GeoBlue Travel Insurance Review: Is It Legit?

GeoBlue is often mentioned in the travel insurance space. But is it really worth the cost? Find out more about our detailed GeoBlue insurance review.

Imagine landing your dream job abroad, only to be sidelined by an unexpected illness just two weeks in. Instead of exploring, you're stuck in a subpar hospital with a hefty bill and no international insurance—a situation any digital nomad could face.

Global health insurance isn't just a nice-to-have; it's essential. But it needs to truly have your back. That's why I'm reviewing GeoBlue's travel health insurance for long-term travelers and remote workers. You've probably heard they offer great plans at attractive prices, but is GeoBlue really worth it? Let's find out.

What We Like About GeoBlue International Health Insurance

To start, let me say that GeoBlue International Health insurance is a super solid option for nomads, expats, and long-term travelers to consider. At the same time, the company and its plans aren't perfect. First, we'll highlight the things we like about GeoBlue.

Extensive Global Network

One of the most frustrating things is buying an international insurance plan from a company with a teeny tiny provider network. In situations like this, instead of focusing on recovering, you’re jumping through hoops trying to find someone who’ll accept your coverage. That’s for the birds.

Thankfully, that won't be the case if you opt for GeoBlue medical insurance. The company has an enormous provider network with doctors and hospitals in over 190 countries. You won't have trouble finding care regardless of where you're staying.

Coverage Flexibility

If GeoBlue wins any awards outright, it's for coverage flexibility. When you go to the website, one of the first things you'll notice is that there are many coverage options to choose from.

There are general plans for single, multiple, and long-term trips. Then, there are specialty plans for groups, education, crew, missionary, and corporate travel. They really thought of everything.

There are eight international medical insurance plans in total as of this writing (as you can see below).

Here are the three plans that are best suited to us - digital nomads, remote workers, and long-term travelers:

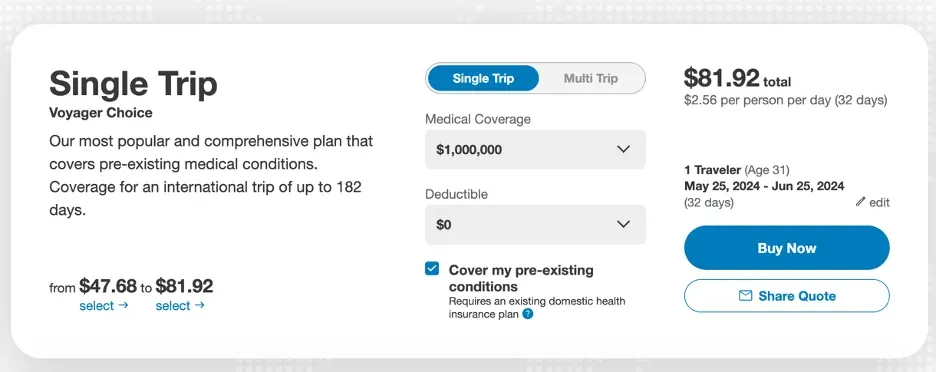

- Voyager Single Trip - For travelers planning a single trip overseas, this is the plan you want. It covers you for a one-time trip lasting less than 183 days.

- Trekker Multi-Trips - Do you have multiple trips planned over the next year? This plan is ideal. It's one plan that covers several trips during a plan year.

- Xplorer Long-Term Expatriate - Will you be taking a long-term trip abroad for a remote work opportunity, work-study, or even to live? Go with this plan.

The plans offer some of the most comprehensive coverage I’ve seen. Here are some of the benefits you can expect if you choose one of these plans:

- Inpatient hospital services

- Prescription drugs

- Physical and occupational therapy

- Office visits

- Surgeries

- Blood transfusions

- Ambulance services

- Complications of pregnancy

- Dental care for accidental injuries

- And more!

If that wasn’t enough, you have the option to customize your coverage. Here are a few ways you can do that:

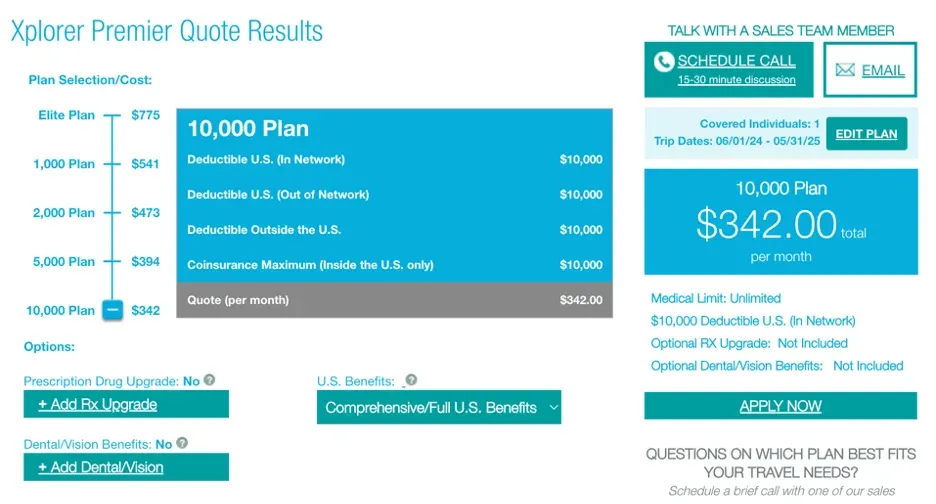

- Add optional USA coverage, prescription upgrades, dental and vision, etc.

- Choose your deductible.

You get the most flexibility with the long-term plans. Update plan selection/cost, add dental/vision, RX upgrade, and more.

24/7 Medical Assistance

When it comes to obtaining medical services or navigating the insurance world, it's always nice to have a helping hand. GeoBlue health insurance for travel has a stellar multilingual assistance team that can take care of your plan changes, one-off questions, and more.

They are available 24 hours a day, 7 days a week, 365 days per year on their website, mobile app, or via phone. You can rest assured that you won't be left alone to deal with medical issues.

Filing a claim can be a drag with some insurance companies, but that's not usually the case with GeoBlue. You can easily file claims at any time, either online or via the GeoBlue app on the App Store or Google Play.

Emergency Evacuation and Repatriation

If you're new to international travel insurance, you may have never heard of emergency evacuation and repatriation. But it's so incredibly important for any traveler, especially when overseas. This benefit does two different things:

- Evacuation. The evacuation portion covers your transportation costs in the event of a serious medical situation so you can get to a facility that can appropriately treat you.

- Repatriation. The repatriation portion comes in handy in the unfortunate situation where travelers pass away. The benefit would cover the costs associated with transporting the body back to the traveler's home country.

GeoBlue offers both of these benefits as part of their international insurance plan offering.

Pre-existing Condition Coverage (With Limitations)

Do you have diabetes, high blood pressure, or another pre-existing condition? GeoBlue international insurance plans sometimes include coverage for pre-existing conditions. This is awesome, considering that when researching international travel insurance plans, you'll often find pre-existing conditions on the exclusion list.

Just know that there may be limitations to pre-existing coverage depending on your plan and health situation. So, if you have a pre-existing condition for which you need coverage, be sure to read and understand your GeoBlue plan before purchasing.

Some Things to Keep in Mind about GeoBlue

GeoBlue has some pretty cool perks, but their international insurance isn't flawless. There are several things you should keep in mind about the company and its plans before you sign on the dotted line. We'll get into them here.

Cost

GeoBlue insurance plans are not going to be the cheapest. And that's because the company offers very comprehensive insurance coverage with $1 million+ coverage limits. GeoBlue can't give that away for pennies. So, the insurance premiums are going to be a little higher than some competitors.

If you want to know how much a plan would cost you, go to this page for a GeoBlue quote. Select your plan type, enter your trip information, and click “Get a Quote”.

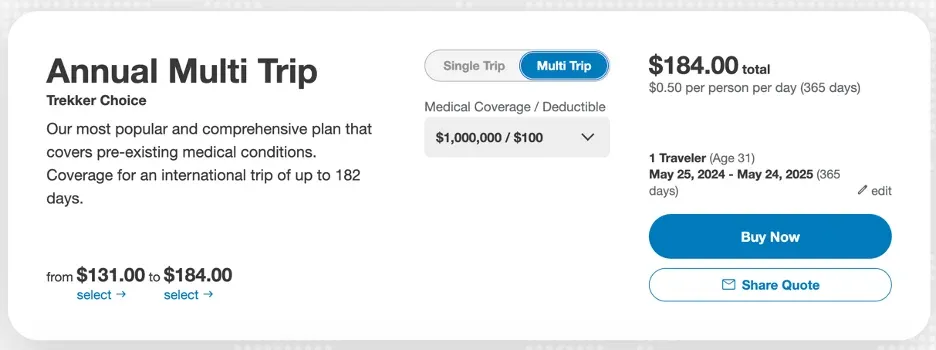

This is an example of what your results will look like:

Limited Mental Health Coverage

International health insurance can only be so comprehensive. In the case of some GeoBlue plans, mental health coverage is lacking. So, if you're someone who values this coverage benefit, be very careful which GeoBlue plan you select.

Exclusions

When shopping for any type of insurance, looking through the exclusions is a no-brainer. GeoBlue doesn't clearly list its exclusions on its main website pages or on FAQ pages, presumably because every plan has a unique set of exclusions.

Here are a few things that may not be covered under a GeoBlue plan, depending on your selection:

- Hospitalizations, services, and supplies that are not medically necessary.

- Services that aren't mentioned in the certificate of coverage.

- Routine physical exams.

- Any expenses before the coverage effective date or after the coverage end date.

- Treatment for hair loss.

This sample Xplorer plan certificate includes a list of 46 exclusions.

Do yourself a favor - before you choose a plan, be sure to look at all of the exclusions so you won't be frustrated later on.

Making a Claim with GeoBlue

The claims process for GeoBlue is really straightforward, and it all depends on the route you decide to take. You may find that the quickest and easiest way is to submit your claim through the GeoBlue app.

You'll do it through the Member Hub account you registered when you bought your plan or through the mobile app. Simply follow the prompts and submit your claim that way.

If you're not into the electronic claims process, you can submit your claim one of the following ways:

- Send an email with your claim information to claims@geo-blue.com. A representative will help you out from there, requesting documentation when necessary and answering any questions you may have.

- Fax your claim in.

- Mail your claim in.

To increase your chances of getting your claim approved and paid quickly, here are some tips:

- Save and include all your receipts and bills, ensuring they are signed and legible.

- File the claim as soon as possible.

- If you won't be sending your claim via the app or member portal, double-check the email address, fax number, or mailing address. You could lose precious time by sending the claim information to the wrong place.

- If you’ll be faxing or mailing your claim in, call GeoBlue first to confirm which documentation to send.

Are There Any Global Health Insurance Alternatives to GeoBlue?

If GeoBlue is rubbing you the wrong way, don’t worry - there are plenty of (insurance) fish in the sea. Below, we'll get into three other international insurance options for people like us:

Genki Native

Need an international health insurance option with comprehensive benefits, outstanding support at all hours, and affordable plan options? Check out Genki Native.

Their Native Basic and Native Premium plans are benefit-heavy in the areas that matter most and are specifically tailored to long-term travel excursions. Plus, there's no age limit for current policyholders, and no payout limits for the Native Premium plan. They also cover pre-existing conditions (after a medical history review).

Just know that Genki Native isn't the best option for those spur-of-the-moment weekend getaways. Their plans are not the cheapest, and you don't want to pay for coverage you'll never take full advantage of. Plus, coverage is limited in the U.S. and Canada.

Both GeoBlue and Genki Native offer very robust insurance plans with high coverage limits (unlimited in the case of Genki Native Premium) and the availability of coverage for pre-existing conditions. Both are really good options.

If you're stuck between the two, have a one-on-one with yourself. Are you looking for coverage for long-term trips? You're better off going with Genki Native. Is customization most important to you? Get a plan that fits you like a glove from GeoBlue.

Safetywing Nomad Insurance Complete

Safetywing's Nomad Insurance Complete is ultra-popular among international travelers looking for some bang for their buck. Like Genki Native and GeoBlue, Nomad Insurance Complete by SafetyWing has some benefit-packed plans that provide travelers with global coverage for unexpected and ongoing health issues, along with extensive travel protection.

You get reimbursement for things like hospital treatments, ICU treatments, evacuation, repatriation, and more. Plus, there are very few exclusions and a $1.5 million plan payout max.

The main catch? Nomad Insurance Complete plan pricing increases sharply with age, so much so that those of advanced age may find it difficult to afford a plan. GeoBlue and Nomad Health both strike gold when it comes to raw benefits. But GeoBlue beats out SafetyWing when it comes to plan customization and pricing for older travelers.

Cigna Global Health

Cigna Global Health is a licensee of Cigna, a Big Five health insurance company. This option is ideal for those who are having trouble finding the right plan at other insurers or want to build their plan brick by brick.

Their worldwide coverage is wide-reaching but allows you the flexibility to select add-ons or remove coverage as you see fit. This means that most people can afford an insurance plan from Cigna Global Health.

Have you peeped it yet? Cigna Global Health and GeoBlue are the most alike out of all the plans in this article. It lies in plan customizability and raw benefits. If you're stuck between those two plans, it can be near impossible to make a decision. But you should know that Cigna Global Health plans are more geared toward health and wellness. If you're into that, I say go with Cigna.

The Bottom Line

Now, it's time for the verdict. Is GeoBlue insurance worth it? It depends.

I'll be honest here, just like I was in the rest of the article. GeoBlue isn't the best international health insurance out there, but it's really freaking solid! They have a ton of insurance options, high benefit maximums, and inclusive benefits…but the kicker that differentiates it from most competitors is the extreme customizability of the plans.

I have to dock them 1 point for thin mental health coverage and sometimes a lengthy exclusion list. All in all, this insurance will be worth it for those who are serious about tailoring their plans. If you aren't, explore other plans to survey your options.

I hope you found this GeoBlue travel insurance review helpful, and I wish you the best as you proudly fly by the seat of your pants!

Ready To Get Coverage for Your Next Travel Adventure?

Join our global

digital nomad community

Join us for free

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Read Next

Are Coworking Spaces Worth It?

Top Digital Nomad Visas in Schengen Countries