Faye Travel Insurance Review: Is It Worth It?

Learn the pros and cons of Faye Travel Insurance based on our real experience using the policy to discover if they're the right provider for you.

If you’re a frequent traveler like us, you’ve probably dealt at least once with issues like lost luggage, flight delays, or unexpected medical issues abroad. It sucks, but when you’re constantly on the move, these things just happen.

That’s why we are big advocated of having the right travel insurance. The problem, though, is that a lot of providers care more about profits than actually helping when things go wrong. So, is Faye Travel insurance any different? Let’s break it down and see if it’s worth your hard-earned money.

The Pros and Cons of Faye Travel Insurance

Who is Faye Travel Insurance?

Faye is a travel insurance provider that offers comprehensive coverage for various aspects of travel, including trip cancellations, medical emergencies, and baggage issues. They refer to themself as the “first-ever person-first travel insurance” with a clear goal of making unexpected travel hiccups as stress-free as possible.

Throughout their marketing material, Faye says they prioritize unmatched customer service from the get-go, with most of the user interaction happening through their app. You can input all your trip details, such as flights and hotels, directly into the app, and then chat with real people in real time if/when you need assistance. They also claim that, by using their app, you can file a claim in minutes and access 24/7 assistance.

How Does Faye Travel Insurance Work?

Unlike the majority of travel insurance companies, Faye only offers one insurance plan. To get a quote, you just need to enter your destinations, dates, age, and email to the website or app, and…that’s it. Faye will show you your policy and everything that’s covered.

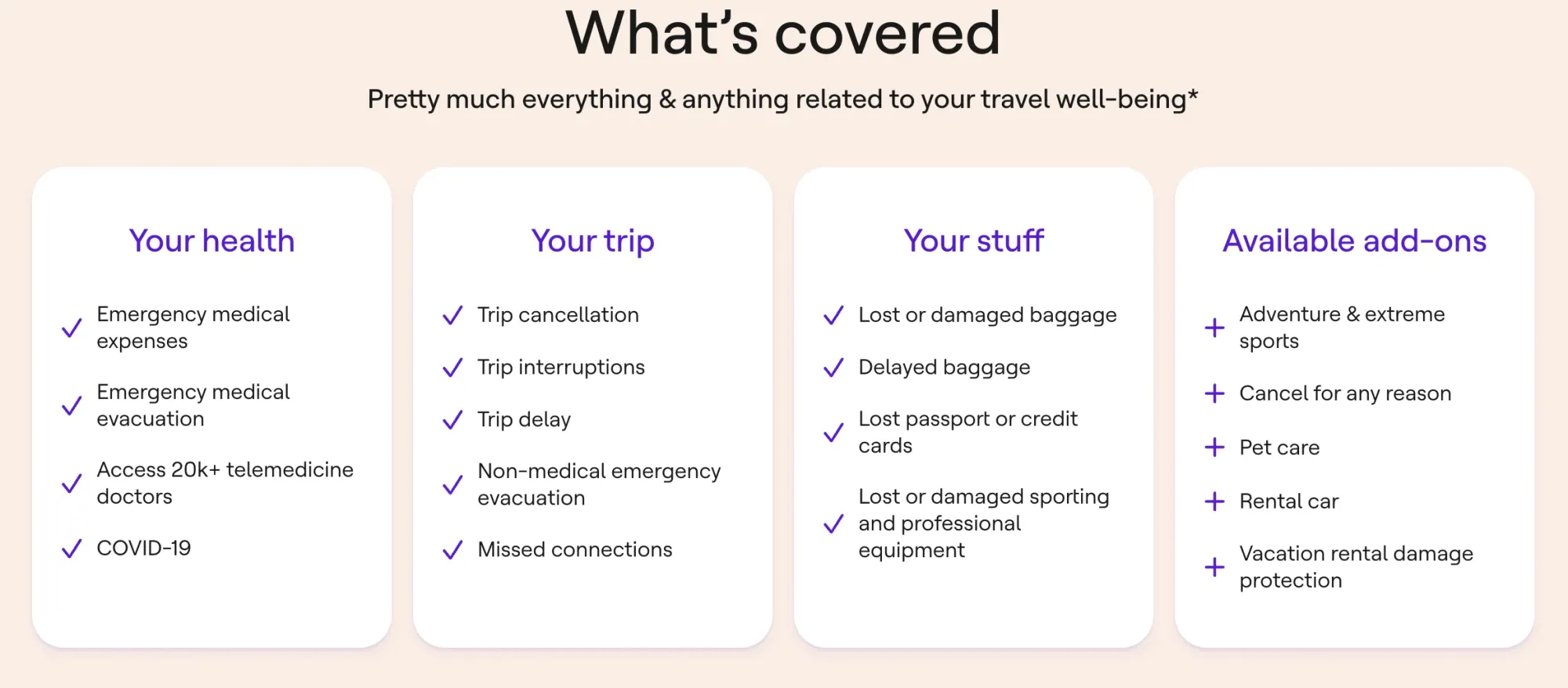

The only flexibility comes by changing the estimated trip cost or the optional add-ons. Although Faye does offer some of the more standard add-ons including extreme sports, we liked seeing a few more unique options, including pet care for vet bills and kenneling if you arrive home later than expected.

How Much Does Faye Travel Insurance Cost?

Faye insurance prices are pretty straightforward, with costs based on a few key factors:

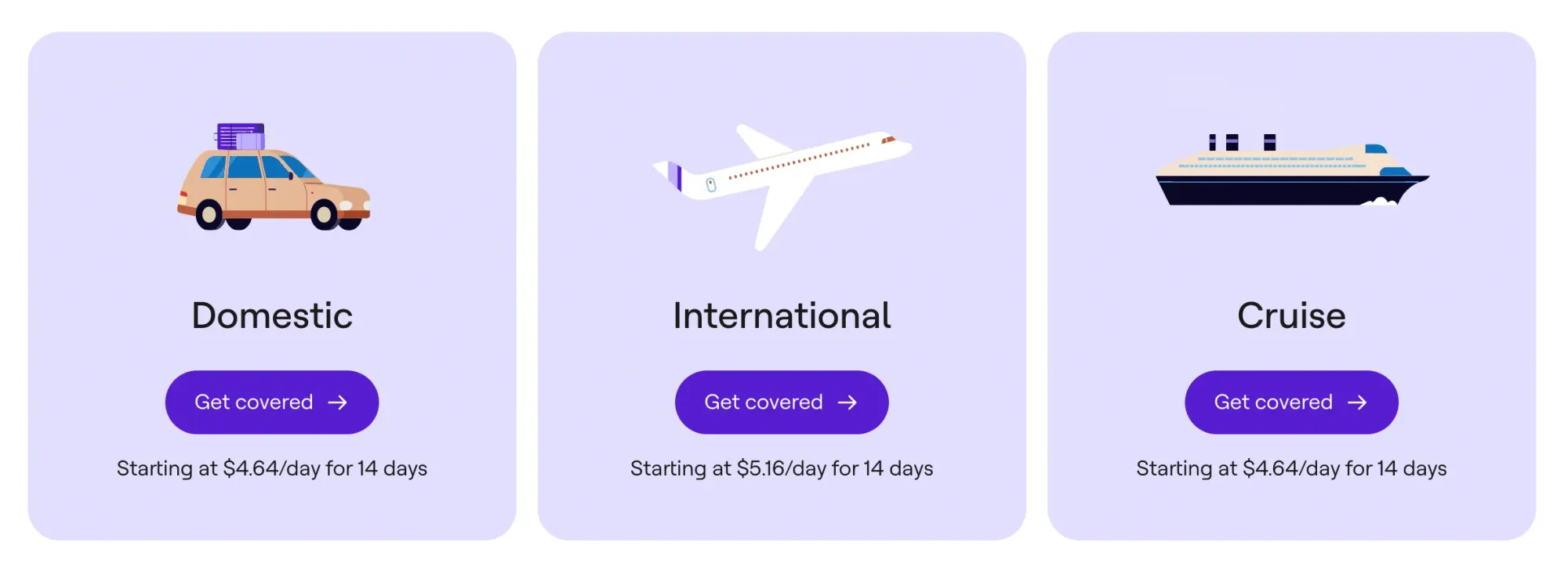

- Trip type: domestic trips and cruises, for instance, generally cost less than international travel.

- Trip cost: the total value of your trip can (and will) affect your premium.

- Add-ons: optional extras like rental car coverage, pet care, or extreme sports protection can actually increase the price.

Here’s a quick look at Faye’s starting daily prices to give you a better idea:

| Trip Type | Starting Price (Per Day) |

|---|---|

| Domestic/Cruises | $4.64 |

| International | $5.16 |

Faye’s pricing leans toward the higher end, but with solid coverage, an easy-to-use app (more on that next), and excellent customer service, we still think it's an interesting insurance provider to consider for travelers who need single-trip coverage.

What Makes Faye Travel Insurance Unique?

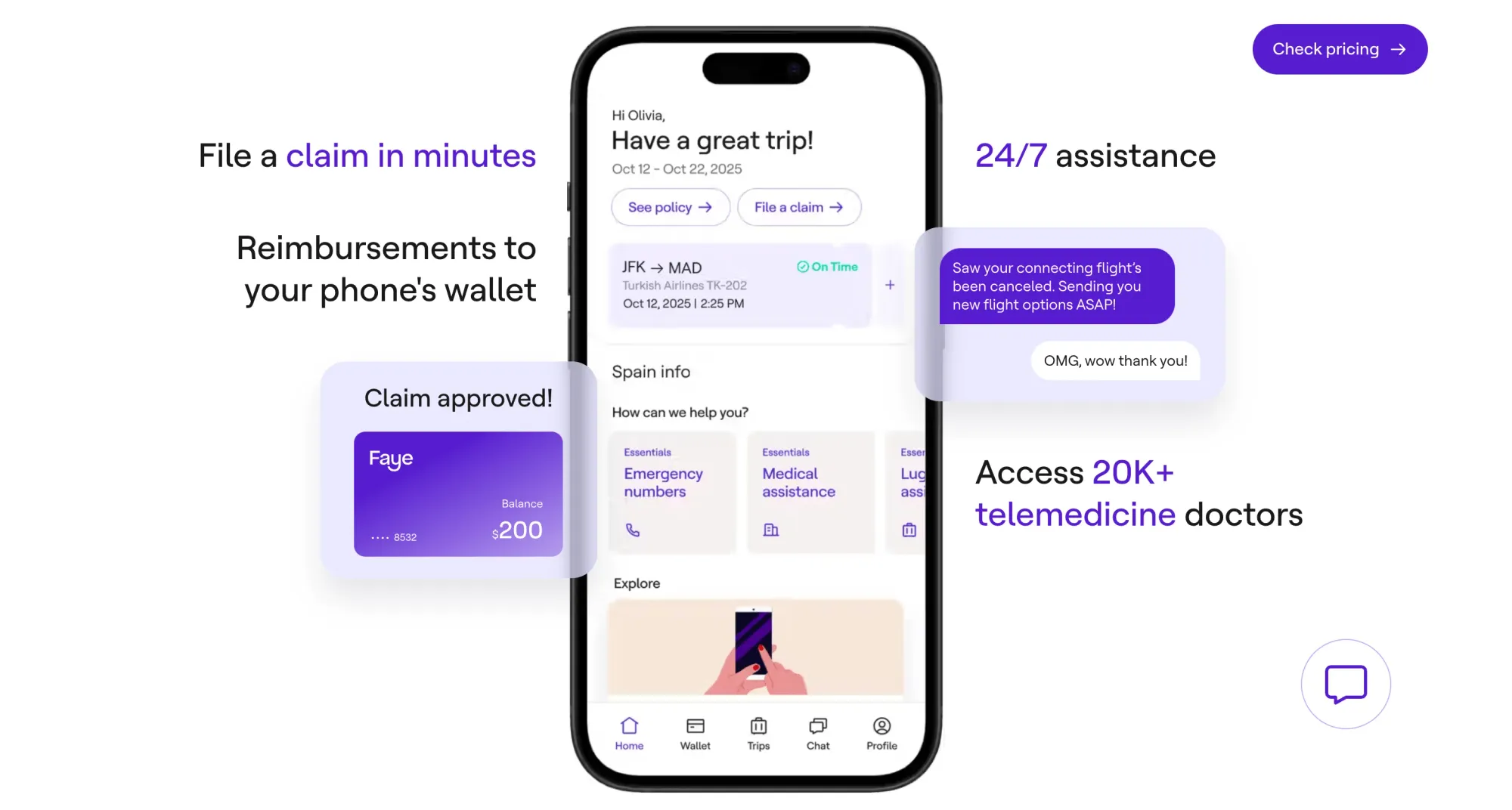

What stands out most to us about Faye is their mobile app which we found actually very intuitive and user-friendly. If you’re a digital nomad always on the go like we are, then you know how having to pull your laptop out to scroll through emails and find one of your countless insurance policies from the last year can be a real pain. Let alone sitting for hours on the phone attempting to make a claim.

With Faye, everything is easily accessible through their app, which usually is not the case with many insurance providers. You’ll find your policy, can file claims, and even receive payments within their app. The UX design is also genuinely enjoyable and, best of all, the in-app chat connects you with real people instantly, meaning no more jumping through the AI bot hoops begging to speak to an actual human being.

This is what we think makes Faye Travel Insurance stand out. They seem to have actually got things right when it comes to customer service. In the world of frustratingly opaque insurance claiming, we found Faye to be refreshingly transparent.

What’s Covered by Faye Travel Insurance?

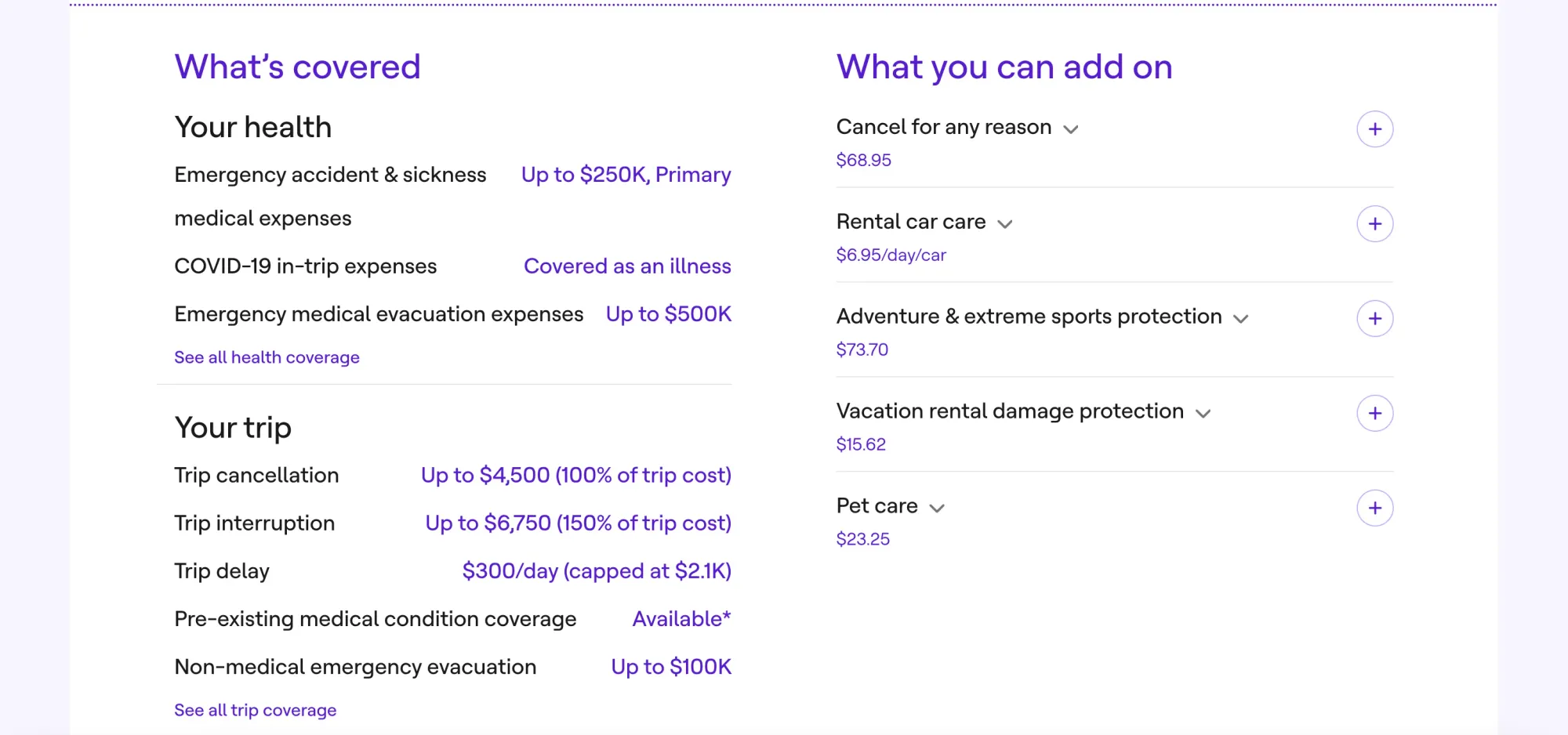

Medical Coverage

Okay, let’s get into the stuff that really matters, that is coverage. In terms of medical, Faye Travel Insurance covers emergency accidents and sickness medical expenses of up to $250k, emergency medical evacuation of up to $500k, and non-emergency evacuation of up to $100k.

When it comes to telemedicine, they have a network of 20k doctors covered by the plan that you can connect to from abroad. If you purchase insurance up to 14 days before departure, Faye will also cover existing medical conditions on your trip.

Travel Disruptions

One thing that we really appreciate is that your Faye Travel Insurance also covers trip cancellation up to 100% and trip interruption up to 150%. You’ll also get up to $300/day for any trip delays. This is great for those who want that extra bit of security that their money isn’t going to waste if something gets in the way of your trip happening.

Your Belongings

Their standard plan also works for protecting your things. Faye Travel Insurance covers lost or damaged baggage up to $2,000 (capped at $150/item). You can also claim up to $300 for baggage delay in order to buy yourself necessities like clothes and toiletries should the airline temporarily lose your things.

What’s NOT Covered by Faye Travel Insurance?

Of course, not everything can be covered by Faye Travel Insurance’s sole plan option. And there are some things that are left out.

Medical Tourism

They don’t cover routine physical examinations or dental care as well as elective treatments. Faye Travel Insurance also won’t cover you if you’re traveling for the purpose of receiving medical care, aka medical tourism.

Pre-existing conditions won’t be covered if you’re booking Faye Travel Insurance within 2 weeks of departure.

Illegal Activities

This goes without saying, but Faye Travel Insurance won’t cover any accidents caused under the influence of drugs or while participating in any illegal act. This also extends to loss or damage caused to items by customs confiscation and destruction.

Is Faye Travel Insurance Right for You?

Faye Travel Insurance is definitely tailored for single-trip coverage as it doesn’t offer longer-stay or monthly plan options, however, you can add multiple countries to one trip. If you’re a remote worker who takes advantage of their location-independent work with frequent trips and wants hassle-free insurance coverage, then Faye might be the perfect provider for you.

Thanks to their extensive medical and trip cancellation coverage, as well as a super responsive customer service team, Faye is best suited for people who like to be prepared. They also offer a cancel for any reason (CFAR) add-on that refunds up to 75% of your trip costs, which is also pretty useful.

For long-term travelers and digital nomads on the move, however, Faye Travel Insurance might not be the best fit. It’s not the most flexible policy as you have to know your exact destinations and dates with no possibility for coverage extensions once the trip has started. There’s also a maximum policy duration of 180 days.

How Can You Get Travel Coverage with Faye Travel Insurance?

If by now you think that Faye travel insurance might be an option for you, let’s dive into the practical steps to get a quote and secure coverage. Here’s a step-by-step guide to getting started with Faye:

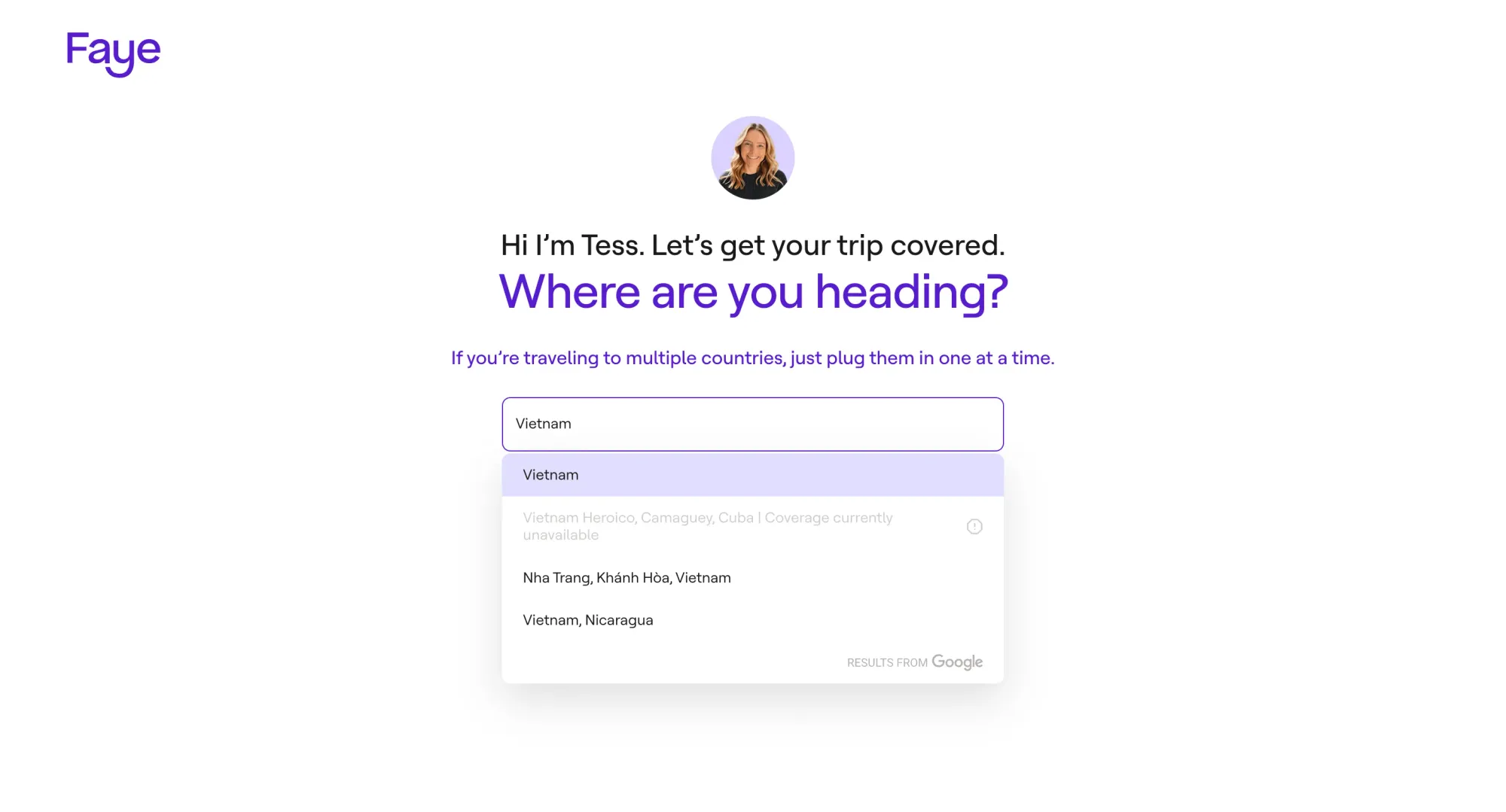

Step 1: Get a Quote

Head over to Faye's website or download the Faye app on your iOS or Android device. They will ask you for basic details about your trip, such as destinations and travel dates, as well as personal details, including name, birthdate, and country of residence. This will generate a personalized quote tailored to your travel plans.

Step 2: Customize Your Coverage

Faye allows you to add optional extras to tailor your policy to your needs. These include rental car protection, pet care, adventure and extreme sports coverage, and Cancel For Any Reason (CFAR). Adding these options will adjust your premium, so you only pay for what you need.

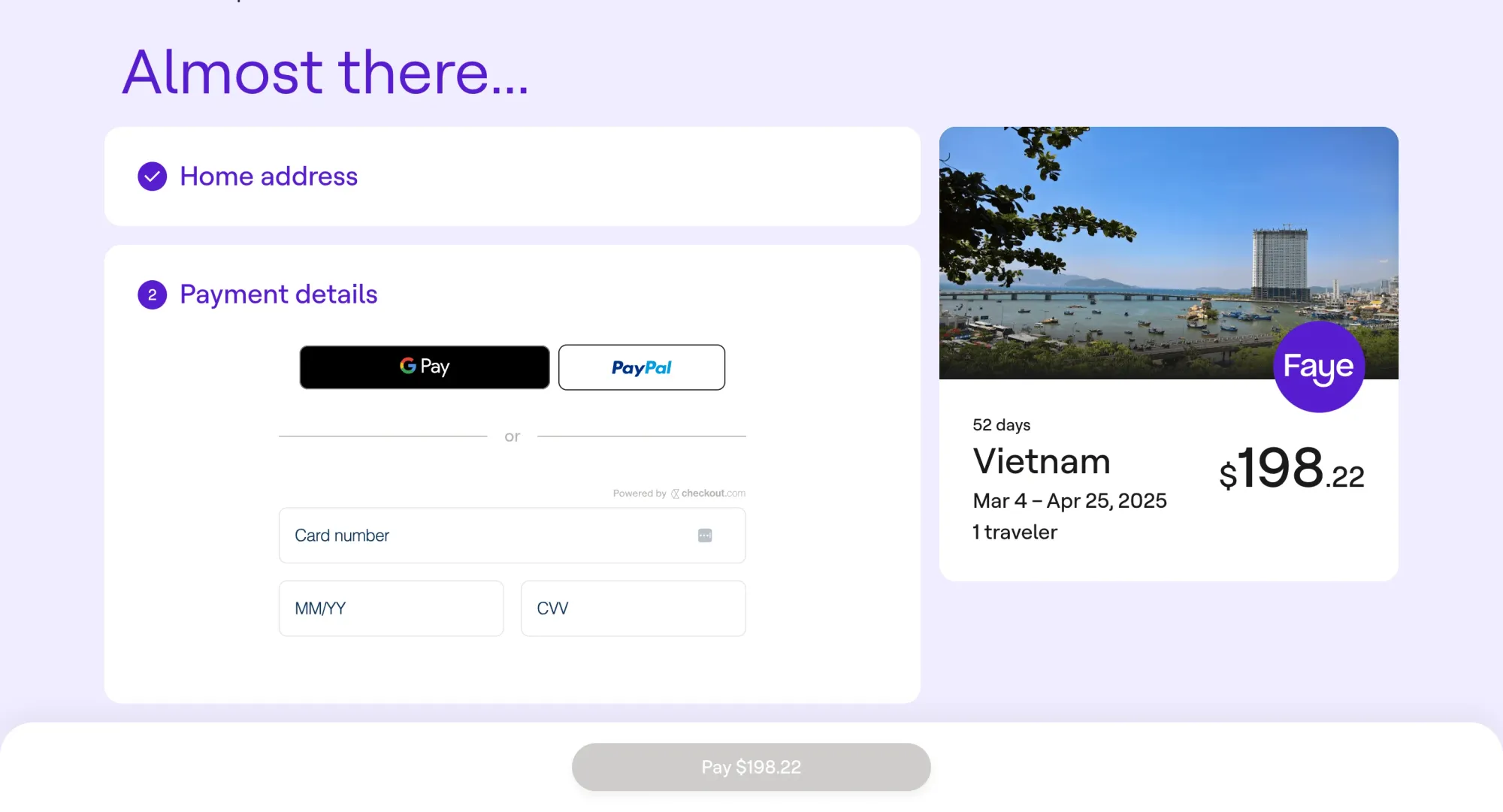

Step 3: Review and Purchase

Once everything looks good, enter your complete home address and proceed to payment. Faye accepts major credit cards, and your policy will be activated immediately.

How to Make a Claim with Faye Travel Insurance

The easiest way to submit a claim with Faye Travel Insurance is via the app. Open it up and click on ‘File a claim’ before being prompted to input more information about the claim. You’ll be connected to a real person to talk through the process and will be asked to upload evidence like proof of payment or cancellation directly into the chat.

The customer service agent will file the claim for you and send over a claim number, and then all you have to do is wait. Usually, Faye gets back in touch via email for any follow-up questions and, if approved, reimbursement will be sent into the wallet tab of your app.

The e-wallet will show your current balance and you can either withdraw it to your bank account or add a Faye digital debit card to your Apple or Google wallet for payments.

How to Cancel Faye Travel Insurance

You can cancel your Faye Travel Insurance and receive a full refund within 14 days of purchasing the plan…just so long as the trip hasn’t already started and you haven’t filed any claims.

To cancel your plan, you’ll need to get in touch with customer service through the Faye Travel Insurance app’s ‘Chat’ feature, by emailing support@withfaye.com, or calling +1-833-240-7056 from within the US and +1-804-482-2122 from abroad.

Our Final Verdict on Faye Travel Insurance

Looking back on our experience with Faye Travel Insurance as digital nomads working and traveling across multiple countries, we have a lot to say. This is a premium product that, without a doubt, left us feeling in safe hands when it came to unexpected costs.

There’s no denying that Faye isn’t tailored for a long-term digital nomad lifestyle compared to other more flexible insurance providers like Safetywing and Genki, however, it’s still a great option when it comes to single-trip insurance.

We found submitting claims to be particularly easy and loved that we could speak to real people at every step of the process. Approvals did take 2-4 weeks to go through but were, in general, faster and way simpler than a lot of competitor insurance providers. It feels like insurance is working the way it’s supposed to.

If you want fuss-free, comprehensive single-trip travel insurance that doesn’t make you feel like you’re running around in circles, then we cannot recommend Faye Travel Insurance enough.

Ready to get insured for your next remote work trip?

Join our global

digital nomad community

Join us for free

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Read Next

Virgin Connect Roam eSIM: Honest Take for International Travelers

espresso by Kensington Magnetic Privacy Screen Review