Genki vs World Nomads: Which Travel Insurance Is Better?

Read our reviews of Genki and World Nomads to discover the best travel and health insurance provider based on coverage, costs, and flexibility.

When it comes to travel insurance for digital nomads, both Genki and World Nomads have earned their stripes—but they cater to different needs and budgets. If you’re on the fence about which one to choose, it’s worth digging into the details.

Having used both during our travels, we’ll compare their coverage, pricing, and how they handle real-life scenarios like medical emergencies, trip cancellations, and lost belongings, so you can choose the one that best fits your lifestyle and travel needs.

What is Genki?

Genki is a digital nomad-founded start-up created to provide excellent worldwide travel insurance that just makes sense. They offer super flexible monthly travel insurance subscriptions that cover digital nomads in every country in the world, as well as amazing coverage options like pre-existing conditions, adventure sports, and pregnancy care.

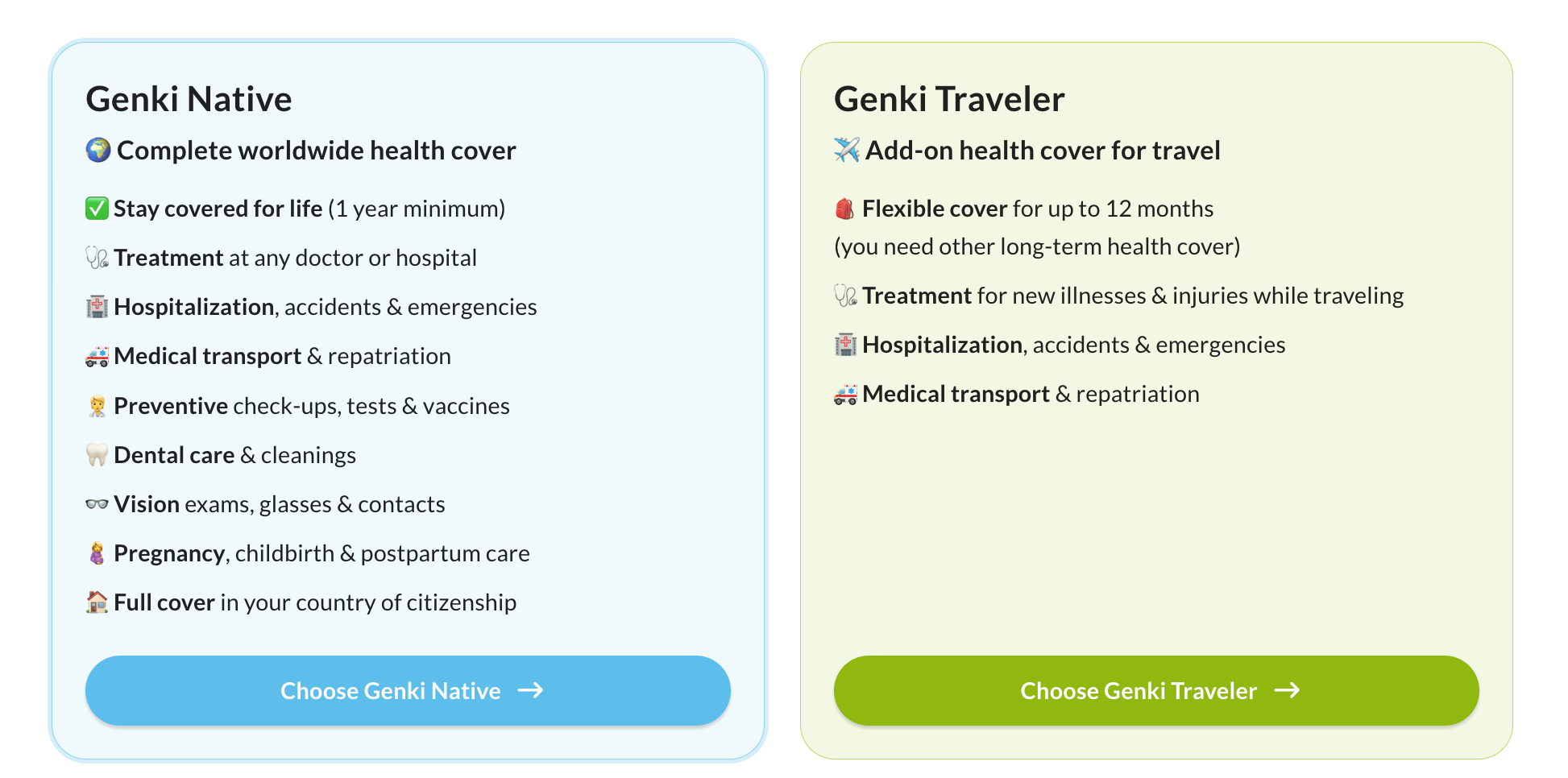

Genki offers two different insurance policies:

- Genki Traveler: Short-term insurance for on-the-go nomads

- Genki Native: Long-term international health insurance for digital nomads living abroad full-time

Although a start-up, Genki is backed by highly established European providers like Allianz, Barmenia, and DR-Walter. They might be the new kid on the block, but they have quickly become the go-to insurance for many digital nomads.

What is World Nomads?

World Nomads is unique in the digital nomad travel insurance world for having been around since 2003. They’re also backed by Nationwide, which makes World Nomads an incredibly established and trustworthy provider.

Unlike Genki, World Nomads offers only insurance for single trips. The policies come in three tiers: Standard, Explorer, and Epic. This allows customers to choose what level of protection (and price point) they want to opt into, with all plans covering trip cancellation, 150+ adventure activities, and overseas medical fees.

World Nomads is suitable for digital nomads as it lets you purchase your policy mid-trip with no long-term commitments, but if you are a backpacker or a frequent traveler, you can check out their Annual Multi-Trip insurance which covers you for all trips within one year, so long as they’re under 45 days.

Genki vs World Nomads: How Do They Compare?

By putting Genki and World Nomads head-to-head in this travel insurance breakdown, it becomes quickly pretty clear just how different these two companies are. We've tried to summarize all the information you need in this table, so you can quickly notice the differences.

|

|

|

|---|---|---|

| Coverage Area | Worldwide | 140+ Countries |

| Monthly Cost | ~$52.09 (Genki Explorer) ~$194.13 (Genki Native) |

From ~$50 per week (Standard) From ~$120 per 4 weeks (Premier) |

| Payment Model | Monthly | One-time upfront payment |

| Age Limit | 69 (Genki Explorer) 70 (Genki Native) |

70 |

| Deductible | €50 (Genki Explorer) | $250 |

| Optional deductible | Claim dependent up to $100 (Optional: €0, €500, or €1,000 for Genki Native) | ❌ |

| Policy Cancellation Terms | Cancel anytime (Genki Explorer) Up to 21 days after purchase (Genki Native) |

Cancel anytime before trip starts Not applicable |

| Coverage Limits | Unlimited (Genki Explorer) Up to €1M (Genki Native): Up to $5M (Standard) |

Up to $3,000 for non-medical claims Up to $5M (Premier) |

| Medical Coverage | Unlimited | Up to $5M (Standard) |

| Trip Delay | ❌ | ✅ |

| Trip Cancellation | ❌ | ✅ |

| Personal Belongings | ❌ | ✅ |

| Specialty Items | ❌ | ✅ |

| Telehealth | ✅ | ❌ |

| Adventure Activities | ✅ | ✅ |

| Routine Check-ups | ✅ (Genki Native Premium only) | ❌ |

| Pre-Existing Conditions | ✅ | ❌ |

| Buy While Abroad | ✅ | ✅ |

| 24/7 Support | ✅ | ✅ |

| Allows for Continuous Travel | ✅ | ❌ |

Now, let's take a closer look and see how each measures up to the key elements of travel insurance.

Medical Coverage

Both Genki and World Nomads offer comprehensive medical coverage for emergency expenses like hospitalization, medication, and in-patient care. Genki goes the extra mile with some coverage for certain pre-existing conditions so long as you’ve been stable for 6 months, not to mention including preventative care with Genki Native Premium.

Evacuation and Repatriation

Genki is all about choice. Not only will they move you to the nearest hospital that meets your medical needs, but they’ll also give you the option to return home should you want it. World Nomads, on the other hand, includes the cost of medical evacuation and repatriation at all tiers to allow you to get where you need to be.

Travel Disruption

This is where Genki and World Nomads really differ. While World Nomads includes things like pre-trip cancellation and interruption, Genki doesn’t cover any non-medical-related costs. It’s important to understand Genki’s products are primarily health insurance based instead of travel.

Adventure Activities and Sports

Amazingly, World Nomads covers over 150 adventure activities like scuba diving, skiing, and white water rafting and that's what made them famous. Genki also includes a large number of adventure sports, however, activities that are considered "dangerous" such as parachuting and bungee jumping are only covered by their upgraded products Genki Native.

Personal Belongings and Electronics

Genki doesn’t offer any coverage for lost or damaged personal belongings. World Nomads insurance, on the other hand, includes items that are stolen, damaged, or destroyed, including electronics up to $500/item.

Pricing

Although pricing for both Genki and World Nomads varies greatly by age, residence, and destination, Genki consistently comes out as the cheaper option among the two. It’s important to note, however, that Genki is offering health insurance, whereas World Nomads policies include travel costs like trip disruption and lost belongings.

Flexibility

Genki comes out ahead in terms of flexibility with a monthly subscription that can be purchased while abroad, canceled at any time, and covers every country in the world. With World Nomads, you’ll need to know your exact countries and dates when purchasing your policy or get a shockingly higher quote for worldwide coverage, which is frankly not ideal.

Additional Benefits

World Nomads offers a few relatively unique benefits with their plans, such as personal liability coverage in case you get sued. You can also enjoy counseling services up to $250 at all tiers. Interestingly, Genki Native Premium has comprehensive maternity care that includes things like midwives, preparation classes, and postnatal care.

Our Experience Using Genki vs World Nomads

Although not insurance professionals, we like to consider ourselves knowledgable in the field of digital nomad insurance as we use them on a daily basis due to our frequent traveling schedule as digital nomads. That's why when we put Genki and World Nomads to the test…we really put them to the test.

With Genki, we're happy to report smooth sailing from start to finish. Buying the policy on the go is a huge bonus, and the fact that there’s no coverage gap for accidents or life-threatening treatments is always a relief. We also have to shout out how consistently quick Genki was with providing claim verdicts - we're talking less than a month!

The thing we really love about Genki is just how malleable it is for the ever-changing digital nomad lifestyle. Their insurance protects you in literally every country in the world and the automatic renewal every month makes having continuous health insurance so easy, regardless of how your plans change and evolve.

Of course, Genki isn’t totally perfect. Losing luggage with an airline while insured with just Genki isn't ideal timing as they don’t cover anything non-medical…although for the price, we really can’t complain too much.

With World Nomads, when we tested it, it was nice to have a choice of tiers to tailor the insurance to our budget and coverage needs. We also liked knowing that missed flights or stolen belongings wouldn’t hit our wallets quite as hard.

World Nomads made us feel at ease as we knew that they have 24/7 customer service. They are able to hook you up to their vast network of hospitals, clinics, etc, when you are in need of help, which is a plus.

To be honest, though, we're not fans of World Nomad’s waiting periods. If you purchase their insurance coverage while already abroad (hello nomad lifestyle), you have to wait 72 hours for it to actually start working and the same even goes for renewing the policy every 6 months.

We also struggled with the rigid nature of World Nomads. We don’t always know where we’re going or for how long, and not being able to travel freely just isn’t the Freaking Nomads’s style.

Which is Best For You, Genki or World Nomads?

At the end of the day, not every policy is designed for every type of traveler. Here are our provider recommendations depending on your travel profile:

- Backpackers and budget conscious travelers: Holistically speaking, Genki is the best bang for your buck with one of the cheapest insurance plans out there.

- Adventure seekers: With 150+ adventure sports, World Nomads is absolutely a better option if you plan to engage in extreme sports.

- Long-term travelers: Genki is designed specifically for long-term travelers who live and travel full-time with zero trip limitations like destination or length, so no doubt here which is the best option.

- Digital nomads: World Nomads is worth considering for their personal belongings and electronics coverage that keeps your portable office set-up safe, but overally Genki is the most suitable option for this category of travelers as they have been literally tailored for them.

A few other major factors also have to play a role in your decision, like for example for those over 70 or people planning to get pregnant (after the 12-month wait period) for which Genki Native is the only option.

Our Verdict

Ultimately, Genki and World Nomads are designed for two different types of travelers. Genki is our prefered choice for digital nomads as they have a simpler subscription model and budget-friendly pricing. On the other hand, World Nomads is a good option for remote workers who are based at home but travel often thanks to the lack of long-term commitments.

Of course, the final choice is going to be personal to you. Choosing the right provider can literally save you tens (if not hundreds) of thousands of dollars, and it’s a decision that shouldn’t be taken lightly.

We can’t tell you which insurance provider is right for your exact situation but to help make the decision, we recommend starting by getting quotes from both providers and taking a deeper look at their policies.

Still not sure? We've compared below the leading travel insurance providers so you can discover their differences and choose the one that fits you best:

Ready to Find the Right Insurance Provider and Get Traveling?

Join our global

digital nomad community

Join us for free

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Read Next

Argentina for Digital Nomads and Remote Workers: The Ultimate Guide

Virgin Connect Roam eSIM: Honest Take for International Travelers