World Nomads Travel Insurance Review: Is it Worth it?

World Nomads travel insurance: is a good choice for international travelers? Our review reveal coverage, claim ease, & value for adventurous travelers.

During my last trip to Europe, I lost a dental filling—a minor issue that could’ve turned into a major expense without travel insurance. Thankfully, I was covered, avoiding a potential nightmare.

The truth is, regular health insurance rarely works abroad, making travel insurance essential. World Nomads claims to protect your trip, belongings, medical emergencies, and even adventurous activities. But does it deliver?

Whether you're an adrenaline junkie or a foodie like me, this review will help you decide if World Nomads is the right travel insurance for your needs. Ready to find out if it’s worth it? Let’s dive in!

What We Like About World Nomads Travel Insurance

Getting protected is fast and easy

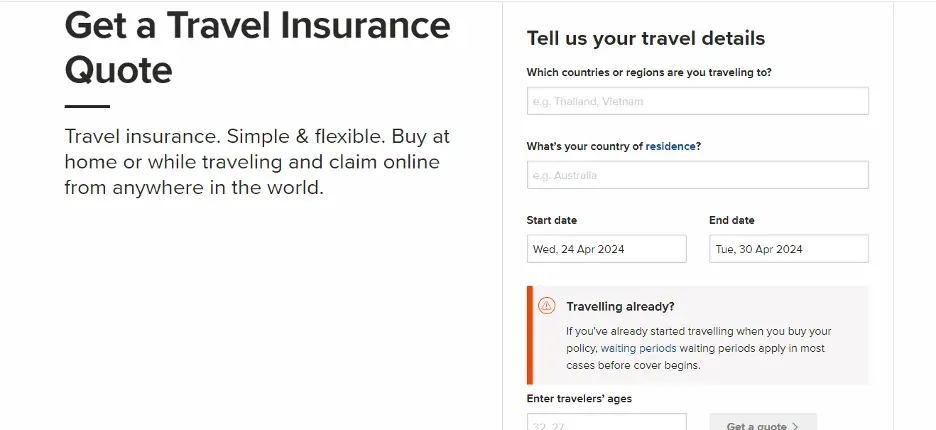

One of the best things about World Nomads is how quick and simple they make it to get covered. Everything's done online – you can get a quote and buy your policy in just a few minutes, all on their website.

Your coverage kicks in as soon as your trip starts. And if you're the type who sometimes forgets things during pre-trip excitement (I know I do!), no worries. You can still get protected while you're already on the road, though there might be a short 72-hour waiting period.

Here's a quick rundown of how this travel insurance works:

Step 1

Head to the World Nomads website and click "Get A Quote".

Step 2

Pop in your travel details (where you're going, where you're from, and your dates).

Step 3

Boom! Instantly see quotes for both their Standard and Explorer plans – pick the one that fits your adventure.

Step 4

Double-check your coverage details and you're all set!

Plans are flexible and comprehensive

World Nomads always have the right plan for your trip, whether you're off on a short adventure or settling in abroad for a while. Let's break down what they've got.

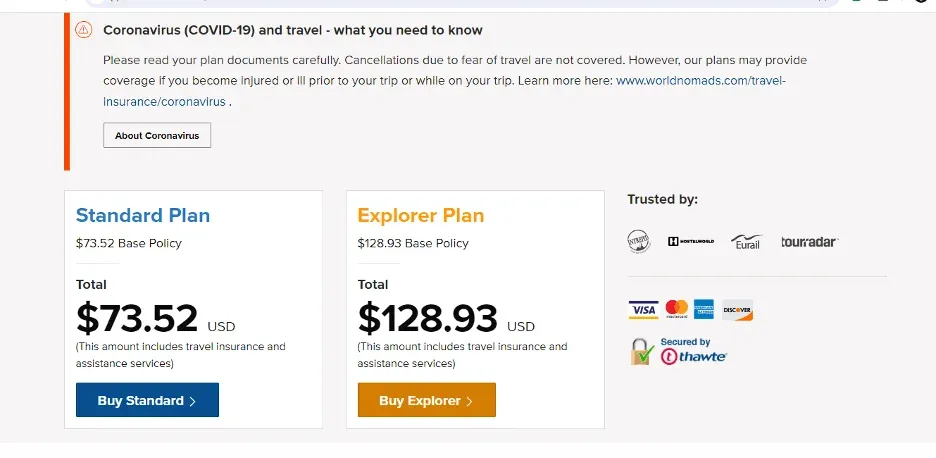

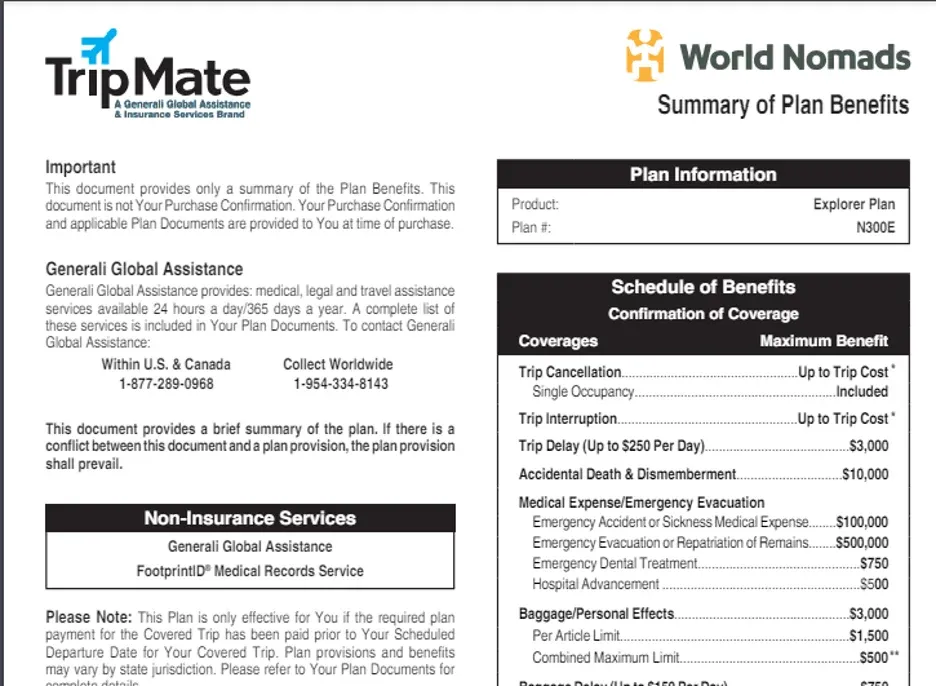

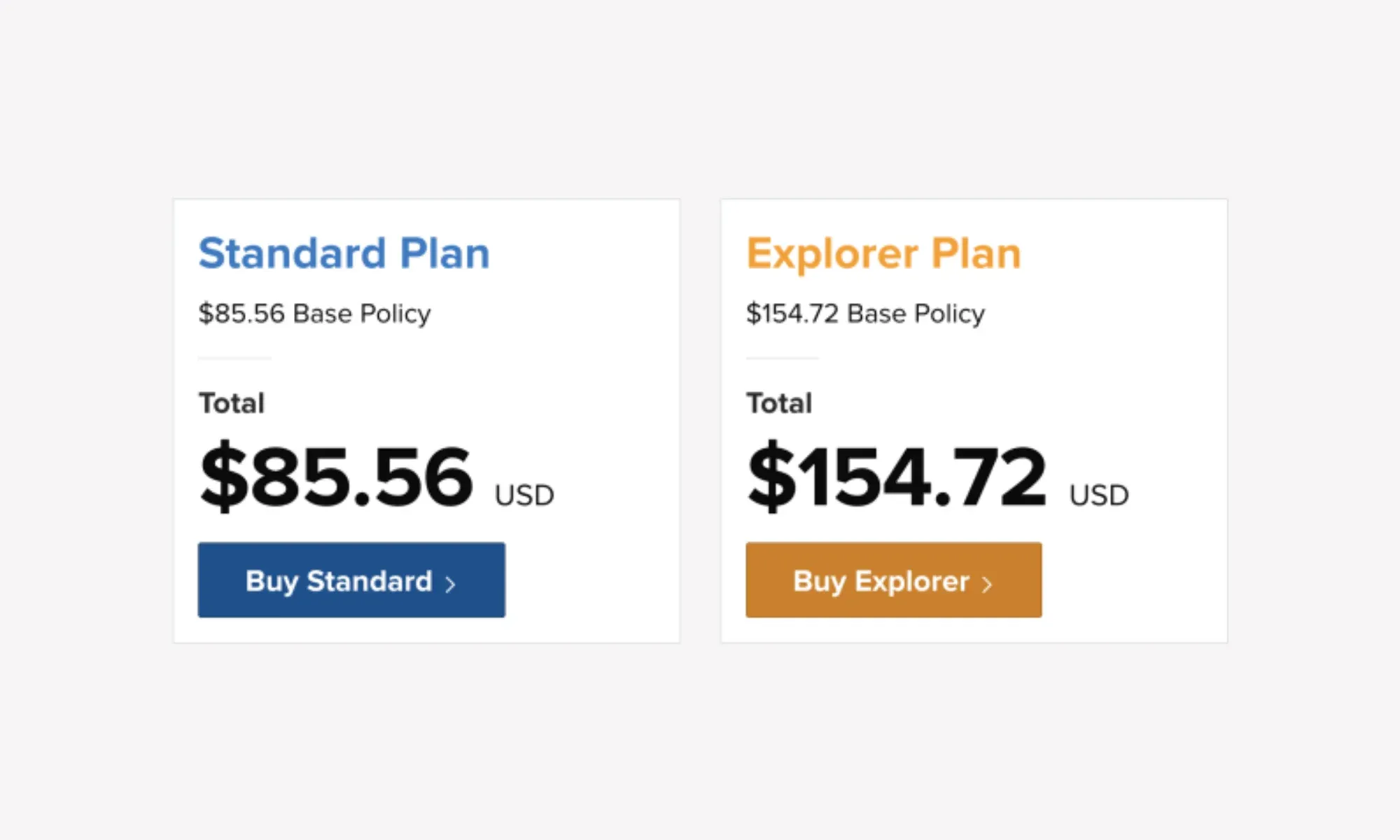

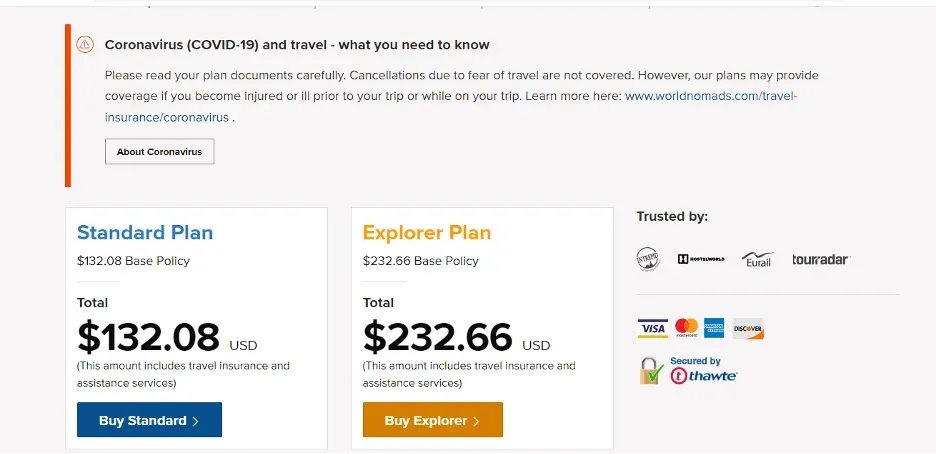

Standard Plans vs. Explorer Plans

World Nomads keeps things simple with two main plans: Standard and Explorer. Both cover the essentials like medical emergencies, cancellations, and your gear. Naturally, Explorer plans boost your coverage limits and protect more activities – but they also cost a bit extra.

Here's a quick side-by-side to make the comparison easier:

- Trip protection: Stuff happens, unfortunately. Both plans have your back if you need to cancel for reasons like a family emergency or a natural disaster. Standard plans cover up to $2,500, Explorer bumps that up to $10,000.

- Emergency evacuation: This covers transportation if a serious situation arises, like a family member passing away or needing urgent hospitalization. Standard offers up to $300,000, Explorer up to $500,000.

- Emergency medical care: Accidents and sudden illnesses can happen anywhere. Both plans have you covered for up to $100,000 for those unexpected medical needs.

- Lost or damaged gear: Take it from someone who's been there – this is very important! Both plans help replace your damaged, lost, or stolen bags, tech – all the important stuff. Standard covers up to $1,000, Explorer up to $3,000.

- Activities: They cover over 200 activities, but if you're an adrenaline junkie, definitely double-check what's included. More on that later in this review!

- Accidental Death: Standard plans will pay a death benefit of $5,000, if you pass away because of an accident or are dismembered. Explorer plans will pay $10,000.

Single and Multi-Destination Coverage

World Nomads works whether you're sticking to one country or traveling to multiple destinations.

Their multi-destination plans make things super easy – a huge relief if something like your passport goes missing on the road!

Long-Term Coverage

If you're a US-based digital nomad, World Nomads has you covered for up to 6 months at a time.

And if you're loving your temporary home abroad and those 6 months fly by, renewing your policy is extremely easy – it kicks in right at midnight the next day.

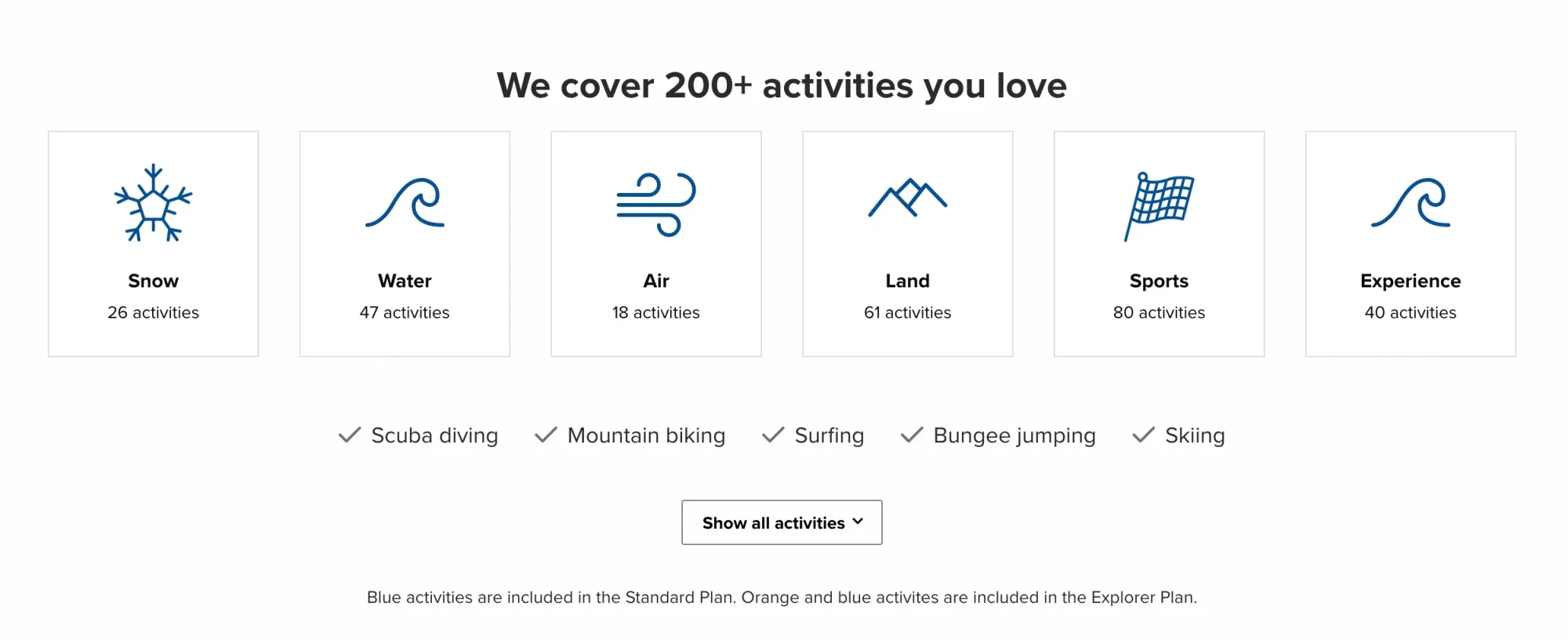

They cover over 200 activities

Let's be honest, if you were just going to work the whole time, you might as well stay home! World Nomads gets that exploring is a major part of the digital nomad lifestyle! So, they offer one of the best travel insurances for adventurous travelers, covering over 200+ activities.

In their Standard plans alone, World Nomads covers over 70 sports and activities, including:

- Aerobics

- Soccer (or football, whichever you prefer!)

- Dancing

- Running

- Weight training

- Martial arts

Explorer plans go even further! But hey, every insurance plan has its limits, and super high-risk activities usually aren't included. So, before you start packing those hiking boots or your scuba gear, be sure to double-check their website for the full list of what's covered.

Some Things to Keep in Mind about World Nomads Travel Insurance

Common exclusions still apply

Like any insurance, World Nomads has some limits on what they'll cover. If you get hurt doing something illegal, while under the influence, or that's considered seriously reckless...chances are World Nomads won't be covering you.

Pre-existing medical conditions also tend to be excluded. For this reason, it's always smart to read the not-so-fun parts of your policy – those exclusions – to make sure you understand them and ultimately find the best travel insurance for your circumstances.

It's not the cheapest option out there

World Nomads is perfect for adventurous travelers. But for someone like me whose main sport in the morning is a gentle yoga routine, or a dip in the ocean, you might find more budget-friendly travel insurance options.

After all, World Nomads covers a ton of riskier activities and emergency medical care, which understandably comes with a slightly higher price tag.

To give you an idea, a World Nomad Standard plan for a 45-year-old US resident traveling to Europe for 90 days (about 3 months) is roughly 3% more expensive than a comparable SafetyWing plan. That difference gets even bigger for younger travelers – almost twice as much for someone who's 25.

It's not ideal for long-term travelers

World Nomads does offer plans for longer trips, but if you're planning to be away for more than 6 months, there are some things to keep in mind:

- Coverage gaps: Ugh, the worst. Your policy will automatically expire after 6 months, and when you renew, there's a waiting period before your new coverage starts. Not ideal! Other travel insurance companies like Safetywing or Genki let you extend your policy without any breaks in coverage – kind of like a subscription service, which is definitely easier.

- Prices can vary: World Nomads prices your policy based on where you're going. Some other companies offer a flat rate for multiple destinations, which could potentially save you some money.

- Pre-existing conditions aren't covered: As discussed before in this guide, World Nomads excludes treatment for pre-existing conditions. You might find other travel insurance companies that provide that for long-term digital nomads or expats.

Making a Claim with World Nomads

World Nomads makes the claims process as straightforward as possible with an online guide – that's always a good sign!

But remember, they're not your everyday travel medical insurance. They're designed for those unexpected emergencies – hospital stays, evacuations, those major situations. For smaller issues, you'll probably need to pay upfront and get reimbursed later. And if it's a serious emergency, always contact their emergency assistance team first!

How you file a claim might change slightly based on your location, but the general process is the same:

Step 1

Collect your receipts and keep them safe! You'll need them.

Step 2

Head to their website, log in (or create an account) and click "Make a claim".

Step 3

Select your policy in their dashboard and file a separate claim for each incident.

Step 4

Answer their questions regarding your claim.

Step 5

List your expenses and provide answers to their questions.

Step 6

Upload those receipts and any other supporting documents they request.

Step 7

Submit your claim – you'll receive an email confirmation from Trip Mate and your claims number.

If any further information is required, you'll be contacted by Trip Mate. Once all your information is received, they will make a determination about your claim within 20 business days. Claims are paid by electronic email or check.

Are There Any Travel Insurance Alternatives to World Nomads?

World Nomads isn't the only product on the travel insurance map. Other companies offer travel plans with different features and coverage amounts. Let's see the top alternatives.

SafetyWing

SafetyWing offers pay-as-you-go coverage at affordable rates in over 180 countries. Their Essential plan is nomad-friendly as you can pay upfront for a specific amount of time or continuously every 4 weeks, with the right to cancel at any time. Medical care doesn't have to be provided by a medical professional within their network, so you can visit any local provider and then file a claim.

The downside is the maximum amount of coverage they provide is $250,000 for medical coverage, property, and travel delay. If you're curious about how SafetyWing compares, you can read more in our breakdown of SafetyWing vs. World Nomads.

Genki

Genki provides both travel insurance and international health insurance. Their travel insurance plans resemble other policies regarding medical care, activities, and emergency transport. Where Genki really stands out is with its international health insurance plan, Genki Resident. This coverage is most like a comprehensive health insurance plan. It covers pre-existing conditions, check-ups, mental health treatments, pregnancy and more. You can choose a deductible to lower the cost of your travel health insurance and choose between the Standard and Premium of their international plans.

Heymondo

Heymondo offers annual multi-trip coverage and travel insurance with varying benefit levels to choose from. You can download their app to get assistance at the drop of a dime. You can chat, make emergency calls, and manage incidents all through the app.

The Bottom Line

World Nomads deserves kudos for becoming one of the first travel insurance companies to consider the needs of digital nomads, way before the world went remote due to Covid-19.

But the world of travel insurance has expanded since then, and so have our options as frequent travelers. If you're the type who needs coverage for serious adventure activities, World Nomads is still a great option. But, for those of us who prefer a budget-friendly plan with solid basics, there might be better deals out there.

So, before you commit to World Nomads, check out other travel insurance companies. You just might find the perfect fit for your travel style (and your wallet!).

Ready to Get Insured and Travel Safe?

Join our global

digital nomad community

Join us for free

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Read Next

Top Digital Nomad Visas in Schengen Countries

BNESIM eSIM Honest Review