Cigna Global Health Insurance: In-Depth Review

Discover if Cigna is a reliable global health insurance. Learn about what Cigna is, plans, coverage benefits, and how much their health insurance costs.

Would you leave the house without your pants? Exactly. So, don’t leave your home country without international health coverage either. That's a given for international travelers and nomads.

Cigna health insurance is considered by many to be a valid health insurance provider, especially for American nomads. Here's all you need to know about them, my experience with it and how they stack against other providers.

What type of insurance is Cigna and is it good?

Cigna is an international health insurance company, and it’s actually one of the most established ones as it's been around since 1982. It’s designed for people living abroad, like expats, remote workers, digital nomads and long-term travelers, who need more than just basic travel coverage.

Instead of just covering emergencies, Cigna offers full private health insurance, including hospital stays, outpatient care, chronic condition management, maternity, mental health, and even serious stuff like cancer treatment. It works more like the health insurance you’d get back home, than a traditional travel insurance.

Cigna’s plans are flexible and modular, letting you build coverage that fits your lifestyle. With access to 1.5 million healthcare professionals across 200+ countries and territories, plus 24/7 support in over 50 languages, it's a truly solid choice if you live and work abroad long-term.

Which insurance plans does Cigna offer?

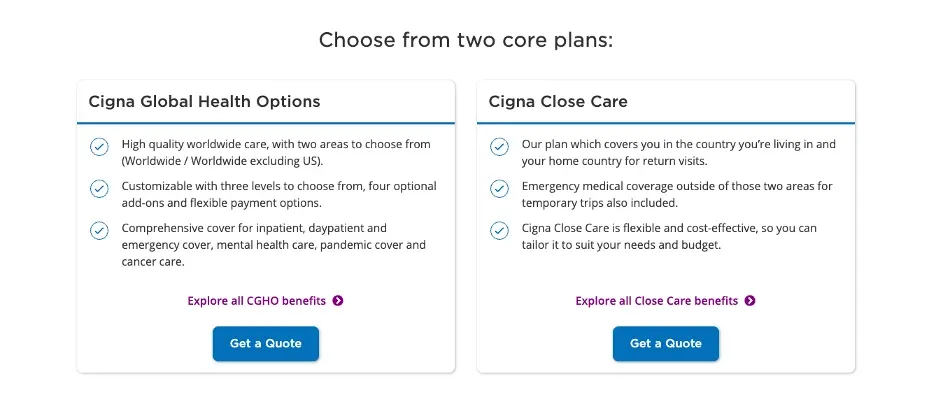

Cigna Global offers mainly two global health insurance plans: Cigna Global Health Options and Cigna Close Care. Here's a quick glance of both:

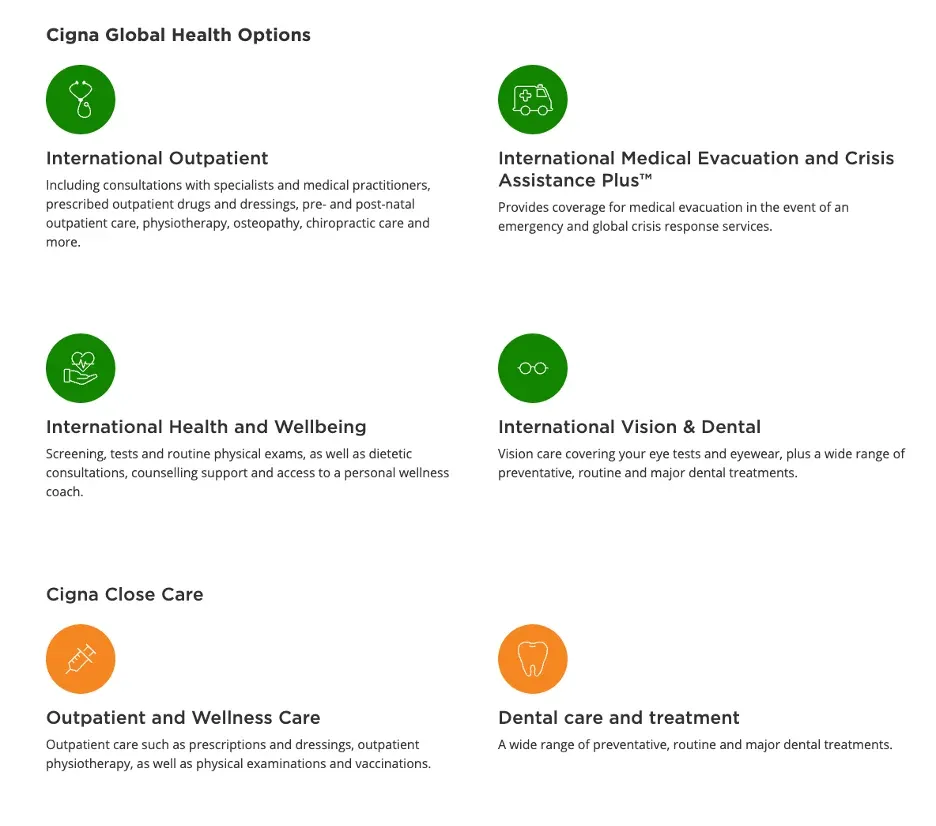

Cigna Global Health Options

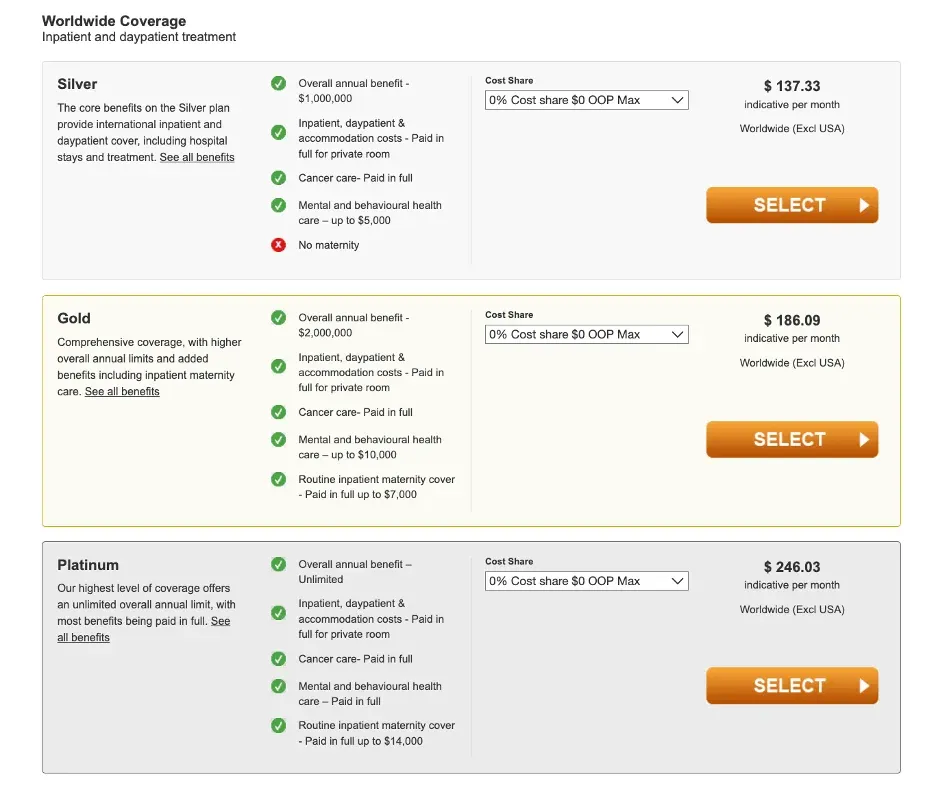

Cigna Global Health options come in three tiers: Silver ($1M annual max), Gold ($2M annual max), and Platinum (no annual max).

All plans include benefits like:

- Private room fees

- Medical imaging and scans

- Full cancer care

- Rehab care

- Emergency room treatments

Cigna Close Care

Cigna Close Care comes instead in two tiers: Close Care and Silver.

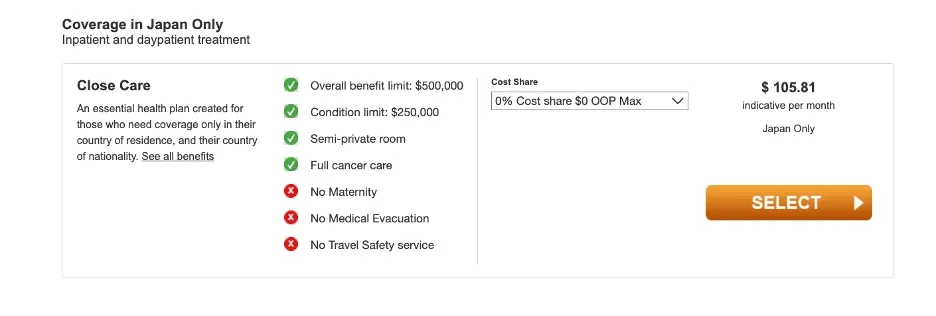

The basic Close Care plan has a $500,000 benefit limit and provides:

- Inpatient and day-patient coverage

- Hospital stays and treatments

- Cancer care

- Medical imaging

The Silver plan has a $1M annual benefit limit. It includes everything in the Close Care plan with higher payout limits and extras like A&E and transplant coverage. The silver plan is a true worldwide plan.

Though each plan has specific nuances, all plans except the basic Close Care Plan offer a healthy coverage mix, hefty benefit limits, and serious peace of mind for policyholders.

How much does Cigna Global Health Insurance cost?

Cigna Global Health insurance premiums run the gamut from super affordable to crazy expensive. Your plan premium will depend on several factors, including:

- Age: the younger you are, the lower your plan premiums may be.

- Location: if you’re living in a country with high medical costs in general, your Cigna premiums may reflect that.

- Coverage level: the Cigna Global coverage options that offer the most benefits will cost the most.

- Deductible: your deductible is the amount you’ll have to pay out of pocket before Cigna pays anything. The lower your deductible is, the higher your monthly premiums will be.

- Add-ons: the more add-ons you choose, the more your plan will ultimately cost.

But on the whole, Cigna Global Health insurance plans tend to be affordable on most budgets.

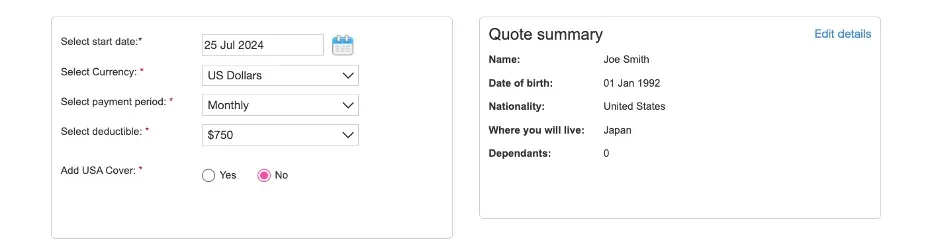

To get you an idea, here's a quote sample for a 32-year-old American looking for plan for a long-term stay in Japan:

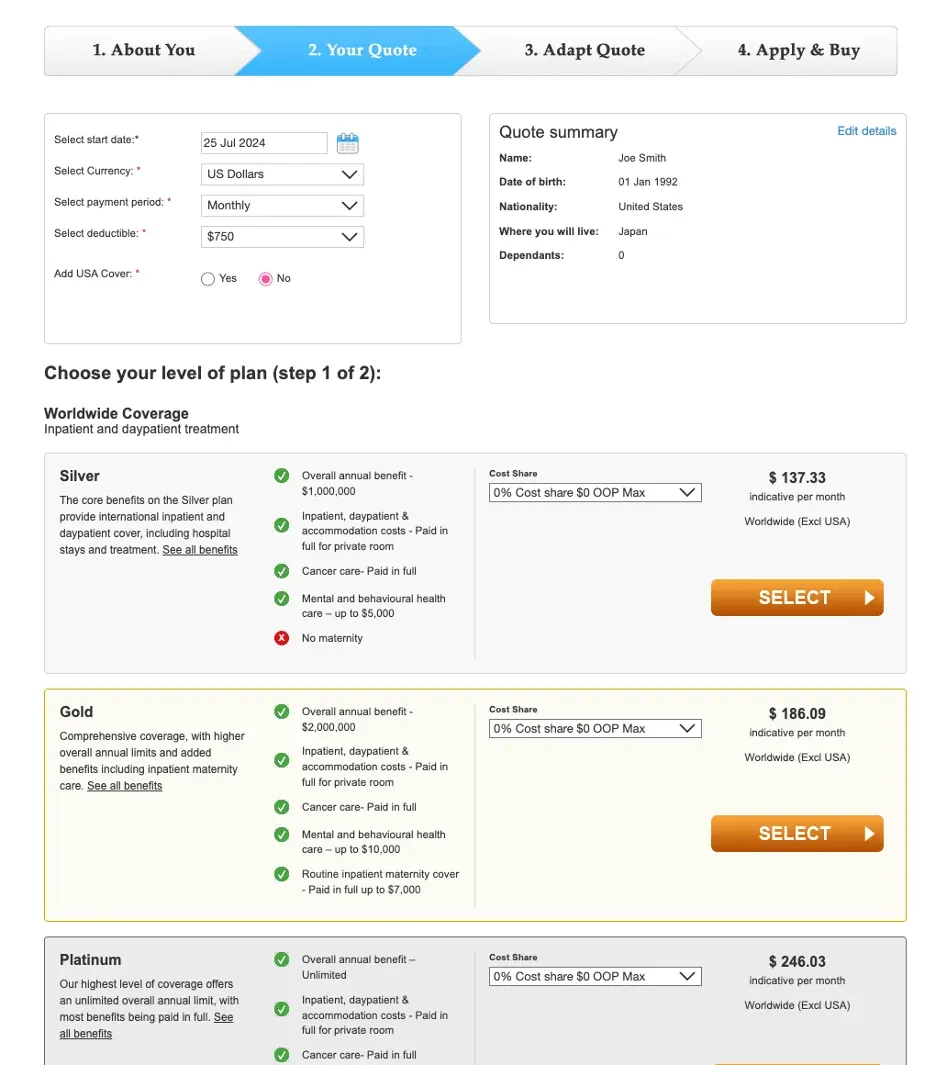

Here are the worldwide coverage options and monthly prices:

Here are instead the Japan-only coverage options and monthly prices:

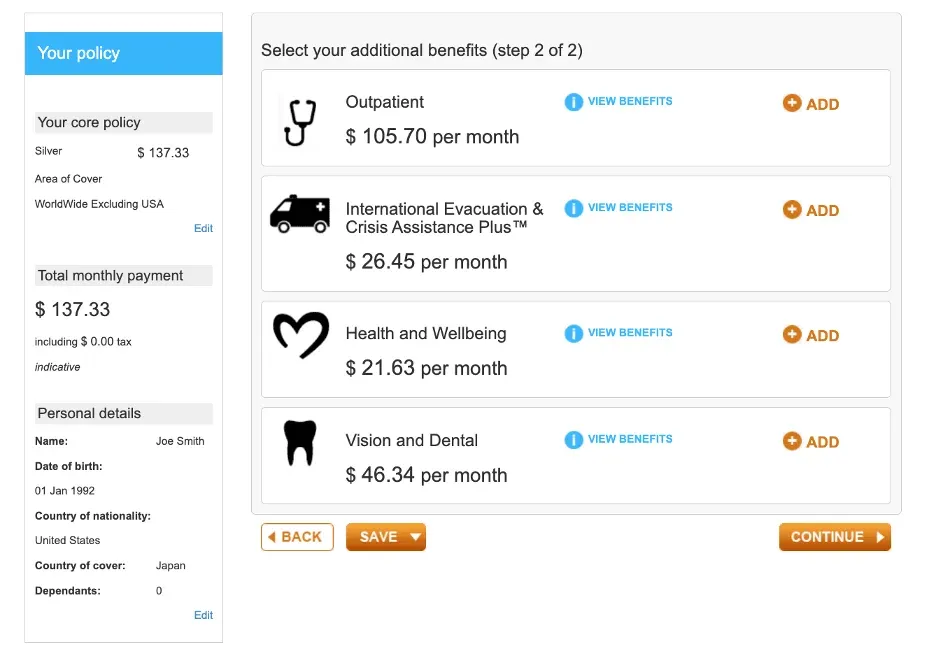

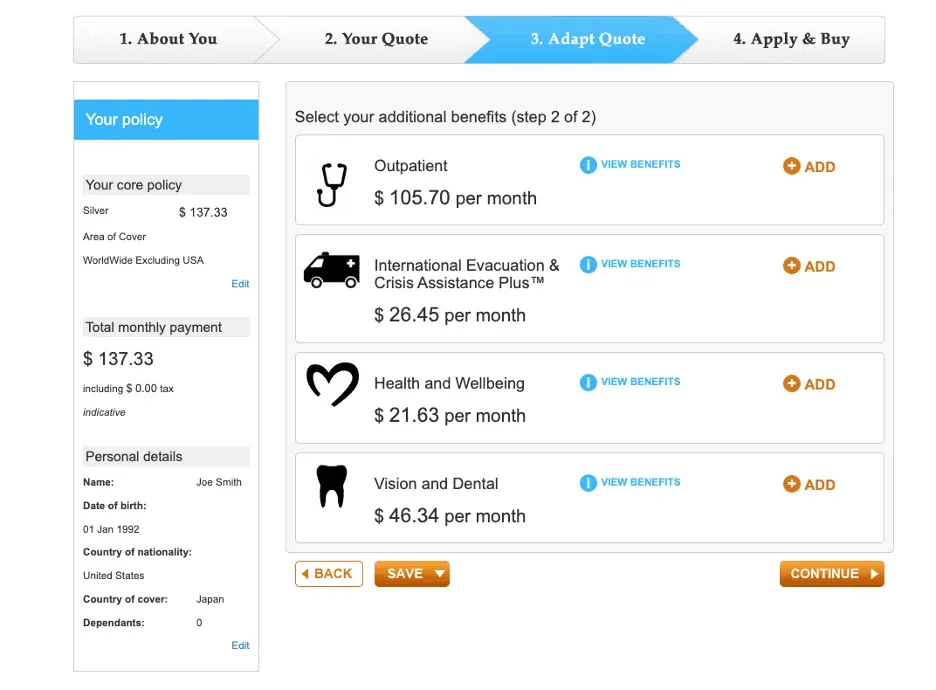

As you can see below, there are also add-ons that will increase your premium price:

Keep in mind that you can always make changes to keep your budget under control, some of which include:

- Increase your deductible (all the way up to $10,000).

- Increase your cost share and out-of-pocket max (up to 30% with a $5,000 OOP max).

- Skip the add-ons

- Choose a lower-tier plan

My experience using Cigna

I used Cigna for a solo trip to Bali, and I was so happy I did as it covered me for a terrifying case of food poisoning, avoiding me sky-high bills that I would have had if I had no insurance during that trip (another reminded for me to get insured before disaster strikes so you can travel with peace of mind).

What I think makes Cigna Global special compared to other insurance providers, it’s the customization options. During the quote process, I appreciate how you can tailor your plan to your needs in several ways.

You can in fact:

- Select your start date

- Update the currency

- Choose your payment period (monthly, annual, or quarterly)

- Select a deductible (from $0 to $10,000)

- Evn choose your out-of-pocket max and cost share

This level of control is almost unheard of in the insurance space.

They also have an extensive network as they are contracted with over 1.5 M hospitals and healthcare professionals and you are billed directly, which is another great advantage, so you’ll spend less time on redundant forms and focus more on making the most of your trip.

And if you go with the Cigna Global Health plan and choose the worldwide coverage option, you can travel literally anywhere, and your benefits will apply.

Some things to keep in mind about Cigna

By no means is Cigna perfect (spoiler: no insurance company is). Here are a few things you should remember as you’re deciding whether Cigna is the right insurance for you like I did.

The basic Close Care Plan is very limited

As I was exploring Cigna’s insurance options, I was surprised by how little the basic Close Care plan covers. First, there’s no A&E coverage (emergencies are an extreme risk with any kind of travel). There’s also no transplant coverage. It’s also not a worldwide plan; it applies only to your home country and one host country. So, if you’re an expat or digital nomad looking for a plan with heavy-duty benefits, you may want to pass on this specific plan from Cigna.

Waiting periods may apply

It’s not particularly clear at first, but many Cigna Global medical insurance benefits come with waiting periods. The Cigna Global Health Platinum plan has waiting periods for the following:

- Up to 12 months for pre-natal and post-natal care

- Up to 24 months for infertility investigations and treatments

- Up to 12 months for genetic cancer test

- 3-18 months (depending on the services) for dental treatments

- Up to 12 months for routine maternity care, maternity complications, homebirths, newborn care

Pre-existing conditions aren’t always covered

Many of us (me included) have pre-existing conditions we’re managing. Just because we go abroad doesn’t mean that we can forget about them. Yes, some Cigna Global plans cover pre-existing conditions (especially for those who are over 60 years old). However, this isn’t guaranteed and will depend on the results of your medical history review.

Interestingly enough, I had a hard time finding information about pre-existing conditions in the benefit documents. However, the topic is addressed on a few of the website’s pages, like this page on expat insurance and this page on international insurance for people working abroad. If you decide to pursue Cigna Global and want coverage for pre-existing conditions, double-check your coverage with one of their insurance professionals before you sign on the dotted line.

How to get a Cigna health insurance quote

You could get a quote from Cigna in your sleep, well, not really, but you get the point. Here are some quick steps to follow:

Step 1: Go to the Cigna Global quote page

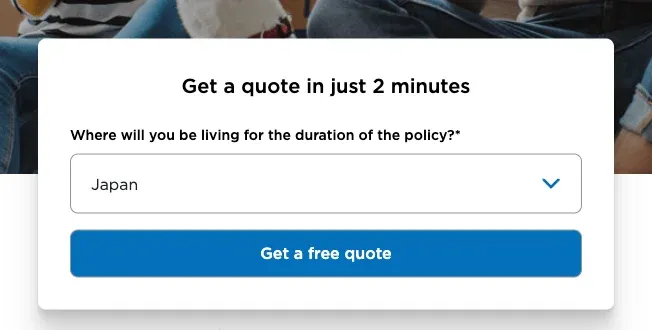

Step 2: Enter the country you’ll be living in for the duration of the policy and click Get a free quote

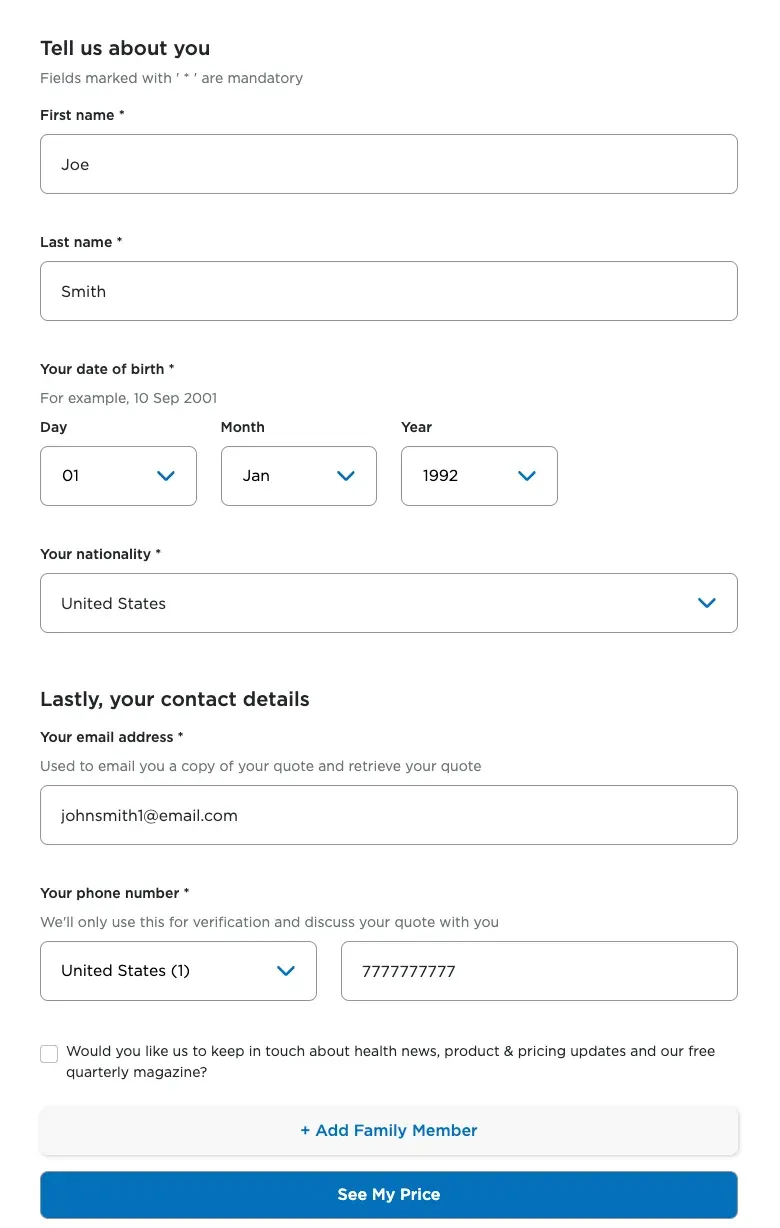

Step 3: Fill out this form and then click the See my price button.

Step 4: You’ll then be able to see the prices and benefits of all the plans. Set the terms you want and then click Select next to your desired plan.

Step 5: Add your add-ons if desired by clicking “ADD.” Then click “Continue” on the bottom right.

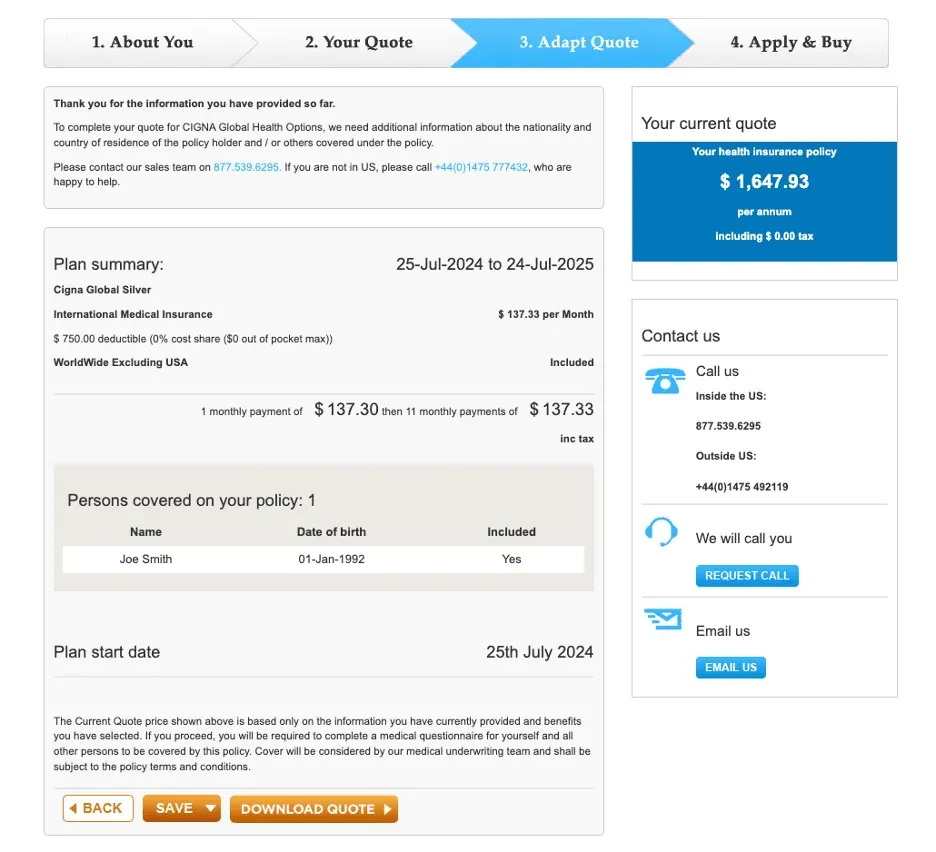

Step 6: View your final price. In some cases, you’ll be able to pay for your policy right then and there. And in other cases, you’ll be instructed to reach out to Cigna to complete the process.

How is the Claim Process for Cigna?

There are a few things I would recommend you keep in mind when submitting a claim to Cigna. Here are my best tips:

- Call customer care whenever you need treatment. Cigna reps will help you find the right healthcare professionals and facilities. They will also set up direct billing if possible.

- Send in a claim to Cigna if needed. If Cigna billed the provider directly, you don’t have to send an invoice or claim form to Cigna. If you paid for your treatment and need reimbursement, you’ll send 1) the invoice from the provider and 2) a claim form to Cigna. Email them to cghoclaims@cigna.com, fax them to +44 (0) 1475 492113, or mail them to Cigna Global Health Options, Customer Service, 1 Knowe Road, Greenock, Scotland, PA15 4RJ. You can also send in claims using your online portal account, which you’ll gain access to after buying a policy.

- For medical and vision claims, you can use this claim form while for dental claims, use instead this claim form.

- Wait for a payment, denial, or documentation request. Claims are typically processed within five working days.

Here’s a handy graphic to make the claims process easier to visualize:

Are there any global health insurance alternatives to Cigna?

Of course, there are. Cigna isn’t the only option you have when shopping for international health insurance. These are the main ones widely recognized as top alternatives to Cigna:

Genki Native

Genki Native is one of the most popular insurance options for digital nomads. They are known for their comprehensive medical benefits, super-fast signup, and quick reimbursement timeframes. Both plans are excellent options for the average digital nomad, but Cigna beats out Genki when it comes to customization options.

Safetywing Nomad Insurance Complete

Nomads everywhere love Safety Wing's Nomad Insurance Complete, mainly because of their perfect mix of travel and health benefits at budget-friendly prices—especially for younger travelers. There’s also 24/7 support and a highly efficient claims process. Though all of these things are great, Nomad Insurance Complete doesn’t give you as much coverage for routine care – it’s more for unexpected events, injuries, etc. Cigna’s best plans give you much more in terms of routine care than SafetyWing.

GeoBlue

GeoBlue is an international insurance provider with a mega-network of providers in over 190 countries, plus telehealth capabilities. And their plans come in at very affordable prices. When it comes to plan choices, GeoBlue and Cigna are neck and neck but in different ways. GeoBlue has loads of plan options with moderate customization, whereas Cigna has fewer plans but more customization options.

Either company is great and likely to provide the options you’re looking for, but Cigna has an edge when it comes to health and wellness. Those who value that may find Cigna a better fit.

Cigna insurance FAQs

Does Cigna cover Wegovy?

Yes, many Cigna plans now include Wegovy, especially after they introduced a pharmacy add-on that caps your out-of-pocket expense at $200/month for Wegovy and Zepbound. Still, coverage depends on your specific plan and doctor approval.

Does Cigna cover Zepbound?

Often yes, but it usually requires prior authorization. Coverage depends on meeting clinical criteria and may exclude if you're already on a similar weight-loss drug.

Does Cigna cover therapy (mental health)?

Yes, many Cigna plans include mental health services like therapy, counseling, and psychiatric care. However, check your specific plan for session limits and in-network provider options.

Does Cigna cover Invisalign?

Yes, some Cigna dental plans include orthodontic benefits like Invisalign or braces. Coverage is usually partial (e.g., 50%), and subject to a lifetime maximum.

Is Cigna HMO or PPO?

They offer both. Cigna provides flexible plan models (HMO, PPO, EPO, etc.), so you can choose based on how much freedom and network flexibility you want.

Does Cigna cover Mounjaro?

Mounjaro (a newer GLP-1 drug) likely follows the same rules as Wegovy/Zepbound. Coverage depends on your plan’s formulary and if your doctor meets the guidelines and prior authorization is typically required.

Will Cigna cover Wegovy for weight loss?

Yes, but only if it’s prescribed according to FDA-approved uses (BMI > 30 or BMI > 27 with related conditions) and meets plan requirements.

Does Cigna cover dental implants?

Maybe, but it depends on your dental plan. Basic plans often don’t, but full dental or dental-plus plans may cover implants partly. Check your specific coverage details.

Is Cigna a private insurance?

Yes, it’s private health insurance. They offer individual, family, and international health plans, not government-run like Medicare or Medicaid.

Does Cigna cover gym membership?

Sometimes. Some plans include wellness perks or HSA-eligible fitness reimbursements. It varies, so check your specific plan.

Is Cigna Medicare?

Cigna offers Medicare Advantage plans through its Cigna Healthcare subsidiaries. They also coordinate with the government Medicare parts but are not the Medicare program itself.

Is Cigna Medicaid?

No, Cigna doesn’t administer Medicaid. They only offer private insurance and Medicare Advantage options.

Which Cigna plan covers IVF?

Some global health and comprehensive employer plans offer fertility benefits, including IVF. It depends heavily on the specific plan and location, so you’d need to check your plan documents or ask your rep.

Will Cigna cover my abortion?

Yes, most private Cigna plans include both elective and therapeutic abortion services, though coverage may vary by state and plan.

Ready to get to your next destination with extra peace of mind?

Join our global

digital nomad community

Join us for free

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Read Next

Virgin Connect Roam eSIM: Honest Take for International Travelers

espresso by Kensington Magnetic Privacy Screen Review