Genki Native: Nomad Health Insurance Review

As digital nomads, we constantly face risks while traveling internationally, making reliable health insurance essential—a safety net for sickness, accidents, and emergencies. But with countless options available, how do you choose the right plan?

We're here to help. In this review, we'll examine Genki Native, an international health insurance plan praised as one of the best for digital nomads, known for worldwide coverage, 24/7 support, and comprehensive benefits.

Is it as good as it sounds? Read on as we dissect Genki Native from the ground up.

What We Like About Genki Native

When it comes to global health insurance, Genki Native is an absolute stunner. We say that because there are just so many things to love! Excuse us while we sing Genki Native's praises for a little bit.

Robust Coverage Options

When we say “robust” coverage, we are not exaggerating.

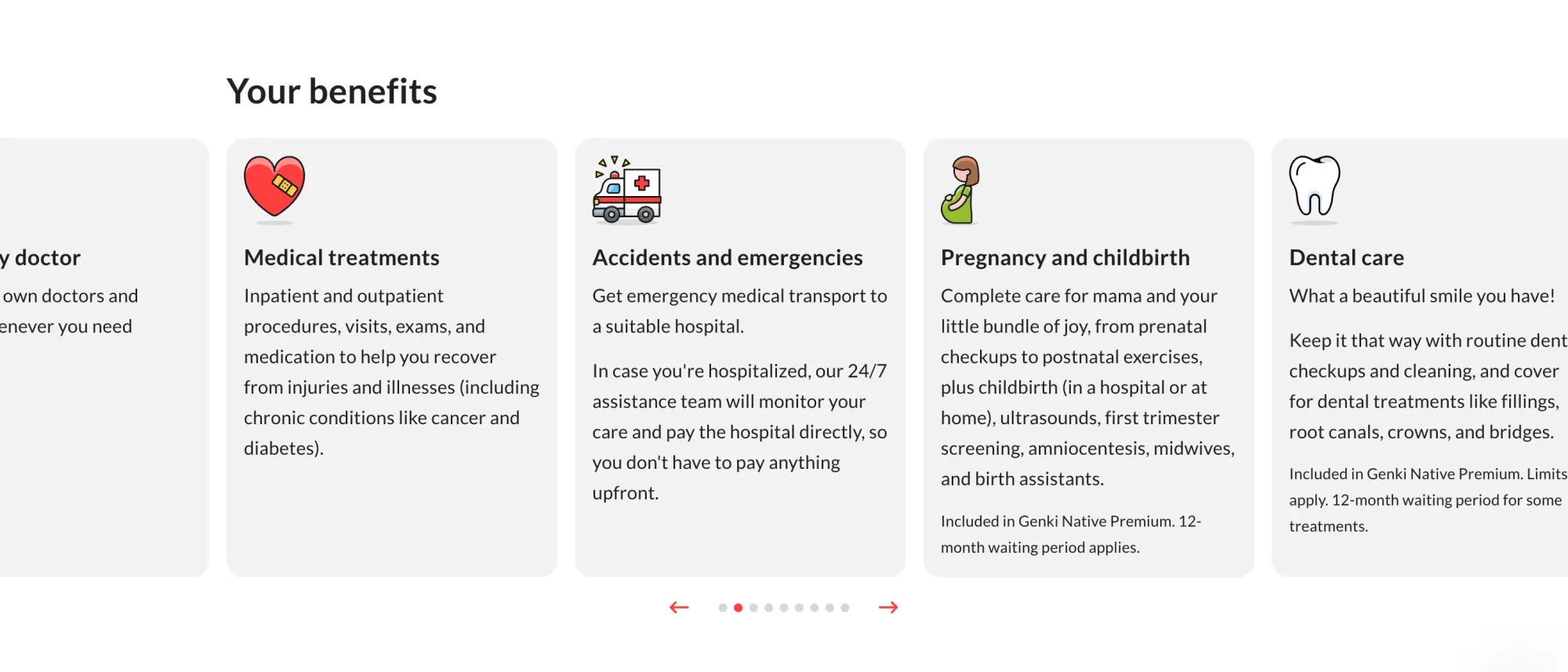

Genki Native international health insurance plans feature heavy-duty coverage options with generous payout limits. You get coverage for dental care, whole-body care, mental well-being, rehab, pregnancy, medical transportation, and the list goes on and on.

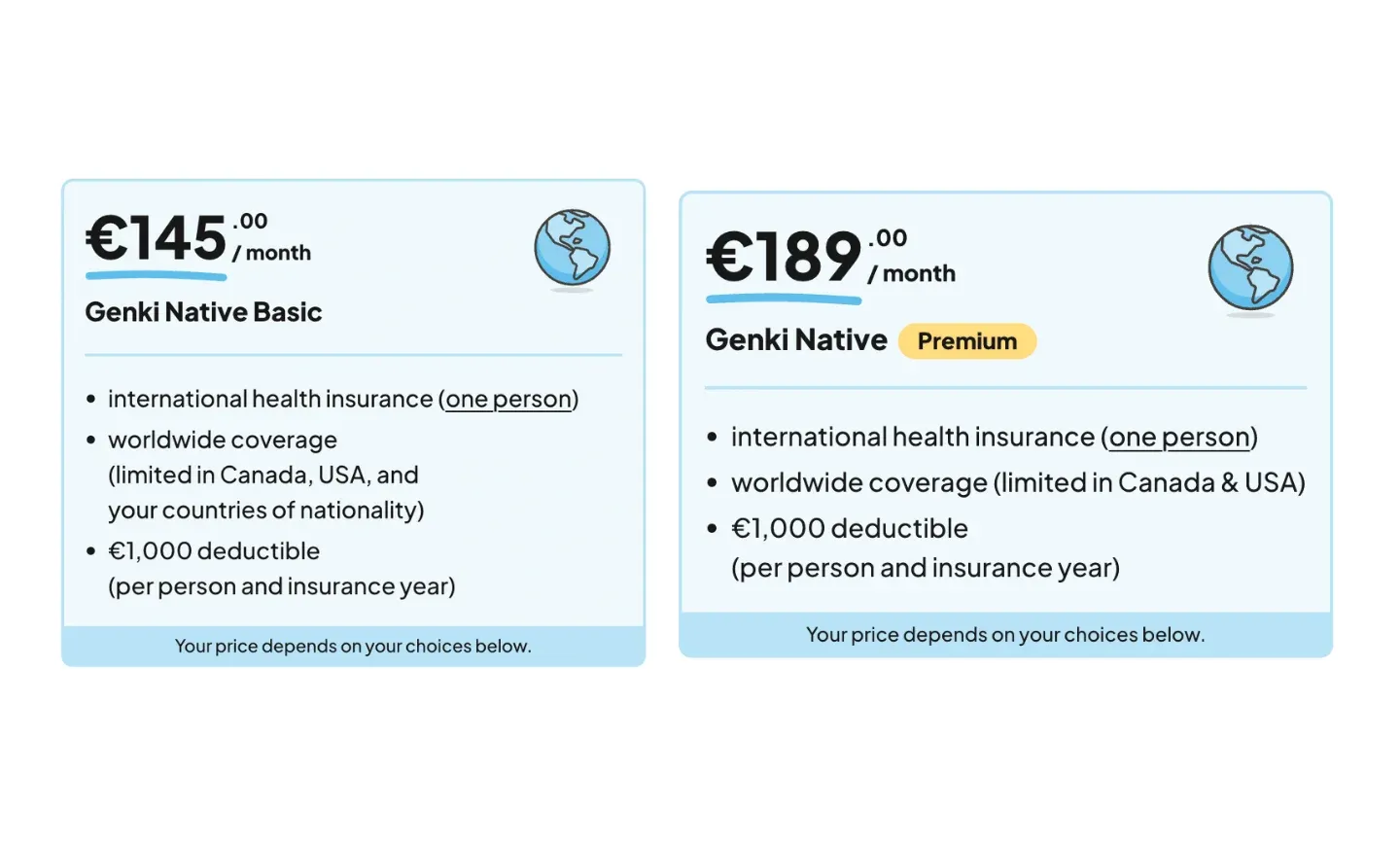

There are two different plans under the Genki Native umbrella, each with a 12-month minimum coverage term:

- Genki Native Basic - Offers comprehensive coverage for emergencies and unexpected medical situations, up to €1,000,000 per year. With no limits on outpatient care costs, Genki Native Basic can help manage ongoing medical conditions, not just one-off emergencies.

- Genki Native Premium - Expands on the Basic plan by including preventive care, full mental health coverage, maternity/childbirth, and vision and dental benefits.

This isn’t even the half of it. Learn more about what’s covered by accessing this table of benefits.

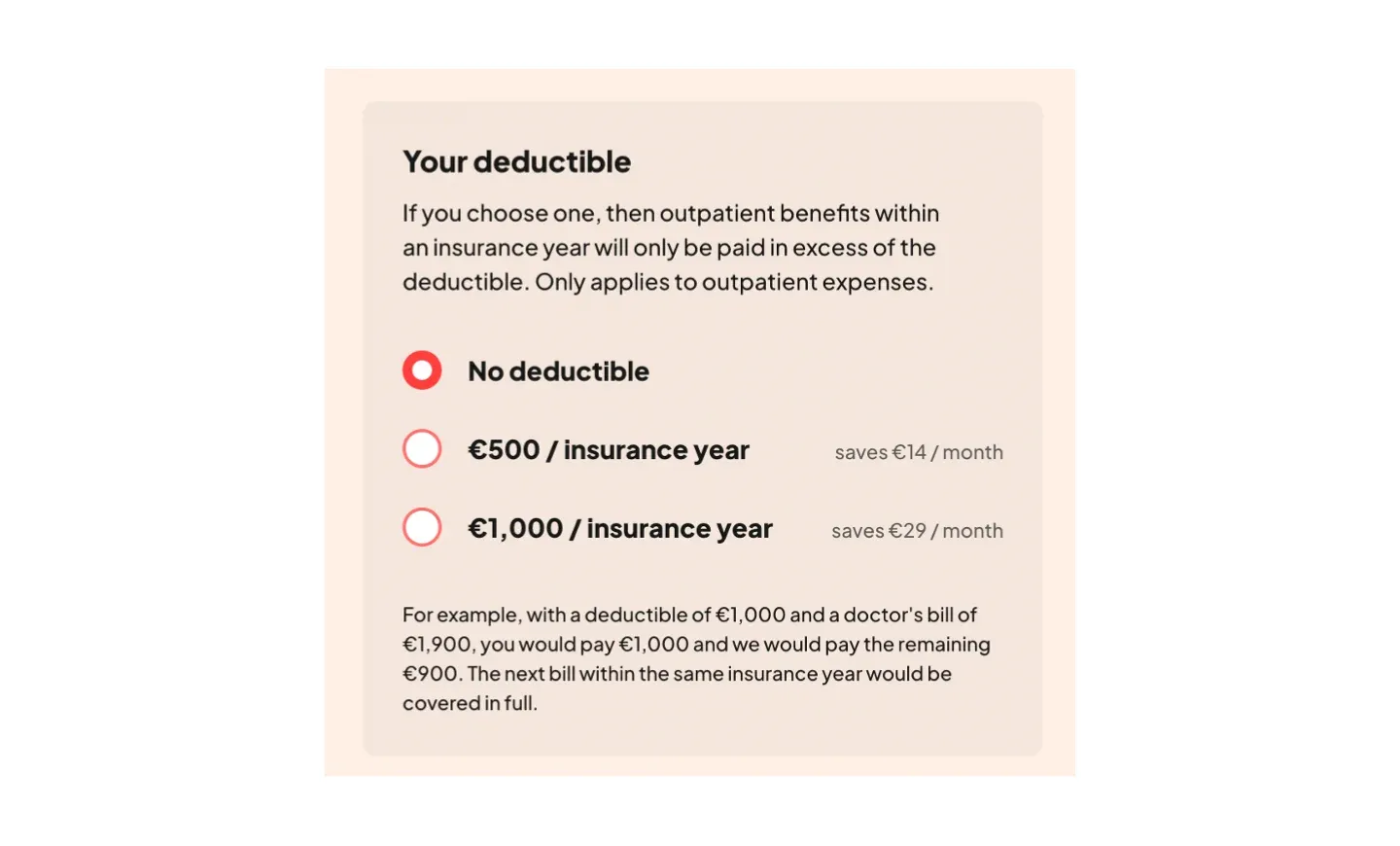

In addition to the plan type, you get to choose your deductible (the amount you pay before your insurance benefits kick in) between €0/yr, €500/yr, or €1,000/yr. These customization options help you craft a plan that fits you financially.

But what really stands out is their pre-existing condition provisions. Unlike most other travel insurance companies, Genki Native may cover pre-existing conditions like asthma, cancer, and diabetes after a medical history review. This is uncommon in the industry.

Then, there’s the fact that they cover mental health services. You get access to inpatient and outpatient psychotherapy coverage, mental health apps, and more with Genki Native Premium. Considering how important mental health is, it's nice to have these benefits.

True Global Health Coverage

Ever heard of travel medical coverage? It typically covers things like:

- Unexpected medical events and accidents

- Baggage issues

- Trip cancellations, interruptions, and delays

That’s not what Genki Native is.

Genki Native is true global health coverage you can use wherever you roam. It offers comprehensive benefits that mirror domestic insurance and includes coverage your typical domestic insurance would. Some of the benefits include routine checkups, prescriptions, and chronic condition management.

It’s also ideal in the following scenarios:

- When you don’t have a U.S. domestic health plan (after missing open enrollment or losing your coverage)

- To expand your treatment options beyond what’s available in the U.S

- To save money on healthcare. Often, you can find cheaper healthcare treatments and services abroad (outside of the U.S.).

And you get all of this for a fair price. Don’t believe us? See for yourself (sample pricing is for a 24-year-old application (€1,000 deductible)

Designed for Long-Term Travelers Living Abroad

Can’t get enough of your new home away from home? You may decide to put down roots there.

If you plan on living abroad long-term, Genki Native is a great expat health insurance option to consider.

When you’re living abroad, you need some degree of stability, and this plan delivers that. You get coverage wherever you are in the world – you don't even have to choose a home country! Wherever you are considered a citizen, you can expect to be covered.

But be sure to ask about any limitations in the U.S. and Canada and trip length stipulations – better safe than sorry!

Aside from that, there’s a dedicated customer service team for anyone who’s struggling to navigate the quirks of a foreign healthcare system. You get the answers you need to ease your spiraling mind.

Quick Sign Up and Payouts

Signing up for a plan with Genki Native is incredibly easy, with uncluttered forms, clear pricing, and fast medical questionnaire reviews. We love this for our nomads who need coverage right away, even after arriving abroad.

What's more is that the claims process is lightning fast, with a reimbursement timeframe that anyone would be excited about – 3 business days. Nuff said.

Some Things to Keep in Mind About Genki Native

Time to switch gears for a bit! Before you get started with a new insurance plan, it’s essential to know the good, the bad, and the ugly. Here are some things to keep in mind about Genki Native before you take the plunge and buy a policy.

Not Ideal for Short-Term Stays

Given their (justified) higher cost and comprehensive nature, buying a Genki Native plan for a short-term stay (less than three months) might be overkill. For shorter trips, Genki offers Genki Explorer, a travel insurance plan that provides essential coverage for emergencies and unexpected events at a lower price point.

Regional Exclusions May Exist

Though Genki Native checks all the boxes when it comes to its extensive coverage mix, not every country is fully covered. Plan benefits are limited in both the U.S. and Canada, regardless of the Genki Native plan you choose.

So, before you snag a policy, be sure to inquire about regional exclusions.

Making a Claim for Genki Native

The claims process for Genki Native is relatively straightforward, though multiple steps are involved. Here’s how it goes:

- Ask for “itemized receipts”, which outline every charge in a transaction. Without such receipts, you could experience unnecessary claims holdups, payment delays, or denials.

- Fill out and send your claim form to Genki, along with itemized receipts and other evidence as proof for your claim. You can send all of this through email or via your online profile, which you’ll gain access to after purchasing your plan. Be sure to do this immediately after the illness or accident.

- Waive your physician-patient-privilege. This way, Genki can access the information they need to process your claim.

- Wait for a response from Genki either by email or through the customer portal account. Take things from there.

Whether you’re having trouble figuring out the claims form or grappling with uncertainty around the claims process, you’re not alone.

Genki’s support team is generally pretty efficient as they are available 24/7. They'll help guide you through each part of the claim process, from start to finish.

Are There Any Global Health Insurance Alternatives to Genki Native?

Do you think you and Genki Native would be a match made in heaven?

Our advice – hold up and consider the other options out there. Without at least glancing at alternatives, there’s no way to know whether you’re making the right decision.

SafetyWing Nomad Insurance Complete

SafetyWing's Nomad Insurance Complete is frequently cited as one of the most popular digital nomad health insurance providers. And that’s for good reason. The plan covers you in 170+ countries, allows you to choose your own doctor, and includes a generous $1.5 million worldwide coverage – that is massive.

If you’re between 18 and 39, you can expect to pay as little as $150.50 per month with a 12-month contract. Opting for an annual payment reduces the cost to $1,625.40, saving you $180.60 (a 10% discount). Just know that the pricing does increase with age, so the plans may be a little rich for seniors.

When comparing Genki and SafetyWing, one thing is for sure. Genki gives you more coverage for the everyday than SafetyWing. Also, Genki Native provides coverage in your country of citizenship for short and long visits, depending on the plan (up to 30 days with Genki Native Basic). SafetyWing only covers one set home country for the duration of your plan, and U.S. residents are not eligible for Nomad Insurance Complete, unfortunately.

Regardless of these differences, both are phenomenal global health insurance plans for digital nomads who will be spending a lot of time overseas.

Cigna Global

Another Genki Native alternative is Cigna Global. The company is well known for its domestic plans in the U.S., but they have extremely flexible, customizable international health plans.

You can set your payment period (monthly, quarterly, or annually), deductible ($0 to $10,000), and whether you want your home country covered. You even get to choose your cost-sharing percentage and out-of-pocket maximum.

Cigna Global offers two plans: Cigna Global Health Options and Cigna Close Care.

Both plans offer worldwide coverage with incredible benefit inclusivity, including essential medical care benefits like inpatient admissions, emergency situations, pandemics, and even cancer care.

Still, Cigna Global and Genki Native are very much different. Cigna Global offers much more customization and flexibility than Genki insurance. If you prefer that, looking into Cigna would be a no-brainer. Otherwise, both insurance options offer high benefit maximums, a wide variety of coverage, telemedicine, and support when you need it. You can’t really go wrong with either.

The Bottom Line

That concludes this Genki health insurance review. All in all, Genki Native is pretty darn close to perfect. We rate it a 4 out of 5 for its extensive coverage options tailored to nomads with long-term living arrangements abroad. And let’s not forget all the extras mentioned earlier – pre-existing condition and mental health coverage, high benefit maxes, and more.

Although we couldn’t give them a perfect score due to the coverage limitations in the U.S. and Canada, this plan is as close to perfect as we’ve seen. We fully recommend Genki Native to any nomad who’s looking for a high-quality health insurance plan at an affordable price for some serious peace of mind.

Ready To Get To Your Next Nomad Destination With Extra Peace of Mind?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

You can also follow us on Instagram and join our Facebook Group if you want to get in touch with other members of our growing digital nomad community!

We'll see you there, Freaking Nomads!

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Travel tips, hacks, and news

Travel tips, hacks, and news Exclusive travel discounts

Exclusive travel discounts Offers and promotions

Offers and promotions Digital nomad inspiration

Digital nomad inspiration Latest articles form our blog

Latest articles form our blog

Comments ()