Best Nomad Health Insurance Options for Travel

Discover the top insurance providers for digital nomads and remote workers in our comprehensive review. Compare coverage, pricing, benefits, and more.

Standard insurance plans often cater to single trips or limit time spent abroad, and even multi-trip policies usually require spending most of the year in your home country, a condition that digital nomads can't usually meet.

The digital nomad lifestyle demands a more tailored coverage. While emergency care suffices for short-term travelers, those on the road indefinitely need additional medical benefits like routine check-ups, dental care, and coverage for pre-existing conditions.

Luckily, many insurance providers now offer tailored coverage for digital nomads, including options for both short-term and long-term nomads. We have used and tested many of them, so here are the best travel insurance options you got as a digital nomad.

1. SafetyWing

SafetyWing is a popular insurance provider among digital nomads. This startup company offers both travel medical insurance (Essential Plan) and global health insurance (Complete Plan).

Essential focuses on travel-specific side coverage. It includes benefits like travel delay coverage, lodging expenses after natural disasters ($100/day for up to 5 days), lost luggage reimbursement (up to $3,000 per certificate, $500 per item), personal liability for accidents, and emergency medical evacuation (up to $100,000 lifetime maximum). This plan is highly affordable (starting at $56.28 for 4 weeks), flexible (no need to purchase in advance, and extendable), and subscription-based, perfect for multiple or extended trips abroad.

Complete takes it a step further, offering both medical and travel coverage in over 170 countries. While it doesn’t cover pre-existing conditions, it provides comprehensive benefits for ongoing medical needs, including doctor and specialist visits ($5,000 outpatient limit), mental health care (up to 10 visits), checkups and vaccines ($350 limit), and physical therapy ($5,000 outpatient limit). Additional coverage options include routine dental care ($1,500 limit) and vision care ($500 limit). On the travel side, it offers extended protection for lost checked luggage, trip interruptions, and travel delays, among other benefits.

Following an overwhelming amount of feedback from its users, the company has, since its launch, improved its claim process, making it way faster than it was before. They also launched extra for their Nomad Insurance products including adventure sports coverage and electronics theft, which were not provided before.

2. Genki

Genki is another great option to consider as a digital nomad. It's an affordable, hassle-free insurance provider with a great buying experience and generous benefits. Similar to Safetywing, they offer both long-term international health coverage (Genki Native) and short-term travel medical insurance, (Genki Traveler).

Their travel health insurance plan Genki Traveler is backed by Allianz Partners and Squarelife and offers a nice selection of benefits for digital nomads. These include an affordable monthly payment (from only €52.50/month) and the ability to cancel the plan at any time. It's great for digital nomads up to 49 years old who intend to take multiple brief trips or a few long-term trips.

The health insurance coverage Genki Native is slightly different and geared more toward digital nomad expats or long-term travelers. It includes a wider variety of benefits designed for long-term protection and it's available to people up to 55 years old (though there's no age limit once you already have coverage). You can cancel the coverage any time after the 12-month minimum contract period and you can choose between two Native plans: Native Basic and Native Premium. With the Native Premium plan, you get full comprehensive health insurance coverage, including vision and dental care, preventive and mental health care, no overall coverage limit and full coverage in your country of citizenship.

Although their health insurance benefits are very comprehensive, their policies exclude some non-medical travel-related issues like trip cancellation and interruption or luggage loss which should be considered if this is something you need for your nomad travels.

3. Heymondo

Digital nomads who are willing to pay a little more for comprehensive travel medical insurance should consider Heymondo. This insurance company is technology-focused, and its website explains your coverage options in very simple terms, making the insurance-buying experience particularly straightforward.

What will be included in your digital nomad insurance will depend on the specific plan you choose. They offer three main types of insurance to suit different travel styles:

- Single trip, if you only need coverage for one trip.

- Annual Multitrip , for digital nomads who want to plan ahead and need a plan for a series of trips over the course of a year.

- Long Stay, for those who are already abroad and want to be able to renew their plan frequently.

Although Heymondo is slightly pricier than some options on our list ($54 for 30 days for their Long Stay travel insurance, except USA), you may find that the enormous benefit amounts and coverage justify that. You have, in fact, 24/7 access to a doctor chat for medical questions (you can contact them anytime from anywhere), extensive medical coverage (up to $10 million for some plans) as well as coverage for trip cancellation, luggage loss/theft, and other travel disruptions. You can also add coverage for electronics and adventure sports as an add-on. Another great aspect of Heymondo for digital nomads is that they offer clear policies without deductibles

4. World Nomads

If you like the thought of a digital nomad insurance plan created by travelers for travelers, World Nomads can be another suitable option. The plans offered by World Nomads are fully loaded and leave very few things out.

They are one of the digital nomad insurance pioneers, their travel health insurance plans come with a laundry list of benefits you will find to be interesting and incredibly useful. Assault, delayed luggage, medical emergencies, 150+ adventure and extreme sports, trip delays, and coverage of your tech gear are just a few benefits you can expect if you go with this plan. However, it must be said that their plans are on the pricy side: for a 1-month plan for one person aged 30, for instance, you can expect to pay $127.64 for their cheapest plan.

In terms of digital nomad insurance plans offered by World Nomads, you can choose between their Standard plan and Explorer plan:

- The Standard plan is for the average digital nomad with basic coverage in general areas. It’s the most affordable plan that World Nomads insurance provides.

- The Explorer plan, which is more expensive, includes coverage for a higher number of sports/activities. It also has higher reimbursement limits for repatriation of remains, trip cancellation, trip interruption, trip delay, baggage/personal effects, and more. It’s for digital nomads who plan on indulging fully in their trips and sampling everything on offer

5. Faye

Faye Travel Insurance is a modern, app-based travel insurance provider built for travelers who want a straightforward, hassle-free experience. Unlike traditional insurers, Faye lets you purchase coverage, file claims, and get reimbursed—all through their mobile app. Their 24/7 real-human chat support makes the claims process faster and more transparent than many competitors.

Faye keeps things simple with one comprehensive plan that covers emergency medical expenses up to $250,000, emergency evacuation up to $500,000, and trip cancellations up to 100% of non-refundable costs. Trip interruptions are covered up to 150%, and if your trip gets delayed, you can claim up to $300 per day. For lost or delayed baggage, Faye offers up to $2,000 in coverage (capped at $150 per item) and $300 for baggage delays, helping you replace essentials while you wait.

That convenience comes at a higher price point, with plans starting at $4.64 per day for domestic travel and $5.16 per day for international trips. Your final cost depends on your trip value and any optional add-ons, which include rental car protection, adventure sports coverage, and pet care insurance. If flexibility is a priority, you can also add a Cancel for Any Reason (CFAR) option, which refunds up to 75% of your trip costs, even if your reason for canceling isn’t covered.

Faye may not be the cheapest option, but its top-notch customer service, intuitive app, and fast claims process make it a great choice for travelers who want stress-free protection with no fine-print headaches.

6. Insured Nomads

Insured Nomads offers multiple plans with terms and benefits that apply to specific types of digital nomads.

They have 4 travel plans available, and the right one for you will depend on your travel plans, finances, and, ultimately, how much coverage you want for your peace of mind. Here's a quick overview of each plan:

- The World Explorer plan is tailored to any digital nomad who wants to take a trip for at least 7 days and up to a year (364 days). You get one chance to extend your plan based on your preferences and needs (the extension may be for up to 6 months). As a whole, the plan provides up to $2,000,000 dollars in medical benefits for travelers (outpatient and telemedicine included) and they also cover personal liability, repatriation costs and accidental death costs.

- The World Explorer Multi Plan is for digital nomads who intend to take trips several times over the course of a year and then come back home. You can get up to $1,000,000 in coverage should you select that level of coverage during the quotation process and it covers medical emergencies, repatriation costs, outpatient care and telemedicine.

- The World Explorer Guardian plan allows you to select specific amounts of coverage for health and medical travel insurance coverage. You can choose between $50,000, $250,000, or $500,000 of total medical benefits. Each of the plans includes trip cancellation and interruption coverage. The $250,000 and $500,000 coverage options include a pre-existing condition waiver. The most expensive coverage option (the one with a $500,000 medical coverage amount) allows the policyholder to cancel their coverage for any reason.

- The World Explorer Hotspot plan is instead for digital nomads looking to travel to riskier countries like Afghanistan or Iraq. The plan covers travel-related medical expenses, personal accidents, wrongful detention costs, natural disaster costs, and more. But what really stands out about this plan is that it also covers search and rescue endeavors and will even cover part of a kidnap remand should you be held for ransom.

Travel plans through Insured Nomads are a little expensive compared to others on this list. For example, a one-month World Explorer plan for someone between 30 and 39 costs over $100.

Though Insured Nomads' plans aren’t the cheapest, they are still very much attainable on the average budget. So, don’t let pricing alone deter you from exploring plans from this reputable company.

7. PassportCard

Traditional insurance companies provide you with a list of benefits, and you access them through the claims submission process. Sometimes that means you have to use your money upfront and wait for reimbursement from the insurance company later.

You don’t have to do that with PassportCard insurance for nomads. Instead of using your own money, you’ll use your PassportCard in real time to pay your medical bills.

You’ll first have to sign up online and then wait to receive your card in the mail. And then, when you get to your destination and need care, you’ll first contact PassportCard, and they’ll load the card with the funds you need. At that point, you can swipe your PassportCard and pay for your services. It’s really that easy. And there’s also 24/7 support to help you out as needed.

Their international travel insurance plan covers certain medical services and treatments you may need as you travel the world. You get to choose between two main plans: Remote and Comfort.

- The Remote Plan offers the traveler basic coverage with a plan limit of up to $1,000,000. It’s a 12-month renewable plan that you can cancel at any time and it's also deductible-free. The plan coverage includes emergency medical services, inpatient and outpatient care, emergency dental care and non-urgent medical treatments and hospitalization up to $5,000.

- The Comfort Plan is the most comprehensive plan of the two. It’s for heavy travelers who often take long-term trips. It doesn’t leave much out regarding benefits: it has no deductible and has a plan limit of up to $3,500,000. The plan includes just about all of the benefits of the Remote plan but also covers hospitalization and inpatient care for continuous medical conditions, chronic and routine medical care, cancer screening and treatment, bone marrow and organ transplants and mental health care.

It must be said that PassportCard is not the cheapest insurance you’ll come across. The Remote plan for someone in their 30s with no chronic medical conditions starts at $119 monthly. The higher-cost comfort plan starts at $214 per month in that same scenario. But in this case, you should consider the convenience of paying for your care with the PassportCard. You won’t have to deal with the rigamarole that comes along with the traditional claims process.

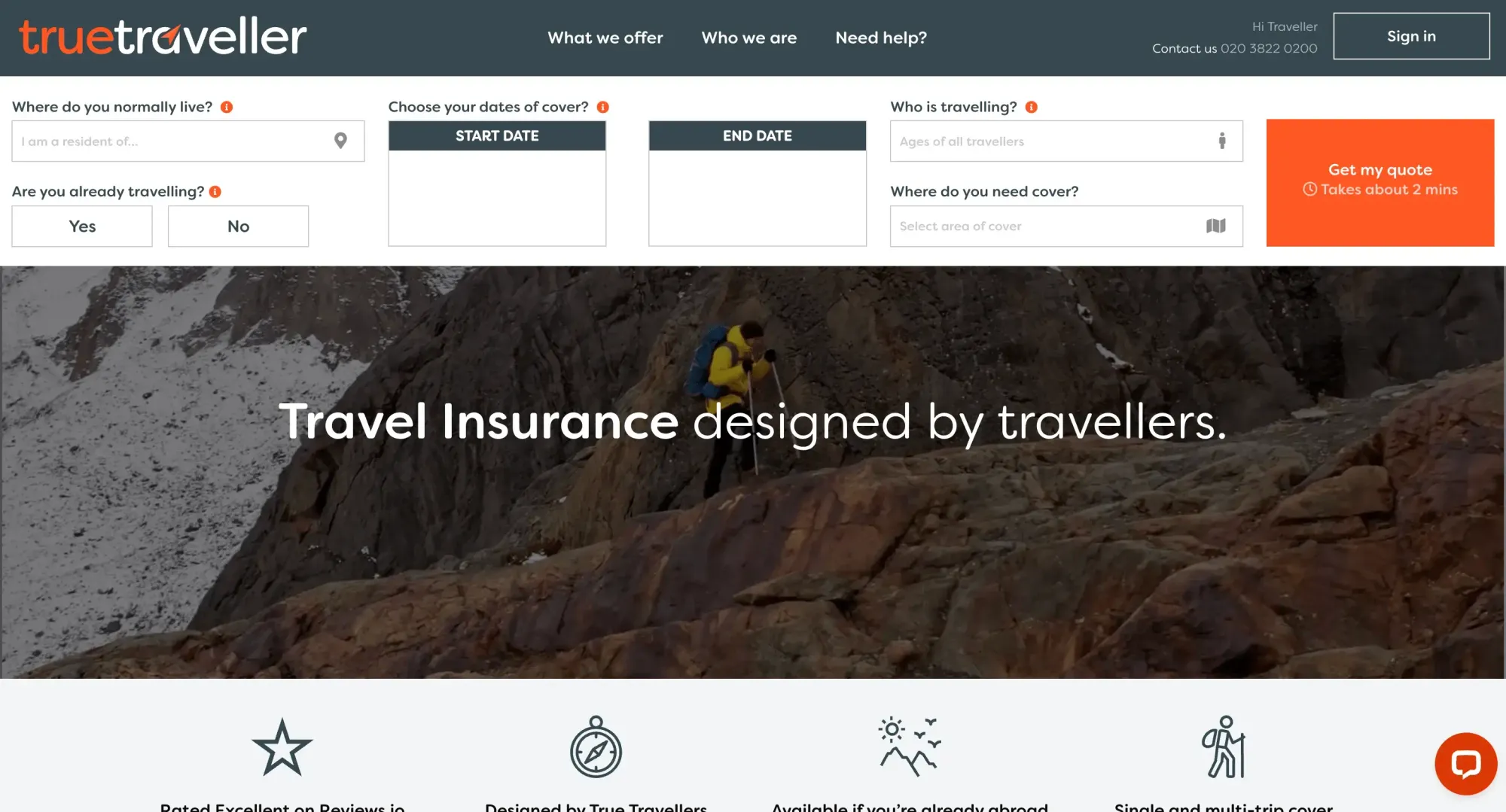

8. True Traveller

True Traveller is a travel insurance provider backed and run by travelers who know your needs and struggles as a digital nomad. The company is newer on the scene but has earned stellar ratings online by their customers.

If you’re looking for single or multi-trip travel insurance coverage in the UK and Europe, TrueTraveller could definitely be for you.

There’s no single insurance plan for all True Traveller customers. Instead, there’s a coverage option for every type of digital nomad.

- As a base option to save you the most money, the True Value plan covers the most basic travel expenses for digital nomads and travelers in general, including medical emergencies (up to £10,000,000), baggage costs (up to £1,000), trip cancellation (up to £1,000), personal liability (up to £1,000,000), accidental disability (up to £10,000) and repatriation (up to £10,000,000). It doesn’t cover travel delays, travel abandonment, or missed departures though.

- The Traveller plan increases the coverage for the benefits in the True Value Plan, and includes also travel delays, travel abandonment, and missed departures (unavailable in the True Value plan).

- Their most comprehensive insurance for digital nomads is the True Traveller plan which gives you even higher benefit limits and you can personalize your plan by adding protection for baggage, travel disruption, scooter or motorbike riding, and more.

It must be said, though, that pricing for the base True Value plan is more expensive than Safety Wing, Genki and several other plans we’ve covered above. For a 30-day worldwide plan for a 30-year-old person, the pricing works out to £78.45 for the True Value, £98.04 for the Traveller plan and £116.51 for the Traveller Plus.

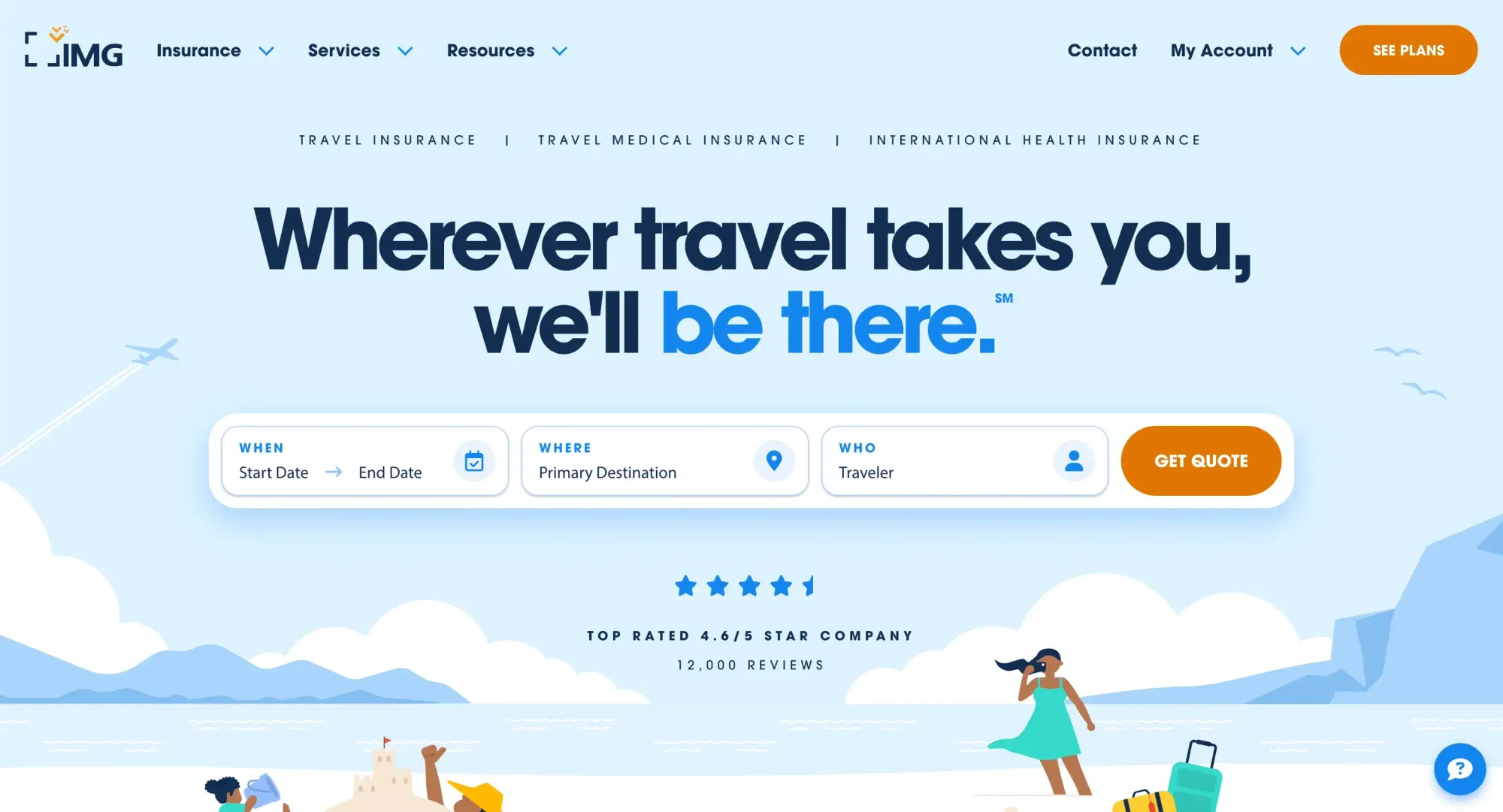

9. IMG Global

If you prefer larger insurance companies with numerous insurance package options and great customer reviews, International Medical Group (IMG) might be the insurance you’ve been looking for.

As an award-winning travel medical insurance benefits provider, IMG boasts an impressive selection of insurance products for every type of digital nomad (8 travel medical insurance plans in total). They focus mainly on accident coverage, evacuation assistance, and unexpected illnesses.

For briefness, we’ll focus on the top 2 plans featured on the IMG website called the Patriot Travel Series:

- The Patriot Lite is a medical insurance plan for digital nomads who plan to take short-term trips. It covers health-related events, like medical emergencies and accidents, medical transportation, chemotherapy, and pre-existing conditions. But that’s not all. It also covers things like natural disaster evacuations, return of remains, personal liability, terrorism, lost luggage, and identity theft. You can also indulge in up to 18 activities listed in the plan benefits.

- The Patriot Platinum option is instead a no-brainer if you want more in your short-term travel medical insurance plan. This plan offers all of the benefits that the “Lite” plan does, but you get more coverage overall with higher potential payouts, travel intelligence, telehealth, and evacuation.

Travel Insurance vs Health Insurance

Right, so now that you have a rundown of all the digital nomad insurance plans, the question is, should digital nomads pick travel insurance or health insurance?

If you are a digital nomad planning short-term trips between 6 to 12 months, you should opt for travel insurance as it often has more flexibility to be purchased while already traveling and it's generally less expensive.

If you are instead planning to live abroad for an extended period, you will benefit more from international health insurance as it provides more comprehensive medical coverage, including routine care like vision and dental care, preventive services, and treatment for chronic conditions among other benefits. The downside is that it has more restrictions on enrollment periods and pre-existing conditions.

Companies like SafetyWing and Genki also offer hybrid plans specifically designed for digital nomads that combine elements of both travel and health insurance. So, these can be also a good "all-in-one" option to consider.

What Should You Look For in a Digital Nomad Insurance?

Ultimately, choosing the right digital nomad insurance depends heavily on how long you plan to travel and work remotely as a digital nomad, the nature of your trip, and what your personal and health needs are.

Generally speaking though, these are the things you might want to check in your policy before purchasing a digital nomad insurance.

Medical coverage

Medical coverage is a benefit included in most digital nomad insurance plans, and that’s because medical issues can be highly expensive in a foreign country without adequate financial protection. The amount of medical coverage needed will vary widely from plan to plan.

Some plans have more comprehensive medical coverage than others, so make sure to consider factors, including the coverage limit, the plan deductible and the covered medical services and treatments such as emergency medical services, outpatient treatments, and medical prescriptions.

Baggage and tech gear loss

This is one of the key areas for digital nomads as tech gear like a laptop is our livelihood. Most digital nomad insurance plans also offer coverage for personal property, protecting the gear and items you carry during your travels.

Insurance companies typically set a maximum dollar limit for this coverage, and won't exceed this amount in reimbursements. However, be aware that not all lost or stolen items are automatically covered. There are often specific requirements and exclusions.

We recommend you inventory your belongings before your trip and compare their value to the coverage limit of potential plans. If the limit falls significantly short of your items' worth, you may need to consider additional coverage options or a different plan altogether.

Adventure activities

There’s no denying that accidents don’t discriminate by the situation and they can happen while you’re having the time of your life ziplining, bungee jumping, or rock climbing.

To save you some funds and frustration, some digital nomad insurance companies include coverage for activities like these and certain extreme sports. But you shouldn’t assume that all of them do. Every plan is different, so before making a plan selection, make sure that you look very closely at covered activities and sports.

Trip cancellations and emergencies

Many unforeseen circumstances can disrupt your travel plans, from natural disasters to sudden illness. A comprehensive digital nomad insurance policy should offer you coverage for trip cancellations, interruptions, and delays. This can include reimbursement for non-refundable expenses like flights, accommodations, and pre-paid activities.

Flexibility and global coverage

The digital nomad lifestyle demands insurance that can adapt to your ever-changing location. Look for plans that offer worldwide coverage and the ability to extend or modify your policy on the go. Some insurers now provide policies that can be adjusted month-to-month, allowing you to tailor your coverage as your travel plans evolve. For Russian nomads, this is especially critical as only some providers offer reliable coverage.

Ready To Get The Right Digital Nomad Insurance?

Join our global

digital nomad community

Join us for free

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Read Next

Are Coworking Spaces Worth It?

Airalo China eSIM: Is It Worth It?