Digital Nomad US Taxes: The Ultimate Guide for American Digital Nomads

Taxes are a major pain for everyone, but this headache is multiplied by ten for digital nomads. Navigating international tax laws as an American, US tax with residency, and staying compliant with US tax laws while traveling the world and working remotely is no walk in the park (to say the least!).

US citizens draw the short straw in this scenario as the US is one of only two nations worldwide whose citizens must file taxes even when they live abroad (the other country is Eritrea, if you are wondering).

So, how do you avoid double taxation as a US citizen who is also a digital nomad? What do you need to do to stay compliant? And how do you determine your tax residency? I will answer these questions and more below!

Do US Nomads Still Need to File Taxes If They Live Abroad?

If you are a digital nomad from the US, you are legally required to file an income tax return even if you do not live in the United States. So, even when paying taxes to a foreign government, US citizens and permanent residents must file a tax return.

For example, if you are a US citizen who lives permanently in Australia and works for an Australian company, you will likely pay taxes to the Australian government. But, when the US tax year ends, you must also file a tax return with the IRS.

The same concept would apply to a digital nomad living in Portugal who has stayed on a digital nomad visa for the last year. Both the Portuguese and US governments will require you to file taxes.

Luckily, this doesn’t automatically mean you will pay double tax. There are a few tax credits and exclusions available to digital nomads and expats paying tax in a foreign country. However, you’ll need to know how to use them both legally and effectively.

What Happens If You Don’t File Taxes to the IRS as a US Nomad?

It is never a good idea to skip out on filing taxes with the IRS. Failing to file your tax return when living abroad can result in significant penalties. If you decide not to file your tax return, you increase your risk of being audited, may incur hefty fines, and dig yourself into a hole that will be pretty difficult (and expensive) to get out of down the road. Needless to say, not filing your income tax return as an American digital nomad is a bad idea!

All this said, the IRS doesn’t always fine US expats and digital nomads. A big percentage of the over 5 million Americans living abroad do not file taxes each year, so there are systems in place to “forgive” this.

For example, there is a Tax Amnesty program for US expats who “forget” or “don’t know how” to file their tax returns abroad. This lets you catch up on late returns without paying fines or penalties.

US Digital Nomad Tax Rates

Did you just find out that you are still required to file a tax for Uncle Sam even though you are a digital nomad? Welcome to the club. It is an unfortunate part of being an American who lives in another country. Unless you are paying taxes to a country with a double taxation treaty with the US (more on this below), you will likely still be obligated to pay some tax to the US, so what are the tax rates you should expect to pay? Let's look at them one by one.

1. Federal Tax Rates

Your federal tax rate is the percentage of your income that you will pay to the federal US government. The United States, like many other countries, uses a marginal tax rate that ranges from 10% to a maximum of 37%, depending on the amount you earn each year. So, instead of paying a flat rate on all your income, you pay specified rates for different tiers of the money you earn each year. Need help figuring out what I am talking about? Don’t worry, I will break it down further.

| Tax Rate | Amount |

|---|---|

| 10% | $0 to $11,600 |

| 12% | $11,601 to $47,150 |

| 22% | $47,151 to $100,525 |

| 24% | $100,526 to $191,950 |

| 32% | $191,951 to $243,725 |

| 35% | $243,726 to $609,350 |

| 37% | $609,350 and up |

For every dollar you earn below $11,600, you will only pay 10% federal tax, but the tax rate jumps to 12% for every dollar over $11,600, 22% for every dollar over $47,151, and so on.

Your effective tax rate is the actual percentage you pay for federal taxes. For example, if you make $100,000 annually, your effective rate is 14.26%.

2. Social Security Tax

Another federal tax to consider is the Federal Insurance Contributions Act (FICA) tax. This is an additional 7.65% tax rate that you must pay. If you are employed, your employer will also pay 7.65%, making up a total of 15.3% tax.

This rate is applied to every US employee and business owner, including expats and digital nomads. That said, if you are self-employed (which is the case for a large percentage of digital nomads), you must also cover the employer rate and pay 15.3% on top of your federal tax rate. For example, if you are self-employed and make $100,000 annually, your effective tax rate is 14.26%, and your FICA tax is 15.3%, so you must pay a total federal tax rate of 29.56%.

3. US State Taxes

If you are lucky enough to be from a few selected states, including Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, or Wyoming, you don’t have to worry about state taxes.

That said, if you are from any of the other 41 US states, you’ll have to factor in your state tax rate on top of that.

Some states charge a flat tax rate. For example, North Carolina has a 4.75% flat tax rate. But, most states also use a marginal state tax rate system.

If you have not spent much time in your home state during the tax year, you may not be liable to pay state taxes. This really depends on the state’s tax laws, though.

Some states, such as California, will still require you to file state taxes even when you live abroad and will tax you on your worldwide income. On the other hand, most others won’t require you to file a return if you lived out-of-state for the tax year and did not have any income in the state.

The only way to get rid of the headache of state taxes is to become a resident of a tax-free state. But, the fact lies that you probably still have family in your home state, have a state-issued driver’s license, and return to your home state when you visit, so you will likely still be considered a resident of that state.

Tax Residency for US Nomads Explained

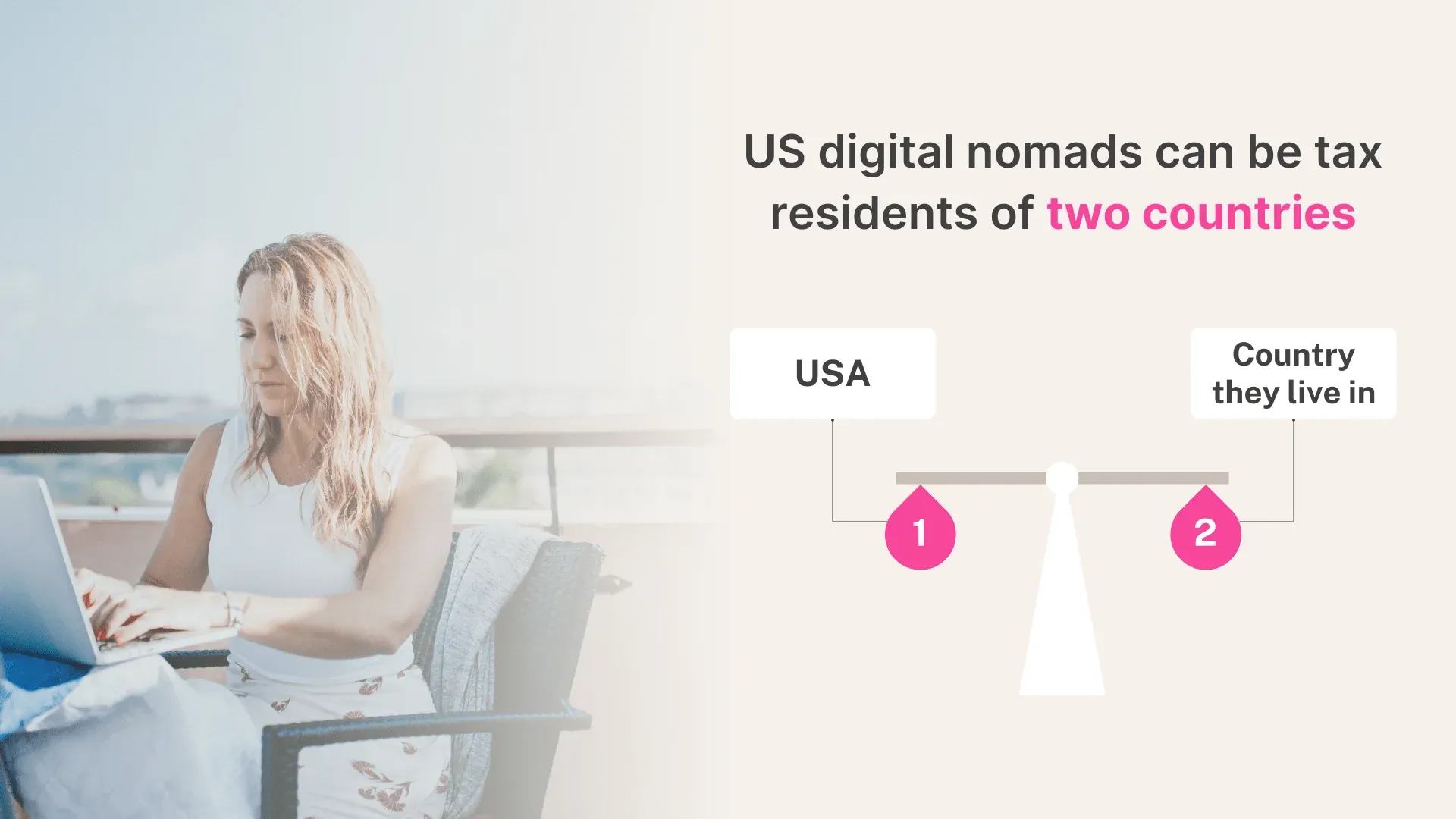

You are a tax resident of the country that considers you a “resident” for tax purposes. This means that although you may not be a resident in terms of immigration, a country may still consider you a tax resident.

In most places, you become a tax resident after spending 6 months in the country. This, of course, depends on the visa you are on, but when it comes to digital nomad visas, many won’t consider you a tax resident until you spend more than 6 months within the country’s borders. Additionally, citizens of most countries worldwide are no longer considered tax residents when living abroad. That said, US citizens are ALWAYS tax residents whether they live in the United States or not.

This means that, as a US digital nomad, it is possible to be a tax resident of two countries. The country you are living in, and the USA.

How to Avoid Double Taxation as an American Digital Nomad

If you are a tax resident of both the USA and another country, you are in danger of paying double taxes. Of course, no one wants this! Paying double taxation is a nightmare scenario for digital nomads.

The only way to legally avoid filing taxes as a US citizen is to renounce your citizenship. And understandably, very few US digital nomads are willing to do this, so what are your other options?

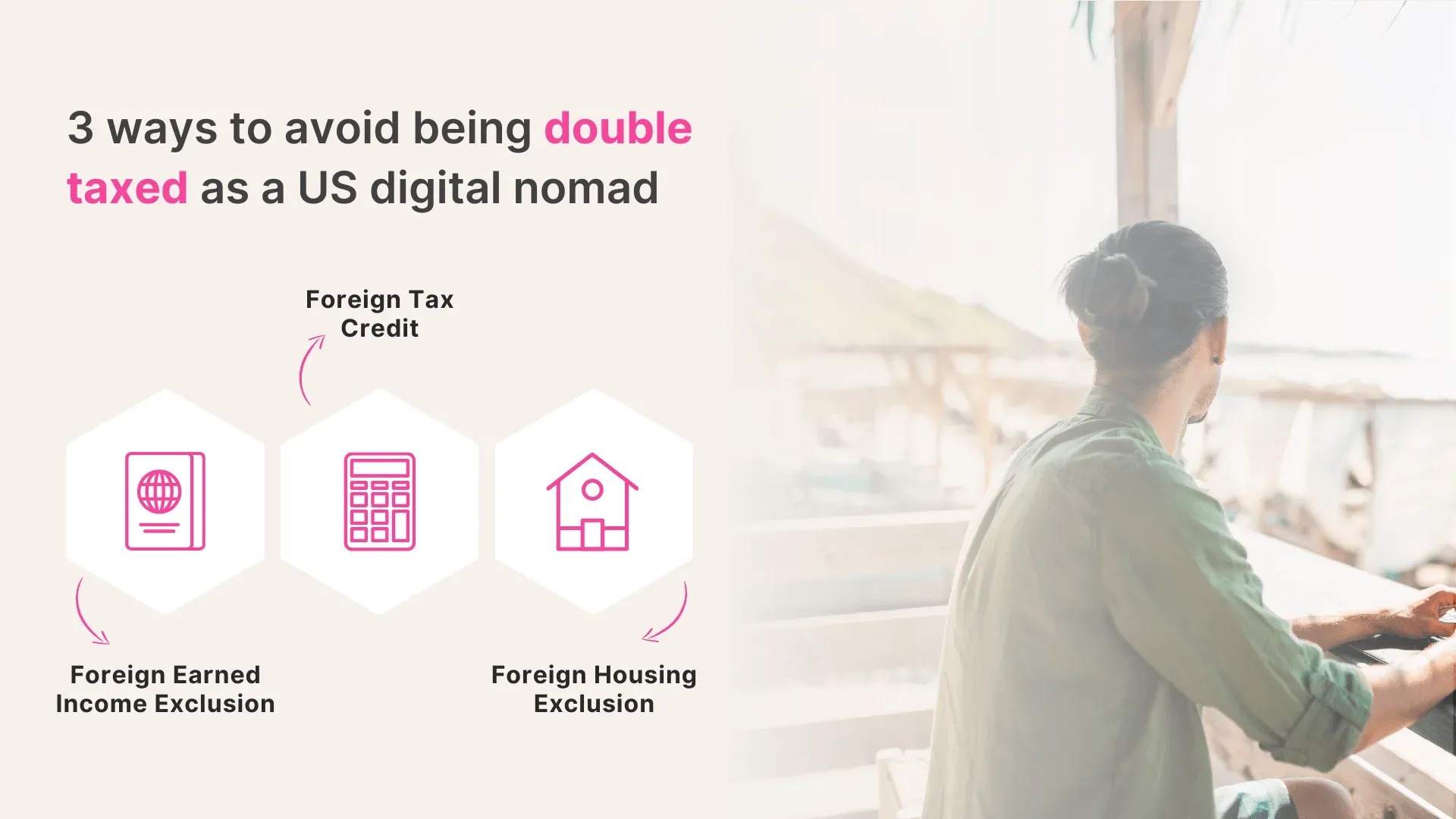

There are three ways to avoid being double taxed as a US digital nomad: the Foreign Earned Income Exclusion, the Foreign Tax Credit, and the Foreign Housing Exclusion. Let’s take a closer look at all of them.

Foreign Earned Income Exclusion (FEIE)

The most common tax provision for expats and digital nomads from the USA is the FEIE. This is essentially a tax break from the IRS that allows you to exclude $120,000 from your taxable income. This exclusion can be used on salaries, wages, tips, bonuses, commissions, and self-employment income.

In order to qualify for the FEIE exclusion, one of the following must be true:

- Bona Fide Residence: You must be a tax resident of a foreign country for the entire tax year.

- Physical Presence Test: You must be physically present in a foreign country for at least 330 days of the tax year.

Here are a few other requirements to keep in mind:

- You can not exclude passive income such as dividends, pensions, rental income, investment interest, etc.

- You cannot exclude income over $120,000.

Foreign Tax Credit (FTC)

The second tax provision for US expats is the Foreign Tax Credit. This is a similar tax break to the FEIE in that it helps expats avoid double taxation, but it works a bit differently and has different requirements.

Instead of excluding income (up to $120,000) from your income tax return, the Foreign Tax Credit allows you to receive a tax credit for taxes you have already paid on your foreign income.

For example, if you pay $5,000 in taxes to a foreign government and apply for the FTC, you may qualify to receive a $5,000 tax credit from the IRS, essentially canceling out your US tax requirements up to that amount.

Foreign Housing Exclusion

Another interesting tax break for US expats is the Foreign Housing Exclusion. This allows US expats to exclude certain expenses from their housing from their taxes.

This tax break is available to digital nomads who meet the same requirements as the FEIE and have housing costs that exceed 16% of the FEIE ($19,200).

If you meet these criteria, you can deduct expenses such as rent, utilities, property insurance, fees, repairs, and even furniture rental fees. You cannot exclude mortgage payments, furniture that you purchase, or payments for maid services.

As long as your foreign housing fees are more than the US base housing cost (16% of the FEIE) and you qualify for the FEIE, you will be able to take advantage of the Foreign Housing Exclusion.

How to Avoid Paying Social Security (FICA) Taxes for Digital Nomads

As mentioned earlier in this guide, if you work for an employer, you’ll pay half of your social security taxes (7.65%) while your employer will cover the other half. But self-employed workers must pay both halves, totaling 15.3%.

While avoiding double taxation on your federal taxes is relatively simple using the FEIE or the FTC, avoiding the Federal Insurance Contributions Act (FICA) tax is a bit more complicated.

Totalization Agreements

Self-employed nomads must pay social security tax to the USA unless the foreign country they live in has a totalization agreement with the United States.

These agreements allow the US to recognize that you are paying into a foreign social security fund, which cancels your requirement to pay FICA tax. Unfortunately, only 30 countries currently have a totalization agreement with the US. So, if you live in a country without one, you will likely be required to pay social security taxes to the USA.

Here is a list of countries that have totalization agreements with the USA:

- Australia

- Austria

- Belgium

- Brazil

- Canada

- Chile

- Czech Republic

- Denmark

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Japan

- Luxembourg

- Netherlands

- Norway

- Poland

- Portugal

- Slovak Republic

- Slovenia

- South Korea

- Spain

- Sweden

- Switzerland

- The United Kingdom

- Uruguay

What If Your Country of Residence Doesn’t Have a Totalization Agreement?

As you can see, quite a few countries have been left off the list when it comes to totalization agreements, such as New Zealand, Mexico, and Thailand. This can be frustrating for self-employed workers, having to pay an additional 15.3%!

So, how can you avoid paying double social security income when you live in a country without a totalization agreement?

In the USA, owners of “pass-through entities”, or companies in which all of the funds pass through to the owners, are considered self-employed for tax reasons. For instance, if you are a sole proprietor and own an LLC or a partnership, your business is a “pass-through entity,” and all of your profits pass down to the company's owners.

C-Corporations

Your best bet as a self-employed or business-owning digital nomad is to structure your business so that you pay yourself a salary. The most simple way to do this is to form an S-Corp or an LLC with a C-corp nomination.

Owners of C-corps are treated as employees of the business, so you will not be liable to pay the extra self-employment tax.

That said, dealing with C-corporations is more complex, and you will likely require an experienced business accountant to help file taxes. Additionally, C-corps are taxed at a corporate level, while S-corps and LLCs are not. This can mean you may pay double tax as you’ll pay on the company and personal level.

How to File Taxes as a US Digital Nomad

I have gone over how to avoid double taxation as a digital nomad and what tax bracket to expect when paying in the USA, but how do you actually file your taxes when living abroad? Let's look at a few common questions many digital nomads might ask themselves.

Can US Digital Nomads File Taxes Online?

The answer really depends. But generally, US expats and digital nomads can file online. If you move countries quite often and the only place you have a tax obligation to is the US, then filing taxes won’t be any different for you than it would be if you weren’t traveling. You can use the IRS E-File system, HR block, Turbo Tax, or whatever tax filing system you have used in the past.

On the other hand, if you are a tax resident of a foreign country, things can get more complicated, and you will likely need to file several more forms and fill out a lot more paperwork than normal. If you need to file the FEIE, FTC, and/or a totalization agreement, I highly recommend hiring an experienced accountant specializing in expat and digital nomad tax.

Can You Deduct Airbnb Expenses as US Digital Nomads?

Many digital nomads live out of Airbnb as they rarely spend enough time in one place to sign a long-term lease. Airbnb expenses are categorized as a “travel expense” by the IRS, so you’ll have to be pretty careful with how you deduct Airbnb expenses.

First of all, you can only deduct Airbnb expenses outside your tax home. So, if your tax home is in the USA, and you are traveling for a month or two in South America, you may be able to deduct some of your Airbnb expenses.

Additionally, you can generally only deduct your Airbnb expenses if the primary reason for your trip is for work. For example, if you stay in London for 5 days to attend a seminar and meet with potential clients, this would be considered a business expense.

However, you cannot deduct 100% of your Airbnb expenses if the primary reason for your trip is “pleasure”. For example, if you spend a month in Bali, and your primary reason for the trip is to relax on the beach, this is a vacation, not a work trip.

If, during this month in Bali, you also write a few travel blogs and meet with potential clients, you may be able to deduct a percentage of your stay, but you should be careful with this. The IRS is known to be very skeptical about travel expenses and may ask you for proof.

Other Tax Documents to Look Out For as a US Digital Nomad

Besides the FEIE, FTC, and your normal tax forms (1040, W2, etc.), US digital nomads may be required to file a few more tax forms to the IRS.

FBAR

The FBAR (Report of Foreign Bank and Financial Accounts) is a form that some digital nomads may need to file to the IRS. This form is required if you hold foreign bank accounts with more than $10,000 (or foreign equivalent) at any point during the tax year.

FATCA

The FATCA (Foreign Account Tax Compliance Act) is another tax requirement for some US digital nomads. This form is required if you have financial assets outside of the US worth more than a certain amount. If you currently live in the USA, the threshold is $50,000. If you live outside of the USA, the threshold is $200,000.

Best Accountants/CPAs for US Digital Nomads

Navigating international tax treaties and ensuring you stay tax-compliant as a US digital nomad can be a nightmare. Trust me, I have been there! So, while you can certainly try to do everything yourself, in my opinion, you are much better off hiring a tax service provider with experience in US expat tax laws. Not only will this save you hours of time and lots of headaches, but it may also save you tons of money, as filing your taxes incorrectly can result in hefty penalties and fees.

Here are a few of the top certified accounts that are specialized for US digital nomads:

Ready To Optimise Your US Taxes While Being Complaint With International Tax Laws?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Travel tips, hacks, and news

Travel tips, hacks, and news Exclusive travel discounts

Exclusive travel discounts Offers and promotions

Offers and promotions Digital nomad inspiration

Digital nomad inspiration Latest articles form our blog

Latest articles form our blog

Comments ()