SafetyWing Nomad Insurance Complete: In-Depth Health Insurance Review

Just like sweet and salty or yin and yang, travel and health insurance are inseparable—you can't have one without the other. Wherever your nomadic adventures take you, don't forget to pack the best health insurance plan.

Today, I'll be reviewing Nomad Insurance Complete by SafetyWing, a global health insurance plan designed specifically for digital nomads and frequent travelers seeking both comprehensive health and travel coverage, no matter where they are.

It's hailed by some as "the best health insurance" because of its comprehensive worldwide coverage, high payout maximums, and affordable pricing.

But is it really the best out there? Let's find out together.

What We Like About SafetyWing Nomad Insurance Complete

Now, let's get into the review. SafetyWing's Nomad Insurance Complete boasts a metric ton of benefits that nomads everywhere love. These benefits are nowhere near gimmicky and actually make a difference in nomads' lives.

Comprehensive Benefits

Here's a tip from me to you: when evaluating any insurance policy, focus on the benefits. What are you getting for your money? To what extent will the company stick its neck out for you in a bind?

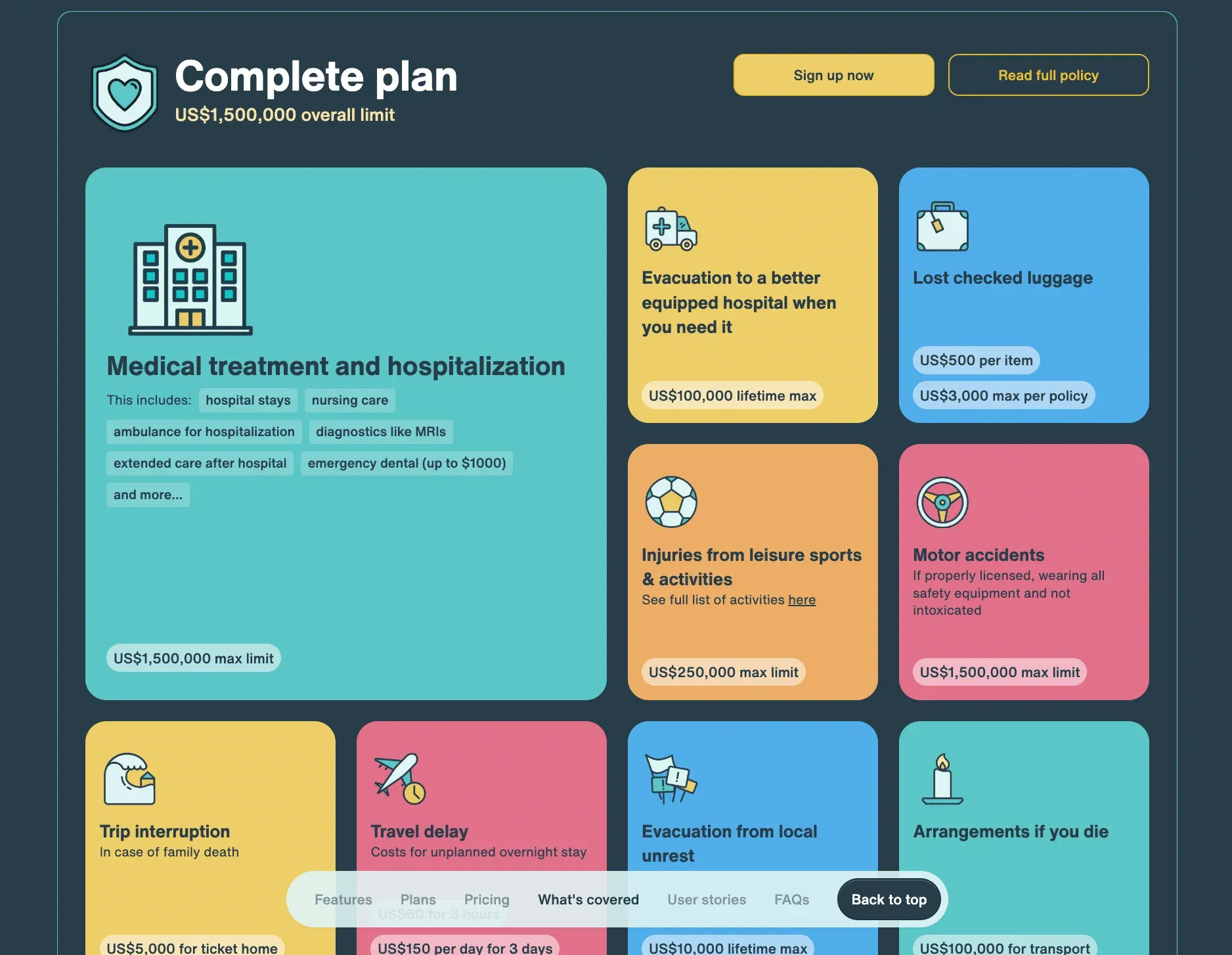

With a Nomad Insurance Complete plan, you’re covered for both health and travel-related needs, and you get a full refund for:

- Hospital treatment and accommodation

- Inpatient surgery

- Reconstructive surgery (following an accident or illness)

- ICU treatment

You also get the following health coverage benefits:

- Up to $500,000 for rehabilitation and specialized treatments

- Up to $1,000 for durable medical equipment (e.g., crutches or wheelchairs)

- Up to $5,000 for up to 10 outpatient psychiatric visits

- Up to $1,000 for an external prosthesis

And for travel coverage, you're protected with:

- $500 per item for lost checked luggage

- $500 per item for burglary while you're out

- $5,000 for ticket home due to trip interruption

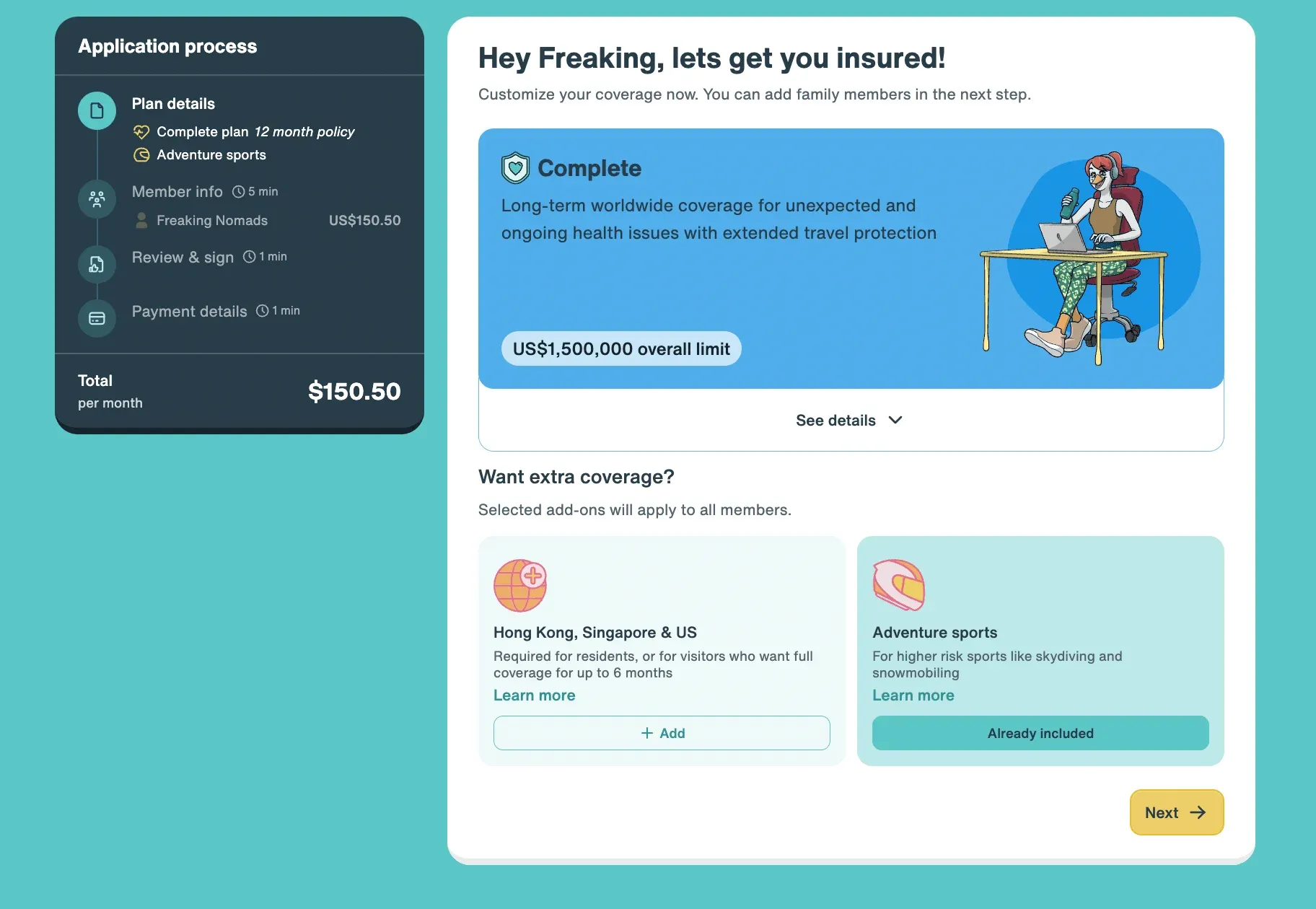

The plan benefit maximum for Nomad Health sits at $1.5 million minimum, which is very high. If you need to use your plan for a covered reason, there's some firepower (cash) to back you up.

Global Coverage with Flexibility

Some "global" health insurance policies aren't really global. Nomad Insurance Complete is "global" in every sense of the word. The policy covers you not only in 170+ countries but also applies to your home country, which is unusual in the travel insurance world.

What's more, you can start coverage even if you're already traveling. If insurance slips your mind until after hopping on your flight or even mid-trip, you're not out of luck. You can still purchase a plan.

Designed with Digital Nomads and Remote Workers in Mind

Wouldn't it be nice to have an insurance plan that was meticulously designed just for you? That's Nomad Insurance Complete. Here's why we say so:

- There's no fixed address requirement, which is great since you're always in the wind as a nomad.

- You can purchase and manage your plan online on an easy-to-use interface, no matter where you are at the moment.

- You get the option to pay as you go; they clearly know how quickly your plans can change.

Competitive Pricing

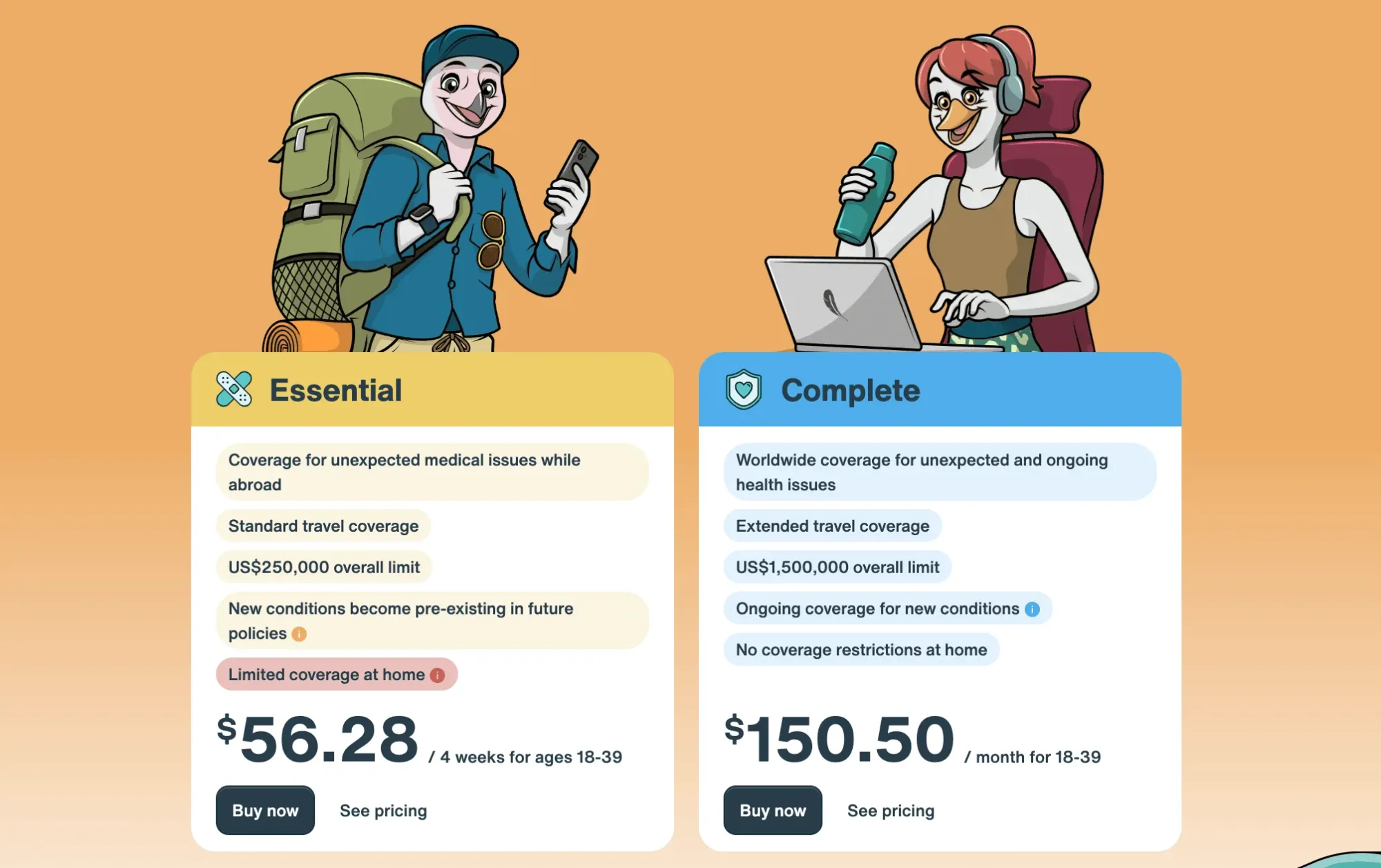

A plan is useless to you if its price is too astronomical to afford. After playing around with some scenarios on various digital nomad websites, I've found that Nomad Insurance Complete is one of the more affordable options, especially when you factor in the coverage you're getting.

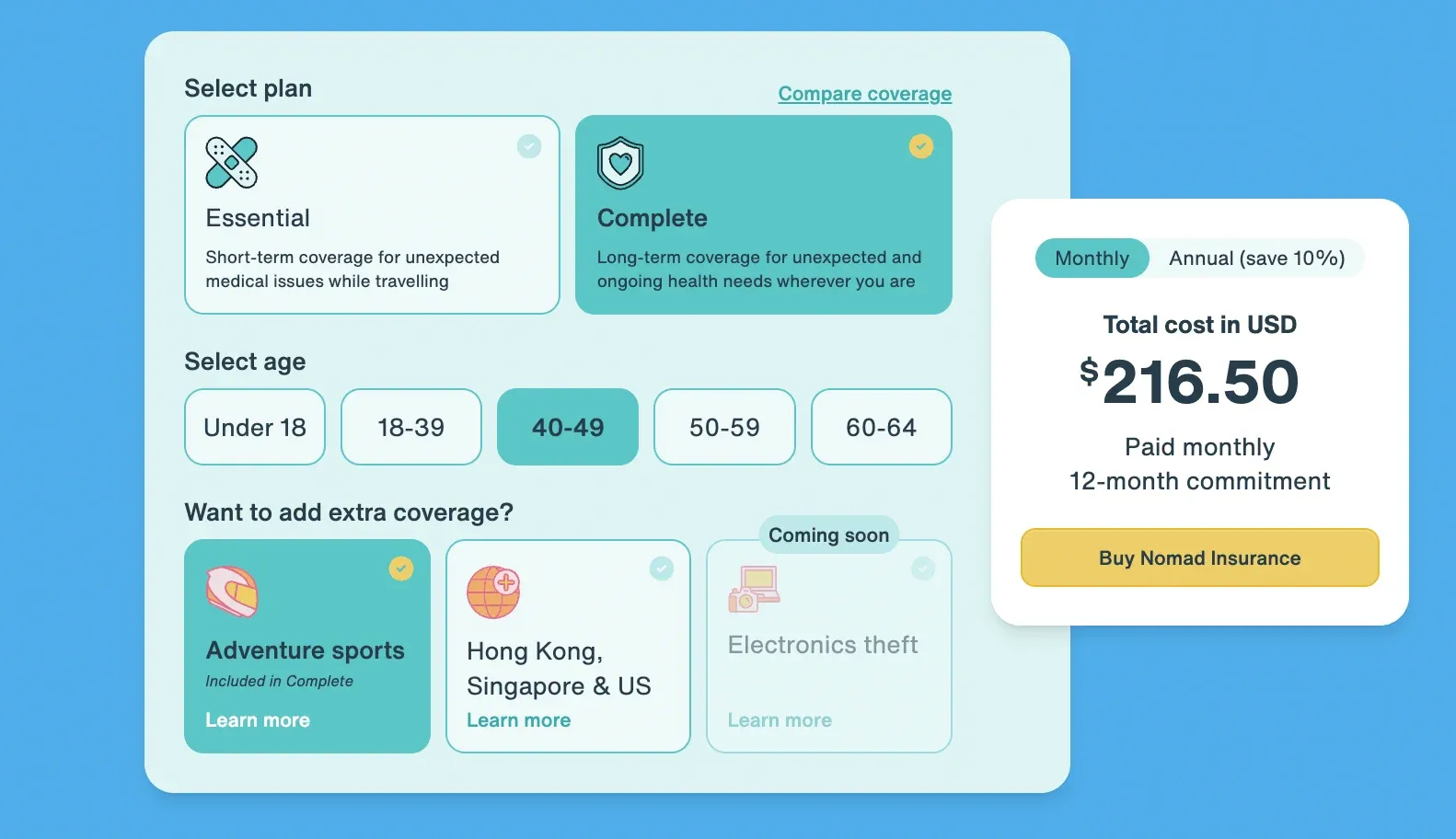

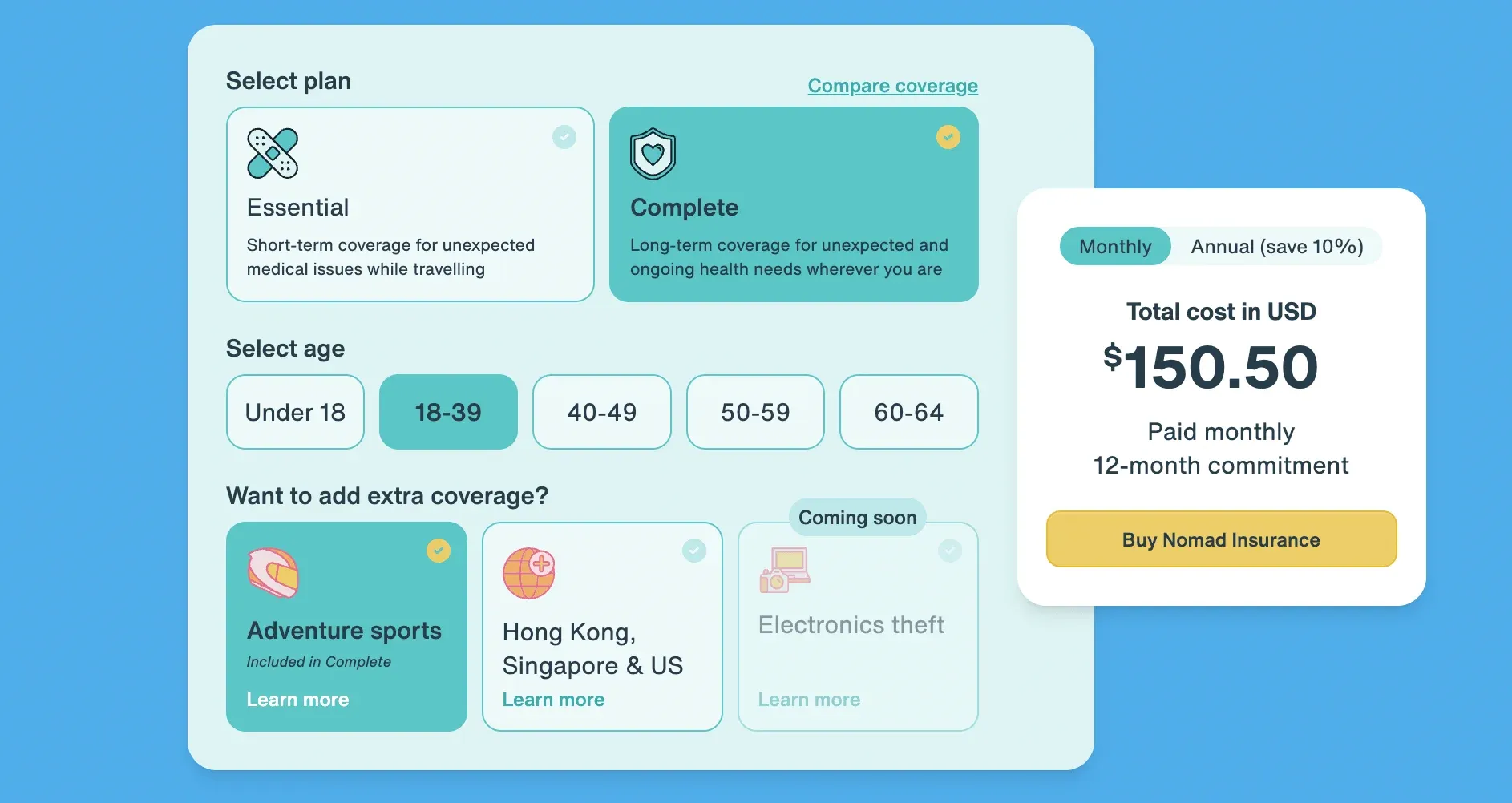

One thing you should know about Nomad Insurance Complete plans is that they follow an age-based pricing model. The higher your age bracket, the higher the price will be. To find out what the price will be for your plan, simply select the "Complete" plan and the appropriate age range to see updated pricing.

Here's the pricing for a traveler between 40 and 49 years old:

And here's the updated pricing for someone between 18 and 39 years old:

As you can see, the pricing will be lower for younger nomads. To get an idea of how much the plan will cost for you, use the dropdown at this link.

What if you're no longer a spring chicken (getting up in age)? Consider the fact that Nomad Insurance Complete is more affordable than the average domestic health plan. Per Forbes, US health insurance costs about $400 to $1100 per month, depending on your age, plan type, and more. If you're a long-term traveler, opting for a global health plan like Nomad Insurance Complete would likely be much more economical than paying for domestic health insurance and travel medical insurance.

Get a Personalized Quote

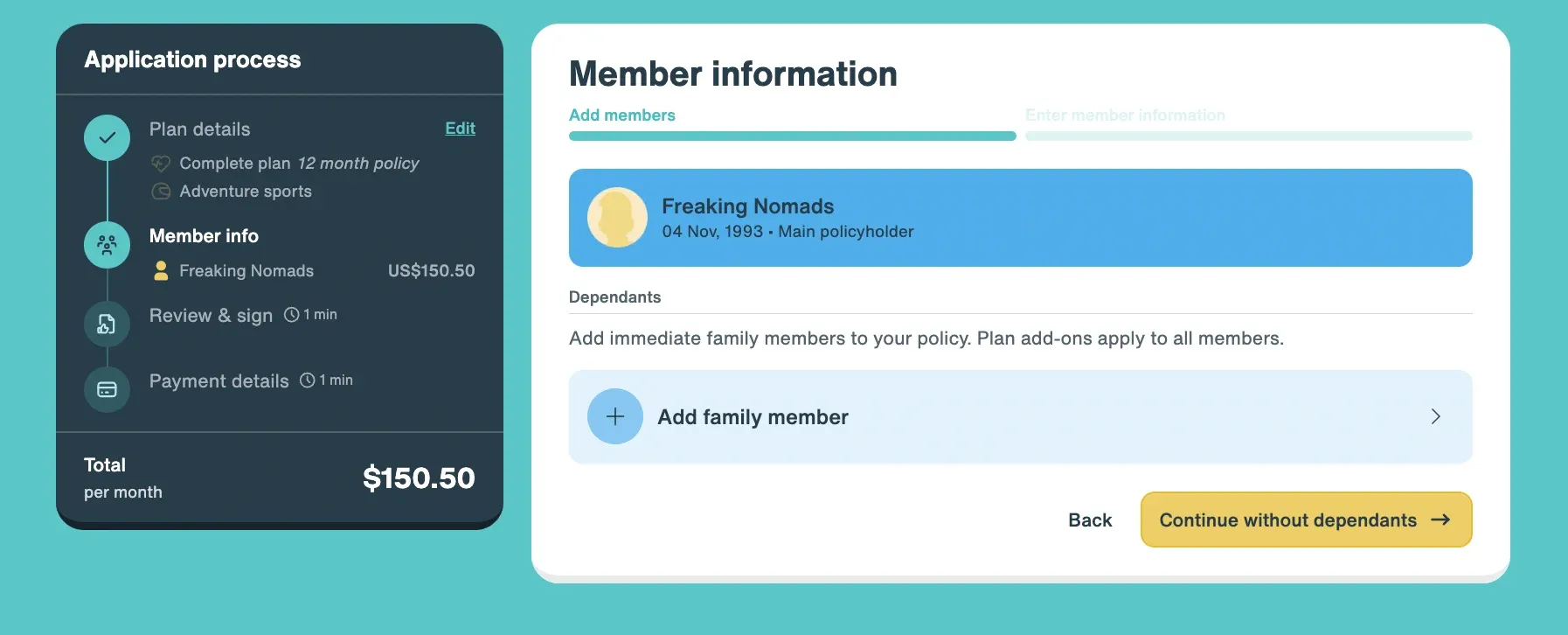

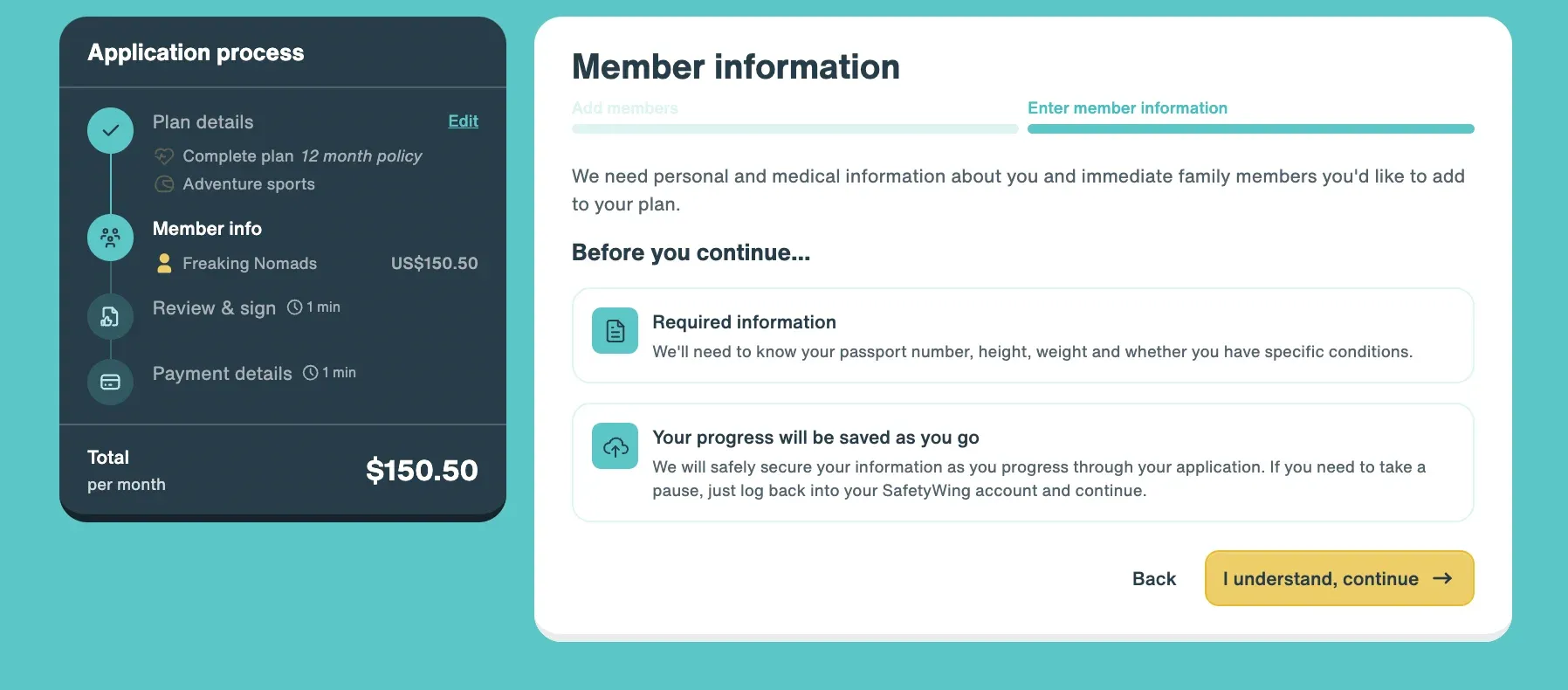

The cost of your plan on the website changes based on your specific trip information, how many people will be covered by the plan, and more. Follow these simple steps to get your personalized quote:

Step 1: Visit the Nomad Insurance page and click the yellow “Sign Me Up” button to get started.

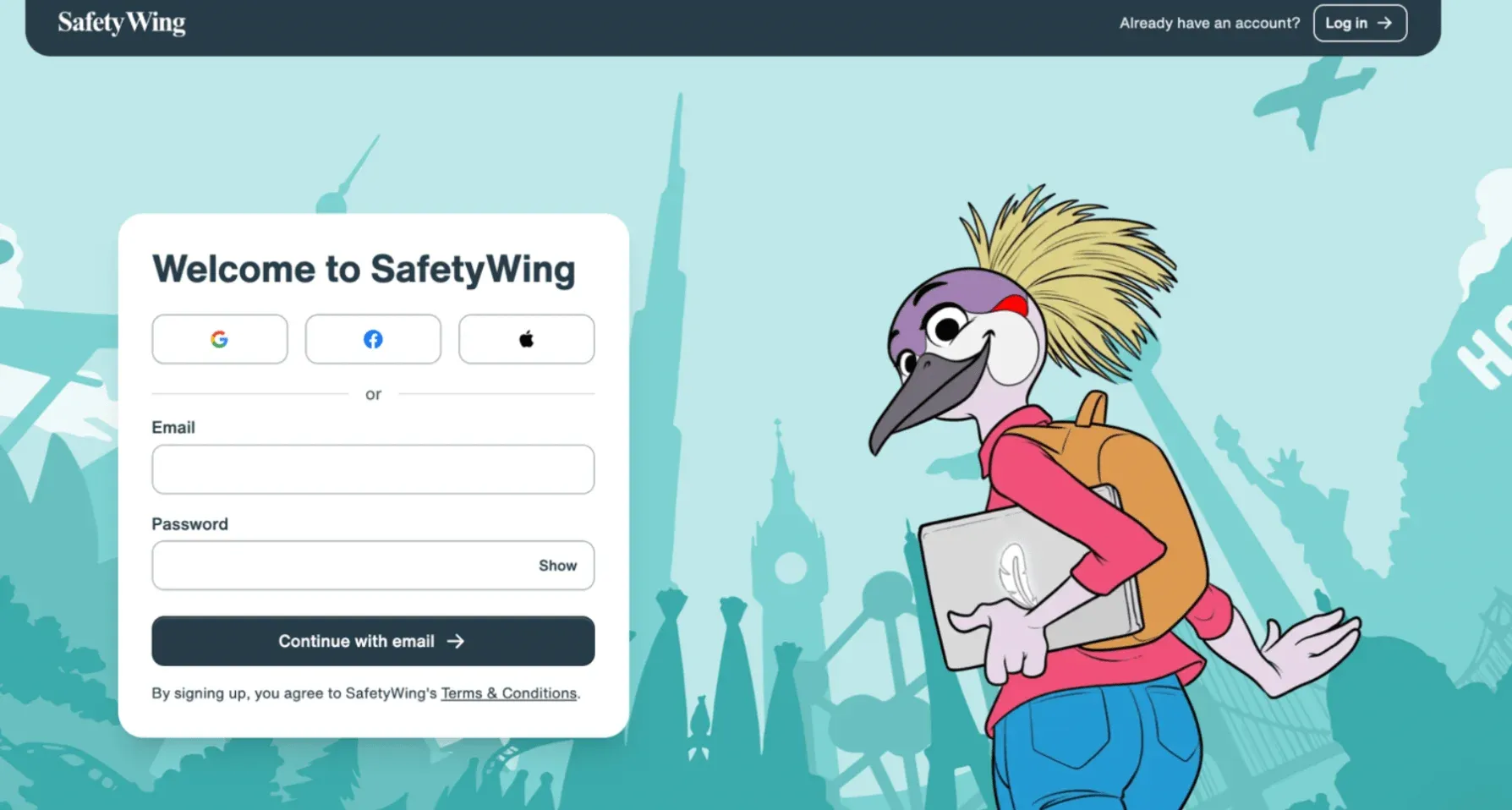

Step 2: Create an account using your email address, Facebook login, or Apple credentials.

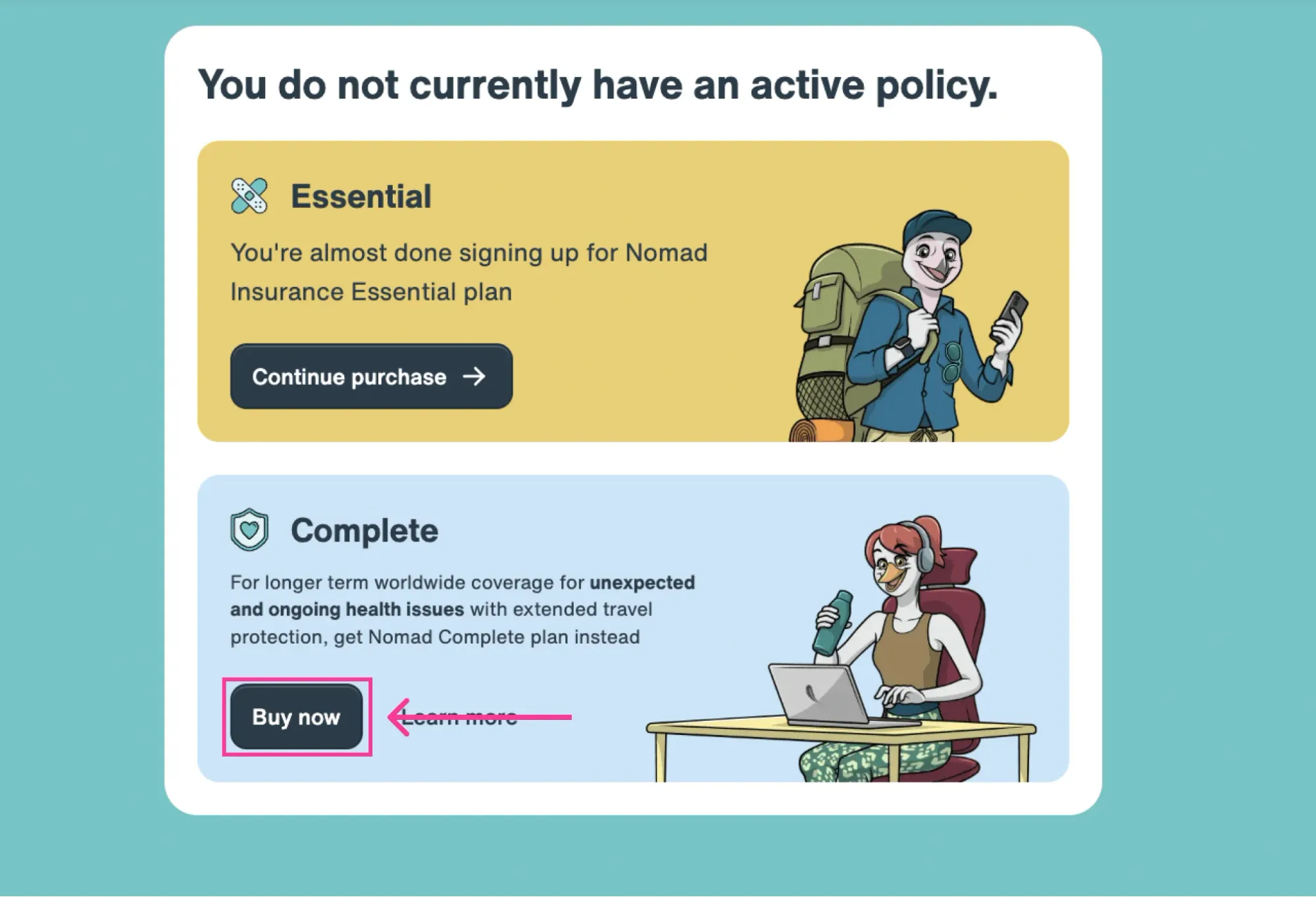

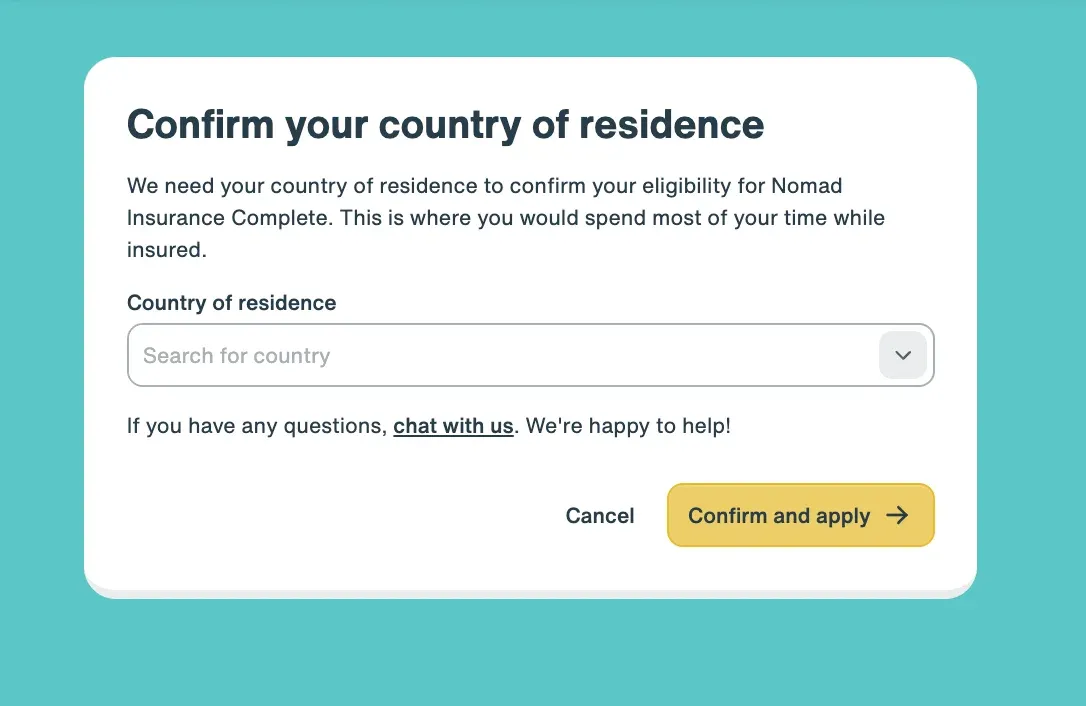

Step 3: Click "Buy now" under the Complete option and select your country of residence. Click “Confirm and apply” afterward.

Step 4: If you're a resident or visitor in Hong Kong, Singapore, or the United States, add the required extra coverage for up to 6 months in these locations.

Step 5: Fill in your personal information and add any family members you’d like to include in the policy. Click “I understand, continue” to proceed.

Step 6: Complete the medical history form for yourself and any family members. Ensure all fields are filled out before clicking “Save and Continue.”

Step 7: Carefully review your details, sign the application, and provide your payment information to pay for the policy.

Step 8: Wait for an approval from SafetyWing. It could take 7 to 10 business days. Your payment method will be charged if, and only if, your application is approved.

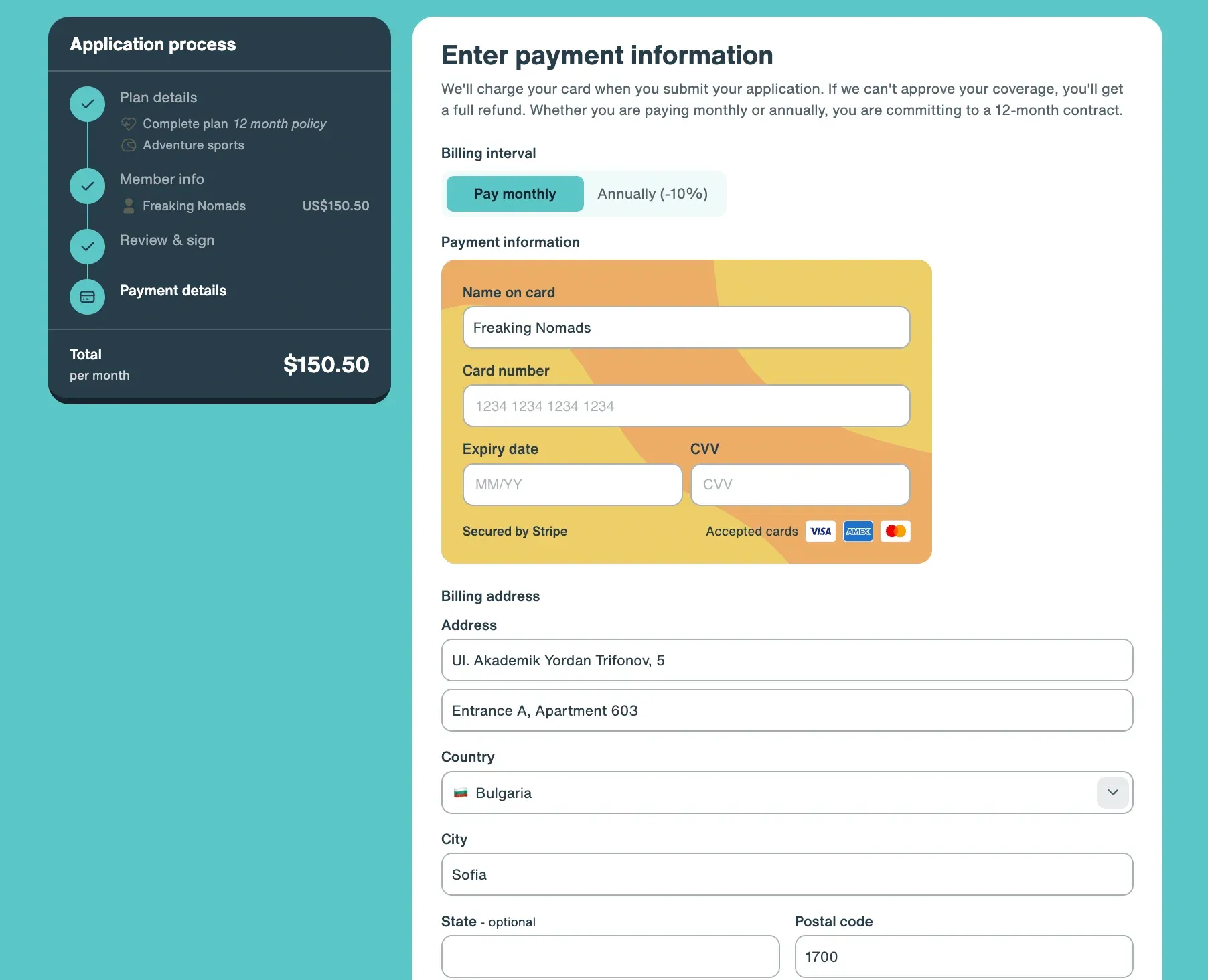

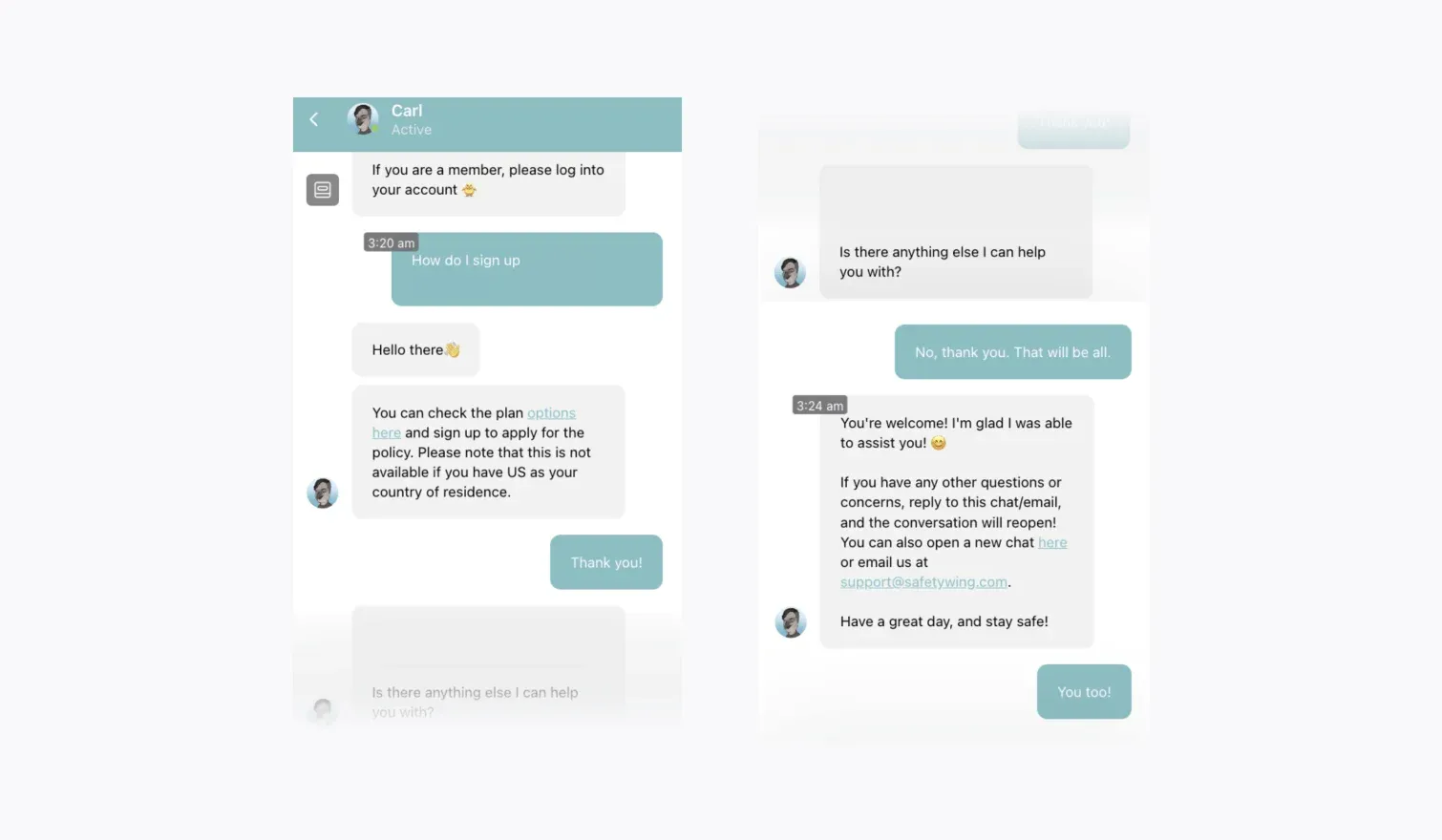

24/7 Customer Support

Things can go wrong whether you're backpacking through Guatemala or living it up in bustling Tokyo. The inconvenience of it all can be overwhelming - that's why you need quick, high-quality customer service support on your timeline. Nomad Insurance Complete provides 24/7 customer support with super quick response times and round-the-clock availability via chat.

I tested the chat support at 3:20 am to see if they’d be responsive. They responded in less than a minute with the information I needed! See the screenshots below.

Improved Claim Process

In years past, Nomad Insurance Complete users complained about claims processing delays and extensive claim documentation requirements.

Clearly, they have listened to the customers’ feedback. Lately, SafetyWing has been working on improving the claims process. It's much more straightforward these days and this can be clearly seen by many users reporting this on platforms like Reddit and TrustPilot.

Some Things to Keep in Mind About SafetyWing Nomad Insurance Complete

When it comes to the above factors, SafetyWing Nomad Insurance Complete knocks it out of the park! But there are a few things you should be aware of before you decide if it's the right fit for you. Read on.

Pre-Existing Condition Limitations

In general, Nomad Insurance Complete by SafetyWing does not cover routine care for pre-existing conditions. For those who don't know, pre-existing conditions are medical issues existing before the active date of your insurance plan. Common pre-existing conditions include:

- Cancer

- Asthma

- Diabetes

- High blood pressure

Coverage Focuses on Emergencies and Urgent Care

It's crucial to know that Nomad Insurance Complete isn't meant to be a replacement for comprehensive domestic health insurance. The bulk of Nomad Insurance Complete's benefits are geared toward emergency-related situations - not routine or everyday health management. If you want to guard against the unexpected, Nomad Insurance Complete is really good for that.

However, if you're looking for more short-term or travel-specific coverage, you might consider SafetyWing's Nomad Insurance Essential, a travel insurance plan that is more affordable and sufficient for those who don't require comprehensive global health insurance.

Making a Claim with SafetyWing Nomad Insurance Complete (Claim Process)

Wondering how the claims process goes with SafetyWing? It's more straightforward than you might think. Here are the steps to follow:

- Log into your SafetyWing dashboard.

- Look for a button that says "Submit a Claim."

- Send in any requested documentation via digital upload (medical reports, invoices, proof of payment).

- Wait for a decision to be made on your claim.

- Follow the next steps (if any) after receiving a response from SafetyWing.

Here are some tips to ensure a smooth claim process with Nomad Insurance Complete:

- Hold onto (and upload) all of your receipts and documents related to your claim situation.

- Take clear photos of all the documentation to reduce delays.

- Ensure that your medical forms are signed.

- Don't forget to click “submit” after the claim submittal form is complete.

Are There Any Global Health Insurance Alternatives to SafetyWing Nomad Insurance Complete?

It's always a good idea to weigh your options before choosing your nomad health insurance. For some perspective, there are two really good alternatives on par with SafetyWing Nomad Insurance Complete, and they include Genki Native and Cigna Global Health. Here's a little bit about both of them:

Genki Native

Genki Native is one of the best digital nomad health plans in existence. The reason (well…reasons) why? First, you get healthy plan benefit maximums. Depending on the plan you choose (Native Basic or Native Premium), it's €1 million per year or unlimited.

In addition to that, depending on the plan, you gain access to a wide array of benefits, including preventive care, hospital and home care, mental health care, rehab, eye care, and much more.

There are two plan tiers - Genki Native Basic and Genki Native Premium, the latter being the most comprehensive plan. What's more, once you sign up for a plan, there's no age cutoff. Though, these plans are only available to people who are 55 or younger.

Here are some additional benefits associated with Genki Native:

- Very good customer reviews on TrustPilot and elsewhere.

- Few exclusions on the Genki Native Premium plan.

- Clean, cheery interface with minimal clutter, making it easy to see what's what.

- Ability to tailor your plan to your needs and save as much money as you can.

- Worldwide coverage available anywhere (ask about U.S. and Canada limitations).

Genki Native and SafetyWing are neck and neck – we even compared them here in detail. However, Genki offers more in the way of routine and everyday health management than SafetyWing.

On the other hand, SafetyWing coverage includes your home country without a limit on how many days are covered in a year. For those who hold citizenship in just one country, this is phenomenal. But if you call more than one country home, Genki Native will be more attractive in this case. You get full coverage in all countries you hold citizenship on the Native Premium plan. There are some limitations on the Native Basic plan, so be sure to ask about them.

All in all, both of these options are outstanding for digital nomads - both would be great options to consider.

Cigna Global Health

Cigna Global Health is another great alternative for digital nomads. It's worldwide coverage that's inclusive and highly customizable to suit your risk profile and budget. I think it's a phenomenal choice for those who are having trouble finding a plan with the coverage mix they're looking for. You really do get to build your plan from the ground up. It also helps that the plans aren't overpriced or out of financial reach for most.

Here are a few other things you should know about Cigna Global Health:

- Quotes are clear and easy to fill out.

- Benefits maxes are generous.

- You get unlimited telehealth appointments.

- The focus is on health and well-being.

SafetyWing plans aren't going to be as customizable as Cigna Global Health. Though, you may find that the Nomad Insurance Complete plan is exactly what you need - no changes/add-ons required. If you value customizability and don't mind having to learn the insurance ropes to build your ideal plan, Cigna Global Health is a plan worth considering. But if you want a plan specifically built for digital nomads without getting too deep into granular benefits, Nomad Insurance Complete will be more your jam.

The Bottom Line

What's the verdict? Nomad Insurance Complete is definitely the best digital nomad health insurance plan I've come across. After doing a ton of research on these types of plans, the following things really stand out about SafetyWing, including the extremely high benefit maxes, the targeted coverage mix designed to protect against the unexpected, and the company's improvement on the claims process (among other things).

With SafetyWing, you not only gain access to a serious financial safety net and helping hand, but you get to work with a company that listens to customers and is working to continually better their product. This is very hard to find.

Considering all of this, I strongly recommend that you check SafetyWing Nomad Insurance Complete out - chances are it's the perfect plan to insure your future travels. Still, given the price increases related to age, I do have to take away a half star for a final rating of 4.5 out of 5 stars.

Ready To Get To Your Next Nomad Destination With Extra Peace of Mind?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

You can also follow us on Instagram and join our Facebook Group if you want to get in touch with other members of our growing digital nomad community!

We'll see you there, Freaking Nomads!

Freaking Nomads is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free, helpful content. Learn more

Travel tips, hacks, and news

Travel tips, hacks, and news Exclusive travel discounts

Exclusive travel discounts Offers and promotions

Offers and promotions Digital nomad inspiration

Digital nomad inspiration Latest articles form our blog

Latest articles form our blog

Comments ()