SafetyWing Travel Insurance Review

Explore the pros and cons of SafetyWing's travel insurance in our review. Find out if it's the right coverage for your nomad adventures.

Over the years, we shared about what digital nomad insurance is, how to get health insurance as a digital nomad, and the best nomad insurance out there.

But there’s one company I’ve personally ended up using the most while traveling as a digital nomad, and that’s SafetyWing. I’ve had their coverage on and off for the past 4 years, and in that time I’ve learned exactly where it shines, where it could be better, and who it’s best for.

TL;DR: If you want something affordable, flexible, and easy to buy even after you’ve already left home, SafetyWing is honestly one of the best options out there. But if you want to learn the actual details of why I would recommend it, keep reading for my full, honest review.

What is SafetyWing?

SafetyWing is a travel medical insurance company created by digital nomads, for digital nomads, aiming to make travel insurance less painful (and way more affordable) for people who work remotely while traveling.

Their most popular product among nomads and travelers is the Nomad Insurance Essential which focuses on trip protection and emergency situations, like canceled flights, lost luggage, stolen passports, and urgent medical care, across 180+ countries. And because it focuses on important stuff covered without paying for extras they’ll never use and skips full medical coverage, it’s cheaper than most other plans out there.

For travelers aged 18-39, it costs just $56.28 for 4 weeks ($1.87 per day). Coverage goes up to age 69, with understandably higher premiums, which is still very reasonable.

It’s also incredibly flexible. You can start your plan even if you’re already abroad, and coverage can be as short as 5 days or as long as 364 days. Plus, it runs on a renewable subscription model, you can cancel anytime.

I’ve used it for everything from delayed flights to a motorbike accident in Turkey, which saved me over $1,500 in hospital bills.

What Does SafetyWing Cover?

SafetyWing’s Nomad Insurance Essential Plan covers the big, most common travel mishaps for just $1.87 a day, without making you pay for extras you’ll probably never use. Here’s what you get:

- Medical treatment & hospitalization: Hospital stays, nursing care, ambulance transport, MRIs and diagnostics, extended recovery, emergency dental (up to $1,000), up to $250,000.

- Evacuation to a better hospital: Up to $100,000 lifetime max.

- Lost checked luggage: $500 per item, up to $3,000 per policy.

- Injuries from leisure sports & activities: Up to $250,000 (see full list of covered activities).

- Motor accidents: If licensed, wearing safety gear, and not intoxicated — up to $250,000.

- Trip interruption: Up to $5,000 for a ticket home in case of a family death.

- Travel delay: $100/day for up to 2 days.

- Evacuation due to local unrest: Up to $10,000 lifetime max.

- Death arrangements: Up to $20,000 for transport and $10,000 for local burial.

For the price, these limits are pretty generous. A lot of plans in this bracket give you lower caps and less flexibility, so SafetyWing holds its own really well here.

And if you want a bit more protection, you can add on extras like U.S. & Canada coverage, adventure sports, or electronics theft. They’re totally optional, so if you don’t need them, your premium stays nice and low.

Make sure to check and not skip the details of your coverage for any conditions that apply.

What's Not Covered?

The Nomad Insurance Essential Plan is mainly built for emergencies and travel hiccups. Here’s what’s generally not included:

- Pre-existing conditions and routine check-ups

- Pregnancy and childbirth (except for certain serious complications)

- Cancer treatment, mental health care, hereditary conditions, and chronic illnesses

- Injuries from drugs, alcohol, illegal activities, or breaking the law

- Professional sports or unlisted extreme activities

- Alternative treatments like massage therapy, acupuncture, or experimental procedures

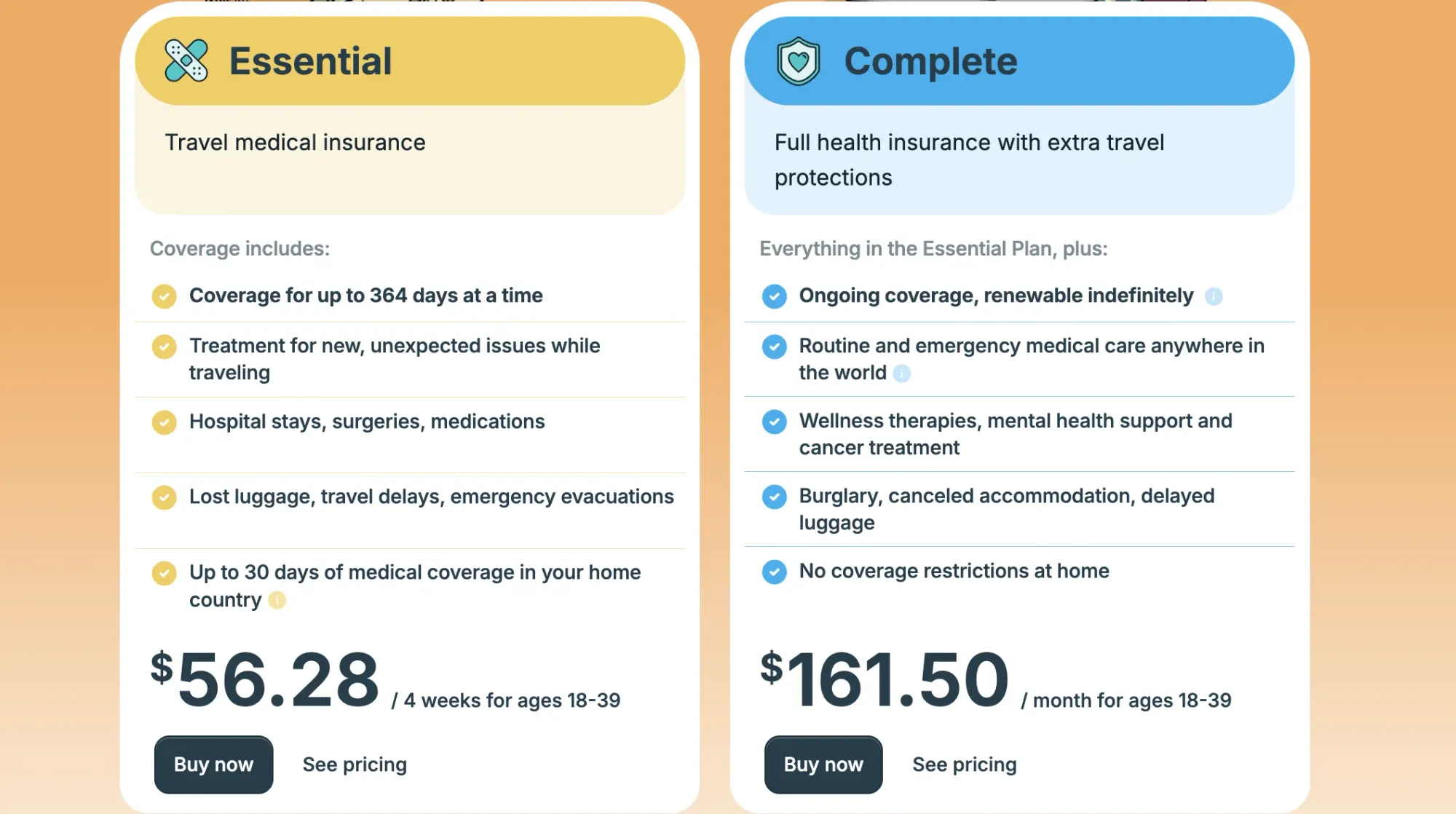

Nomad Insurance Complete: a Global Health Insurance for Long-Term Travelers

If you’re only away for a few weeks or months, the Essential Plan will likely cover everything you need. But if you’re planning to travel for many months, years, or a full-on expat life, their recently launched Nomad Insurance Complete plan is a smarter pick.

This is SafetyWing’s full-scale global health insurance. You get everything in Essential plus ongoing care for conditions that appear after coverage starts in 170+ countries, with medical limits jumping to $1.5 million.

It covers things like routine check-ups, specialist visits, wellness therapies, cancer treatments, maternity care, mental health sessions, and even stolen belongings. And it includes home country coverage with no restrictions, a huge win if you’re American or spend time in countries with expensive healthcare.

At $161.50 a month for travelers aged 18–39, it’s pricier than Essential, but if you are a long-term nomad who wants peace of mind for both emergencies and everyday health, it can be worth every cent. If you want a quick comparison of both plans, this explains it well:

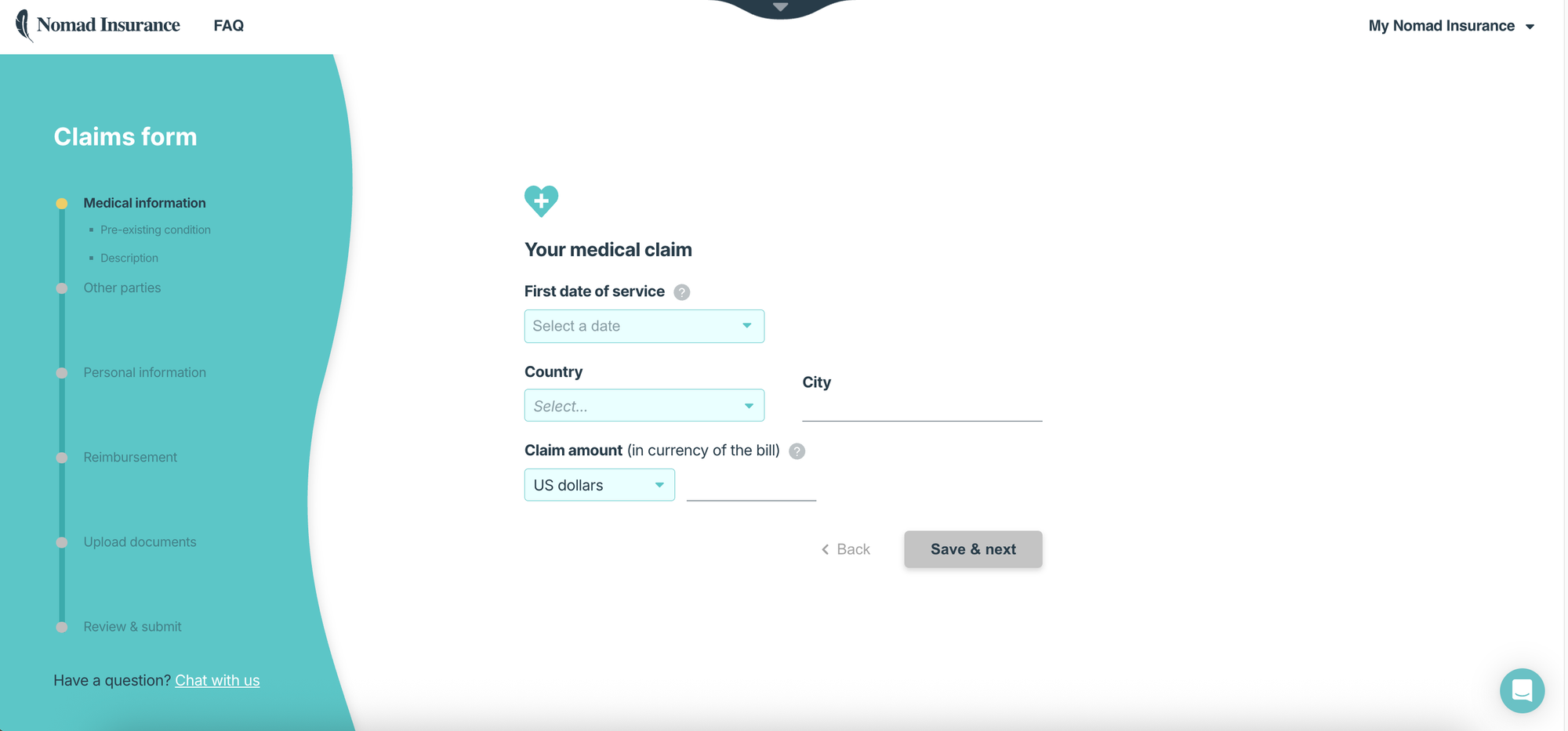

Making a Claim with SafetyWing

Making a claim with SafetyWing is takes only a few minuted. You’ve got up to 60 days after your coverage ends to submit everything, and you can do it all online.

If you’ve already paid out of pocket, you’ll just upload your receipts and any supporting documents through their claims portal at safetywing.com/nomad-insurance/profile/claims.

I would recommend having the following documents ready to speed things up:

- Your medical report (symptom(s), date of onset, diagnosis, treatment)

- Any medical invoices outlining what you paid

- Any relevant receipts

- Your bank account information

There’s a $250 deductible per approved claim, which basically means you cover the first $250 and they take care of the rest. For the most common expenses like hospital stays, tests, or emergency treatment, that’s usually just a tiny slice of the bill, and it still saves you hundreds (and in my case, even thousands) compared to paying everything yourself.

As of writing, the average wait time for reimbursements is about 4 days, which is impressively fast compared to most travel insurance companies.

Pros and Cons of Using SafetyWing

Based on my experience using SafetyWing for the past 4 years, here's what I see SafetyWing excelling and what they could honestly do better:

Who Is SafetyWing Good (and Not Good) For?

To make it even easier for you, I thought it would be a good idea to give you a quick snapshot of where SafetyWing really shines, and when you might want to look at other options instead so you can decide yourself whether it's a good travel insurance worth getting.

| Best For | Not So Good For |

|---|---|

| Digital nomads and remote workers who travel year-round | Travelers needing full global health insurance with no deductibles (opt for Complete instead) |

| People who want to start coverage after leaving their home country | Those who need ongoing care for chronic conditions |

| Budget-conscious travelers looking for flexible monthly pricing | Travelers who want coverage for very high-risk sports without add-ons |

| Long-term travelers who mainly want emergency and trip protection | People who want zero out-of-pocket costs for claims |

I’ve tried a lot of travel insurance options over the years, and SafetyWing is still the one I keep coming back to. It’s simple, it works, and it’s one of the few travel insurance products actually built with nomads in mind.

Use the widget below to get a free quote and see what your plan would cost.

Ready to Get Insurance for Your Next Trip?

Join our global

digital nomad community

Join us for free

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Read Next

espresso by Kensington Magnetic Privacy Screen Review

Airalo China eSIM: Is It Worth It?