusions can put a damper on your fun.

- Long-term nomads: SafetyWing’s Nomad Insurance Complete plan is ideal for digital nomads who want comprehensive long-term coverage at an affordable price. Genki offers long-term coverage, too, but if you only need it for a few months, you may be unable to justify the price.

- Digital nomads working remotely: Genki beats out SafetyWing when it comes to general coverage for digital nomads working remotely. The benefit mix, high plan maximums, and clean track record all factor into this recommendation.

Ultimately, you should consider the following factors before making your final decision:

- Age

- Health conditions

- Planned activities

The Bottom Line

To sum it all up, Genki and SafetyWing are two of the leading digital nomad travel insurance options on the market. You can’t go wrong with either of them, but there are distinct differences to keep in mind.

Genki and SafetyWing offer heavy-duty plans with loads of benefits tailored to digital nomads and long-term travelers. But Genki offers more comprehensive standard benefits, quick claims processing, and extras that other insurance carriers offer as add-ons.

SafetyWing excels in cost transparency, raw benefits, add-ons, and affordability. But coverage for adventure activities is on the thinner side, and the claims process can be lengthy and sometimes difficult.

It’s good to be concerned about choosing the right plan to insure your travels – not every plan will do, and you don’t want to overpay or be left underinsured. To ensure you’re making the absolute best choice, we urge you to get a quote from Genki and SafetyWing.

During the quoting process, you’ll be able to see all your benefits up close and get a concrete price. After you get your quote, you’ll be in a much better position to make a sound decision.

If you’re also weighing other options, we've compared below the leading travel insurance providers so you can see how they stack up in terms of affordability and benefits:

Ready to Pick The Most Suitable Travel Insurance To Get an Extra Piece of Mind?

Join our global

digital nomad community

Join us for free

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Read Next

Ireland Digital Nomad Visa: Application and Requirements

Airalo China eSIM: Is It Worth It?