Wise Travel Debit Card Review

Wise is among the most popular travel cards out there. But is it worth it? Read our review that covers fees, exchange rates, pros, cons and more.

The Wise debit card is one of the most popular financial solutions for frequent international travelers and digital nomads. But what is the fuss about this Wise travel card? How does it work? And most importantly, should you hop on the bandwagon and sign up for it?

I have been using the Wise Travel Card for quite some time now and, in this article, I will share my honest opinion about it and whether it's good for travel.

What is Wise?

If you travel often, you have probably used or at least heard of Wise (formerly Transfer Wise). This UK-based tech company was founded in 2011 by Estonian businessmen Kristo Käärmann and Taavet Hinrikus on the principle of providing fast and fair exchange rates for international transfers without any sneaky fees or below-par exchange rates.

I have been personally using their Wise multi-currency account for years now, and it is still the primary way I transfer money abroad. However, I recently started using the Wise card, which added an entirely new dimension to my travels.

Who is the Wise Debit Card for?

Obviously, this is a “travel” card, so its primary purpose is for spending abroad while traveling. That said, you could totally use this for your day-to-day expenses. Traditional banks aren’t really designed to cater to frequent travelers, and the Wise card fills this gap.

For example, my wages are paid from the US, but I live abroad permanently, so I can easily transfer from my US-based bank to Wise and then simply use my Wise card for most of my daily expenses.

You should consider using the Wise Travel Card if one or more of the following applies to you:

- You frequently transfer funds from another country that uses a different currency.

- You travel internationally often and need a card with low currency conversion fees.

- You often shop online with international retailers that sell their products in a foreign currency.

- You own a business and need a card for international expenses.

- Your current bank card has high currency conversion fees and you want to get away from a traditional bank account.

- Your current bank card has high fees for using international ATMs.

What Can You Do With a Wise Debit Card?

If you have used Revolut, Chime®, or Monzo in the past, you can expect similar features from the Wise Travel Card. Let's see which ones are those:

- Low fees on conversions with the mid-market exchange rate

- Hold, spend, and exchange more than 40 different currencies in your Wise account

- Available to citizens and residents of more than 30 countries, including the UK, Canada, EU, USA, and Australia

- Manage, top up, freeze, and view your card balance in the Wise App

- Use at over 2 million ATMs with free monthly withdrawals up to certain limits.

- Create up to 3 digital virtual cards for free

- Auto currency convert feature to automatically convert your funds at your set rate

- Ability to make Contactless payments

- Connect to most popular eWallets like Google Pay, Apple Pay, and more

- Free spending of any currency you hold in your Wise account

- Biodegradable and eco-friendly card design

What Are The Benefits of Using Wise for Travel?

One of the main reasons Wise has kept me on board as a customer all these years is their multi-currency account. This is truly the crown jewel of all of Wise’s features.

You can store 40+ currencies in various wallets in your Wise account, but this doesn’t mean you are limited to spending in those currencies. In fact, you can use the Wise debit card in more than 160+ countries! If the currency you are spending in doesn’t have a wallet option, the Wise card will simply exchange the money into the payment currency at the time of your purchase.

For example, I was recently in Guatemala, and, unfortunately, I was not able to store Quetzal (the local currency) in my multi-currency account. But when I bought something, my funds were automatically converted from USD to Quetzal at the mid-market rate (plus 0.5%).

There are also 11 currencies for which you get account details to make bank transfers. This means you can transfer funds in the following currency balances directly from your Wise account to another bank account.

- USD

- GBP

- EUR

- AUD

- MYR

- NZD

- CAD

- HUF

- SGD

- TRY

- RON

This is a feature of Wise that I use often. If I need to transfer funds from my US bank account to one in another country, I almost always use Wise as a “middleman” in order to avoid unexpected transfer fees.

While you won’t be able to make bank transfers in other currencies, you can hold them in your Wise account and spend with your travel card.

What Could Be Improved About Wise?

The obvious downsides of Wise to me lies with ATM withdrawal limits, longer card delivery timeframes, and the lack of a premium option.

I am based in the USA, and my card took more than 2 weeks to arrive. Most digital nomads don’t spend too much time in each place, so this can make it difficult to receive your card initially if you are a frequent traveler.

Also, while card transactions are becoming the norm in many countries, cash is still king in several countries I have traveled to in the past few years. The Wise card is NOT exactly the ideal card for withdrawing cash. You’ll only get two transactions for free, and then you’ll be paying a usage fee as well as a 1.75% to 2% markup. This definitely isn’t a dealbreaker, but I hope Wise will improve this in the future.

Pros and Cons of the Wise Card for Travel

I used this card so many times that I now know the ins and outs of this card. Let me summarize for you the upsides and downsides of the Wise debit card:

How Does the Wise Debit Card Work?

Now that you know the advantages and disadvantages of using Wise, let's actually see how the Wise debit card works, so you know exactly what to expect.

The Wise debit card is specifically designed for spending money outside of your home country, so as you would expect, it is pretty easy to use abroad.

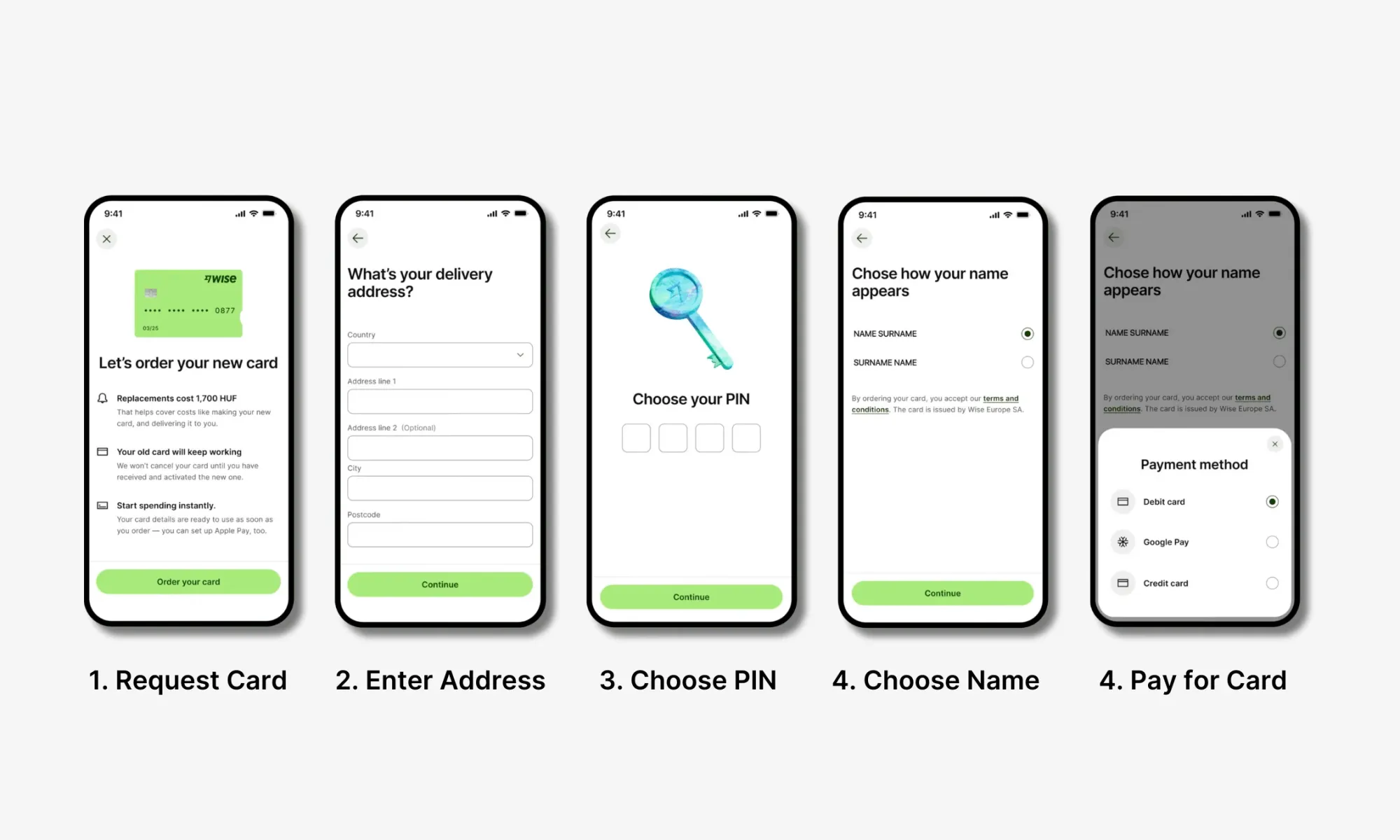

How to Order Your Wise Debit Card

Ordering your Wise debit card can take some time (mine took more than 2 weeks to arrive), so I recommend getting on this as soon as possible to ensure you have the card for your next trip.

These are the 3 simple steps you will need to go through:

Step 1: Create a Multi-Currency Account

If you don’t have one already, your first step will be to sign up for a Multi-Currency Account with Wise

Step 2: Start Using Your Virtual Card Immediately

After making an account and verifying your details, you will then be directed to choose a digital/virtual card or a physical card. Digital cards are free and can be added to Google/Apple Pay or used for online payments immediately!

Step 3: Order a Wise Debit Card (Recommended)

If you want instead a physical card, you can do so by clicking on the “Card” tab on the main page and then click on “Order a Debit Card”. Physical cards cost a one-off fee of 7 GBP/7 EUR/10 USD, and it will take 7 to 21 business days for the card to arrive, based on your location.

How long does it take for the Wise debit card to arrive?

Once you order your Wise Travel Card, you can expect it to take between 3 and 21 days to arrive, depending on your location. If you live in Singapore, you’ll get your card SUPER fast. Unfortunately for Americans like me, this isn’t the case.

| Country | Delivery Timeframe |

|---|---|

| USA | 14 to 21 working days |

| EU | Up to 14 working days |

| UK | 2 to 6 working days |

| Malaysia | Up to 5 working days |

| Singapore | Up to 3 working days |

| Australia | 7 to 14 working days |

| New Zealand | 7 to 10 working days |

| Japan | 7 to 10 working days |

| Brazil | 5 to 7 working days |

| Canada | Up to 14 working days |

How to Activate Your Wise Debit Card

Once your Wise travel card arrives, it is time to activate it and start spending. Luckily, for most Wise account holders, you won’t need to take any steps to activate the card, simply make a chip and PIN payment, and the card is ready to go.

Activating Your Wise Debit Card (for US and Japan Customers Only)

If you are a US or Japanese customer, you must activate your card in the US or Japan before traveling. This was another major downside for me. As an American digital nomad, I had to wait to activate my Wise debit card until I was back in the USA. All other nationalities can use their card immediately and won’t have to be physically present in their home country.

Here is a step-by-step breakdown of activating your card if you are a US and Japan customer.

- Log into the Wise app and tap on “Card”.

- Then tap on “Activate Card”.

- You’ll then be prompted to enter a 6-digit code that you’ll find on your card.

- After entering the code, you’ll create your PIN.

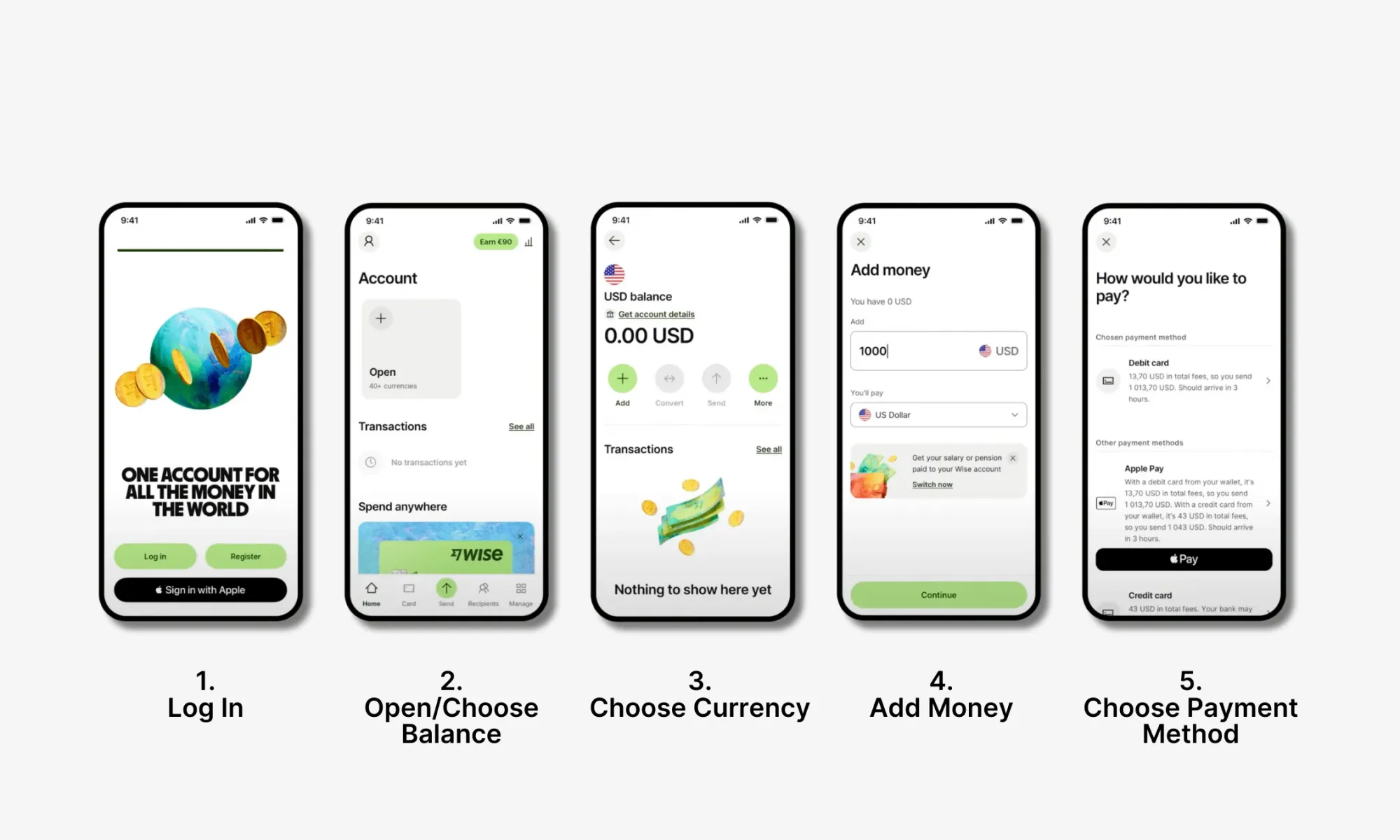

How to Add Money to Your Wise Debit Card

Your Wise debit card is linked to your Wise Multi-Currency account, so you’ll need to top up your Wise account with funds before using the card.

This is a pretty straightforward process:

- Logging into your account

- Choose which currency balance you want to add money to.

- Click “Add”.

- Choose which currency you want to use to top up the account.

- Type in the amount of money you want to add.

- Choose your payment method (bank transfer, debit card)

- Confirm the top-up and verify the money arrives in your balance.

How to Use an ATM with Your Wise Debit Card

As mentioned before, ATM withdrawal is not the strongest feature of the Wise card, but you can definitely still use the card to take out cash. Spending with your Wise card is simple since the card can make contactless, chip, and swipe payments and is eligible for Google, Apple, Fitbit, and Garmin Pay.

It works exactly the same as using any other bank card:

- Insert your card into the ATM machine

- Enter your PIN

- Determine how much cash you want to withdraw

- Take your cash

ATM Limits for the Wise Debit Card

One of the biggest downsides with the Wise card is that you’ll have limited free ATM withdrawals. For all accounts, you’ll have 2 free ATM withdrawals each month, after which you will be charged an ATM usage fee and a percentage markup on the amount of cash you withdraw.

I generally use the Wise Travel Card for many of my day-to-day travel expenses while traveling, and my Charles Schwab Investor Checking account for ATMs, as this card not only has a 0% ATM markup, but it also refunds any fees the ATM provider charges.

| Country | Allowance | ATM Usage Fee | Variable Rate |

| USA | 100 USD | 1.50 USD | 2% |

| UK | 200 GBP | .50 GBP | 1.75% |

| EEA/EU | 200 EUR | .50 EUR | 1.75% |

| Australia | 350 AUD | 1.50 AUD | 1.75% |

| New Zealand | 350 NZD | 1.50 NZD | 1.75% |

| Canada | 350 CAD | 1.50 CAD | 1.75% |

| Brazil | 1,400 BRL | 6.50 BRL | 1.75% |

| Malaysia | 1,000 MYR | 5 MYR | 1.75% |

| Singapore | 350 SGD | 1.5 SGD | 1.75% |

| Japan | 30,000 JPY | 70 JPY | 1.75% |

How to Change the PIN of Your Wise Debit Card

Did you forget your PIN? Don’t worry, it happens to the best of us. Luckily, if you are a US card holder, you can easily change your PIN in the Wise app:

- Tap on “Card” in the Wise app

- Select “Change PIN”

- Enter your new PIN 2 times, and you are all set!

Unfortunately, if you are a non-US Wise card holder, you cannot change your PIN in the app. Instead, you’ll need to change it using an ATM that supports PIN changes.

My best advice? Choose a PIN you’ll never forget, or keep it written down somewhere secure.

How to Freeze/Unfreeze Your Wise Debit Card

One of the downsides of constant travel is that you put yourself at risk of fraud or losing your card. If you notice potential fraudulent transactions from your Wise card, or you believe your card is lost/stolen, you should freeze your card immediately. This way, you’ll avoid more fraud on your account.

Here are the steps to take to freeze your Wise Travel Card.

- After logging in to your Wise account, tap on “Card.”

- Then simply click “Freeze Card” or, if you want to unfreeze, “Unfreeze Card.”

- Fill out this transaction dispute form and contact customer support right away. They will be able to help you determine what to do next.

How to Replace a Lost or Stolen Wise Card

If you can confirm that your card has been lost or stolen, you’ll want to cancel the card and then order a new one.

- Log in to your Wise account and click on “Card.”

- Tap “Replace Card.”

- You’ll then be prompted to answer why you need a replacement card.

- Wait for the new card to arrive.

What Are Wise Fees and Exchange Rates?

One thing I really love is that using the Wise debit card itself is free, and you won’t have to pay an ongoing fee to Wise to use the card. In fact, there isn’t even a Premium account feature, so all users get 100% of the features for free.

All this said, there are some charges and exchange rates you should know about before you start using Wise.

| Type of Fee | Wise Fee Amount |

|---|---|

| Ordering New Wise Card | 7 GBP/ 7 EUR / 10 USD |

| Replace an Expiring Card | Free |

| Currency Conversion | 0.42% |

| First 2 ATM Withdrawals Less than Free Limit | Free |

| ATM Withdrawals After Free Limit | 1.75% (2% in USA) + Usage fee (after 2 free withdrawals) |

Are There Spending Limits for the Wise Debit Card?

The Wise debit card has set daily and monthly spending limits for all types of transactions. While these limits won’t be a deal breaker for the vast majority of users, they are still worth noting.

| Transaction Category | Single Transaction | Daily Spending Limit | Monthly Spending Limit |

| Chip and Pin | Max: $2,000 Default: $1,000 | Max: $2,000 Default: $1,000 | Max: $15,000 Default: $5,000 |

| Contactless | Max: $200 Default: $400 | Max: $1,000 Default: $500 | Max: $6,000 Default: $1,500 |

| ATM | Max: $1,000 Default: $250 | Max: $1,000 Default: $250 | Max: $4,000 Default: $1,500 |

| Online Transaction | Max: $1,500 Default: $1,000 | Max: $1,500 Default: $1,000 | Max: $6,000 Default: $1,500 |

| Magnetic Stripe | Max: $1,500 Default: $1,000 | Max: $1,500 Default: $1,000 | Max: $6,000 Default: $1,500 |

Is It Safe to Use the Wise Card While Traveling Internationally?

Wise is a trusted and safe travel card provider, and as a licensed and regulated financial institution, your funds are safeguarded in Wise. The company uses several security features to protect your data, including HTTPS encryption, a two-step login process, and 24/7 fraud prevention.

It is, however, worth noting that Wise is not considered a bank and it is not FDIC-insured.

FDIC insures up to $250,000 of bank customer's money, but Wise works a bit differently. Wise safeguards users’ money and is required to ensure all customers have access to all of their funds. I don’t recommend keeping all of your money in Wise, but in general, it is a perfectly secure financial institution.

How Does the Wise Card Hold Up Against Other Travel Cards?

Wise is the leader in the travel cards space, but it still has some major competitors in the travel debit card space. While all of these different companies vary, they all cater to digital nomads and frequent travelers. The table below will compare some key factors with Wise, Revolut, N26, and Chime.

| Wise | Revolut | N26 | Chime | |

| Free ATM Limits | 100 USD (200 GBP) | 400 USD (200 GBP) | 3 Free withdrawals per month | None |

| ATM Fees | 1.75% (2% USA) + usage fee | 2% | 1.7% (non EUR ATM) + 2 EUR per withdrawal | $2.50 per out-of-network ATM withdrawal1 |

| Card Order Fee | 7 GBP (10 USD) | Delivery fee only (amount subject to location) | 10 EUR delivery fee | Free |

| Exchange Rate Markup | +.42% | No fee up to 1,000 USD/GBP (.5% after that) | No fee | No fee |

| Exchange rate | Mid-Market | Mid-Market | Mastercard | Visa |

| Available Currencies | 40+ Currencies | 26 Currencies | Euro only | USD only |

| Account Fees | Free | Free (standard), 9.99 USD/7.88 GBP per month (Premium) | Free (Standard), 4.90 EUR (Smart), 9.90 EUR (You) | Free |

| Account Eligibility | 30+ Nationalities | 38 Nationalities (15 more can use Lite Accounts) | EEA Only | USA Only |

Is the Wise Card Worth it for Travel? Our Final Thoughts

Time for the 1 million dollar question: Should you get the Wise Travel Card?

If you are a frequent traveler like me and you don’t already have a solid travel card with fair exchange rates, low ATM fees the answer is a resounding yes!

The Wise Travel Card is one of the best cards for digital nomads and expats, as it allows you to seamlessly spend money, withdraw cash, and transfer funds from anywhere around the globe without having to worry about excessive fees. The best part? After paying a one-time card order fee, your Wise account is completely free to use!

Ready To Save Money Abroad with Wise?

Join our global

digital nomad community

Join us for free

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Read Next

Ireland Digital Nomad Visa: Application and Requirements

Airalo China eSIM: Is It Worth It?